YUANBA, China China has spent tens of billions of dollars buying into energy resources from Africa to Latin America to slake the unquenched thirst for fuel from its growing industry and burgeoning cities.

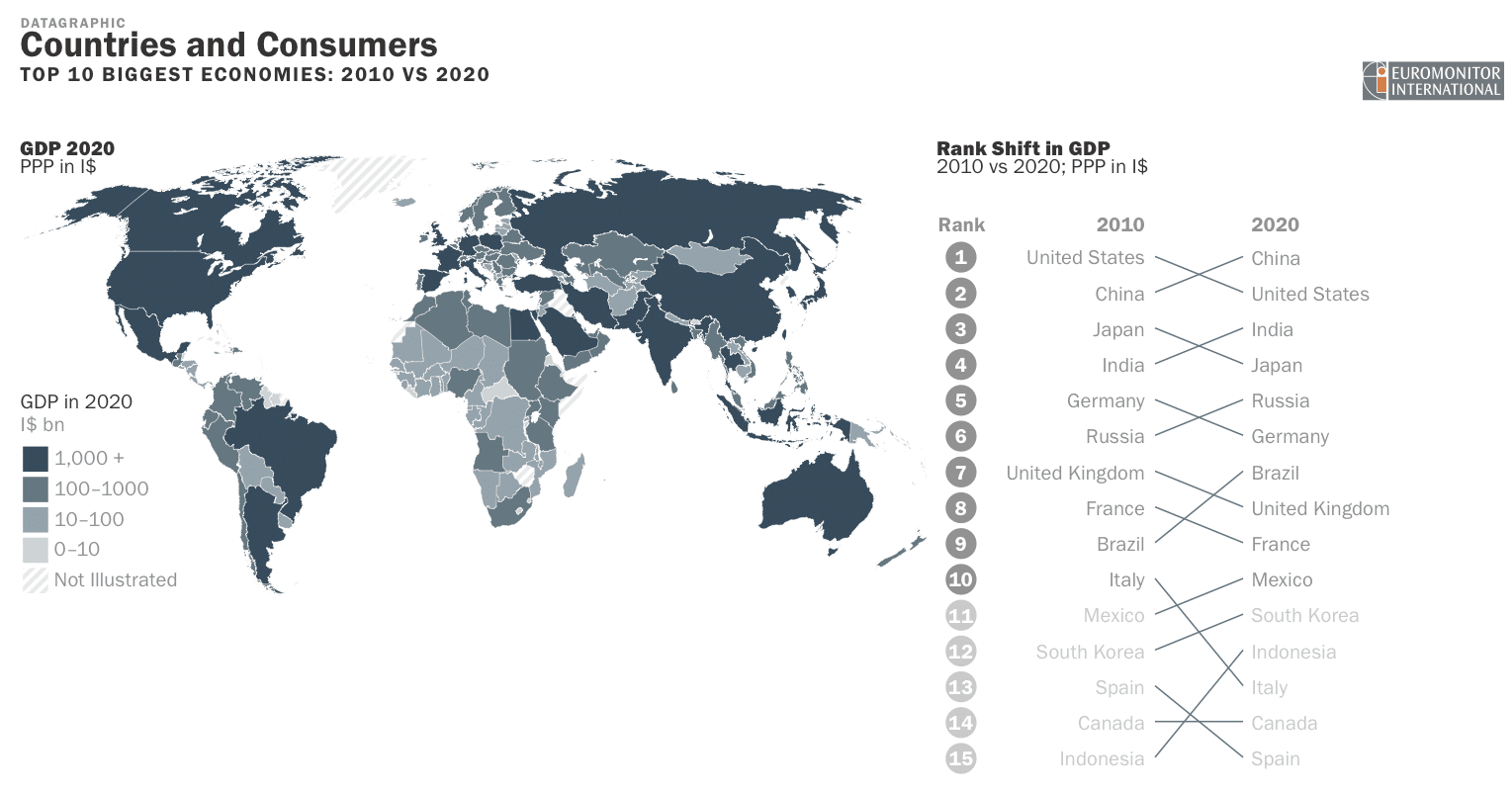

But China may have more energy riches under its own soil than policy makers in the world's second-largest economy ever dared imagine.

Just over a year ago, Beijing awakened to a technology revolution that has unlocked massive reserves of gas trapped within shale rock formations in the United States.

