A lot of the weapons posted here are NOT stand-off by nature. A Stand off missile has the aircraft in fairly safe waters from enemy threats.. hence the term stand-off. The JAGM or the Cirit do not guarantee such a range that the aircraft is able to avoid any enemy threat to it.

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AGMs and Standoff Weapons

- Thread starter Manticore

- Start date

Manticore

RETIRED MOD

- Joined

- Jan 18, 2009

- Messages

- 10,115

- Reaction score

- 114

- Country

- Location

TuAFFalcon

FULL MEMBER

- Joined

- Jan 9, 2013

- Messages

- 151

- Reaction score

- 0

- Country

- Location

A lot of the weapons posted here are NOT stand-off by nature. A Stand off missile has the aircraft in fairly safe waters from enemy threats.. hence the term stand-off. The JAGM or the Cirit do not guarantee such a range that the aircraft is able to avoid any enemy threat to it.

Can we put a number on that?

How many kms on average?

Let's all think of Stand off = Sniper rifles.

I think as Pakistan has be facing severe shortage of funds in developing Sensors along with Weapons and other needed equipment; they should welcome Middle Eastern countries to become partner in these programs to learn and build with Pakistan. More over, they can take help from EU, China and other countries over that.

Indus Falcon

SENIOR MEMBER

- Joined

- Mar 4, 2011

- Messages

- 6,910

- Reaction score

- 107

- Country

- Location

AGM-158 JASSM:

Lockheed’s Family of Stealthy Cruise Missiles

JASSM family missiles are guided by a combination of GPS/INS positioning en route, and Imaging Infrared (IIR) for final targeting. They carry a dual-mode penetrator and blast fragmentation warhead at subsonic speed, in a body shape designed to have a very low radar profile.

The US military intends to buy over 5,000 missiles in this family: 2,400 JASSMs, and 2,978 JASSM-ERs. AGM-158 JASSM production looks set to end around FY 2021, but planned AGM-158B JASSM-ER orders would keep the production line going into the late 2020s, and possibly beyond. Customers include the USA, Australia, Finland, and the Netherlands. Poland has stated their intention to buy some, but the formal DSCA request isn’t out yet.

The AGM-158 JASSM is currently integrated on B-2A Spirit stealth bombers, B-1B Lancer, and B-52H Stratofortress bombers. On the fighter front, its platforms include the F-15E Strike Eagle, F-16 Falcon (MLU standard & Block 50), and the Royal Australian Air Force’s upgraded F/A-18 AM/BM Hornets. Finland is following suit for its own F/A-18C/D Hornets.

The US military intends to add the F/A-18E/F Super Hornet family to this list, and to extend F-16 compatibility to earlier Block 40 models. JASSM will also be carried by theF-35, eventually, but it’s no longer on the list of weapons for certification by the end of the development program. If and when it’s certified for the F-35 family after 2020, it will have to be carried externally, because it’s too large for the internal weapon bays.

Unit cost for the baseline AGM-158 JASSM is currently around $1 million per missile, but the USAF hopes to bring that down to around $800,000 eventually. Don’t forget the ongoing maintenance costs, either: Lockheed Martin hasa 2012-2017 support contract underway for the entire weapon family.

JASSM-ER: Long Range Reach

The AGM-158B JASSM-ER maintains the same mold line and size, but it substitutes a Williams International turbofan for the baseline JASSM’s Teledyne turbojet, and adds extra fuel within the missile body, without dropping payload or electronics capabilities. The 2 variants share 70% of their hardware, and 95% of their software.

The result is an extension of the missile’s range from “over 200 nm” to “over 500 nm”. JASSM-ER has also been certified for use in environments where GPS is heavily jammed, or not available.

JASSM-ER unit cost is eventually expected to be around $1.25 million per missile, but current costs are running around $1.75 million.

The USAF says that AGM-158B JASSM-ER will eventually be integrated with as very similar plane set: B-1 Lancer, B-2 Spirit, B-52 Stratofortress, F-15E Strike Eagle, F-16 Falcon (Block 25+), F/A-18E/F Super Hornet, and F-35A-C Lightning II.

Under current USAF plans, however, the B-1 Lancer will be the only plane certified with the new missile for a few years. The B-1′s 24-missile payload capacity is double the B-52′s, and the new missile will make the USAF’s Lancer fleet its key strike force in the Pacific theater. Even as operating costs per flight hour are putting very large crosshairs on that same fleet’s continued existence.

A variant of JASSM-ER called LRASM-A promises to add shipborne vertical launch capabilities to the platform, and will refine the missile’s ability to hit moving targets like ships. It’s just one of several potential competitors for a program called OASuW, but even if LRASM isn’t picked, Lockheed Martin is likely to cycle its improvements back into the JASSM family.

Global Competition

The JASSM family has several international competitors, with MBDA’s Storm Shadow leading the pack. Storm Shadow was used over Libya by French and British aircraft, and a SCALP Naval variant offers very long range strike from submarines, or from shipborne Sylver A70 vertical launch cells.

MBDA & Saab’s Taurus KEPD 350, Raytheon’s powered JSOW-ER, and Boeing’s AGM-84K SLAM-ER also represent sub-sonic cruise missiles with some level of stealth, and similar range to the base AGM-158.Norway’s NSM/JSM is about to add itself to that mix, and will fit inside the F-35. The JASSM family can’t match that stealthy internal carriage, which may open a significant global niche for Kongsberg.

Russian strike missile designs

, and derivatives like the Russo-Indian PJ-10 BrahMos, emphasize speed over stealth, and aren’t compatible with the same base platforms. They aren’t really competitors in the same niche.

, and derivatives like the Russo-Indian PJ-10 BrahMos, emphasize speed over stealth, and aren’t compatible with the same base platforms. They aren’t really competitors in the same niche.

AGM-158 JASSM: Lockheed’s Family of Stealthy Cruise Missiles

Lockheed’s Family of Stealthy Cruise Missiles

JASSM family missiles are guided by a combination of GPS/INS positioning en route, and Imaging Infrared (IIR) for final targeting. They carry a dual-mode penetrator and blast fragmentation warhead at subsonic speed, in a body shape designed to have a very low radar profile.

The US military intends to buy over 5,000 missiles in this family: 2,400 JASSMs, and 2,978 JASSM-ERs. AGM-158 JASSM production looks set to end around FY 2021, but planned AGM-158B JASSM-ER orders would keep the production line going into the late 2020s, and possibly beyond. Customers include the USA, Australia, Finland, and the Netherlands. Poland has stated their intention to buy some, but the formal DSCA request isn’t out yet.

The AGM-158 JASSM is currently integrated on B-2A Spirit stealth bombers, B-1B Lancer, and B-52H Stratofortress bombers. On the fighter front, its platforms include the F-15E Strike Eagle, F-16 Falcon (MLU standard & Block 50), and the Royal Australian Air Force’s upgraded F/A-18 AM/BM Hornets. Finland is following suit for its own F/A-18C/D Hornets.

The US military intends to add the F/A-18E/F Super Hornet family to this list, and to extend F-16 compatibility to earlier Block 40 models. JASSM will also be carried by theF-35, eventually, but it’s no longer on the list of weapons for certification by the end of the development program. If and when it’s certified for the F-35 family after 2020, it will have to be carried externally, because it’s too large for the internal weapon bays.

Unit cost for the baseline AGM-158 JASSM is currently around $1 million per missile, but the USAF hopes to bring that down to around $800,000 eventually. Don’t forget the ongoing maintenance costs, either: Lockheed Martin hasa 2012-2017 support contract underway for the entire weapon family.

JASSM-ER: Long Range Reach

The AGM-158B JASSM-ER maintains the same mold line and size, but it substitutes a Williams International turbofan for the baseline JASSM’s Teledyne turbojet, and adds extra fuel within the missile body, without dropping payload or electronics capabilities. The 2 variants share 70% of their hardware, and 95% of their software.

The result is an extension of the missile’s range from “over 200 nm” to “over 500 nm”. JASSM-ER has also been certified for use in environments where GPS is heavily jammed, or not available.

JASSM-ER unit cost is eventually expected to be around $1.25 million per missile, but current costs are running around $1.75 million.

The USAF says that AGM-158B JASSM-ER will eventually be integrated with as very similar plane set: B-1 Lancer, B-2 Spirit, B-52 Stratofortress, F-15E Strike Eagle, F-16 Falcon (Block 25+), F/A-18E/F Super Hornet, and F-35A-C Lightning II.

