Bilal9

ELITE MEMBER

- Joined

- Feb 4, 2014

- Messages

- 26,569

- Reaction score

- 9

- Country

- Location

Sajjad HossanJune 24, 2023

REPORT

Mahindra, the world’s largest tractor producer, distributor, and seller, as well as the 4th largest car manufacturer in the Indian automobile industry, recently closed its subsidiary in Bangladesh (Mahindra Bangladesh Private Limited). The Mahindra Group has been importing and distributing its various segment vehicles in Bangladesh for 25 years. Recognizing the demand and potential market for automobiles in the country, the Mahindra Group established a subsidiary in 2019 to directly import products to Bangladesh. However, due to various reasons, the subsidiary did not carry out any operations in the four years following its establishment. Consequently, in 2023, the subsidiary was entirely closed at the collective call of shareholders.

Overview

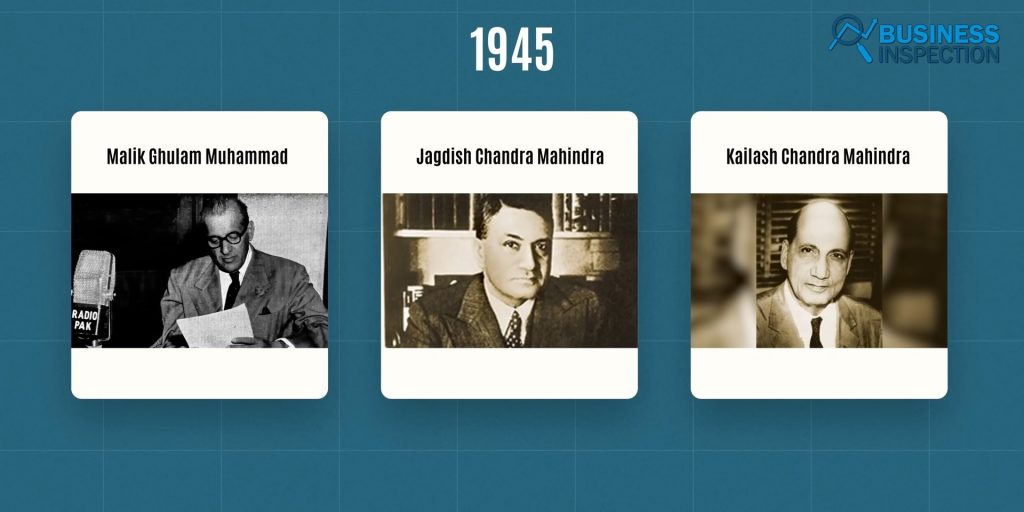

In 1945, Mahindra & Muhammad, one of the most popular automobile manufacturing companies in India, was started by owners Ghulam Muhammad, JC Mahindra, and KC Mahindra. Initially, the company mainly imported steel from UK suppliers and distributed it in India. When owner Ghulam Muhammad moved to Pakistan after partition in 1947, the company was renamed to ‘Mahindra & Mahindra’ (M&M). In the same year, Mahindra entered the automobile industry by importing 75 dismantled jeeps from the Willys Overland Export Corporation of America and reassembling them in India. In the early 1950s, the company started manufacturing commercial vehicles and agricultural tractors. Over the next few decades, the company expanded its product range as well as started exporting.

Mahindra & Muhammad, a popular Indian automobile manufacturing company, was founded in 1945 by Ghulam Muhammad, JC Mahindra, and KC Mahindra.

In 1995, Mahindra & Mahindra started manufacturing passenger cars in India in a joint venture with Ford Motor Company. When this partnership expired in 2005, M&M resumed SUV manufacturing and focused on global business expansion. In addition to establishing joint ventures with global automobile manufacturers such as Renault and Nissan, Mahindra also acquired SsangYong Motors of South Korea and Pininfarina of Italy. Mahindra & Mahindra is currently running its operations in more than 100 countries around the world through subsidiaries, joint ventures, and partnerships.