Once deemed too costly to extract, shale gas has turned around U.S. dependence on foreign gas imports. Just a few years ago, the United States was building scores of expensive facilities to import liquefied natural gas (LNG), looking at booming long-term demand forecasts and wondering which countries would supply the huge volume of imports it needed.

Instead, the United States is turning import facilities into export terminals, because its shale gas reserves are estimated to be big enough to meet domestic demand for 30 years. This is an American dream that China wants to emulate.

"America's shale gas production alone has exceeded that of total Chinese gas output. That gives us a lot of confidence," said Zhang Dawei, deputy director of the Strategic Research Center for Oil and Gas in the Ministry of Land and Resources(MLR).

China's confidence has been bolstered by a new report of its estimated reserves of shale gas, which shows them to be, by far, the largest in the world.

The U.S. Energy Information Agency in a report last month estimates China holds 36.1 trillion cubic meters (1,275 trillion cubic feet) of technically recoverable shale gas reserves -- significantly higher than the 24.4 tcm (862 trillion cubic feet) in the United States, which has the second-most.

Industry estimates in China peg shale gas resources slightly lower -- but still huge -- at 26 trillion cubic meters (tcm), although they have yet to give their own forecasts of how much of that is recoverable.

China's imminent shale rush comes at a critical point.

It will soon overtake the United States as the world's top energy user and is already the world's biggest coal burner. China also pumps more carbon dioxide into the atmosphere than any other country.

Beijing's bureaucrats thus face a daunting challenge: how to clean up its brown skies while meeting the world's fastest growing energy demand.

Natural gas burns more cleanly than other fossil fuels and installing gas-fired power generation is cheaper and easier than building nuclear plants. The problem is China cannot meet its rising demand for gas with its limited reserves of conventional gas. It faces the prospect of becoming as dependent on international markets for gas as it is for oil, where China is the world's second-largest importer.

But shale gas may not be as clean as advertised, according to a study released last week by Cornell University in New York. This study argues that significant amounts of methane -- a potent greenhouse gas -- escape into the atmosphere during production in wells and distribution in pipelines.

Regardless, China is racing to find out how much shale gas it can exploit -- and how quickly it can get the technology and build the infrastructure it needs to pump it to market -- to reduce its dependence on foreign sources of gas.

Auction action

The starting gun for that race is about to fire any day now.

The MLR said it would hold the first auction of shale gas blocks by the end of the first quarter of this year, so it is already overdue. The ministry had previously delayed the auction, initially scheduled last November, to open up the bidding to more domestic companies -- inject more competition into the process and quicken the pace of shale development.

The auction is for eight exploration blocks covering 18,000 square kilometers in four inland provinces: southwest Sichuan, Chongqing and Guizhou, and central Hubei province.

"We are aiming for major breakthroughs in locating the reserves in five years, and in eight years shale gas should take a significant position in China's energy mix," said Zhang at the land ministry. He talked of having shale gas account for one-tenth of China's total gas output by 2020.

China has identified shale gas as one of the country's top targets for technological breakthroughs in the 2011-2015 five-year plan, which means that Beijing will be opening the funding faucets for shale gas research.

China's National Energy Administration is setting up a shale gas laboratory in Langfang, near Beijing, to be financed mostly by PetroChina, and that will become China's national shale gas research center, officials say.

Experts say shale, which needs intensive drilling and many wells, plays to China's strengths.

"Shale gas projects are sometimes referred to as manufacturing operations. Which countries globally are particularly good at manufacturing?" said Robert Clarke, global head of unconventional gas research for Wood Mackenzie.

"China certainly comes to the forefront of your mind -- good in controlling costs, looking at efficiencies, and continually learning from earlier mistakes."

PetroChina, which produces nearly 80 percent of China's total gas output, just last month completed its first horizontal shale gas well in the Weiyuan block of Sichuan province.

Its parent company and China's biggest oil and gas firm, China National Petroleum Corporation (CNPC), said it aimed to have unconventional gas, mostly shale, account for about a fifth of total gas production by 2030.

CNPC predicts China's overall gas production will more than triple to 300 billion cubic meters by 2030 from 94 bcm in 2010. That would put shale gas output up near 60 billion bcm in 20 years, or more gas than India currently consumes.

That's quite a jump, because right now, China is pumping nothing at all from its shale gas reserves.

Obama visits

The shale rush only really began in China when President Barack Obama signed a cooperation pact on shale gas in November 2009 during a state visit to Beijing, just weeks before the Copenhagen climate talks. Washington thought that if China could increase gas usage at the expense of dirty coal, it would reduce the carbon footprint of the world's biggest greenhouse gas polluter.

