,.,.,

Will Pakistan’s banking system be able to effect its conversion to a completely Islamic system within the government's stated timeline?

The former governor of the State Bank of Pakistan (SBP), Dr Ishrat Husain, sounded uncharacteristically upset one morning in November 2021. His mood was in contrast with the upbeat feel of the campus at the Institute of Business Management (IBA), where seasoned bankers in sharp suits and flowing beards had gathered to take part in a conference on Islamic banking, a rather mundane affair the promoters of Islamic banking indulge in every few months to pat themselves on the back for doing banking the halal way.

In his video link address, Dr Husain told the self-satisfied Islamic bankers that they had become “complacent” over the last two decades. The Sharia-compliant banking industry had fallen “short of the expectations” he had when as governor, he issued the country’s first Islamic banking licence at the turn of the century. Something had gone wrong with Islamic banking, despite all the hype its supporters had built up, partly based on cherry-picked data. Exactly a year later, in November 2022, the Government of Pakistan announced it was targeting a complete transition from conventional to Islamic banking by the end of 2027.

Given the timelines involved, let’s take a deep dive and try to understand what Islamic banking is; how it differs from its conventional counterparts, the level of maturity it has achieved over two decades, and why the increased push towards its adoption.

All For Islamic Banking

In the early 90s, the Federal Shariat Court ruled that interest-based banking must cease to exist because it went against the teachings of Islam. Back then, conventional banking was all Pakistan had and banning interest from the economy outright would have thrown the system off the rails. Understandably, the government appealed, through the SBP, to the Supreme Court of Pakistan against the decision and was granted a stay order. Meanwhile, commercial banks requested the Supreme Court not to rock the boat lest it sank everyone aboard. The status quo prevailed for about three decades. Then all of a sudden, something changed last November.

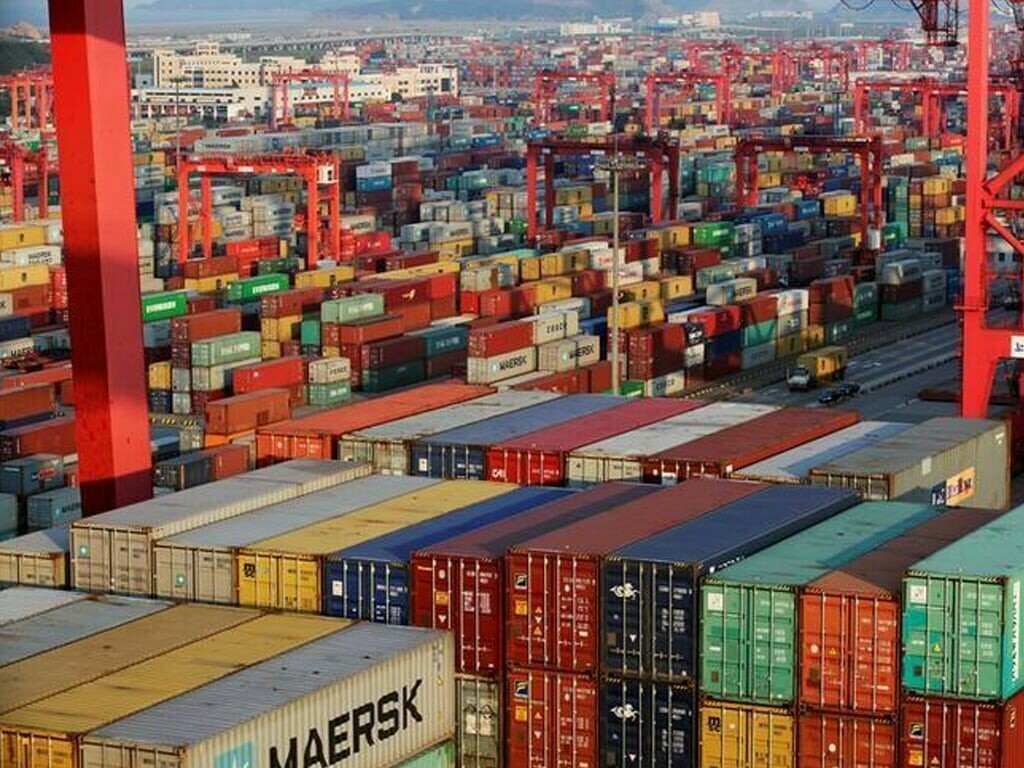

Ishaq Dar, the Minister of Finance, decided to capitalise on the widespread support for interest-free banking amongst the general public and announced that the SBP was withdrawing its legal challenge to the FSC decision and that Pakistan would do away with interest-based banking by 2027. The announcement was bold. Pakistan has a massive banking system with an asset base of Rs 34.5 trillion.

