StraightEdge

SENIOR MEMBER

- Joined

- Jan 21, 2021

- Messages

- 2,261

- Reaction score

- -6

- Country

- Location

Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History – Hindenburg Research

Published on January 24, 2023

GET OUR LATEST REPORTS DELIVERED TO YOUR INBOX

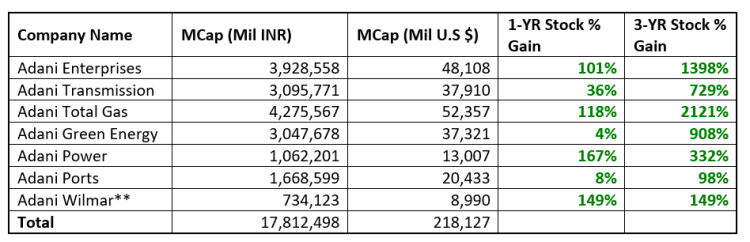

- Today we reveal the findings of our 2-year investigation, presenting evidence that the INR 17.8 trillion (U.S. $218 billion) Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades.

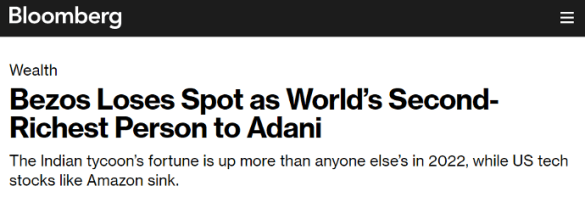

- Gautam Adani, Founder and Chairman of the Adani Group, has amassed a net worth of roughly $120 billion, adding over $100 billion in the past 3 years largely through stock price appreciation in the group’s 7 key listed companies, which have spiked an average of 819% in that period.

- Our research involved speaking with dozens of individuals, including former senior executives of the Adani Group, reviewing thousands of documents, and conducting diligence site visits in almost half a dozen countries.

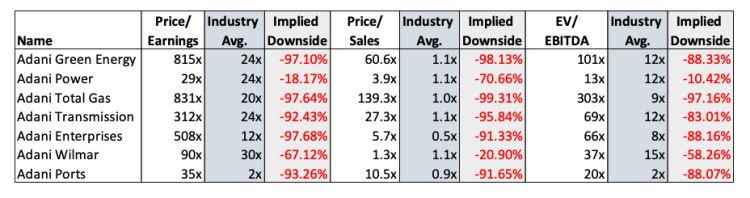

- Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its 7 key listed companies have 85% downside purely on a fundamental basis owing to sky-high valuations.

- Key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing. 5 of 7 key listed companies have reported ‘current ratios’ below 1, indicating near-term liquidity pressure.

- The group’s very top ranks and 8 of 22 key leaders are Adani family members, a dynamic that places control of the group’s financials and key decisions in the hands of a few. A former executive described the Adani Group as “a family business.”

- The Adani Group has previously been the focus of 4 major government fraud investigations which have alleged money laundering, theft of taxpayer funds and corruption, totaling an estimated U.S. $17 billion. Adani family members allegedly cooperated to create offshore shell entities in tax-haven jurisdictions like Mauritius, the UAE, and Caribbean Islands, generating forged import/export documentation in an apparent effort to generate fake or illegitimate turnover and to siphon money from the listed companies.

- Gautam Adani’s younger brother, Rajesh Adani, was accused by the Directorate of Revenue Intelligence (DRI) of playing a central role in a diamond trading import/export scheme around 2004-2005. The alleged scheme involved the use of offshore shell entities to generate artificial turnover. Rajesh was arrested at least twice over separate allegations of forgery and tax fraud. He was subsequently promoted to serve as Managing Director of Adani Group.

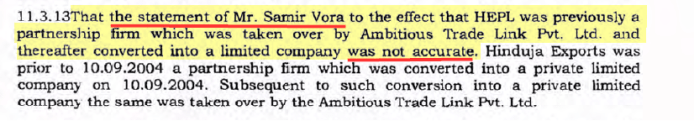

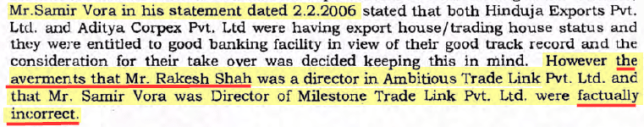

- Gautam Adani’s brother-in-law, Samir Vora, was accused by the DRI of being a ringleader of the same diamond trading scam and of repeatedly making false statements to regulators. He was subsequently promoted to Executive Director of the critical Adani Australia division.

- Gautam Adani’s elder brother, Vinod Adani, has been described by media as “an elusive figure”. He has regularly been found at the center of the government’s investigations into Adani for his alleged role in managing a network of offshore entities used to facilitate fraud.

