fsayed

SENIOR MEMBER

- Joined

- Feb 21, 2013

- Messages

- 2,606

- Reaction score

- -2

- Country

- Location

Take a look at @PankajPachauri's Tweet:

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

This is big.India Jumps 13 Positions to Rank 2nd on Ease of Doing Business: Study

http://www.news18.com/news/business...-on-ease-of-doing-business-study-1252727.html

#5493

Ease of doing business?

This is Network 18 = Mukesh Ambani media.

India is no more known to be a developing country.

Its now known as a lower income country.

2016 index, India = 130

Jordan & Lebanon better ranked than Modi's India.

ROFOL

https://en.wikipedia.org/wiki/Ease_of_doing_business_index

[http://m.economictimes.com/news/eco...0-8-vs-0-1-in-march/articleshow/52689916.cms] [Trouble for Make in India! April IIP disappoints at -0.8% vs 0.1% in March - The Economic Times on Mobile] is good,have a look at it!

@nair @proud_indian @Roybot @jbgt90 @Sergi @Water Car Engineer @dadeechi @kurup @Rain Man @kaykay @Abingdonboy @SR-91 @nang2 @Stephen Cohen @anant_s

@jbgt90 @ranjeet @4GTejasBVR @The_Showstopper @guest11 @ranjeet

@GURU DUTT

NEW DELHI: India's industrial production shrank 0.8% in April after expanding for two months, dragged by a 3.1% decline in manufacturing output.

"In terms of industries, nine out of the twenty two industry groups in the manufacturing sector have shown negative growth during the month of April 2016 as compared to the corresponding month of the previous year," the statistics office said in a release on Friday.

February IIP numbers were marginally revised downwards to 1.9% growth from 2% earlier and March growth was revised up to 0.3% from 0.1% earlier.

Consumer goods production fell 1.2% in April. While consumer non-durables output declined 9.7%, the output of consumer durables was up 11.8%.

The industry group 'Electrical machinery & apparatus' showed the steepest decline of 55.9%, followed by a 24.5% fall in 'Food products and beverages' and 17.6% drop in the production of 'Tobacco products'. On the other hand, the industry group 'Furniture; manufacturing' showed the highest growth of 28% percent followed by 18.8% in 'Radio, TV and communication equipment & apparatus' and 18.7% in 'Office, accounting & computing machinery.

http://m.economictimes.com/industry...short-of-fy16-target/articleshow/52693908.cms

NEW DELHI: Textiles exports for the 2015-16 fiscal stood at $40 billion, falling way short of the $47.5 billion target, a senior official said today.

"The quantum of shipments from the textiles sector during 2015-16 was $40 billion," Joint Secretary in the Textile Ministry Sunaina Tomar told PTI.

The ministry has set an exports target of $48.5 billion for the current fiscal.

Last fiscal's shipments were also below the $41.4 billion exports achieved in 2014-15.

Meanwhile, Textiles Minister Santosh Gangwar today said the new national textiles policy, which aims to achieve $300 billion exports by 2024-25, may be unveiled soon.

The new policy also aims to create an additional 35 million jobs.

Keeping in view various domestic and international developments in the industry and the need for a roadmap, the ministry has initiated the process of reviewing the National Textiles Policy, 2000.

The minister also informed that around 3.75 lakh youth belonging to the textiles sector have been trained under the Integrated Skill Development Scheme (ISDS) and 70 per cent of the trainees have already got jobs.

IIP data shows revival a major challenge: India Inc

By PTI | 10 Jun, 2016, 21:24 hrs IST

gplus

message

aPlus

Industrial output contracted by 0.8 per cent in April, the first decline in three months, due to drastic fall in capital goods production and manufacturing activities.

NEW DELHI: Disappointed over the latest IIP data, India Inc today said industrial revival is going to be a major challenge going ahead but expressed hope that the growth will pick up on account of the recent measures taken by the government.

"The negative growth of general index further worsens the prevailing levels of demand-supply imbalances in the country. The significant shrinkage in production of capital goods and consumer non-durables shows that industrial revival is going to be one of the major challenges in days to come," Assocham Secretary General D S Rawat said.