Under current USAF plans, however, the B-1 Lancer will be the only plane certified with the new missile for a few years. The B-1′s 24-missile payload capacity is double the B-52′s, and the new missile will make the USAF’s Lancer fleet its key strike force in the Pacific theater. Even as operating costs per flight hour are putting very large crosshairs on that same fleet’s continued existence.

A variant of JASSM-ER called LRASM-A promises to add shipborne vertical launch capabilities to the platform, and will refine the missile’s ability to hit moving targets like ships. It’s just one of several potential competitors for a program called OASuW, but even if LRASM isn’t picked, Lockheed Martin is likely to cycle its improvements back into the JASSM family.

Global Competition

The JASSM family has several international competitors, with MBDA’s Storm Shadow leading the pack. Storm Shadow was used over Libya by French and British aircraft, and a SCALP Naval variant offers very long range strike from submarines, or from shipborne Sylver A70 vertical launch cells.

MBDA & Saab’s Taurus KEPD 350, Raytheon’s powered JSOW-ER, and Boeing’s AGM-84K SLAM-ER also represent sub-sonic cruise missiles with some level of stealth, and similar range to the base AGM-158.Norway’s NSM/JSM is about to add itself to that mix, and will fit inside the F-35. The JASSM family can’t match that stealthy internal carriage, which may open a significant global niche for Kongsberg.

Russian strike missile designs

AGM-158 JASSM: Lockheed’s Family of Stealthy Cruise Missiles

Indus Falcon

SENIOR MEMBER

- Joined

- Mar 4, 2011

- Messages

- 6,910

- Reaction score

- 107

- Country

- Location

BAE contracted to study Brimstone 2 for Typhoon

By: Beth Stevenson

19 Jun 2014

Following doubts over the timeline for the integration of MBDA-developed Brimstone 2 missiles on the Royal Air Force’s Eurofighter Typhoons, the UK Ministry of Defence has contracted BAE Systems to study the possibility of accelerating the process.

In February the National Audit Office released its Major Projects Report 2013, which claimed the integration of the air-to-surface Brimstone 2 on the Typhoon would not come to pass until 2021. This would result in a two year capability gap, following the retirement of the Panavia Tornado GR4 in 2019.

The £5 million ($8.5 million) contract for an initial study will facilitate an "effective route" to Brimstone 2 integration for the RAF by 2018, according to BAE and MBDA. The study will also explore the possibility of a common launcher that could be used with other RAF weapon systems, such as the latter's future Spear 3.

BAE is currently carrying out windtunnel tests at its facility in Warton, Lancashire, which will assess the aerodynamic effects of carrying the precision-guided weapon on the aircraft.

Brimstone 2 was originally due to enter service in October 2012 with the Tornado, although integration is now slated for completion in November 2015.

The delay in the introduction of Brimstone 2 has been attributed to a reliability problem with the Roxel rocket motor, which came to light during the latter stages of an environmental stress testing campaign in January 2012. Issues with the weapon’s new warhead also contributed to the slip.

"The Brimstone 2 will add to the swing-role capability of the Typhoon," BAE says in a statement released on 19 June. “Brimstone 2 is effective against the most challenging, high speed and manoeuvring targets over land and sea."

BAE adds: “The study contract will transition the dual-mode Brimstone capability that is combat-proven on Tornado GR4 to [the] Typhoon.”

One way to mitigate a capability gap between the retirement of the RAF's remaining Tornados and the introduction of Brimstone 2 on the Typhoon would be to integrate the dual-mode variant of Brimstone with the service's General Atomics Aeronautical Systems Reaper unmanned air vehicles.

In March, MBDA announced a series of tests into the integration of the weapon with the Reaper had concluded in January 2014, at the US Navy’s China Lake weapons range in California.

The campaign involved nine live firings against moving ground vehicles, all of which resulted in “direct hits”, according to MBDA.

BAE contracted to study Brimstone 2 for Typhoon - 6/19/2014 - Flight Global

Specifications

Weight: 110lb

Length: 71in

Diameter: 7in

Guidance: Millimeter Wave Radar and Semi-Active Laser

Warhead: Tandem Shaped Charge

By: Beth Stevenson

19 Jun 2014

Following doubts over the timeline for the integration of MBDA-developed Brimstone 2 missiles on the Royal Air Force’s Eurofighter Typhoons, the UK Ministry of Defence has contracted BAE Systems to study the possibility of accelerating the process.

In February the National Audit Office released its Major Projects Report 2013, which claimed the integration of the air-to-surface Brimstone 2 on the Typhoon would not come to pass until 2021. This would result in a two year capability gap, following the retirement of the Panavia Tornado GR4 in 2019.

The £5 million ($8.5 million) contract for an initial study will facilitate an "effective route" to Brimstone 2 integration for the RAF by 2018, according to BAE and MBDA. The study will also explore the possibility of a common launcher that could be used with other RAF weapon systems, such as the latter's future Spear 3.

BAE is currently carrying out windtunnel tests at its facility in Warton, Lancashire, which will assess the aerodynamic effects of carrying the precision-guided weapon on the aircraft.

Brimstone 2 was originally due to enter service in October 2012 with the Tornado, although integration is now slated for completion in November 2015.

The delay in the introduction of Brimstone 2 has been attributed to a reliability problem with the Roxel rocket motor, which came to light during the latter stages of an environmental stress testing campaign in January 2012. Issues with the weapon’s new warhead also contributed to the slip.

"The Brimstone 2 will add to the swing-role capability of the Typhoon," BAE says in a statement released on 19 June. “Brimstone 2 is effective against the most challenging, high speed and manoeuvring targets over land and sea."

BAE adds: “The study contract will transition the dual-mode Brimstone capability that is combat-proven on Tornado GR4 to [the] Typhoon.”

One way to mitigate a capability gap between the retirement of the RAF's remaining Tornados and the introduction of Brimstone 2 on the Typhoon would be to integrate the dual-mode variant of Brimstone with the service's General Atomics Aeronautical Systems Reaper unmanned air vehicles.

In March, MBDA announced a series of tests into the integration of the weapon with the Reaper had concluded in January 2014, at the US Navy’s China Lake weapons range in California.

The campaign involved nine live firings against moving ground vehicles, all of which resulted in “direct hits”, according to MBDA.

BAE contracted to study Brimstone 2 for Typhoon - 6/19/2014 - Flight Global

Specifications

Weight: 110lb

Length: 71in

Diameter: 7in

Guidance: Millimeter Wave Radar and Semi-Active Laser

Warhead: Tandem Shaped Charge

Attachments

Indus Falcon

SENIOR MEMBER

- Joined

- Mar 4, 2011

- Messages

- 6,910

- Reaction score

- 107

- Country

- Location

Raytheon’s GBU-53 Small Diameter Bomb

SDB-Is on F-15E

Raytheon’s GBU-53/B SDB-II is 7″ in diameter around the tri-mode (laser, IIR, radar) seeker, with a clamshell protective door that comes off when the bomb is dropped. A GPS receiver adds a 4th targeting mode. The bomb tapers to about 6″ diameter beyond the pop-out wings, and is about 69.5″ long. The wings remain swept back when deployed, and are about 66″ across with a 5 degree anhedral slope. The bomb weighs about 200 pounds, and all of these dimensions are important when trying to ensure that the US Marines’ F-35B, with its cut-down internal weapon bays, can still carry 8 of them per bay.

The US Navy is developing a Joint Miniature Munitions BRU to address internal F-35 carriage, and SDB-II also fits on BRU-61 external bomb racks. No word yet on whether the JMM BRU will also fit in the USAF’s F-22A, which is also slated to deploy this weapon now.

Range is expected to be up to 40 nautical miles when launched at altitude, thanks to a high lift-to-drag ratio in the design. Since SDB-II is an unpowered glide bomb, its actual range will always depend on launching altitude and circumstances. An F-22A would be able to extend that range significantly by launching at supercruise speeds of Mach 1.5, for instance, as long as the bomb proves safe and stable at those launch speeds in tests.

SDB-II’s Attack Modes: Seekers & Sequences

Once a target is picked by the pilot, initial communication and GPS coordinates are transmitted between the aircraft and the SDB-II bomb using the Universal Armament Interface (UAI) messaging protocol, which was designed to make integration of new weapons easier. The post-launch datalink will be Rockwell Collins’ TacNet, a 2-way, dual band link that enters the network quickly using encrypted UHF radio frequencies from the ground or secure Link-16 from the launching aircraft, and provides both weapon and target status to the shooter. TacNet’s datalink software is programmable if other frequencies/waveforms need to added in future, and Raytheon cites a message speed of 38 messages per minute as further evidence of the system’s ability to keep pace with future needs. Link-16 makes the weapon part of a much larger system, and gives SDB-II the ability to be dropped by one platform and then targeted or re-targeted by another. The bomb can also be sent an abort command, if necessary. If the link is lost, the bomb will continue with its mission, using its own on-board seekers.