- Our research, which included downloading and cataloguing the entire Mauritius corporate registry, has uncovered that Vinod Adani, through several close associates, manages a vast labyrinth of offshore shell entities.

- We have identified 38 Mauritius shell entities controlled by Vinod Adani or close associates. We have identified entities that are also surreptitiously controlled by Vinod Adani in Cyprus, the UAE, Singapore, and several Caribbean Islands.

- Many of the Vinod Adani-associated entities have no obvious signs of operations, including no reported employees, no independent addresses or phone numbers and no meaningful online presence. Despite this, they have collectively moved billions of dollars into Indian Adani publicly listed and private entities, often without required disclosure of the related party nature of the deals.

- We have also uncovered rudimentary efforts seemingly designed to mask the nature of some of the shell entities. For example, 13 websites were created for Vinod Adani-associated entities; many were suspiciously formed on the same days, featuring only stock photos, naming no actual employees and listing the same set of nonsensical services, such as “consumption abroad” and “commercial presence”.

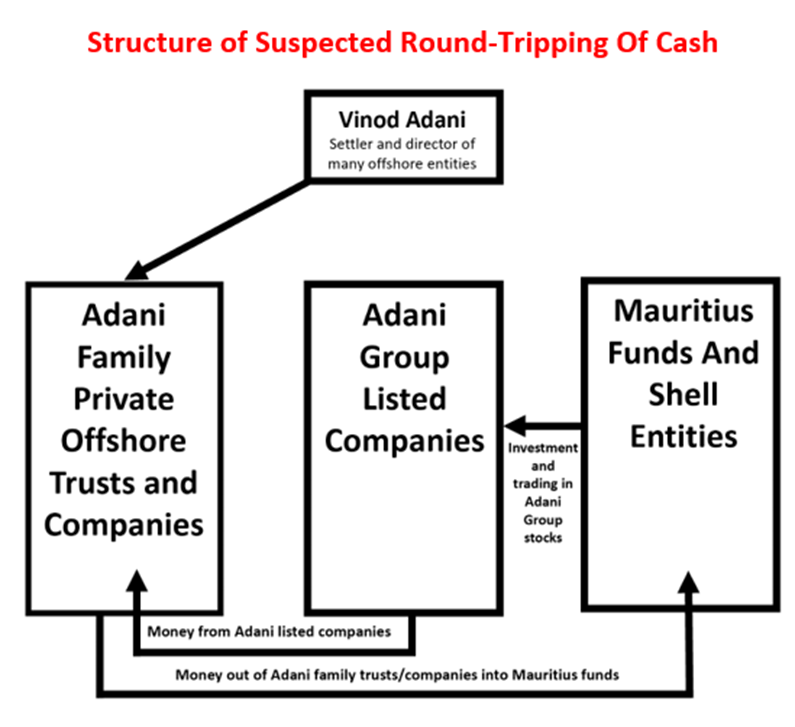

- The Vinod-Adani shells seem to serve several functions, including (1) stock parking / stock manipulation (2) and laundering money through Adani’s private companies onto the listed companies’ balance sheets in order to maintain the appearance of financial health and solvency.

- Publicly listed companies in India are subject to rules that require all promoter holdings (known as insider holdings in the U.S.) to be disclosed. Rules also require that listed companies have at least 25% of the float held by non-promoters in order to mitigate manipulation and insider trading. 4 of Adani’s listed companies are on the brink of the delisting threshold due to high promoter ownership.

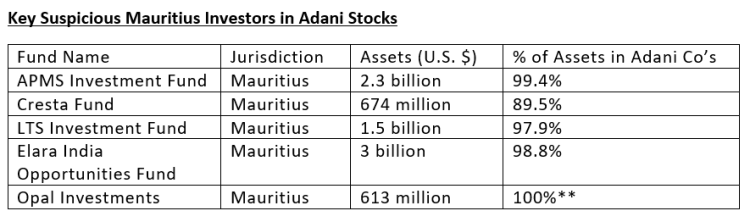

- Our research indicates that offshore shells and funds tied to the Adani Group comprise many of the largest “public” (i.e., non-promoter) holders of Adani stock, an issue that would subject the Adani companies to delisting, were Indian securities regulator SEBI’s rules enforced.

- Many of the supposed “public” funds exhibit flagrant irregularities such as being (1) Mauritius or offshore-based entities, often shells (2) with beneficial ownership concealed via nominee directors (3) and with little to no diversification, holding portfolios almost exclusively consisting of shares in Adani listed companies.

- Right to Information (RTI) requests we filed with SEBI confirm that the offshore funds are the subjects of an ongoing investigation, more than a year-and-a-half after concerns were initially raised by media and members of parliament.

