beijingwalker

ELITE MEMBER

- Joined

- Nov 4, 2011

- Messages

- 65,187

- Reaction score

- -55

- Country

- Location

China to hold over 80% of global solar power manufacturing capacity from 2023-26

November 7, 2023Despite local manufacturing policies in overseas markets, China’s expansion will dominate global solar supply chain, and widen the technology and cost gap.

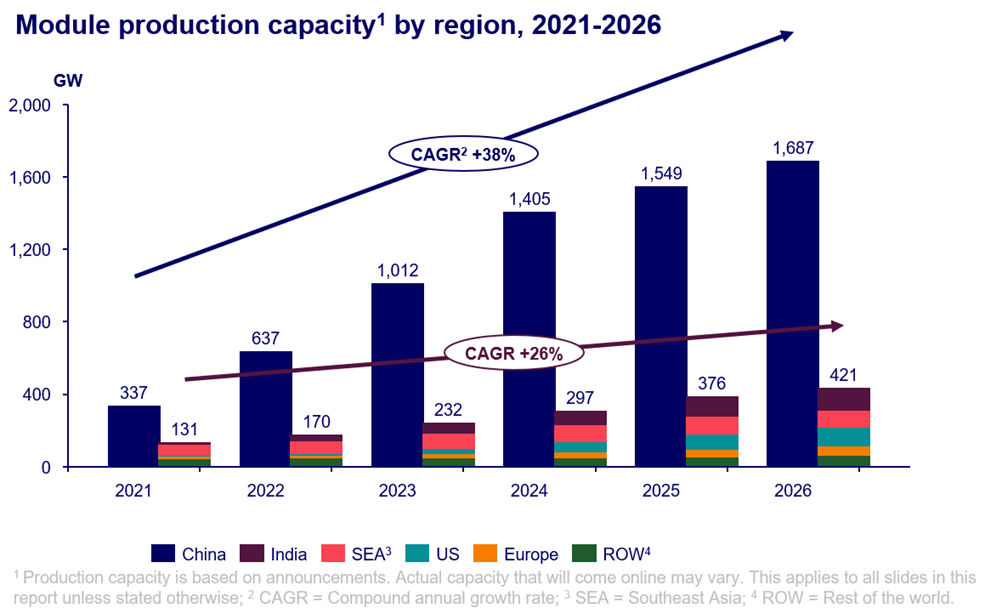

After investing over US$130 billion into the solar industry in 2023, China will hold more than 80% of the world’s polysilicon, wafer, cell, and module manufacturing capacity from 2023 to 2026, according to a recent report by Wood Mackenzie titled “How will China’s expansion affect global solar module supply chains?”.

Huaiyan Sun, senior consultant at Wood Mackenzie, and author of the report said: “China’s solar manufacturing expansion has been driven by high margins for polysilicon, technology upgrades and for developing local manufacturing in overseas markets, China will still dominate the global solar supply chain and continue to widen the technology and cost gap with competitors.”

More than one terawatt (TW) of wafer, cell and module capacity is forecasted to come online by 2024, meaning China’s capacity is sufficient to meet annual global demand now through to 2032, based on Wood Mackenzie forecasts of annual demand growth.

China’s capacity expansion will perpetuate its dominance in the global solar industry with its advanced technology, low costs and complete supply chain

Strong government policies in overseas markets have started to increase local solar manufacturing, but they are still not cost-competitive compared to Chinese supply. A module made in China is 50% cheaper than that produced in Europe and 65% cheaper than the US, according to the report.

The US and India have announced more than 200 gigawatts (GW) of planned module capacity since 2022, driven by the Inflation Reduction Act (IRA) in the US and the Production Linked Incentive (PLI) in India.

“Despite considerable module expansion plans, overseas markets still cannot eliminate their dependence on China for wafers and cells in the next three years,” Sun said.

China will continue to be the global technological leader with its announcements to build more than 1,000 GW of N-type cell capacity, the next-generation technology after P-type. This represents 17 times more capacity than the rest of the world.

Looking outside China, India is forecasted to overtake Southeast Asia as the second-largest module production region by 2025, which will be driven by India’s strong PLI incentives.

Oversupply and intense competition will characterise the solar supply chain going forward, and is already driving cancellations of some expansion plans

Concerns about the market’s oversupply are mainly aimed at old production lines that produce lower efficiency products, such as the P-type and M6 cells. Demand for P-type cells began to decline in 2023 and Wood Mackenzie analysts expect it to be only 17% of supply by 2026.

Sun added: “Oversupply will undeniably hinder some of the current expansion plans. More than 70 GW of capacity in China has been terminated or suspended in the past three months.”

The solar manufacturing industry in China is entering a challenging time. Module manufacturers will be forced to take orders at a loss, reduce capacity, or shut down entirely.