Raytheon’s SDB-II contender uses a close precursor of the tri-mode seeker technology featured in the joint Raytheon/Boeing bid for theJAGM missile, which adds some refinements. The SDB-II uses jam-resistant GPS/INS targeting like Boeing’s GBU-39 SDB-I, but its added seeker features 3 modes of operation: semi-active laser, millimeter-wave radar, and uncooled imaging infrared. By combining these 3 modes, the GBU-53 can have excellent performance against a variety of target types, under any weather conditions, while making it much more difficult to use countermeasures or decoys successfully:

Semi-active laser guidance. This is standard for a wide range of missiles and rockets, and offers the best on-target accuracy and assurance, especially in urban environments. Its flip side is problematic performance through heavy fog, sandstorms, etc. That’s where GPS/INS guidance to a specified coordinate, and the next 2 fire-and-forget modes, come in.

Millimeter wave radar

will operate through any weather. It’s especially good at distinguishing metal targets and noting movement, and is used in weapons like AGM-114 Hellfire Longbow missiles to give them “fire and forget” capability. These days, most people probably hear the term and think of airport scanners.

will operate through any weather. It’s especially good at distinguishing metal targets and noting movement, and is used in weapons like AGM-114 Hellfire Longbow missiles to give them “fire and forget” capability. These days, most people probably hear the term and think of airport scanners.

Imaging infrared (IIR)This was adapted from the much larger AGM-154 JSOW glide bomb, and uses high-resolution thermal scans to create a target picture. It also helps with target identification, and offers better performance against some kinds of targets like humans. By using an uncooled IIR seeker, the bomb lowers both its cost and its maintenance requirements. The uncooled seeker also allows snap-attacks against targets that present themselves quickly, since the it doesn’t need any time to cool down before it begins to work.

Once launched, the SDB-II relies on a sophisticated package of internal computing and algorithms that are designed to get the most out of its tri-mode sensors, and make the process of launch and targeting as simple and flexible as possible for the pilot. The GPS/INS system or datalink messages guide the bomb toward the target during the initial search phase, while the tri-mode seeker gathers initial data. A revisit phase combines information from all of its sensor modes to classify targets. That’s especially useful because the SDB-II can be told to prioritize certain types of targets, for example by distinguishing between tracked and wheeled vehicles, or by giving laser “painted” targets priority.

Different targets require different warhead types, which is why the GBU-53 contains a warhead from General Dynamics Ordnance & Tactical Systems that delivers shaped charge, blast and fragmentation effects all at once. A scored blast and fragmentation warhead makes it deadly against buildings and people as well.

This warhead was actually redesigned mid-way through the development phase, as the USAF added a requirement to destroy main battle tanks. That initial hardship became a positive experience, as the redesign actually ended up shrinking Team Raytheon’s bomb’s size, and improving its manufacturing costs.

Moving Target: Raytheon’s GBU-53 Small Diameter Bomb II

The company's tri-mode seeker fuses millimeter-wave radar, uncooled IIR and digital semi-active laser sensors on a single gimbal. The result is a powerful, integrated seeker that seamlessly shares targeting information between all three modes, enabling weapons to engage fixed, relocatable or moving targets at any time of day and in adverse weather conditions.

SDB II's tri-mode seeker can peer through storm clouds or battlefield dust and debris to engage fixed or moving targets, giving the warfighter a capability that's unaffected by conditions on the ground or in the air.

The warfighter also gains enhanced security with SDB II as it can fly more than 45 miles to strike a mobile target. And, because of SDB II's small size, fewer aircraft can take out the same number of targets that used to require many jets,each carrying a handful of large weapons. SDB II's size has broader implications for both the warfighter and taxpayers as it means fewer sorties – and less time spent flying dangerous missions.

Key Attributes

SDB-Is on F-15E

Raytheon’s GBU-53/B SDB-II is 7″ in diameter around the tri-mode (laser, IIR, radar) seeker, with a clamshell protective door that comes off when the bomb is dropped. A GPS receiver adds a 4th targeting mode. The bomb tapers to about 6″ diameter beyond the pop-out wings, and is about 69.5″ long. The wings remain swept back when deployed, and are about 66″ across with a 5 degree anhedral slope. The bomb weighs about 200 pounds, and all of these dimensions are important when trying to ensure that the US Marines’ F-35B, with its cut-down internal weapon bays, can still carry 8 of them per bay.

The US Navy is developing a Joint Miniature Munitions BRU to address internal F-35 carriage, and SDB-II also fits on BRU-61 external bomb racks. No word yet on whether the JMM BRU will also fit in the USAF’s F-22A, which is also slated to deploy this weapon now.

Range is expected to be up to 40 nautical miles when launched at altitude, thanks to a high lift-to-drag ratio in the design. Since SDB-II is an unpowered glide bomb, its actual range will always depend on launching altitude and circumstances. An F-22A would be able to extend that range significantly by launching at supercruise speeds of Mach 1.5, for instance, as long as the bomb proves safe and stable at those launch speeds in tests.

SDB-II’s Attack Modes: Seekers & Sequences

Once a target is picked by the pilot, initial communication and GPS coordinates are transmitted between the aircraft and the SDB-II bomb using the Universal Armament Interface (UAI) messaging protocol, which was designed to make integration of new weapons easier. The post-launch datalink will be Rockwell Collins’ TacNet, a 2-way, dual band link that enters the network quickly using encrypted UHF radio frequencies from the ground or secure Link-16 from the launching aircraft, and provides both weapon and target status to the shooter. TacNet’s datalink software is programmable if other frequencies/waveforms need to added in future, and Raytheon cites a message speed of 38 messages per minute as further evidence of the system’s ability to keep pace with future needs. Link-16 makes the weapon part of a much larger system, and gives SDB-II the ability to be dropped by one platform and then targeted or re-targeted by another. The bomb can also be sent an abort command, if necessary. If the link is lost, the bomb will continue with its mission, using its own on-board seekers.

Raytheon’s SDB-II contender uses a close precursor of the tri-mode seeker technology featured in the joint Raytheon/Boeing bid for theJAGM missile, which adds some refinements. The SDB-II uses jam-resistant GPS/INS targeting like Boeing’s GBU-39 SDB-I, but its added seeker features 3 modes of operation: semi-active laser, millimeter-wave radar, and uncooled imaging infrared. By combining these 3 modes, the GBU-53 can have excellent performance against a variety of target types, under any weather conditions, while making it much more difficult to use countermeasures or decoys successfully:

Semi-active laser guidance. This is standard for a wide range of missiles and rockets, and offers the best on-target accuracy and assurance, especially in urban environments. Its flip side is problematic performance through heavy fog, sandstorms, etc. That’s where GPS/INS guidance to a specified coordinate, and the next 2 fire-and-forget modes, come in.

Millimeter wave radar

Imaging infrared (IIR)This was adapted from the much larger AGM-154 JSOW glide bomb, and uses high-resolution thermal scans to create a target picture. It also helps with target identification, and offers better performance against some kinds of targets like humans. By using an uncooled IIR seeker, the bomb lowers both its cost and its maintenance requirements. The uncooled seeker also allows snap-attacks against targets that present themselves quickly, since the it doesn’t need any time to cool down before it begins to work.

Once launched, the SDB-II relies on a sophisticated package of internal computing and algorithms that are designed to get the most out of its tri-mode sensors, and make the process of launch and targeting as simple and flexible as possible for the pilot. The GPS/INS system or datalink messages guide the bomb toward the target during the initial search phase, while the tri-mode seeker gathers initial data. A revisit phase combines information from all of its sensor modes to classify targets. That’s especially useful because the SDB-II can be told to prioritize certain types of targets, for example by distinguishing between tracked and wheeled vehicles, or by giving laser “painted” targets priority.

Different targets require different warhead types, which is why the GBU-53 contains a warhead from General Dynamics Ordnance & Tactical Systems that delivers shaped charge, blast and fragmentation effects all at once. A scored blast and fragmentation warhead makes it deadly against buildings and people as well.

This warhead was actually redesigned mid-way through the development phase, as the USAF added a requirement to destroy main battle tanks. That initial hardship became a positive experience, as the redesign actually ended up shrinking Team Raytheon’s bomb’s size, and improving its manufacturing costs.

Moving Target: Raytheon’s GBU-53 Small Diameter Bomb II

The company's tri-mode seeker fuses millimeter-wave radar, uncooled IIR and digital semi-active laser sensors on a single gimbal. The result is a powerful, integrated seeker that seamlessly shares targeting information between all three modes, enabling weapons to engage fixed, relocatable or moving targets at any time of day and in adverse weather conditions.