- A former trader for Elara, an offshore fund with almost $3 billion in concentrated holdings of Adani shares, including a fund that is ~99% concentrated in shares of Adani, told us that it is obvious that Adani controls the shares. He explained that the funds are intentionally structured to conceal their ultimate beneficial ownership.

- Leaked emails show that the CEO of Elara worked on deals with Dharmesh Doshi, a fugitive accountant who worked closely on stock manipulation deals with Ketan Parekh, an infamous Indian market manipulator. The emails indicate that the CEO of Elara worked with Doshi on stock deals after he evaded arrest and was widely known as a fugitive.

- Another firm called Monterosa Investment Holdings controls 5 supposedly independent funds that collectively hold over INR 360 billion (U.S. $4.5 billion) in shares of listed Adani companies, according to Legal Entity Identifier (LEI) data and Indian exchange data.

- Monterosa’s Chairman and CEO served as director in 3 companies alongside a fugitive diamond merchant who allegedly stole U.S. $1 billion before fleeing India. Vinod Adani’s daughter married the fugitive diamond merchant’s son.

- A once-related party entity of Adani invested heavily in one of the Monterosa funds that allocated to Adani Enterprises and Adani Power, according to corporate records, drawing a clear line between the Adani Group and the suspect offshore funds.

- Another Cyprus-based entity called New Leaina Investments until June-September 2021 owned over U.S. $420 million in Adani Green Energy shares, comprising ~95% of its portfolio. Parliamentary records show it was (and may still be) a shareholder of other Adani listed entities.

- New Leaina is operated by incorporation services firm Amicorp, which has worked extensively to aid Adani in developing its offshore entity network. Amicorp formed at least 7 Adani promoter entities, at least 17 offshore shells and entities associated with Vinod Adani, and at least 3 Mauritius-based offshore shareholders of Adani stock.

- Amicorp played a key role in the 1MDB international fraud scandal that resulted in U.S. $4.5 billion being siphoned from Malaysian taxpayers. Amicorp established ‘investment funds’ for the key perpetrators that were “simply a way to wash a client’s money through what looked like a mutual fund”, according to the book Billion Dollar Whale, which reported on the scandal.

- ‘Delivery volume’ is a unique daily data point that reports institutional investment flows. Our analysis found that offshore suspected stock parking entities accounted for up to 30%-47% of yearly ‘delivery volume’ in several Adani listed companies, a flagrant irregularity indicating that Adani stocks have likely been subject to ‘wash trading’ or other forms of manipulative trading via the suspect offshore entities.

- Evidence of stock manipulation in Adani listed companies shouldn’t come as a surprise. SEBI has investigated and prosecuted more than 70 entities and individuals over the years, including Adani promoters, for pumping Adani Enterprises’ stock.

- A 2007 SEBI ruling stated that “the charges leveled against promoters of Adani that they aided and abetted Ketan Parekh entities in manipulating the scrip of Adani stand proved”. Ketan Parekh is perhaps India’s most notorious stock market manipulator. Adani Group entities originally received bans for their roles, but those were later reduced to fines, a show of government leniency toward the Group that has become a decades-long pattern.

- Per the 2007 investigation, 14 Adani private entities transferred shares to entities controlled by Parekh, who then engaged in blatant market manipulation. Adani Group responded to SEBI by arguing that it had dealt with Ketan Parekh to finance the start of its operations at Mundra port, seemingly suggesting that share sales via stock manipulation somehow constitutes a legitimate form of financing.

- As part of our investigation, we interviewed an individual who was banned from trading on Indian markets for stock manipulation via Mauritius-based funds. He told us that he knew Ketan Parekh personally, and that little has changed, explaining “all the previous clients are still loyal to Ketan and are still working with Ketan”.

- In addition to using offshore capital to park stock, we found numerous examples of offshore shells sending money through onshore private Adani companies onto listed public Adani companies.

- The funds then seem to be used to engineer Adani’s accounting (whether by bolstering its reported profit or cash flows), cushioning its capital balances in order to make listed entities appear more creditworthy, or simply moved back out to other parts of the Adani empire where capital is needed.

- We also identified numerous undisclosed related party transactions by both listed and private companies, seemingly an open and repeated violation of Indian disclosure laws.

- In one instance, a Vinod Adani-controlled Mauritius entity with no signs of substantive operations lent INR 11.71 billion (U.S. ~$253 million at that time) to a private Adani entity which did not disclose it as being a related party loan. The private entity subsequently lent funds to listed entities, including INR 9.84 billion (U.S. $138 million at more recent substantially lower exchange rates) to Adani Enterprises.

- Another Vinod Adani-controlled Mauritius entity called Emerging Market Investment DMCC lists no employees on LinkedIn, has no substantive online presence, has announced no clients or deals, and is based out of an apartment in the UAE. It lent U.S. $1 billion to an Adani Power subsidiary.