U.S. firms had hoped the pact would help them leverage their technology to gain rare access to China's tightly controlled oil and gas reserves. China may have hoped to acquire some of that technology to help develop its fledgling shale industry.

Neither has materialized to any great extent so far. But the pact has undoubtedly helped smooth out any political objections to acquisitions by cash-rich Chinese energy giants of stakes in North American shale assets. In a flurry of recent deals, they have effectively purchased the technology and expertise they lack back home.

China's third-largest oil and gas firm CNOOC struck two deals with leading U.S. shale gas player Chesapeake over the last several months, giving it access to drilling leases in Texas, Wyoming and Colorado.

The deals marked CNOOC's triumphant entry into the United States after its 2005 bid for Unocal Corp was killed by strident political opposition over the involvement of Chinese state companies in the U.S. energy sector. Chevron later acquired the U.S. oil firm instead.

"Chesapeake has accumulated abundant experience in drilling and completion in various U.S. shale plays," CNOOC said in a statement e-mailed to Reuters. "The techniques and experiences we learn from the U.S. shale projects will benefit our potential participation in other areas in the future."

PetroChina, the world's second-most valuable energy company, announced in February it would buy a $5.4 billion (3.3 billion pounds) stake in Calgary-based Encana Corp's shale gas assets. Analysts say PetroChina paid a fat premium for that deal. But a CNPC executive said it was all about gaining expertise for shale.

"We don't care much about whether the market believes it's a good or bad price. The top priority is gaining access to a resource and mature technology," he said. "Price is only a secondary consideration."

U.S. companies, on the other hand, have had little luck getting their foot in China's door.

Majors like Exxon Mobil and ConocoPhilips, and smaller independents like Hess and Newfield, are looking for opportunities but Beijing-based international industry executives lamented the door was at best ajar.

In fact, ever since the failed Unocal bid, dealmaking between the world's two largest economies has been largely in limbo. A series of planned acquisitions has died in the hands of bureaucrats or politicians in Beijing and Washington, and other ideas haven't seen the light of day for fear they will also be blocked.

The energy sector has been a case in point.

Six months after Obama's visit, China and the United States set up a shale gas task force and agreed to jointly conduct a shale gas project -- assessing the Lower Liaohe basin in northeastern Liaoning province. The block is part of an aging oil basin and fell short of U.S. expectations that it would cover a much wider area.

While the U.S. government and companies have invited Chinese geologists for technical workshops and field trips, Chinese firms have been more lukewarm about sharing technical information, or opening up new blocks for resource studies, industry officials said.

China remains wary about letting foreigners prowl too much around the interior.

Secretive energy approach

"It's no secret China has a secretive approach to energy security ... Some in the government have a deep mistrust of U.S. motives," said a Beijing-based diplomat who requested anonymity.

China last year sentenced U.S. geologist Xue Feng to eight years in jail for leaking state secrets after he arranged the sale of an industry database to his then employer, Colorado-based consultancy IHS Energy.

China's notoriously vague state secrets laws drew international attention last year when Australian citizen Stern Hu and three colleagues working for mining giant Rio Tinto were detained for stealing state secrets during the course of tense iron ore negotiations.

China is especially sensitive when it comes to onshore oil and gas projects, which account for most of its domestic production.

Several rounds of onshore concessions in the 1990s attracted firms such as Exxon Mobil, BP, Royal Dutch Shell and Chevron. But the companies were largely disappointed by how little they found after spending hundreds of millions of dollar drilling.

Royal Dutch Shell, whose current and previous greater China Chief Executive Officers are both Malaysian Chinese, has so far won the biggest access to China's onshore sector among international firms.

The first among international majors to win an onshore gas contract in northwest China's Changbei field in 2005, Shell is now drilling at least two shale gas wells in Sichuan's Fushun block under an agreement with PetroChina.

"It's too early to say that shale gas is a game-changer (in China) but I have great expectations," Shell CEO Peter Voser told Reuters last month in Beijing.

Shell is drilling 17 wells this year, which should give it a good idea about the potential, he said. "If we are successful, we are aiming to spend $1 billion a year over the next five years on shale gas (in China)," said Voser, adding the firm was spending $400 million this year.