The journey of Mahindra & Mahindra in Bangladesh started in 1994. Two domestic companies, Rangs Group and Karnaphuli Group, distribute all types of automobiles including Mahindra & Mahindra pickups, trucks, tractors, and passenger cars in Bangladesh. Among the two Rangos group companies, Rangos Motors distributes several types of four-wheeler vehicles, including Mahindra-branded pickups. On the other hand, another subsidiary, Rancon Motors, distributes Mahindra tractors in the Rajshahi and Rangpur areas of the country, along with Mahindra commercial vehicles of three tonnes and above.

Besides, Karnaphuli Group is distributing Mahindra tractors in other divisions and divisional cities of the country. Mahindra, which has been doing business in Bangladesh for almost 30 years, currently has more than 50,000 Bangladeshi customers. In 2019, Mahindra & Mahindra established a subsidiary named Mahindra Bangladesh Private Limited (MBPL) to further expand its business in Bangladesh. This subsidiary was originally established to expand the business by distributing Mahindra products in Bangladesh, avoiding various obstacles in importing the products.

Through this subsidiary, Mahindra can directly address the competition in every segment in the country’s market, and its own subsidiary can strengthen its position in the neighboring market. Apart from this, Mahindra had a strong position in the country’s market, and the company planned to eventually set up a manufacturing plant in Bangladesh. But even in the last four years, Mahindra has not been able to increase its customer base in the segments in which it does business in Bangladesh, such as tractors, pickups, and trucks. One of the biggest reasons is the corona epidemic in 2020. As a result, Mahindra’s expansion plans in Bangladesh collapsed, and even after four years, this subsidiary of Mahindra could not start its official operations in the country.

Meanwhile, Mahindra’s subsidiary could not start official operations, but the distributors of Mahindra products in Bangladesh, Rangs Motors, Rancon Autos, and Karnaphuli Group, continued their regular activities. Due to the current global economic crisis, the earlier expansion plan in the Bangladesh market was no longer aligned with Mahindra’s strategic expansion plan. The company completely wound up its subsidiary Mahindra Bangladesh Private Limited (MBPL) in Bangladesh in March 2023. However, despite the closure of the subsidiary, Rangs Motors, Rancon Autos, and Karnaphuli Group will continue to sell Mahindra products and carry out all promotional activities in Bangladesh as before. That is, Mahindra did not actually leave Bangladesh. Basically, they have moved away from their previous expansion plan in Bangladesh. But why did they decide to withdraw from their expansion plan in Bangladesh?

Why Did Mahindra Leave?