- This offshore shell network also seems to be used for earnings manipulation. For example, we detail a series of transactions where assets were transferred from a subsidiary of listed Adani Enterprises to a private Singaporean entity controlled by Vinod Adani, without disclosure of the related party nature of these deals. Once on the books of the private entity, the assets were almost immediately impaired, likely helping the public entity avoid a material write-down and negative impact to net income.

- Adani Group’s obvious accounting irregularities and sketchy dealings seem to be enabled by virtually non-existent financial controls. Listed Adani companies have seen sustained turnover in the Chief Financial Officer role. For example, Adani Enterprises has had 5 chief financial officers over the course of 8 years, a key red flag indicating potential accounting issues.

- The independent auditor for Adani Enterprises and Adani Total Gas is a tiny firm called Shah Dhandharia. Shah Dhandharia seems to have no current website. Historical archives of its website show that it had only 4 partners and 11 employees. Records show it pays INR 32,000 (U.S. $435 in 2021) in monthly office rent. The only other listed entity we found that it audits has a market capitalization of about INR 640 million (U.S. $7.8 million).

- Shah Dhandharia hardly seems capable of complex audit work. Adani Enterprises alone has 156 subsidiaries and many more joint ventures and affiliates, for example. Further, Adani’s 7 key listed entities collectively have 578 subsidiaries and have engaged in a total of 6,025 separate related-party transactions in fiscal year 2022 alone, per BSE disclosures.

- The audit partners at Shah Dhandharia who respectively signed off on Adani Enterprises and Adani Total Gas’ annual audits were as young as 24 and 23 years old when they began approving the audits. They were essentially fresh out of school, hardly in a position to scrutinize and hold to account the financials of some of the largest companies in the country, run by one of its most powerful individuals.

- Gautam Adani has claimed in an interview to “have a very open mind towards criticism…Every criticism gives me an opportunity to improve myself.” Despite these claims, Adani has repeatedly sought to have critical journalists or commentators jailed or silenced through litigation, using his immense power to pressure the government and regulators to pursue those who question him.

- We believe the Adani Group has been able to operate a large, flagrant fraud in broad daylight in large part because investors, journalists, citizens and even politicians have been afraid to speak out for fear of reprisal.

- We have included 88 questions in the conclusion of our report. If Gautam Adani truly embraces transparency, as he claims, they should be easy questions to answer. We look forward to Adani’s response.

Introduction

India is home to many of the world’s most brilliant entrepreneurs, engineers, and technologists and is emerging as a global superpower. However, the country’s economy has been held back by the broken state of its capital markets.Criticism of India’s elite businessmen and politicians has increasingly resulted in journalists being imprisoned or outright murdered. Stock market analysts have been arrested for writing negatively about companies. Amidst this climate of stifled expression, corporate fraud has largely gone unchecked.

In this report, we highlight what we believe to be one of, if not the most egregious example of corporate fraud in history.

We have uncovered evidence of brazen accounting fraud, stock manipulation and money laundering at Adani, taking place over the course of decades. Adani has pulled off this gargantuan feat with the help of enablers in government and a cottage industry of international companies that facilitate these activities.

These issues of corruption permeate multiple layers of government. According to numerous sources we spoke with, Indian securities regulator SEBI seems more inclined to protect the perpetrators than punish them.

We view sunlight as the best remedy, and hope this report helps illuminate these issues. Further to that goal, we hope Adani addresses the 88 questions we have included in the conclusion to this report.

Background On Adani Group, One Of India’s Largest Conglomerates With a Collective Market Capitalization Of INR 17.8 Trillion (U.S. $218 Billion)

Adani Group is the 2nd largest conglomerate in India, run by its Chairman and Founder Gautam Adani, who is currently the 3rd richest man on earth, previously having reached the #2 spot.

The group has 7 key publicly listed equities (9 in total) with a collective market value of about INR 17.8 trillion (U.S. $218 billion).[1] It also includes a maze of Adani private companies and family trusts. Through their holdings in the group, Gautam Adani and his family have amassed a paper fortune of over U.S. $120 billion, with over $100 billion of that coming in the past 3 years, largely through the meteoric appreciation of its stock prices.

The conglomerate is involved in a wide array of businesses, largely focused on key infrastructure projects such as development of ports, mines, airports, data centers, power generation and power transmission.

The 7 key Adani listed companies have seen their stock prices mysteriously surge over the past 3 years – with most increasing multifold – ranking them individually among the largest companies in India. Both Adani Enterprises and Adani Ports feature in India’s Nifty 50 index and 6 of the companies are included in the MSCI India Index.[2]

**Adani Wilmar performance is since February 2022 IPO

The 7 Listed Companies Of Adani Group Are 85%+ Overvalued Even If You Ignore Our Investigation And Take The Companies’ Financials At Face Value

Even before examining the evidence put forward in this report and based solely on financials taken directly from its companies, the Adani Group appears to be highly overvalued.Infrastructure firms are generally relatively sleepy, low growth, low multiple enterprises, yet valuation metrics of the Adani listed companies are comparable to the frothiest of high-growth tech companies.