China is the world's second-largest oil consumer and the fifth-largest producer. But a cap on domestic gas prices to support the domestic fertilizing sector meant gas reserves were neglected until the last decade, when rapid urbanization and industrial growth spurred demand for the fuel.

Rising demand has sparked pressure to open up the upstream gas industry to smaller state-run firms or even foreign investment.

The land ministry's Zhang, one of the officials organizing the shale gas block auction, has repeatedly delivered the same message: a diversified body of investors and an open market were key to the U.S. shale gas rush once the technological breakthrough was made, and the same holds for China.

"Money, technology is not a problem, but the (Chinese) monopoly system is," Zhang told Reuters after returning from a tour of government agencies and shale gas companies in the United States.

The Barnett shale deposit in Texas, he noted, attracted more than 100 individual operators, each drilling a few wells and looking to sell to bigger companies.

Fracking controversy

In Yuanba, a green hilly county dotted with rice paddies and vegetable farms about 500 kilometers from Sichuan province's capital of Chengdu in China's southwest, Sinopec Corp drilled its first shale gas test well last December.

Using a vertical exploration well, the type designed for conventional gas, it struck a shale formation about 4,100 meters deep yielding a daily gas flow of 11,500 cubic meters.

It was a start. But for commercial production, shale gas needs a different type of well -- one drilled horizontally and used to pump in ******** of sand, water and chemicals to crack open channels in the rock for the gas to flow through.

The technique is called hydraulic fracturing, or "fracking", and it has opened up gas reserves trapped in rocks with little permeability -- reserves hitherto seen as too difficult and too expensive to exploit.

Sinopec plans to drill its first horizontal shale gas well around June in Fuling, not far from Yuanba and in the same geological Sichuan basin -- China's most prolific gas producing region.

Hydraulic fracking has provoked opposition from environmentalists who say the injection of chemicals contaminates water tables, concerns that are vividly depicted in the documentary Gasland.

The Oscar-nominated film showed tap water in the homes of families living near drilling sites in Pennsylvania turning a foul color and catching fire when touched with a lighter.(

Gasland: A film by Josh Fox).

Energy companies say there is no evidence that fracking has contaminated water supplies. But the U.S. Environmental Protection Agency said in March it would begin to take a closer look at the impact of shale gas drilling on both human health and the environment.

Shale's green credentials have also been questioned.

A study released last week by professors at Cornell said that while shale gas burns much cleaner than coal, it also leaks more methane in production, whether accidentally or through releases designed to relieve well pressure.

The research, led by Cornell University ecology professor Robert Howarth and published in the journal Climatic Change Letters, raised howls of protest from the gas industry, which said the study used flawed data and the document was political.

"Compared to coal, the footprint of shale gas is at least 20 percent greater and perhaps more than twice as great on the 20-year horizon ...", the study says.

The gas industry says producers already have the means to eliminate the bulk of these emissions, and the incentive to do so -- sales of trapped methane were worth $344 million in 2009.

Fast learners

Indeed, much is yet to be learned about shale gas, especially in China, which has little expertise in interpreting shale data, a shoddy environmental record, and has only just begun to acquire operational experience with fracking.

"I have a lot of difficulty understanding the shale resource ... struggling to figure out where are the exact spaces in the rocks that trap the gas and oil," said Wei Zhihong, a shale gas project manager with Chengdu-based Sinopec South Exploration Corp, an exploration unit of number-two energy firm Sinopec Corp.

It worries him a little because his bosses are so eager to get the latest news on their shale projects in Sichuan.

"In a little over six months, I was called to take more than 10 trips to Beijing to update the management on shale gas," Wei said. "The company's very top boss on upstream listened in on many of the meetings. I have the feeling our big bosses are very keen on shale gas."

China's energy giants believe they can pick up the technology fast.

"We will develop and build our own knowledge based on what the international companies have showed us... we will compare that to our own gas basins and pick and choose the knowledge that is relevant to our own geological conditions," Wei said.

The United States is home to mostly shallow, broad marine basins, while China has a mix of lake, marine and continent-based structures. The difference in geology may initially result in a higher exploration cost for China and it will need to fine-tune existing fracking techniques.

"The question remains as to whether U.S. technology can easily be replicated in China. China's geological conditions are more complicated," said Song Yan, a senior researcher with PetroChina.

It took nearly two decades for U.S. companies to perfect shale gas technology, which requires many more wells being drilled than conventional reservoirs and often lots of failed early wells.