SDB II's tri-mode seeker can peer through storm clouds or battlefield dust and debris to engage fixed or moving targets, giving the warfighter a capability that's unaffected by conditions on the ground or in the air.

The warfighter also gains enhanced security with SDB II as it can fly more than 45 miles to strike a mobile target. And, because of SDB II's small size, fewer aircraft can take out the same number of targets that used to require many jets,each carrying a handful of large weapons. SDB II's size has broader implications for both the warfighter and taxpayers as it means fewer sorties – and less time spent flying dangerous missions.

Key Attributes

- Keeps aviators away from many surface-to-air missiles by flying 45 miles to its target

- Aircrews spend less time in harm's way because fewer aircraft are required to take out large numbers of targets

Indus Falcon

SENIOR MEMBER

- Joined

- Mar 4, 2011

- Messages

- 6,910

- Reaction score

- 107

- Country

- Location

Kongsberg’s New NSM/JSM Anti-Ship & Strike Missile

Kongsberg’s New NSM/JSM Anti-Ship & Strike Missile

Kongsberg’s New NSM/JSM Anti-Ship & Strike Missile

Indus Falcon

SENIOR MEMBER

- Joined

- Mar 4, 2011

- Messages

- 6,910

- Reaction score

- 107

- Country

- Location

BAE ‘Bullish’ Army Will Buy Missile Guidance Kits

by Brendan McGarry, July 18th, 2014

FARNBOROUGH, England — The U.S. subsidiary of British defense giant BAE Systems Plc is confident the Army will begin buying its kits to convert unguided rockets on helicopters into “smart” heat-seeking missiles, a company official said.

The so-called Advanced Precision Kill Weapon System, or APKWS, converts a 2.75-inch Hydra rocket into a “smart” munition by adding a semi-active laser guidance and control mid-section.

It’s a low-cost option for precision strike, costing some $30,000 apiece — roughly a third of the price tag of an AGM-114 Hellfire missile made by Lockheed Martin Corp., according to David Harrold, director of precision guidance solutions and electronic systems at BAE Systems Inc. While not as powerful as the Hellfire, the system is effective at soft, light targets such as wheeled vehicles and small boats.

“We developed APKWS to fill that gap,” he said during a briefing on Thursday here at the Farnborough International Air Show.

The system is one of several competing products targeting the global market for upgrades to the 70mm rocket. There are hundreds of thousands of the munitions in military inventories around the world.

Other products include the Direct Attack Guided Rocket, or DAGR, made by Bethesda, Maryland-based Lockheed; the Cirit made by the Turkish missile-maker Roketsan and the Talon developed jointly by Waltham, Massachusetts-based Raytheon and United Arab Emirates-based Emirates Advanced Investments, or EAI.

BAE a few months ago announced its first international sale of the product, a $5.5 million deal with the kingdom of Jordan to arm a pair of Casa CN-235 gunships with the guided munitions.

The company has already delivered more than 3,000 of the kits to the U.S. military. In 2012, the Marine Corps deployed the weapon to Afghanistan on AH-1 Cobra and UH-1 Huey helicopters. The company has already certified the technology on the Army’s AH-64 Apache chopper and expects the service to begin buying the system fiscal 2015.

“We’re really looking forward to bringing it to the Army,” Harrold said. “I’m feeling pretty bullish about the Army buying some APKWS in 2015.”

The Army’s lead office for missiles and space has already expressed a need for the technology and the service’s budget request for the fiscal year beginning Oct. 1 references it, he said. The request includes a $27 million line item for 741 Hydra rockets and other components, including about $4 million for 66 guidance sections, according to budget documents.

The Navy this year began testing the system in new 19-tube digital rocket launches aboard MH-60R Sea Hawk helicopters. The launcher is almost triple the capacity of seven-tube launches on Cobras and Hueys.

“You can imagine just the game-changer that is,” Harrold said.

U.S. Central Command last year test-fired the system on fixed-wing aircraft, including the A-10 Warthog gunship, the F-16 fighter jet and the AV-8B Harrier jump-jet, he said. While the system’s performance varies depending on the type of platform, it has a range of between 1.5 kilometers and 5 kilometers, with an optimal range of 3 kilometers, he said.

Overall, the company has fired the guided rocket off more than a dozen aircraft, both fixed and rotary wing, even the MQ-8 Fire Scout helicopter drone, Harrold said. It has tested the weapon on the ground, and could adapted for use on ground vehicles, too, such as the Stryker armored personnel carrier, he said.

“This is a very easy system to integrate onto any platform that already fires the Hydra 70,” Harrold said. “That’s why it’s been relatively painless to go this path of multiple platforms.”

BAE 'Bullish' Army Will Buy Missile Guidance Kits | DoD Buzz

by Brendan McGarry, July 18th, 2014

FARNBOROUGH, England — The U.S. subsidiary of British defense giant BAE Systems Plc is confident the Army will begin buying its kits to convert unguided rockets on helicopters into “smart” heat-seeking missiles, a company official said.

The so-called Advanced Precision Kill Weapon System, or APKWS, converts a 2.75-inch Hydra rocket into a “smart” munition by adding a semi-active laser guidance and control mid-section.

It’s a low-cost option for precision strike, costing some $30,000 apiece — roughly a third of the price tag of an AGM-114 Hellfire missile made by Lockheed Martin Corp., according to David Harrold, director of precision guidance solutions and electronic systems at BAE Systems Inc. While not as powerful as the Hellfire, the system is effective at soft, light targets such as wheeled vehicles and small boats.

“We developed APKWS to fill that gap,” he said during a briefing on Thursday here at the Farnborough International Air Show.

The system is one of several competing products targeting the global market for upgrades to the 70mm rocket. There are hundreds of thousands of the munitions in military inventories around the world.

Other products include the Direct Attack Guided Rocket, or DAGR, made by Bethesda, Maryland-based Lockheed; the Cirit made by the Turkish missile-maker Roketsan and the Talon developed jointly by Waltham, Massachusetts-based Raytheon and United Arab Emirates-based Emirates Advanced Investments, or EAI.

BAE a few months ago announced its first international sale of the product, a $5.5 million deal with the kingdom of Jordan to arm a pair of Casa CN-235 gunships with the guided munitions.

The company has already delivered more than 3,000 of the kits to the U.S. military. In 2012, the Marine Corps deployed the weapon to Afghanistan on AH-1 Cobra and UH-1 Huey helicopters. The company has already certified the technology on the Army’s AH-64 Apache chopper and expects the service to begin buying the system fiscal 2015.

“We’re really looking forward to bringing it to the Army,” Harrold said. “I’m feeling pretty bullish about the Army buying some APKWS in 2015.”

The Army’s lead office for missiles and space has already expressed a need for the technology and the service’s budget request for the fiscal year beginning Oct. 1 references it, he said. The request includes a $27 million line item for 741 Hydra rockets and other components, including about $4 million for 66 guidance sections, according to budget documents.

The Navy this year began testing the system in new 19-tube digital rocket launches aboard MH-60R Sea Hawk helicopters. The launcher is almost triple the capacity of seven-tube launches on Cobras and Hueys.

“You can imagine just the game-changer that is,” Harrold said.

U.S. Central Command last year test-fired the system on fixed-wing aircraft, including the A-10 Warthog gunship, the F-16 fighter jet and the AV-8B Harrier jump-jet, he said. While the system’s performance varies depending on the type of platform, it has a range of between 1.5 kilometers and 5 kilometers, with an optimal range of 3 kilometers, he said.

Overall, the company has fired the guided rocket off more than a dozen aircraft, both fixed and rotary wing, even the MQ-8 Fire Scout helicopter drone, Harrold said. It has tested the weapon on the ground, and could adapted for use on ground vehicles, too, such as the Stryker armored personnel carrier, he said.

“This is a very easy system to integrate onto any platform that already fires the Hydra 70,” Harrold said. “That’s why it’s been relatively painless to go this path of multiple platforms.”

BAE 'Bullish' Army Will Buy Missile Guidance Kits | DoD Buzz

Hakan

RETIRED INTL MOD

- Joined

- Feb 9, 2014

- Messages

- 6,271

- Reaction score

- 39

- Country

- Location

Lockheed Martin Teams with Roketsan of Turkey on New Standoff Missile for the F-35

The SOM system is an autonomous, long-range, low-observable, all-weather, precision air-to-surface cruise missile. The SOM-J variant is tailored for internal carriage on the F-35 aircraft. The companies will jointly develop, produce, market

and support SOM-J for internal carriage on the F-35 aircraft or external carriage on

other aircraft.