On a blended basis, compared to industry peers, we see 85%+ downside purely on fundamentals.

Adani Group Companies’ Use Of Extreme Leverage Spells Danger For Creditors. In The Past, Members Of The Adani Group Have Breached Financial Covenants And Obligations, According To Regulatory Filings

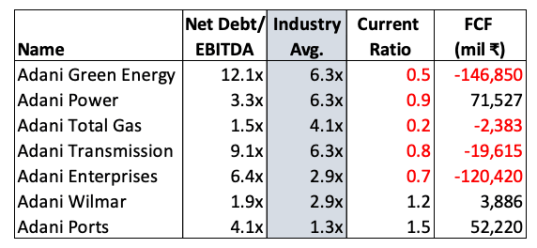

From a solvency perspective, multiple listed entities in the group are highly leveraged relative to industry averages: Four of 7 of these entities have negative free cash flow, indicating that the situation is worsening.“Any Group With Such A Meteoric Ride Based On Borrowings, Acquisitions, And An Elevated Stock Price Deserves Scrutiny.” – Former Senior Reserve Bank of India (RBI) Official

A company’s ‘current ratio’ is a measure of liquid assets less near-term liabilities. Five companies in the group (all but Adani Ports and Adani Wilmar) have current ratios below 1.0, suggesting a heightened short-term liquidity risk.

In terms of unrestricted cash, Adani Ports is the only listed entity with significant reserves at INR 86 billion (U.S. $1.05 billion), according to its FY 2022 Annual Report. [Pg. 515] It is also the only listed entity which seems capable of consistently generating substantial positive cash flow: approximately INR 52 billion (U.S. $640 million) as of 31 March 2022. [Pg. 141]

Concerns about the Adani Group’s leverage have been expressed by CreditSights, a fixed income research firm owned by prestigious financial services firm Fitch Group. A blistering report about Adani Group published in August 2022 had called the group “deeply over-leveraged” and suggested it could “unravel Adani’s vast business empire”. The report was “toned down” in September 2022 after CreditSights met with the company.

In its latest report, CreditSights refused to change its investment recommendations, and maintained that “several of the Group companies maintain elevated leverage, owing to aggressive expansion plans, that are largely debt-funded and that have pressurized their credit metrics and cash flow”, per local media.

We contacted a former senior official with India´s central bank, the Reserve Bank of India (RBI), to hear his view on the Adani Group´s debt mountain and possible knock-on effects for the public banking sector. His comments were guarded, saying:

An Adani Green Energy Offering Circular, dated September 2021, stated that members of the Adani Group “have from time to time breached, and may in the future breach, certain covenants and obligations under existing financing arrangements.” [Pg. 69]“Any group with such a meteoric ride based on borrowings, acquisitions, and an elevated stock price deserves scrutiny. That said, he [Gautam Adani] also has an amazing ability to buy assets on the cheap. That may mitigate credit risk, but worth examining why.”

As a result of these breaches, lenders could declare an event of default, accelerate repayments or trigger cross defaults on other arrangements. The company provided no assurances that it would have “sufficient resources to repay these borrowings” if this were to happen. [Pg. 69, 70]

As detailed below, the Adani Group companies are intricately and distinctly linked and dependent upon one another. None of the listed entities are isolated from the performance, or failure, of the other group companies.

We believe it could take only one serious liquidity event at a single entity to trigger a negative cascade of events at other group entities which could affect the entire Adani Group.

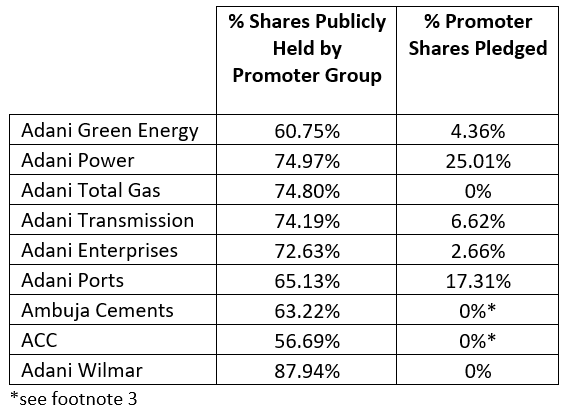

A Portion Of Promoter Equity In Adani Group Listed Entities Is Pledged For Loans, Effectively Leveraging The Group To The Hilt

Beyond debt held by individual Adani Group entities, the companies’ promoter group (i.e., Adani insiders) have pledged portions of their equity as collateral for loans.Equity share pledges are an inherently unstable source of lending collateral because if share prices drop, the lender can make a collateral call. If no additional collateral is available, the lender could require a forced liquidation of shares (often perpetuating a self-fulfilling cycle as stock prices move lower and selling continues).