"The growth in manufacturing may take some more time to pick up as the measures taken by the government in the last few months start yielding results," Ficci President Harshavardhan Neotia said.

Industrial output contracted by 0.8 per cent in April, the first decline in three months, due to drastic fall in capital goods production and manufacturing activities, prompting demands for pro-active measures by government to boost demand.

Factory output measured in terms of the Index of Industrial Production (IIP) had expanded by 3 per cent in April last year, the data released by Central Statistics Office (CSO) today showed.

The IIP had registered a growth of about 2 per cent in February this year. The provisional estimates of 0.1 per cent growth in March this year was revised slightly upwards to 0.3 per cent. The IIP declined by 1.6 per cent this January.

"The 0.8 per cent contraction in industrial output in April 2016 is inferior to our expectation of a mild growth in that month. The volume-based contraction in manufacturing output in five of the last six months is disheartening," Aditi Nayar, Senior Economist at ICRA, said.

CARE Ratings said the industrial production in FY2016-17 is expected to pick up in coming months on the back of improved infrastructure spending by the government and improvement in the consumer goods segment.

The manufacturing sector which constitutes over 75 per cent of the index, contracted by 3.1 per cent in April this year compared to a growth of 3.9 per cent in same month last year.

Similarly the capital goods output, which is a barometer of investment, declined sharply by 24.9 per cent in April compared to a growth of 5.5 per cent during the same month last year.

"The deep contraction in capital goods highlights that investment activity by the private sector remains feeble," Nayar said.

Overall, 9 of the 22 industry groups in manufacturing sector showed negative growth in April 2016 as compared to year ago period.

Global economy is slowing down, we have to bear some repercussions, most of these figures are results of declining exports.

What is the applicable GST rate?

What is the applicable GST rate?

India Jumps 13 Positions to Rank 2nd on Ease of Doing Business: Study

http://www.news18.com/news/business...-on-ease-of-doing-business-study-1252727.html

What is GST (Goods & Services Tax) : Details & Benefits

The present structure of Indirect Taxes is very complex in India. There are so many types of taxes that are levied by the Central and State Governments on Goods & Services.

We have to pay ‘Entertainment Tax’ for watching a movie. We have to pay Value Added Tax (VAT) on purchasing goods & services. And there are Excise duties, Import Duties, Luxury Tax, Central Sales Tax, Service Tax….hhmmm

As of today some of these taxes are levied by the Central Government and some are by the State governments. How nice will it be if there is only one unified tax rate instead of all these taxes?

In this post, let us understand – what is Goods and Services Tax and its importance. What are the benefits of GST Bill to Corp orates, common man and end consumer? What are the advantages, disadvantages and challenges?

What is GST?

It has been long pending issue to streamline all the different types of indirect taxes and implement a “single taxation” system. This system is called as GST ( GST is the abbreviated form of Goods & Services Tax). The main expectation from this system is to abolish all indirect taxes and only GST would be levied. As the name suggests, the GST will be levied both on Goods and Services.

GST was first introduced during 2007-08 budget session. On 17th December 2014, the current Union Cabinet ministry approved the proposal for introduction GST Constitutional Amendment Bill. On 19th of December 2014, the bill was presented on GST in Loksabha. The Bill will be tabled and taken up for discussion during the coming Budget session. The current central government is very determined to implement GST Constitutional Amendment Bill.

GST is a tax that we need to pay on supply of goods & services. Any person, who is providing or supplying goods and services is liable to charge GST.

How is GST applied?

GST is a consumption based tax/levy. It is based on the “Destination principle.” GST is applied on goods and services at the place where final/actual consumption happens.

GST is collected on value-added goods and services at each stage of sale or purchase in the supply chain. GST paid on the procurement of goods and services can be set off against that payable on the supply of goods or services.The manufacturer or wholesaler or retailer will pay the applicable GST rate but will claim back through tax credit mechanism.

But being the last person in the supply chain, the end consumer has to bear this tax and so, in many respects, GST is like a last-point retail tax. GST is going to be collected at point of Sale.