Before the conversion of Faysal Bank into a full-fledged Islamic bank in January 2023, Pakistan had five Islamic banks and 17 conventional banks with Islamic banking branches. The share of Islamic banking assets was worth approximately Rs 6.9 trillion (20% of the total) at the end of September 2022, the latest period for which industry-wide data is available. The share of Sharia-compliant deposits also equals nearly 20% of the total.

The decision to withdraw the legal challenge was hailed by most, if not all, stakeholders. (Those who believed that the decision was premature or wrong expressed their views only in private because explicit resistance to Islamic banking can be construed in more ways than one in our society.) In this context, senior Islamic bank officials speaking to Aurora said the decision was belated rather than premature and that conversion from conventional to Islamic banking in five years was possible given the available pool of expertise, the existence of long-established players and at least one example of a successful transition.

Like their conventional competitors, Islamic banks are financial intermediaries. They collect money from those who have it (savers) and lend it to those who need it (borrowers) – a process that galvanises the economic cycle and produces material progress for society at large. Under the conventional model, banks perform this function against ‘interest’ – a fee the bank pays to the saver and collects from the borrower. However, Islam prohibits interest because of its exploitative nature that makes transactions inequitable. In its place, Muslim scholars have devised an elaborate Sharia-compliant financial system to replace interest with profit and loans with financing. This raises the question of whether the goal of 100% conversion to Islamic banking by the end of 2027 is realistic.

Only one-fifth of Pakistan’s banking assets are currently Sharia-compliant, despite active regulatory backing, indisputable public support and the solid financial strength of the industry players over the last 20 years. The question then is, if left to grow at its organic pace, would it not take the industry many more decades before achieving 100% conversion?

In the opinion of Ahmed Ali Siddiqui, Senior Executive VP, Meezan Bank, the government should turbo-charge the conversion process by opting for Islamic means to meet its own banking needs. Firstly, the government should immediately start converting its own commercial bank into a Sharia-compliant entity. In this respect, he points to National Bank of Pakistan (NBP), which is one of the largest conventional lenders in the country and ranks among the top three banks, including both conventional and Islamic, when it comes to assets as well as profitability. Even though it does run an Islamic window for a small segment of clients, the bank practises conventional banking by and large. Secondly, many state-owned enterprises that carry massive assets on their balance sheets should be the next in line. Here, Siddiqui mentions energy exploration and production companies like the Oil and Gas Development Company and Mari Petroleum Company, which run huge, capital-intensive operations that require constant liquidity management. The same is the case with Pakistan State Oil, one of the largest Pakistani companies in terms of revenue. Thirdly, the relevant departments within the government that act as custodians of public money should be made to deposit their excess cash in Islamic banks.

Notwithstanding the existing stock of government debt, which is mainly interest-based (to the tune of Rs 48 trillion), Siddiqui says the government should raise new funds only through Ijarah Sukuk (Islamic bonds). In other words, the government should stop interest-based borrowing at once, while gradually retiring the existing stock of conventional debt over the coming years.

Syed Majid Ali, Chief Financial Officer, Faysal Bank, says it is possible to switch from conventional to Islamic banking in five years. He speaks from experience given his bank completed its conversion into a 100% Sharia-compliant entity in five years. To this end, Faysal Bank adopted an ‘asset-led’ conversion model that prioritised the conversion of banking assets (investments and financings) over liabilities (deposits). Apart from making all new branches Sharia-compliant from day one, the bank converted its conventional business into Islamic, one branch at a time.

How is Islamic Banking Different from Conventional?

At its core, Islamic banking is interest-free. But this does not mean that Islamic banks lend money and take back an equal amount in the name of an interest-free system. Operating on a no-profit, no-loss basis would make little financial sense. Islamic banks are for-profit entities that generate returns for their shareholders through banking. So how is it done? Let’s understand it through a simple example.