Below is a breakdown of the publicly disclosed equity share pledges by promoter group entities for each of its listed companies: [3]

Beyond explicit leverage, we strongly suspect there may be additional, hidden leverage within the Adani empire in the form of pledges on the undisclosed shareholdings described in Part 1.

A Family Affair: The Adani Group Is Largely Controlled By Family Members, Creating A Ripe Environment For Unilateral And Opaque Financing Decisions

The Chairman and Founder of the Adani Group is Gautam Adani, a former school drop-out turned diamond and plastics trader. He is also chairman of 6 out of Adani´s 7 publicly listed entities bearing the Adani name.[4]The CreditSights August 2022 report referenced above also warned of the problems of concentrating power in the hands of Gautam Adani, saying:

The Adani Group has been managed by family since its formation. Beyond Gautam Adani, the Adani Group’s 22-person leadership team features at least 8 members of the Adani family.

From early in our investigation, it became apparent that it would be a major challenge getting first-hand insight into the sprawling business empire from former employees.

We contacted dozens of former senior executives and former directors or past members of the Group´s audit committees. Some expressed loyalty or admiration for their former bosses. Others seemed acutely aware of the Adani leadership´s relentless retaliation against its critics via criminal legal proceedings. [See Part 7] Some, however, did agree to talk on condition of strict anonymity.

Despite its formidable expansion in recent years, former senior executives told us that the Adani Group remains very much a family affair. One former executive said:

Other former senior executives echoed that assessment. One explained that “as far as any key decision-making, I would say it all flows back to Gautam Adani. All key decisions are made by Gautam Adani himself”.“It’s a family business, you know, it has been developed as a family business. It’s the first-generation business… In the Adani Group, Gautam Adani, his brother, his sons, I think they play a very, very, you know, hands-on role in day-to-day business. Because frankly, the culture has not changed since the time it was a small business. Since the time they had just got into Mundra port.”

Another said Gautam Adani retained maximum permissible shareholdings because “he felt he had built up the business and it was his and the family´s”.

The Adani Group Has Repeatedly Faced Allegations Of Corruption, Money Laundering And Theft Of Taxpayer Funds, Totaling An Estimated U.S. $17 Billion

Investigations Have Either Been Stalled Or Stonewalled By Various Arms Of The Indian Government

Members of the Adani family have also played a significant role in alleged illegal activities taking place within the group.Import-export scams – involving diamonds, iron ore, coal and power equipment — were some of the early building blocks of the Adani business empire, according to multiple investigations by the Finance Ministry´s anti-smuggling unit and other national and state-level investigative authorities.

The Adani Group has been the focus of multiple government investigations alleging corruption, money laundering, theft of taxpayer funds and siphoning from listed companies, estimated to total at least U.S. $17 billion.[6] [1, 2, 3]

We thoroughly detail these investigations, in Part 5 below.

In virtually all these cases, despite what appears to be extensive evidence of wrongdoing, including documents, witnesses, and bank records, relevant investigations were eventually stonewalled or delayed by various other arms of the Indian government.

Gautam Adani’s Brother Helped Plan A Diamond Trading Scheme Between 2004 to 2006, As Alleged By Directorate Of Revenue Intelligence (DRI) Investigative Records

He Had Separately Been Arrested On Allegations Of Customs Tax Evasion, Forging Documents And Illegal Imports

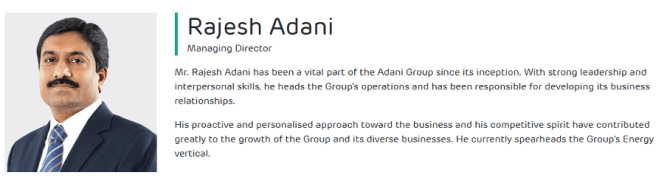

He Currently Serves As Managing Director Of A “Vital” Part of the Adani Group

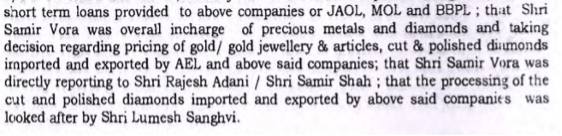

Gautam Adani´s younger brother, Rajesh Adani, then managing director of Adani Exports (later renamed Adani Enterprises), was one of several family members accused by investigators of playing a central planning and consultation role in a diamond trading import/export scheme around 2004-2005.Per DRI investigators and witness statements:

Rajesh Adani has been arrested twice, in 1999 and 2010, for matters unrelated to the diamond trading accusations, according to media reports. The 1999 arrest was over allegations of customs tax evasion, forging import documentation and illegal coal imports, according to one media report.“…all the policy decisions regarding imports/exports of gold/diamonds in respect of AEL (Adani Exports Ltd) and other companies was being taken by Shri Samir Vora in consultation with Shri Rajesh Adani, Managing Director, AEL.” [Pg. 6]

The 2010 arrest was linked to a separate allegation of customs tax evasion and undervaluation of imported goods, this time related to naphtha and petroleum products, according to another media report.