Lockheed Martin Missiles and Fire Control Executive Vice President Rick Edwards and Roketsan Chairman of the Board Eyüp Kaptan signed the agreement.

“Lockheed Martin has a long history of partnership with the Republic of Turkey, and we look forward to working closely with Roketsan on this very important project,” Edwards said. “SOM-J will provide the F-35 and other aircraft an exceptional capability to meet the most challenging mission requirements. We look forward to combining the skills and know-how of our two great companies to produce a world-class system to meet customers’ expanding needs for long-range, survivable cruise missile technology.”

“At Roketsan, we believe this teaming will increase the attention on SOM-J and present a superior solution to fulfill the requirements of anti-surface warfare capabilities on the F-35 aircraft,” Kaptan said. “We value our partnership with Lockheed Martin and look forward to additional business opportunities in the future.”

Roketsan Inc. was founded in 1988 for the purpose of “possessing a leading institution in the country for designing, developing and manufacturing rockets and missiles.” Roketsan is rapidly going forward to become a global company in defense industries sector with personnel of more than 1,800, 51 percent of which comprise engineers, an invested capital of TL 4 billion and its accumulation of technologic knowledge. Roketsan has become a corporation, the operations of which now extend beyond the borders of the country, which participates in NATO programs in its field of technology and is capable of supplying its products to friendly countries besides the Turkish Armed Forces.

Headquartered in Bethesda, Maryland, Lockheed Martin is a global security and aerospace company that employs approximately 113,000 people worldwide and is principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. The Corporation’s net sales for 2013 were $45.4 billion.

Lockheed Martin Teams with Roketsan of Turkey on New Standoff Missile for the F-35 · Lockheed Martin

Indus Falcon

SENIOR MEMBER

- Joined

- Mar 4, 2011

- Messages

- 6,910

- Reaction score

- 107

- Country

- Location

Army Win Solidifies Lockheed's Air-to-Ground Market Share

By Joe Gould and Andrew Chuter

August 9, 2015

WASHINGTON and LONDON — As operations in Iraq and Syria continue to drive demand for the Hellfire missile, Lockheed Martin has secured an Army contract to develop its successor — one which offers the company hope of blocking competitors Raytheon and MBDA from having even a toehold in the air-to-ground missile market.

The $66.3 million contract for the Joint Air-to-Ground Missile (JAGM) gives Lockheed the right to replace its popular Hellfire missile, as well as the Raytheon-made air-launched TOW anti-tank missiles, on rotary wing and unmanned aircraft for the US Army, Navy and Marine Corps. The Pentagon made the announcement on July 31.

Under the contract, Lockheed is developing a dual-mode seeker, housed in an AGM-114R Hellfire "Romeo" body, that combines a semi-active laser and "fire-and-forget" millimeter wave radar. The combination improves accuracy against moving targets, like trucks and tanks, and in poor weather.

Though Lockheed was the lone bidder, the Europe-based consortium MBDA had voiced hopes of breaking into the US market with a similar capability, the Brimstone 2, which also uses a dual-mode seeker. Raytheon participated in an early stage of the Army program but opted out.

"This was a way for Lockheed Martin to keep its hand on the Hellfire business," said senior analyst Steve Zaroga, of the Teal Group. "There is an element of Lockheed Martin versus Raytheon, but another element is the European attempt, MBDA, trying to sell their weapon into the US market."

As the US and its allies conduct airstrikes and bombing raids against the Islamic State group, Hellfire missiles are in high demand. The US Air Force budgeted more than $700 million for 3,756 Hellfire missiles for 2016, and the Pentagon has in recent months sought approval for Hellfire sales to Lebanon, Saudi Arabia, Israel, Egypt, Pakistan and South Korea that amount to thousands of missiles worth hundreds of millions of dollars.

"I can tell you absolutely yes, the demand for Hellfire has increased, and we are managing the Army inventory very closely, so we are balancing [production] against the demand to deliver quickly to many other countries and our US forces overseas," said Army Col. James Romero, project manager, joint attack munitions systems.

With JAGM scheduled to reach initial operational capability in 2018, Hellfire will likely remain in demand even afterward, as the Army ramps up production of the new missile, Romero said. In June, the Army announced that it asked Lockheed to boost production of the Hellfire from 500 rounds per month to 650 by November 2016.

The JAGM development contract covers 185 missiles, and includes two $60 million low-rate initial production options for up to 2,600 missiles. Army officials said the plan is to eventually replace Hellfire missiles as they expire with JAGM, at a cost of about 10 to 20 percent above the cost of a Hellfire, which typically costs $80,000 to $130,000 each, depending on quantity.

JAGM would first be placed on the Army's AH-64 Apache and Marine Corps' AH-1Z Viper helicopters, and talks are ongoing to install it on the Army's MQ-1C Gray Eagle drone, and on Air Force platforms. It is compatible with all Hellfire II firing platforms, a list that includes the MQ-9 Reaper and MQ-1 Predator drones.

"We know there is a lot of interest not just from the 'big blue' Air Force, but the special operations community as well, and we think it would be a great fit," Romero said. "We are certainly involved in doing this with the Air Force, and we want to make sure they have all the information they need to make a decision whether or not they want JAGM integrated or hosted on qualified platforms."

The latest contract award punctuates a history of fits and starts in this area for the Army. JAGM is the successor to the defunct Joint Common Missile program, which had been envisioned as a new missile that each of the services would buy — before it was canceled in 2006 over cost concerns.

At the time, the concept included a more sophisticated propulsion system and a tri-mode seeker. A tri-mode seeker would include a semi-active laser, millimeter wave radar and infrared guidance, similar to that found on the FGM-148 Javelin anti-tank missile.

While that remains the Army's objective, the program was broken into three increments in January 2013. Today, only the first increment, for the developmental guidance system, has received funding.

Program officials said they plan to discuss with Army and Navy leaders whether to pursue a tri-mode seeker and more advanced motor, but that future competitions would focus on improvements to the missile, not an entirely new development, given the Army's investment in the testing behind the Hellfire.

"Yes, we welcome competition at every stage, but anyone who competes would have to show all the same maturity that we expect to have from our selected contractor, so the bar ends up being higher for level of maturity and expectation of ability to produce a qualified missile," Romero said.

"We don't exclude competition, but we are aware anyone who would compete would have to do investment on their own to catch up, if you will, with the developmental process in the second stage right now."

Raytheon

In 2011, the Army released a solicitation to industry, but the program was defunded before the Army could make an award. The Pentagon ordered a technology demonstration with Raytheon and Lockheed. In 2012, a budget rescission forced the Army to make a decision, based on a preliminary design review, and the Army eliminated Raytheon.

Raytheon opted not to bid when the Army issued its solicitation in late May.

Another potential competitor, MBDA, "took serious consideration on the JAGM competition" but did not compete, according to Jan Gerokostopoulos, communications director for MBDA's US group.

Had Raytheon entered the competition, it was expected to offer a product based on its proposal for the Air Force's Small Diameter Bomb II (SDB II) program, which has a tri-mode seeker. The Air Force and Navy are expected to integrate the SDB II onto the F-35 joint strike fighter and the F/A-18E/F Super Hornet aircraft.

Infrared improves accuracy, but "the seeker really drives up the cost," according to Zaroga.

Raytheon has not given up hope it might one day compete for a Hellfire replacement, and offered the following statement:

"After careful consideration, Raytheon chose not to bid for the JAGM contract. If the requirements change, Raytheon stands ready to assist the US Army with its efforts to field a JAGM missile. We would plan to offer Raytheon's proven tri-mode seeker as part of the solution."

MBDA

MBDA is still in the game. Gerokostopoulos said the US Air Force and Navy are still assessing the Brimstone 2, and the company responded to a request for information for the F/A-18 Growler as recently as late July.

The Navy had taken an initial look at integrating the weapon on F/A-18 Super Hornets and the US Air Force tested the weapon on a Reaper, although that work was done principally for the British.

During a briefing in London on March 16, MBDA boss Antoine Bouvier expressed frustration about US market openness.

“If we are not able in the next few weeks to confirm that we have entered the US market with the Dual Mode Brimstone we will have to recognize that we have failed ... if we have failed to enter with such a perfect case there is something wrong with [market] accessibility,” the MBDA CEO said.

He said he was “not overly optimistic” of receiving “some indication” from the Pentagon that would allow MBDA to pursue Brimstone opportunities. If not, US credibility regarding competition and market access would be damaged, as the weapon is being seen in the UK and elsewhere as a test case, he said.