Suppose you want to buy a car. You do not have the full payment capacity, but you have the capacity to make a small down payment and pay the remaining price in equal instalments over three years. You can either go to a conventional bank or an Islamic bank. Both banks will first look at your credit history and income to ascertain whether they should help you buy a car. Let’s suppose you tick all the boxes. If you opt for a conventional bank, the bank will give you the money to buy a car and you will then pay back that money as well as an additional fee (read: interest) as per the mutually agreed loan terms.

The transaction will be a little different if you opt for the Islamic option. As opposed to giving you cash to buy a car, the Islamic bank will buy the car and rent it out to you. In return, it will charge you ‘rent’ – as opposed to ‘interest’ – every month and gradually transfer the car’s ownership rights over the financing period. The bank will act as a ‘lessor’ instead of a lender. The customer will become the ‘lessee’ instead of a borrower.

In all likelihood, the transaction under both types of banking will generate the same return to the respective banks, but the circuitous way of enabling a client to own a car makes the second transaction Islamic. The principle is simple: interest is prohibited by Islam, but trading is not. The conventional transaction is purely monetary: a loan given on interest. The Islamic transaction is asset-based: the bank sold a car to its client and made a profit. The existence of a real asset (a car in this instance) in the transaction made the deal Islamic.

Challenges Abound

There is no doubt that Islamic banking faces multiple challenges at regulatory, institutional and consumer levels. For example, analysts point to the Islamic banks’ overwhelming focus on the corporate sector when it comes to extending financing. This ratio differs little from that of conventional banks, which are equally enthusiastic about lending to blue-chip clients with established credit histories. As a result, small and medium enterprises (SMEs) lose out, despite the fact that these businesses create the highest economic value for the maximum number of people in society.

Less than three percent of Islamic banking portfolios consist of SMEs, which otherwise form the vast majority of businesses operating in Pakistan. Dr Husain believes Islamic banks draw deposits from the relatively less developed provinces of Balochistan and Khyber-Pakhtunkhwa, but extend financing in big cities of Punjab and Sindh – a pattern witnessed in the conventional banking sector as well.

From the perspective of Islamic banks, the biggest challenge appears to be the deployment of assets. Unlike conventional banks that can (and do) park a massive chunk of their trillions of deposits in risk-free treasury bills and Pakistan Investment Bonds (PIBs), Islamic banks cannot earn easy money that way.

Treasury bills and PIBs are interest-bearing instruments the government uses to raise funds to bridge its fiscal deficit. However, they are out of bounds for Islamic banks as they involve no actual asset and the reason why Islamic banks are urging the government to increase issuing Ijarah Sukuk, which allow the government to raise funds against a leased-out fixed asset, such as an airport, motorway, power plant or even a public park.

Here it is pertinent to emphasise that one of the biggest problems for the government is the lack of infrastructure projects, or even land, that are unencumbered and therefore can be used as underlying assets for Islamic bonds.

In a recent article in Dawn, Riaz Riazuddin, a former SBP banker, wrote that only Rs 2.3 trillion (or five percent of the Rs 48 trillion government debt) is currently Sharia-compliant. Clearly, the government is faced with the Herculean task of converting 95% of its debt into Islamic mode in the next five years.

The fact is that the government cannot swiftly issue new Islamic bonds to retire the old conventional stock of debt; it simply does not have enough real assets to provide the basis for Ijarah Sukuk transactions. The most readily available asset is land, but land ownership in Pakistan lies with the respective provincial governments while the sovereign debt exists on the books of the federal government.

According to Riazuddin, the federal government can either amend the Constitution and make land a federal subject or devise “ingenious ways” to use provincial land as an underlying asset for Ijarah Sukuk.

Another challenge is the perceived lack of trained human resources as well as the notion that full conversion may adversely affect Pakistan’s relationship with international financial institutions such as the International Monetary Fund (IMF) and the World Bank, although industry experts say these are basically cited as excuses to slow down the pace of transition.

According to Siddiqui, he has been actively involved in the operations of the Centre for Excellence in Islamic Finance at IBA, Karachi. It’s one of the many training facilities that prepare young men and women for the rapidly expanding Islamic banking industry. As for Pakistan’s relationship with international financial institutions, Siddiqui says the IMF and the World Bank have no issue with Islamic banking because it’s built upon a sounder foundation. “Islamic banking is asset-backed, which effectively eliminates the possibility of economic bubbles seen so frequently in the conventional system,” concludes Siddiqui.

Kazim Alam is a staff member of Dawn.

[email protected]