Typically, when an executive is alleged to have spearheaded a scheme to defraud the government and is arrested multiple times over allegations of other types of fraud, that executive is terminated. In some countries, they end up in jail.

At Adani Group, they apparently get promoted. Rajesh Adani currently serves as Adani Group’s managing director, described as a “vital” part of the Adani Group, adept at “developing its business relationships”.

Gautam Adani’s Brother-In-Law, Samir Vora, Was Allegedly A Ringleader Of The Same Diamond Trading Scam And Was Accused Of Repeatedly Making False Statements To Regulators, Per The Same DRI Fraud Investigation

He Was Subsequently Promoted To Executive Director Of Adani Australia

Another Adani family member accused of being a ringleader of a diamond trading scam was Samir Vora, according to DRI investigation records. [Pg. 4] Samir Vora is identified in the investigation as the brother-in-law of Adani Group Chairman Gautam Adani.[7]One of the witnesses in the case, an Adani company senior vice president, told investigators that Samir Vora oversaw the pricing and import-export of diamonds and precious metals between various front companies.

When questioned about the use of front companies to engage in a circular trading scheme to defraud the government of export credits, a key witness said:

Samir Vora was alleged to have made multiple inaccurate statements to regulators during the investigation.“Samir Vora looked after entire business of exports/imports of gold & diamonds for all the above said (front) companies”. [Pg. 7]

Typically, when an executive is alleged to have spearheaded a scheme to defraud the government and then provides false testimony about it, that executive is terminated. In some countries they might even end up in jail.

Once again, at the Adani Group, they apparently get promoted.

Samir Vora was named Executive Director of Adani Australia from April 2017, according to his LinkedIn profile. In that role he oversees the company’s key Carmichael Mine and Rail Projects.

Gautam Adani´s Elder Brother, Vinod, Was A Group Executive Also Implicated In The Diamond And Power Equipment Scams

While Adani Now Denies Vinod’s Involvement In The Group Outside Of Being A Shareholder, In Reality He Operates A Vast Empire Of Shell Companies That Funnel Assets Through Adani Group Companies

Vinod Adani (also known as Vinod Shantilal Shah in certain company documents) held various official executive roles early in the history of the Adani Group until at least 2011. [8] [9] A pre-IPO prospectus for Adani Power from 2009 detailed that Vinod was director of at least 6 Adani Group companies, a shareholder of Adani Enterprises and part of the promoter group of Adani Power. [Pgs. 175, 190, 194, 204, 206, 216, 223, 224] He does not appear to hold any current formal positions.Despite his early formal roles, the Adani Group has at times denied Vinod Adani´s involvement. As part of the 2014 DRI investigation regarding an INR 39.74 billion (~U.S. $800 million) power generation over-invoicing scandal [See Part 5], which covered the period 2009-2014, Adani submitted that Vinod Adani was “not at all having any involvement in any Adani Group of companies,” except as a shareholder. [Pg. 109]

Like younger brother Rajesh, Vinod also allegedly played a key role in the INR 6.8 billion (U.S. $151 million) diamond trading scandal. [See Part 5]

Indian media describes Vinod as an elusive and enigmatic figure with a vague role in the Adani empire.

Per media outlet The Morning Context:

During our investigation, a confidante of Gautam Adani and former director of one of the Adani Group entities told us Vinod Adani “continues to be in [the] Middle East. He takes cares of Adani Group’s interest in Dubai.”“For years, Vinod Adani has been an elusive figure…Not much is known about him other than a few advertorials”

That corroborates a November 2022 biography of Gautam Adani that states Vinod Adani “does not hold any formal position with the group,” but “remains actively involved with the group, especially when negotiating international finance and connections.”

In the course of our research, we downloaded and catalogued the full Mauritius corporate registry database and were able to document how Vinod Adani, along with other close associates, have set up dozens of entities in Mauritius that have little to no genuine corporate presence.