"Unconventional gas plays need hundreds, and sometimes thousands, of wells. It will be interesting to see if management fatigue develops in large companies -- are they going to continue investing in a statistical project if maybe the first 10 wells don't work?" Wood Mackenzie's Clarke said.

Chinese firms say they are undaunted by the technical hurdles.

"You should have confidence in Chinese companies... If many small U.S. firms can do the job, why not big Chinese companies? They simply have not tried it before. Chinese (companies) are extremely good in emulating and imitating, they will get there very quickly," said Zhang at the land ministry.

Companies may also choose to pick up the know-how from service companies such as Baker Hughes, Halliburton and Schlumberger, probably a quicker route than undergoing the lengthy negotiations that go with sharing equity with energy companies, analysts said.

Schlumberger, for instance, won a contract to supply Sinopec with long-term, on-demand service on well appraisals that covers both conventional and shale gas, said Sinopec's Wei.

"Is it a huge opportunity to service companies, or is it just an area in which the Chinese just want to learn what they need to do and then do it on their own?" said Gavin Thompson, Beijing-based head of China gas research of Wood Mackenzie.

This shale game will largely play out in Sichuan, one of the largest and most inaccessible provinces in China, just north of Tibet, with 87 million people.

The gas frontier

Sichuan province is about four times the size of Pennsylvania, the U.S. state which holds the huge Marcellus shale deposit.

Sichuan is where China's Song Dynasty people invented bamboo wells to drill for salt about 1,000 years ago. Today, the province pumps nearly a quarter of China's total natural gas production.

One of China's main rice-growing provinces, Sichuan has rich water sources, sitting at the upper reaches of China's longest river, the Yangtze. Access to water is key to shale development because fracking is so water-intensive.

"If there are any major breakthroughs, they should come from Sichuan," said Guo Tonglou, chief geologist of Sinopec South Exploration Company. "We've done lots of work in the basin."

Explorers have sunk wells over 7 kms deep and made major discoveries such as Puguang, a conventional gas reservoir with proven reserves of 400 billion cubic meters, one of the country's largest gas fields. Geologists believe shale deposits normally sit close to big conventional reservoirs.

Few at Chinese firms think money will be a problem once companies prove sizeable reserves can be tapped.

"Decisions on spending come really quick nowadays if you can convince management it's a good project," said Sinopec's Wei.

The rising cost of importing gas is imparting some urgency to those decisions.

China is set to secure nearly a third of its gas consumption through imports by 2020, much of it from costly sources such as gas piped from Turkmenistan and a string of long-term purchase agreements for liquefied natural gas (LNG) from Australia, Qatar and Indonesia. The price of the gas in those contracts is indexed to oil, making them relatively expensive when oil prices are high compared to other fuels.

A rapid rise in domestic gas reserves, boosted by shale development, would be likely to depress domestic prices and may make China think twice about those LNG deals.

PetroChina's Chief Financial Officer Zhou Mingchun said in March the company lost 3.7 billion yuan in marketing 4.3 bcm of imported gas last year, mostly from Central Asia, because domestic gas prices were capped lower than import costs.

Still, China faces huge development costs in bringing shale gas supplies online. It only has 49,000 kms of gas pipeline grids, barely a tenth of the U.S. system, and would need to spend billions of dollars to build infrastructure to pump the gas to market.

Farmers such as Cui Jinlian, who is planting peas and eggplants by a conventional gas well near Yuanba county in Sichuan, say they've never heard of "shale gas" -- or had any idea it could contaminate the water they use for cooking and farming.

But Cui is aware the gas under their land has a poisonous component -- hydrogen sulphide (H2S)-- that can kill people. Gas pumped from the Sichuan basin, both conventional and unconventional, is mostly sour gas that contains H2S.

"It is no good for immediate use. The gas needs to be sent somewhere for processing first," said Cui in her musical Sichuan dialect, while resting by her small vegetable field. Piling up at the backyard of her simple one-story brick house were the dried tree twigs her family uses for cooking.

She knew also that hydrogen sulphide leaked from an explosion at a PetroChina exploration well in 2004 in Chongqing, killing hundreds of villagers in their sleep.

"Shale gas is a bit controversial, it can have a negative impact if done improperly," said Johnny Browaeys of CH2M, a U.S. consulting firm providing environmental and engineering services with an office in Shanghai.

"It's something we need to do right from the very start," said Browaeys, a fluent mandarin speaker who once lived in western China. "You don't want to get into a reputation issue."