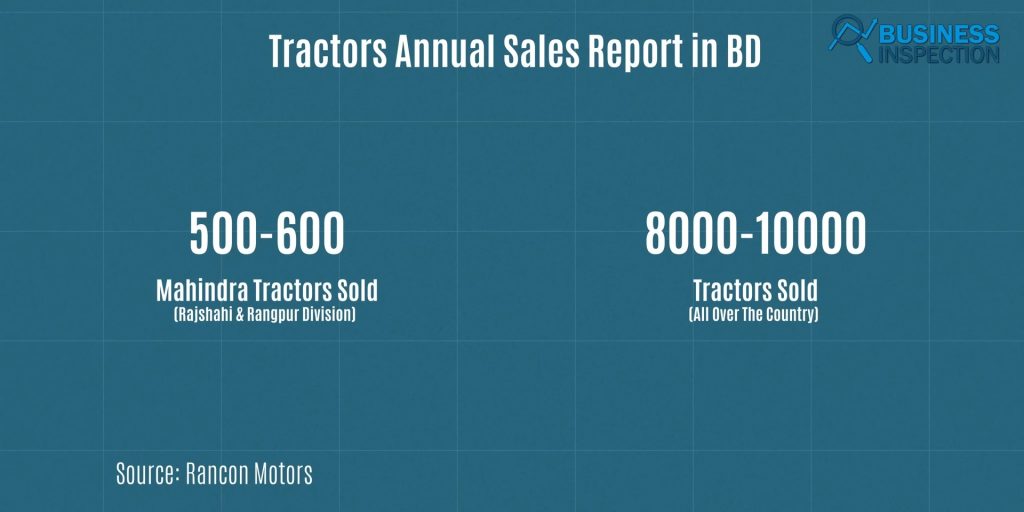

Mahindra’s journey in Bangladesh started in 1994 with the importation of tractors. Until 1990, Mahindra was primarily known for its tractors, which were highly popular in India. Mahindra expanded its business in Bangladesh due to the similarities in farming patterns between the two neighboring countries. However, the company did not achieve the desired success in Bangladesh. The use of machinery in agriculture is still limited in Bangladesh because most marginal farmers have small land holdings and find tractors unaffordable.Nonetheless, tractors are widely used in the country for transporting agricultural products, bricks, sand, and soil. Sonalika tractors from ACI Motors dominate the growing tractor market in Bangladesh, with TAFE, EICHER, and Mahindra tractors also being sold. According to a source from Rancon Motors, approximately 500 to 600 Mahindra tractors are sold annually in the Rajshahi and Rangpur divisions, while the country as a whole sells around 8,000 to 10,000 tractors per year. Sonalika, TAFE, and EICHER tractors have a greater market presence, preventing Mahindra from establishing a stronger position.

A similar situation can be observed in the pickup, truck, and tractor segments. Tata Motors vehicles, another renowned Indian brand, have gained significant popularity in the pickup and truck market in Bangladesh. Tata sells trucks of various models and capacities in the Bangladeshi market, and Niloy-Nitol Group, the sole distributor of Tata’s commercial vehicles, holds a 31% market share. Among these models, Tata ACE and INTRA have become particularly popular. Besides Tata, Indian brands Ashok Leyland and EICHER also have a strong market presence in this segment. ACI Motors, in addition to Indian brands, distributes Chinese brands such as Foton and Energypac JAC for light-duty trucks, vans, pick-ups, and medium to heavy-duty trucks in Bangladesh.

Japanese brands, including ISUZU and Mitsubishi, which once dominated the commercial vehicle market in Bangladesh, are also being distributed in the country. However, Mitsubishi, ISUZU, and the US brand Ford commercial vehicles are primarily used in various government projects. Mahindra’s commercial vehicles are mainly seen in districts like Rangamati and Bandarban in Bangladesh, while Akij Motors also sells light and heavy-duty commercial vehicles in the country.

A review of Bangladesh’s light, medium, and heavy-duty truck market reveals that the commercial vehicle segment is quite saturated. To gain a competitive advantage in such a saturated market, brands like Tata, Ashok Leyland, Eicher, JAC, and Foton are assembling vehicles in joint ventures with domestic companies. However, despite operating in the country for nearly 30 years, Mahindra has been unable to establish its own assembly plant. Consequently, Mahindra is unable to benefit from the advantages that domestically assembled brands enjoy, resulting in a lack of pricing advantage and an inability to increase its market share amidst intense competition.

A similar situation can be observed in the CNG market for trucks. CNG is widely used as public transportation in Bangladesh, with brands like Bajaj and TVS dominating the market. Bajaj, in particular, manufactures CNG in a joint venture with Runner Automobiles in Mymensingh. Additionally, TVS plans to start manufacturing three-wheelers in Bogura through a joint venture with domestic automobile conglomerate Nitol Motors, with an investment of Rs 300 crore.

Although CNG is popular as a public transport option in Bangladesh, the market is relatively small due to the country’s size. Furthermore, Bajaj and TVS have already established a strong foothold in the market for many years, resulting in market saturation. As a result, Mahindra has been unable to establish itself in the country’s CNG market.

Motorcycles are one of the most popular and widely used means of personal transportation in Bangladesh. Yamaha holds the leading position in the motorcycle market of Bangladesh, while brands like Honda, Suzuki, Hero, TVS, and Bajaj offer motorcycles and scooters in various segments. The Bangladesh Road Transport Authority permits motorcycles up to 165 cc in the country. Mahindra primarily offers lower and mid-range bikes and scooters, but the brand withdrew from manufacturing lower-segment motorcycles around 2017 due to a lack of response in the Indian two-wheeler market.