The GST is an indirect tax which means that the tax is passed on till the last stage wherein it is the customer of the goods and services who bears the tax. This is the case even today for all indirect taxes but the difference under the GST is that with streamlining of the multiple taxes the final cost to the customer will come out to be lower on the elimination of double charging in the system.

Let us understand the above supply chain of GST with an example:

The current tax structure does not allow a business person to take tax credits. There are lot of chances that double taxation takes place at every step of supply chain. This may set to change with the implementation of GST.

Indian Government is opting for Dual System GST. This system will have two components which will be known as

The current taxes like Excise duties, service tax, custom duty etc will be merged under CGST. The taxes like sales tax, entertainment tax, VAT and other state taxes will be included in SGST.

- Central Goods and Service Tax (CGST) and

- State Goods and Service Tax (SGST).

So, how is GST Levied? GST will be levied on the place of consumption of Goods and services. It can be levied on :

- Intra-state supply and consumption of goods & services

- Inter-state movement of goods

- Import of Goods & Services

What is the applicable GST rate?

The rate (percentage) of GST is not yet decided. As mentioned in the above table, there might be CGST, SGST and Integrated GST rates. It is also widely believed that there will be 2 or 3 rates based on the importance of goods. Like, the rates can be lower for essential goods and could be high for precious/luxury items.

Benefits of GST Bill implementation

Challenges for implementing Goods & Services Tax system

- The tax structure will be made lean and simple

- The entire Indian market will be a unified market which may translate into lower business costs. It can facilitate seamless movement of goods across states and reduce the transaction costs of businesses.

- It is good for export oriented businesses. Because it is not applied for goods/services which are exported out of India.

- In the long run, the lower tax burden could translate into lower prices on goods for consumers.

- The Suppliers, manufacturers, wholesalers and retailers are able to recover GST incurred on input costs as tax credits. This reduces the cost of doing business, thus enabling fairer prices for consumers.

- It can bring more transparency and better compliance.

- Number of departments (tax departments) will reduce which in turn may lead to less corruption

- More business entities will come under the tax system thus widening the tax base. This may lead to better and more tax revenue collections.

- Companies which are under unorganized sector will come under tax regime.

Since GST replaces many cascading taxes, the common man may benefit after implementing it. But it all depends on ‘what rate the GST is going to be fixed at?’ Also, Small Traders (based on Annual Business turnover) may be exempted from it.

- The bill is yet to be tabled and passed in the Parliament

- To implement the bill (if cleared by the Parliament) there has to be lot changes at administration level, Information Technology integration has to happen, sound IT infrastructure is needed, the state governments has to be compensated for the loss of revenues (if any) and many more..

- GST, being a consumption-based tax, states with higher consumption of goods and services will have better revenues. So, the co-operation from state governments would be one of the key factors for the successful implementation of GST

France was the first country to introduce this system in 1954. Nearly 140 countries are following this tax system. GST could be the next biggest tax reform in India. This reform could be a continuing process until it is fully evolved. We need to wait few more months for more details on Goods & Services Tax system.