We also found other entities in Cyprus, the UAE, Singapore and the Caribbean associated with Vinod Adani, comprising a vast empire of shells. Many of these entities later appear in suspect transactions, often funneling assets into or out of the Adani Group companies. [See Part 3]

Part 1: Stock Parking – Offshore Funds And Shells Tied To The Adani Group Surreptitiously Own Stock In Adani Listed Companies, Seemingly In Blatant Violation Of SEBI Exchange Rules

Indian Securities Regulator SEBI’s Rules Require A Minimum Public Shareholding of 25% To Limit Insider Trading, Stock Manipulation, And Undisclosed Margin Lending

Publicly listed companies in India are subject to rules that require all promoter holdings (more commonly known internationally as insider holdings) to be disclosed.These disclosures are required in order to satisfy Indian rules that publicly listed companies have a float of at least 25% that is not controlled by promoters (insiders). The minimum public float rules are intended to ensure a minimum level of liquidity, to reduce insider trading and market manipulation, and to minimize volatility.

Promoter shareholding disclosures also allow investors to determine whether insiders have pledged their shares, an important gauge of the financial strength and/or potential solvency risk of insider entities and individuals.

Indian market observers have long been aware that Indian promoters may use entities based in Mauritius and other offshore jurisdictions to evade these disclosure requirements and manipulate the share prices of their listed companies.

Suspicions over the shareholding patterns in Adani listed companies held by a number of offshore funds has previously attracted questions from the media and Indian politicians, but deep dives into their shareholders have yet to be carried out.

“We Want To Know Whose Money It Is. If It Is Adani’s Money, Then Minority Shareholders Are Being Screwed”: Indian Opposition Politician And Former Investment Banker In July 2021

In June 2021, Adani Enterprises stock fell as much as 25%, with other group companies falling 4%-8% on the day, amid media controversy over who the ultimate beneficial owners of a handful of offshore funds heavily invested in Adani stock were, and reports that those trading accounts had been frozen.In outspoken comments to the media at that time, opposition lawmaker Mahua Moitra, herself a former investment banker, said:

Below is a simplified overview of the alleged scheme, which appears to involve money being routed out of companies controlled by the Adani Group, through multiple tax havens and then invested back into listed stocks of the Adani Group.“We want to know whose money is it. If it is Adani’s money, then minority shareholders are being screwed.”

Such a scheme could have critical implications for any investor in Adani listed companies. If the Adani Group secretly controls significant amounts of publicly traded stock without disclosure, the resultant share price of Adani listed companies could be easily manipulated to meet the immediate needs of the Adani Group (i.e., to give the appearance of liquidity, to help raise money, etc.)

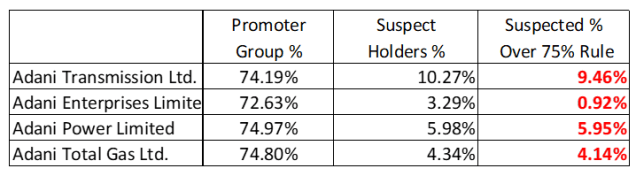

Background: 4 of Adani’s Listed Companies Are On The Brink Of India’s Delisting Threshold Due To High Reported Promoter Ownership

Currently, 4 Adani listed companies are on the brink of India’s delisting threshold due to high disclosed promoter (insider) ownership. Adani Enterprises, Adani Transmission, Adani Power, and Adani Total Gas all report 72%+ of their shares held by insiders. Furthermore, Adani Wilmar, a new company with current insider ownership of 87.94%, must reduce its insider holdings to 75% by early 2025 to meet these requirements – a significant feat requiring the offloading of 12.94% of its current insider equity.- Adani Transmission (74.19%)

- Adani Enterprises (72.63%)

- Adani Power (74.97%)

- Adani Total Gas (74.80%)

- Adani Wilmar (87.94%)

For many Adani listed companies, a large portion of their “public” shareholders are funds based in the opaque jurisdiction of Mauritius. Importantly, funds identified in this section, which we believe should be classified as “promoter” (insider) entities, hold enough shares of Adani listed companies to put four of them well over the 75% threshold, triggering delisting.

Note that shareholding lists in India only specifically name foreign funds (FPIs) if they hold more than 1% of equity. We believe it likely that smaller stockholders below this threshold are also be used as vehicles to conceal promoter/insider ownership.

The total stockholding of all offshore foreign funds (FPIs), including smaller funds (below 1%) and large funds (above 1%), in Adani listed companies is, per the latest disclosures: Adani Transmission (19.32%), Adani Enterprises (15.39%), Adani Power (12.88%), Adani Total Gas (17.25%), Adani Green (15.14%), Adani Ports (13.76%), and Adani Wilmar (1.57%).

Our estimates, which only analyze the pattern of larger named funds, likely significantly understates the scale of the issue. This suspicion is reinforced when examining 2021 parliamentary disclosure of all the Adani shareholders and their beneficial owners which showed many suspect Mauritius-based funds with holdings below the 1% threshold that were not normally visible to the investing public.