Carried by Royal Air Force Tornado strike jets, Brimstone has been widely used in recent conflicts where its ability to hit small, maneuvering targets with high accuracy and low collateral damage has drawn widespread plaudits from the military.

Prompted by a question from a reporter, Bouvier said the Brimstone 2 being offered to the US "ticks all the boxes, it's an excellent product, there is a capability gap in the US and we have made a very attractive financial proposal," he said.

Brimstone is a pure British product, supported personally by British Prime Minister David Cameron in talks at the highest levels of the US administration, he said.

When British defense Procurement Minister Philip Dunne met with Frank Kendall, US undersecretary of defense for acquisition, technology and logistics, in Washington in late July, he said he had not given up hope of selling Brimstone to the US, and that there is "continuing interest" in reaching agreement.

For their part, Army program officials said they were open to MBDA's involvement and met with its representatives at various points in the years before the Army's solicitation. Romero said they gave MBDA "every opportunity to compete" and provided the company with technical assessments of the company's progress.

"At the end of the day, their decision was not to propose, and if you want more details, you have to talk directly to them," Romero said.

"I'm concerned about anyone who thinks they did not get a fair shot or that their solution was the solution to our requirements, and I can tell you both of those perceptions are untrue."

Romero said it was inaccurate to presume the Army is attempting to reinvent a capability the UK and MBDA is already fielding. While the system is derived from the Hellfire, the company had trouble reconfiguring its missile to adapt to the Hellfire's back end.

"They certainly had time if they were a serious competitor," Romero said. "You might ask them if they had full consensus and support to move forward on our program."

Note: An earlier version of this story attributed Romero's comments to Lt. Col. Phil Rottenborn, product manager for JAGM.

JAGM Win Boosts Lockheed Profile

By Joe Gould and Andrew Chuter

August 9, 2015

WASHINGTON and LONDON — As operations in Iraq and Syria continue to drive demand for the Hellfire missile, Lockheed Martin has secured an Army contract to develop its successor — one which offers the company hope of blocking competitors Raytheon and MBDA from having even a toehold in the air-to-ground missile market.

The $66.3 million contract for the Joint Air-to-Ground Missile (JAGM) gives Lockheed the right to replace its popular Hellfire missile, as well as the Raytheon-made air-launched TOW anti-tank missiles, on rotary wing and unmanned aircraft for the US Army, Navy and Marine Corps. The Pentagon made the announcement on July 31.

Under the contract, Lockheed is developing a dual-mode seeker, housed in an AGM-114R Hellfire "Romeo" body, that combines a semi-active laser and "fire-and-forget" millimeter wave radar. The combination improves accuracy against moving targets, like trucks and tanks, and in poor weather.

Though Lockheed was the lone bidder, the Europe-based consortium MBDA had voiced hopes of breaking into the US market with a similar capability, the Brimstone 2, which also uses a dual-mode seeker. Raytheon participated in an early stage of the Army program but opted out.

"This was a way for Lockheed Martin to keep its hand on the Hellfire business," said senior analyst Steve Zaroga, of the Teal Group. "There is an element of Lockheed Martin versus Raytheon, but another element is the European attempt, MBDA, trying to sell their weapon into the US market."

As the US and its allies conduct airstrikes and bombing raids against the Islamic State group, Hellfire missiles are in high demand. The US Air Force budgeted more than $700 million for 3,756 Hellfire missiles for 2016, and the Pentagon has in recent months sought approval for Hellfire sales to Lebanon, Saudi Arabia, Israel, Egypt, Pakistan and South Korea that amount to thousands of missiles worth hundreds of millions of dollars.

"I can tell you absolutely yes, the demand for Hellfire has increased, and we are managing the Army inventory very closely, so we are balancing [production] against the demand to deliver quickly to many other countries and our US forces overseas," said Army Col. James Romero, project manager, joint attack munitions systems.

With JAGM scheduled to reach initial operational capability in 2018, Hellfire will likely remain in demand even afterward, as the Army ramps up production of the new missile, Romero said. In June, the Army announced that it asked Lockheed to boost production of the Hellfire from 500 rounds per month to 650 by November 2016.

The JAGM development contract covers 185 missiles, and includes two $60 million low-rate initial production options for up to 2,600 missiles. Army officials said the plan is to eventually replace Hellfire missiles as they expire with JAGM, at a cost of about 10 to 20 percent above the cost of a Hellfire, which typically costs $80,000 to $130,000 each, depending on quantity.

JAGM would first be placed on the Army's AH-64 Apache and Marine Corps' AH-1Z Viper helicopters, and talks are ongoing to install it on the Army's MQ-1C Gray Eagle drone, and on Air Force platforms. It is compatible with all Hellfire II firing platforms, a list that includes the MQ-9 Reaper and MQ-1 Predator drones.

"We know there is a lot of interest not just from the 'big blue' Air Force, but the special operations community as well, and we think it would be a great fit," Romero said. "We are certainly involved in doing this with the Air Force, and we want to make sure they have all the information they need to make a decision whether or not they want JAGM integrated or hosted on qualified platforms."

The latest contract award punctuates a history of fits and starts in this area for the Army. JAGM is the successor to the defunct Joint Common Missile program, which had been envisioned as a new missile that each of the services would buy — before it was canceled in 2006 over cost concerns.

At the time, the concept included a more sophisticated propulsion system and a tri-mode seeker. A tri-mode seeker would include a semi-active laser, millimeter wave radar and infrared guidance, similar to that found on the FGM-148 Javelin anti-tank missile.

While that remains the Army's objective, the program was broken into three increments in January 2013. Today, only the first increment, for the developmental guidance system, has received funding.

Program officials said they plan to discuss with Army and Navy leaders whether to pursue a tri-mode seeker and more advanced motor, but that future competitions would focus on improvements to the missile, not an entirely new development, given the Army's investment in the testing behind the Hellfire.

"Yes, we welcome competition at every stage, but anyone who competes would have to show all the same maturity that we expect to have from our selected contractor, so the bar ends up being higher for level of maturity and expectation of ability to produce a qualified missile," Romero said.

"We don't exclude competition, but we are aware anyone who would compete would have to do investment on their own to catch up, if you will, with the developmental process in the second stage right now."

Raytheon

In 2011, the Army released a solicitation to industry, but the program was defunded before the Army could make an award. The Pentagon ordered a technology demonstration with Raytheon and Lockheed. In 2012, a budget rescission forced the Army to make a decision, based on a preliminary design review, and the Army eliminated Raytheon.

Raytheon opted not to bid when the Army issued its solicitation in late May.

Another potential competitor, MBDA, "took serious consideration on the JAGM competition" but did not compete, according to Jan Gerokostopoulos, communications director for MBDA's US group.

Had Raytheon entered the competition, it was expected to offer a product based on its proposal for the Air Force's Small Diameter Bomb II (SDB II) program, which has a tri-mode seeker. The Air Force and Navy are expected to integrate the SDB II onto the F-35 joint strike fighter and the F/A-18E/F Super Hornet aircraft.

Infrared improves accuracy, but "the seeker really drives up the cost," according to Zaroga.

Raytheon has not given up hope it might one day compete for a Hellfire replacement, and offered the following statement:

"After careful consideration, Raytheon chose not to bid for the JAGM contract. If the requirements change, Raytheon stands ready to assist the US Army with its efforts to field a JAGM missile. We would plan to offer Raytheon's proven tri-mode seeker as part of the solution."

MBDA

MBDA is still in the game. Gerokostopoulos said the US Air Force and Navy are still assessing the Brimstone 2, and the company responded to a request for information for the F/A-18 Growler as recently as late July.

The Navy had taken an initial look at integrating the weapon on F/A-18 Super Hornets and the US Air Force tested the weapon on a Reaper, although that work was done principally for the British.

During a briefing in London on March 16, MBDA boss Antoine Bouvier expressed frustration about US market openness.

“If we are not able in the next few weeks to confirm that we have entered the US market with the Dual Mode Brimstone we will have to recognize that we have failed ... if we have failed to enter with such a perfect case there is something wrong with [market] accessibility,” the MBDA CEO said.

He said he was “not overly optimistic” of receiving “some indication” from the Pentagon that would allow MBDA to pursue Brimstone opportunities. If not, US credibility regarding competition and market access would be damaged, as the weapon is being seen in the UK and elsewhere as a test case, he said.

Carried by Royal Air Force Tornado strike jets, Brimstone has been widely used in recent conflicts where its ability to hit small, maneuvering targets with high accuracy and low collateral damage has drawn widespread plaudits from the military.