http://www.relakhs.com/gst-goods-services-tax-in-india/

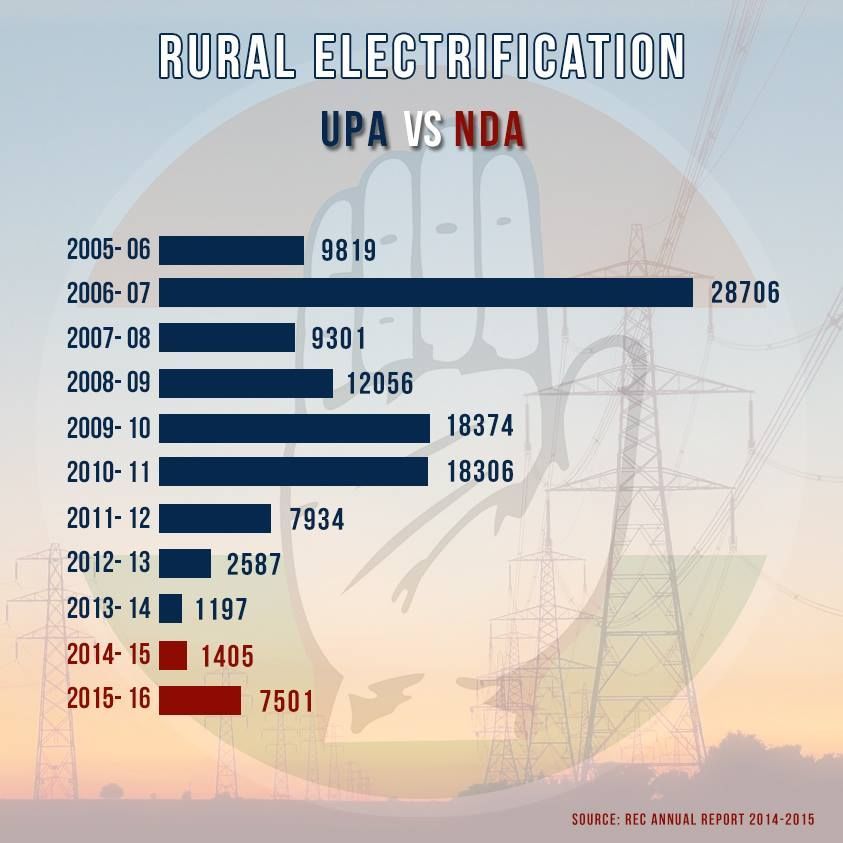

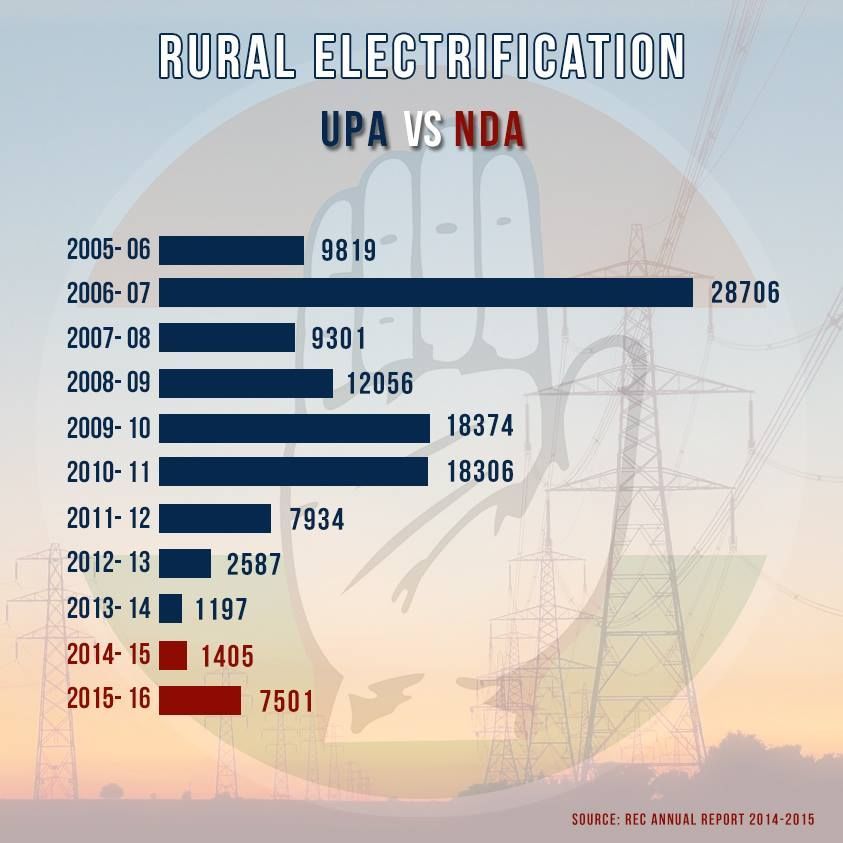

View attachment 309980 View attachment 309981

@GURU DUTT @Rain Man @ranjeet @Abingdonboy @Levina @Roybot @Water Car Engineer @PARIKRAMA @Nilgiri