Currently, Mahindra is focusing more on manufacturing higher-tier or 200 to 350-cc motorcycles, which are not viable for the Bangladeshi market because Mahindra will not be able to launch these new cars in Bangladesh due to a lack of road permits. Additionally, in the motorcycle or two-wheeler market, Mahindra faces stiff competition from Japanese brands like Honda, Yamaha, Suzuki, as well as Bharti, Hero, TVS, Bajaj, and domestic Runner, as every brand assembles or manufactures bikes in Bangladesh. In fact, 96-percent of motorcycles in the Bangladeshi market are assembled or manufactured in the country.

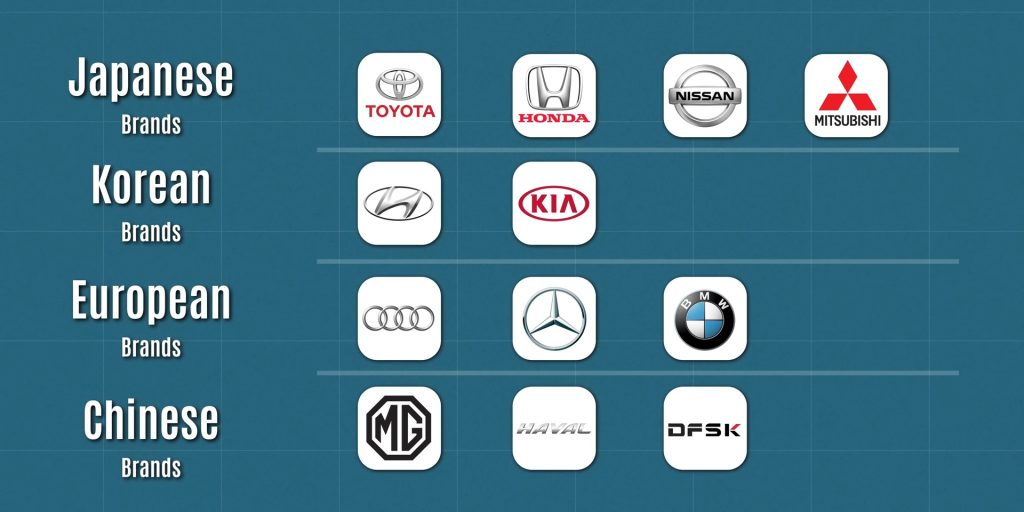

Similarly, in the case of private cars in Bangladesh, Japanese brand cars are the most preferred among customers, accounting for 85 percent of the private cars seen on the roads. However, there are also Japanese Toyota, Honda, Nissan, Mitsubishi, Korean brands Hyundai and Kia, European brands Audi, Mercedes, BMW, and Chinese brands MG, Haval, and DFSK seen on the roads of Bangladesh.

Bangladeshi buyers are not as price-sensitive as Indian customers when it comes to buying a car. Instead, Bangladeshi customers prioritize strong build quality and reliable driving experience, which is why they mainly prefer Japanese brand cars. While European brand-new cars are also sold, their numbers are still not significant. Indian auto manufacturer Tata Motors has been trying to sell cars in the Bangladesh market for a long time but has not been successful, partly due to lower build quality and other issues with Tata cars.

Additionally, Mahindra, known mostly as a tractor company in Bangladesh, does not generate much interest among Bangladeshi customers for their brand of cars. Moreover, Mahindra has never placed much emphasis on distributing their cars in Bangladesh due to the dominance of Japanese-brand cars in the country. Apart from this, Mitsubishi, Proton, Foton, and Hyundai have already started assembling cars in the country. However, Mahindra did not fare well due to the overall popularity of Japanese brands in the country’s market.

In Bangladesh, Mahindra mainly operates in the tractor, light and heavy commercial vehicle, CNG two-wheeler, and passenger vehicle segments. While the brand has met local demand through imports for nearly 30 years in Bangladesh, other brands have expanded their business by setting up their own assembly or manufacturing plants. Mahindra, being a latecomer to such expansion, could not strengthen its position in the market and compete.