Prompted by a question from a reporter, Bouvier said the Brimstone 2 being offered to the US "ticks all the boxes, it's an excellent product, there is a capability gap in the US and we have made a very attractive financial proposal," he said.

Brimstone is a pure British product, supported personally by British Prime Minister David Cameron in talks at the highest levels of the US administration, he said.

When British defense Procurement Minister Philip Dunne met with Frank Kendall, US undersecretary of defense for acquisition, technology and logistics, in Washington in late July, he said he had not given up hope of selling Brimstone to the US, and that there is "continuing interest" in reaching agreement.

For their part, Army program officials said they were open to MBDA's involvement and met with its representatives at various points in the years before the Army's solicitation. Romero said they gave MBDA "every opportunity to compete" and provided the company with technical assessments of the company's progress.

"At the end of the day, their decision was not to propose, and if you want more details, you have to talk directly to them," Romero said.

"I'm concerned about anyone who thinks they did not get a fair shot or that their solution was the solution to our requirements, and I can tell you both of those perceptions are untrue."

Romero said it was inaccurate to presume the Army is attempting to reinvent a capability the UK and MBDA is already fielding. While the system is derived from the Hellfire, the company had trouble reconfiguring its missile to adapt to the Hellfire's back end.

"They certainly had time if they were a serious competitor," Romero said. "You might ask them if they had full consensus and support to move forward on our program."

Note: An earlier version of this story attributed Romero's comments to Lt. Col. Phil Rottenborn, product manager for JAGM.

JAGM Win Boosts Lockheed Profile

Fenrir

FULL MEMBER

- Joined

- Jul 14, 2015

- Messages

- 1,291

- Reaction score

- 0

- Country

- Location

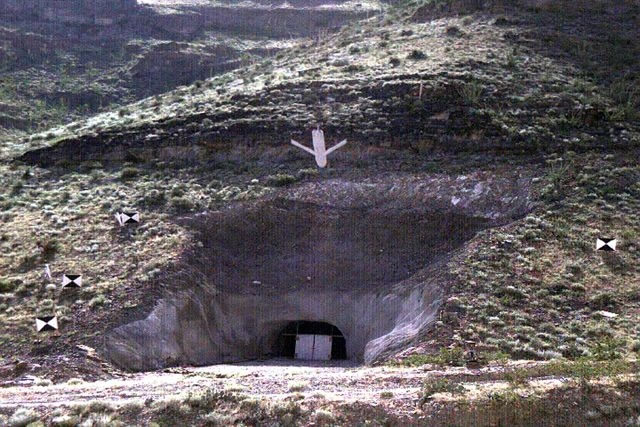

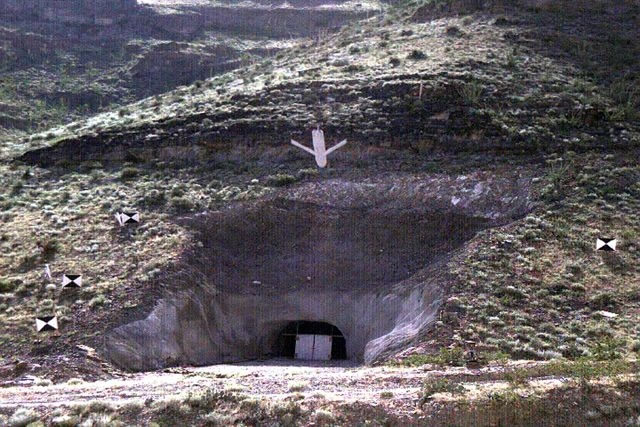

CHAMP

The Pentagon’s Counter-Electronics High-Power Advanced Microwave Project (CHAMP) has been one of the sci-fi like weapons programs that has the ability to change warfare as we know forever. Now it looks like the CHAMP has found an ideal delivery vehicle, the stealthy Joint Air-to-Surface Standoff Missile-Extended Range.

The whole idea behind CHAMP is to be able to destroy an enemy’s command, control, communication and computing, surveillance and intelligence (C4SI) capabilities without doing any damage to the people or traditional infrastructure in and around it. In other words, it can eliminate a facility’s effectiveness by destroying the electronics within it alone, via a microwave pulse, without kinetically attacking the facility itself. Think of it as the mother of all less than lethal weapons.

The effects of a CHAMP are very similar to what would happen during an electromagnetic pulse (EMP) caused by a high-altitude nuclear detonation or by a powerful solar storm, just on a much smaller, more focused scale. Unlike an EMP bomb, which are area weapons and indiscriminate as to who they target within their blast area, CHAMP is really an EMP assassin that comes in and surgically eliminates an enemy’s war enabling technology, barely leaving a fingerprint it was ever even there.

The technology has been around conceptually for many years and something like it was even rumored to have been deployed secretly before. For instance, there were reports that during the fall of Qaddafi, unmanned aircraft orbited over Libya’s most volatile weapons stockpiles and zapped vehicles engines and electronics that approached.

Regardless of if this technology already exists in any operational form or not, CHAMP is a heavier hitting capability that could very well save many lives while dealing the enemy a huge blow during the opening stages of major air campaigns. CHAMP, which is a Boeing and Air Force Research Laboratory project, was successfully tested in 2012 aboard a AGM-86 Conventional Air Launched Cruise Missile (CALCM). During the test, which occurred over a bombing and testing range in Utah, the CHAMP equipped CALCM flew over a two story building filled with computers and other powered technology and initiated a high-power, directed microwave burst above it as it passed by. The burst knocked out all the equipment inside. The test went on to zap six more targets successfully before the missile crashed itself in a pre-designated area. Other test flights are set to have followed, and even hardened targets were not completely immune to CHAMP’s zapping power.

CHAMP’s previous tests are said to have used a unit based on a powerful vacuum tube that used a magnetron that produces large directed pulses of microwave radiation. Newer systems will most likely be based on Active Electronically Scanned Arrays (AESAs) like those used in cutting-edge radar systems. These systems have a whole slew of advantages of their ‘analogue’ predecessors, one of which is miniaturization, beam focus and agility.

X-band AESA radar arrays are currently flying aboard F-15C and F/A-18E/F/G and F-22 fighters, and will be a centerpiece sensor aboard the F-35. They are also migrating to airborne surveillance and reconnaissance aircraft, as well as surface combatants. Details as to these platform’s ability to use their powerful radars for pinpoint “soft kill” attacks against electronics, especially those fitted onto sensitive enemy sensors and even incoming missiles, remains cloaked in classification but is clearly exists. As one contact of mine in the electronic warfare field puts, “everywhere there is an aperture (an antenna or radar array) there is a vulnerability.”

JASSM-ER (for Extended Range) is a logical platform for CHAMP as it can be launched by both bombers and fighters, and is a proven design that is already being evolved into a highly advanced anti-ship missile, the Long-Range Anti-Ship Missile, or LRASM. Also, it is smart and stealthy, able to actively detect threatening radars and evade or attack them, making it survivable against the world’s most capable air defense systems.

The ER model also offers double the range as the older AGM-158 JASSM model (about 550 miles), and this may even end up being extended further as the CHAMP equipped JASSM-ER will need no terminal homing sensor or warhead at all, which could make space for more fuel.

Once integrated into JASSM-ER, CHAMP will be a ‘first day of war’ standoff weapon that can be launched outside an enemy’s area-denial/anti-access capabilities, and fly a route over known C4SI facilities, zapping them along its way, before destroying itself at the end of its mission. Because of its stealth design, long-range and is expendable, it will fly where no other assets could and because it does not blow anything up, its use does not necessarily give away the fact that the enemy is under direct attack in the first place. In that sense, it is a psychological weapon, capable of at least partially blinding an enemy before they even know that a larger-scale attack is coming.

CHAMP may have trouble knocking out the most hardened enemy electronic systems, but their sensors are possibly another story. Command and control components and sensors used at surface-to-air missile sites and for integrated air defense system connectivity could be put at great risk by the stealthy JASSM-ER/CHAMP combo. Such a system could loiter for prolonged periods of time over enemy territory, and use similar radar warning receivers as those featured on the LRASM to attack enemy air defense nodes that come online.

If a swarm of these missiles were networked together, they could work as a team to suppress the enemy’s ability to communicate and defend itself in real time without any direction from human operators. In such a role, CHAMP equipped JASSM-ERs could be used alongside Miniature Air Launched Decoys to play complete havoc on an enemy’s ability to defend its airspace to an incoming attack.

Although the stealthy and expensive JASSM-ER will be an effective ‘fire and forget’ platform for a CHAMP-like device, this capability is really suited for unmanned aircraft that can have all the advantages of JASSM-ER but can return to base to be used again when their mission ends. Really, any combat aircraft could benefit from a CHAMP-like ability.

