Hi,

Thanks for the tag.

Russia exports tonnes of Lng. They can provide us through their Yamal Lng project.

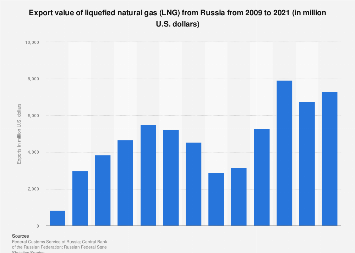

The value of liquefied natural gas (LNG) exports from Russia reached approximately 7.3 billion U.S.

www.statista.com

The question is not whether Russia can provide Lng, but at what price? We can't afford spot buys, even at 50% discount. Dutch TTF traded above $100/mmbtu today, so we should be looking for 5 or 10 years term contract. Any long term contract price, whether through pipeline

(TAPI, IP, or Russia-Kazakhstan-Uzbekistan/Turkmenistan-Afghanistan-Pakistan) or seaborne

(Lng) has to be lower or match our 2021 Qatar Lng contract

(that is 10.2% of three months averaged Brent), which will be extremely hard in case of Lng supplies for Russia.

Unfortunately, no information regarding supposed gas sales have been made public so we can only make guesses.

For pipeline gas, Russia can make couple of plays, a separate pipeline from 1) Uzbekistan

(Pipeline No. 4, Fig 2) to Pakistan via Afghanistan, but in my opinion they would simply piggyback on 2) TAPI, that is, tie in the existing CAC Pipeline

(Pipeline No. 2, Fig 2) in Turkmenistan to TAPI starting point, buy extra capacity in TAPI and provide Pakistan 750-1000 mmcfd

(keeping it under Gazprom's sanction limit and financially less burdening on Russia). There's is a reason why Mr. Zamir Kabulov finds Tapi pipeline idea interesting.

But all this will come into fruition only after TAPI is constructed. So, at least 3 years from the start of construction, the contract term will be much longer 20-25 years

(specially if they decide for standalone Uzbekistan route).

So, if a contract

(a strategic energy partnership) was indeed signed, it would be multi pronged.

1. Work on pipeline construction through Uzbekistan Route or Turkmenistan route.

(Physical gas supply starting after 3-5 years)

2. In meanwhile, supply LNG

(1.5mtpa or 2 cargoes/ month) through short term contract

(for 3-5 years term) starting October/ November 2022.

Hope, this makes some sense.

View attachment 821739

View attachment 821738