Even if laser weaponry is seen as the future’s super pinpoint aerial attack capability, it still causes physical damage to its target, including to human beings. CHAMP on the other hand would be able to neutralize many targets by destroying electronics alone. In doing so the system could be greatly effective at doing everything from stopping trucks full of insurgents, to rendering improvised explosive devices (IEDs) inoperable, to disabling massive command and control facilities full of computers and communications devices. As such, everything from a Predator unmanned aircraft to an F-35 could use such a capability in its quiver.

Seeing as CHAMP can fit inside a CALCM today, and probably inside a small diameter bomb in the future, there is no reason to think that combat aircraft around the globe won’t be equipped with CHAMP-like pods in the not so distant future. Even here at home, law enforcement could use such a device to totally eliminate dangerous high-speed vehicle chases. The Coast Guard and Navy could also potentially use similar devices to disable unresponsive ships or those that are swarming around surface combatants in a combined attack.

A very precise, close-in air defense version of CHAMP, based on an AESA type emitter, could solve the White House’s and other VVIP’s hobby drone problems. Simply zap them out of the sky by frying their electronic components instead of using kinetic weapons, such as missiles or bullets, or even lasers. This precise ‘soft kill’ capability solves so many modern day security and defense problems that it could very well revolutionize the way we look at ‘striking’ a target.

Right now, CHAMP is like the first guided bombs of the 1970s. Sure, its technology is exciting and shown to be effective, but where it will quickly lead has the ability to change modern warfare as we know it forever, and for the better.

The Pentagon’s Counter-Electronics High-Power Advanced Microwave Project (CHAMP) has been one of the sci-fi like weapons programs that has the ability to change warfare as we know forever. Now it looks like the CHAMP has found an ideal delivery vehicle, the stealthy Joint Air-to-Surface Standoff Missile-Extended Range.

The whole idea behind CHAMP is to be able to destroy an enemy’s command, control, communication and computing, surveillance and intelligence (C4SI) capabilities without doing any damage to the people or traditional infrastructure in and around it. In other words, it can eliminate a facility’s effectiveness by destroying the electronics within it alone, via a microwave pulse, without kinetically attacking the facility itself. Think of it as the mother of all less than lethal weapons.

The effects of a CHAMP are very similar to what would happen during an electromagnetic pulse (EMP) caused by a high-altitude nuclear detonation or by a powerful solar storm, just on a much smaller, more focused scale. Unlike an EMP bomb, which are area weapons and indiscriminate as to who they target within their blast area, CHAMP is really an EMP assassin that comes in and surgically eliminates an enemy’s war enabling technology, barely leaving a fingerprint it was ever even there.

The technology has been around conceptually for many years and something like it was even rumored to have been deployed secretly before. For instance, there were reports that during the fall of Qaddafi, unmanned aircraft orbited over Libya’s most volatile weapons stockpiles and zapped vehicles engines and electronics that approached.

Regardless of if this technology already exists in any operational form or not, CHAMP is a heavier hitting capability that could very well save many lives while dealing the enemy a huge blow during the opening stages of major air campaigns. CHAMP, which is a Boeing and Air Force Research Laboratory project, was successfully tested in 2012 aboard a AGM-86 Conventional Air Launched Cruise Missile (CALCM). During the test, which occurred over a bombing and testing range in Utah, the CHAMP equipped CALCM flew over a two story building filled with computers and other powered technology and initiated a high-power, directed microwave burst above it as it passed by. The burst knocked out all the equipment inside. The test went on to zap six more targets successfully before the missile crashed itself in a pre-designated area. Other test flights are set to have followed, and even hardened targets were not completely immune to CHAMP’s zapping power.

CHAMP’s previous tests are said to have used a unit based on a powerful vacuum tube that used a magnetron that produces large directed pulses of microwave radiation. Newer systems will most likely be based on Active Electronically Scanned Arrays (AESAs) like those used in cutting-edge radar systems. These systems have a whole slew of advantages of their ‘analogue’ predecessors, one of which is miniaturization, beam focus and agility.

X-band AESA radar arrays are currently flying aboard F-15C and F/A-18E/F/G and F-22 fighters, and will be a centerpiece sensor aboard the F-35. They are also migrating to airborne surveillance and reconnaissance aircraft, as well as surface combatants. Details as to these platform’s ability to use their powerful radars for pinpoint “soft kill” attacks against electronics, especially those fitted onto sensitive enemy sensors and even incoming missiles, remains cloaked in classification but is clearly exists. As one contact of mine in the electronic warfare field puts, “everywhere there is an aperture (an antenna or radar array) there is a vulnerability.”

JASSM-ER (for Extended Range) is a logical platform for CHAMP as it can be launched by both bombers and fighters, and is a proven design that is already being evolved into a highly advanced anti-ship missile, the Long-Range Anti-Ship Missile, or LRASM. Also, it is smart and stealthy, able to actively detect threatening radars and evade or attack them, making it survivable against the world’s most capable air defense systems.

The ER model also offers double the range as the older AGM-158 JASSM model (about 550 miles), and this may even end up being extended further as the CHAMP equipped JASSM-ER will need no terminal homing sensor or warhead at all, which could make space for more fuel.

Once integrated into JASSM-ER, CHAMP will be a ‘first day of war’ standoff weapon that can be launched outside an enemy’s area-denial/anti-access capabilities, and fly a route over known C4SI facilities, zapping them along its way, before destroying itself at the end of its mission. Because of its stealth design, long-range and is expendable, it will fly where no other assets could and because it does not blow anything up, its use does not necessarily give away the fact that the enemy is under direct attack in the first place. In that sense, it is a psychological weapon, capable of at least partially blinding an enemy before they even know that a larger-scale attack is coming.

CHAMP may have trouble knocking out the most hardened enemy electronic systems, but their sensors are possibly another story. Command and control components and sensors used at surface-to-air missile sites and for integrated air defense system connectivity could be put at great risk by the stealthy JASSM-ER/CHAMP combo. Such a system could loiter for prolonged periods of time over enemy territory, and use similar radar warning receivers as those featured on the LRASM to attack enemy air defense nodes that come online.

If a swarm of these missiles were networked together, they could work as a team to suppress the enemy’s ability to communicate and defend itself in real time without any direction from human operators. In such a role, CHAMP equipped JASSM-ERs could be used alongside Miniature Air Launched Decoys to play complete havoc on an enemy’s ability to defend its airspace to an incoming attack.

Although the stealthy and expensive JASSM-ER will be an effective ‘fire and forget’ platform for a CHAMP-like device, this capability is really suited for unmanned aircraft that can have all the advantages of JASSM-ER but can return to base to be used again when their mission ends. Really, any combat aircraft could benefit from a CHAMP-like ability.

Even if laser weaponry is seen as the future’s super pinpoint aerial attack capability, it still causes physical damage to its target, including to human beings. CHAMP on the other hand would be able to neutralize many targets by destroying electronics alone. In doing so the system could be greatly effective at doing everything from stopping trucks full of insurgents, to rendering improvised explosive devices (IEDs) inoperable, to disabling massive command and control facilities full of computers and communications devices. As such, everything from a Predator unmanned aircraft to an F-35 could use such a capability in its quiver.

Seeing as CHAMP can fit inside a CALCM today, and probably inside a small diameter bomb in the future, there is no reason to think that combat aircraft around the globe won’t be equipped with CHAMP-like pods in the not so distant future. Even here at home, law enforcement could use such a device to totally eliminate dangerous high-speed vehicle chases. The Coast Guard and Navy could also potentially use similar devices to disable unresponsive ships or those that are swarming around surface combatants in a combined attack.

A very precise, close-in air defense version of CHAMP, based on an AESA type emitter, could solve the White House’s and other VVIP’s hobby drone problems. Simply zap them out of the sky by frying their electronic components instead of using kinetic weapons, such as missiles or bullets, or even lasers. This precise ‘soft kill’ capability solves so many modern day security and defense problems that it could very well revolutionize the way we look at ‘striking’ a target.

Right now, CHAMP is like the first guided bombs of the 1970s. Sure, its technology is exciting and shown to be effective, but where it will quickly lead has the ability to change modern warfare as we know it forever, and for the better.

Fenrir

FULL MEMBER

- Joined

- Jul 14, 2015

- Messages

- 1,291

- Reaction score

- 0

- Country

- Location

Similar threads

- Replies

- 9

- Views

- 2K

- Replies

- 1

- Views

- 1K

- Replies

- 43

- Views

- 5K

- Replies

- 56

- Views

- 7K

- Replies

- 0

- Views