艹艹艹

SENIOR MEMBER

- Joined

- Jul 7, 2016

- Messages

- 5,149

- Reaction score

- 0

- Country

- Location

http://www.macrobusiness.com.au/2017/02/morgan-stanley-turned-bullish-china/

Why Morgan Stanley has turned bullish on China

at 10:39 am on February 15, 2017|

China’s shift from low income to middle income status has been the largest and most rapid economic transition in world economic history. Yet, throughout this journey doubts have been raised about its sustainability. Rising imbalances prior to 2007, a rapid buildup of debt after 2008, the currency regime shift in 2015 and more recently the impact of rising protectionism have all been cited as factors that could constrain China’s economic development.

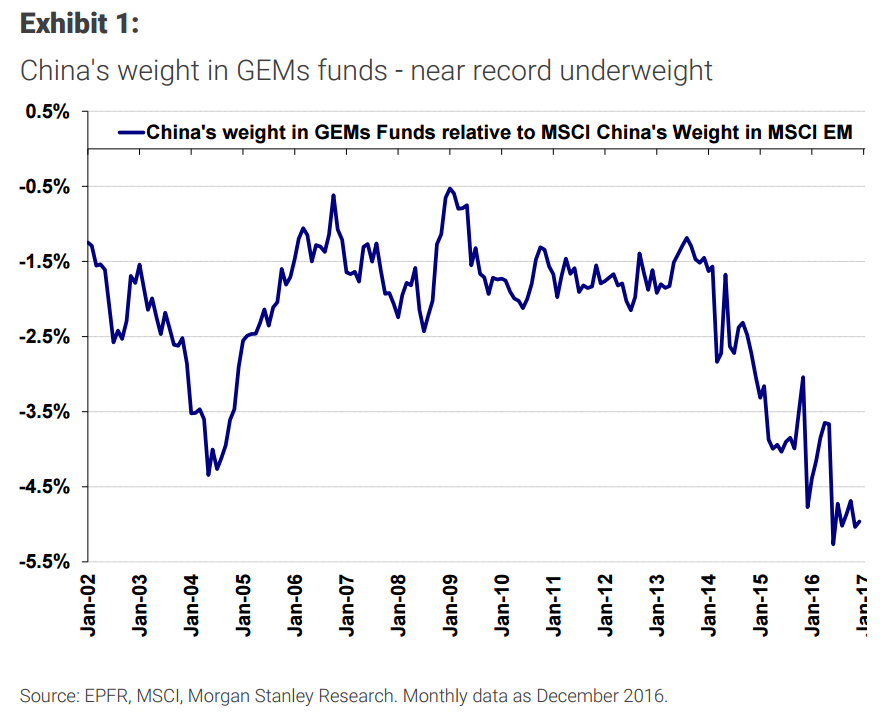

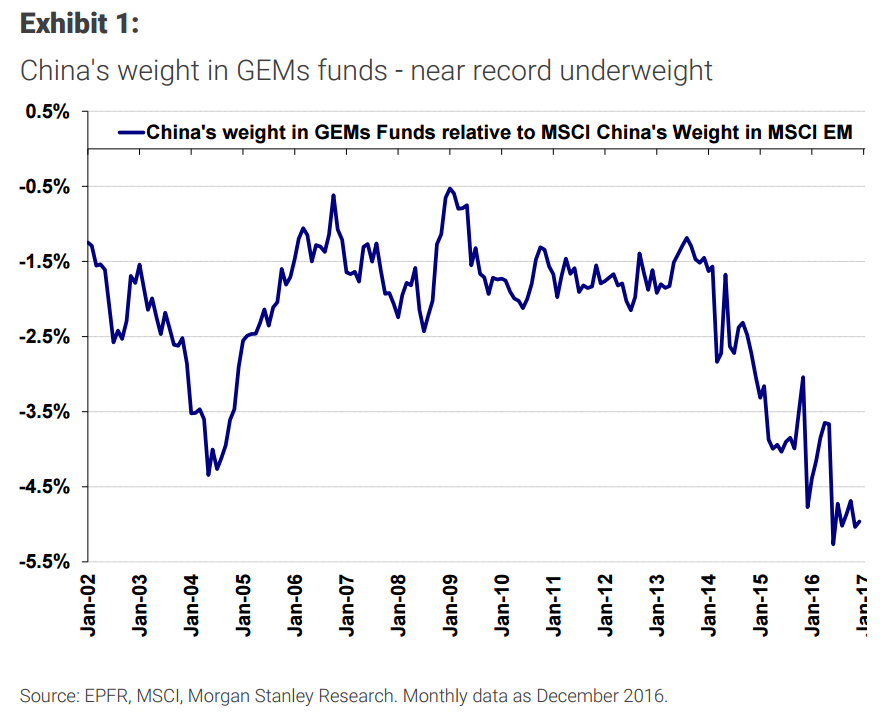

We take a positive view that China will continue to be able to navigate these challenges. Although investors have turned more skeptical and indeed hold a decade-low underweight position in China equities, we are confident that China will avoid a financial shock and complete its transition towards high-value added manufacturing and services and hence attain a high per capita income status.

In this report, we are taking a step back from our usual 12-18 month view and instead we focus on the longer term, laying down the macro outlook for China, addressing the key debates and identifying the key transitions and investment opportunities.

We lay out the view that China will be able to avoid a financial shock, as the self-funded nature of China’s growth, its specific macro setup and policy preferences will allow policy makers to manage liquidity conditions and prevent the debt cycle from becoming adverse. Under this scenario, a one-off devaluation of the currency is not our base case. That said, we think the currency will depreciate by a moderate but manageable pace over the forecast horizon.

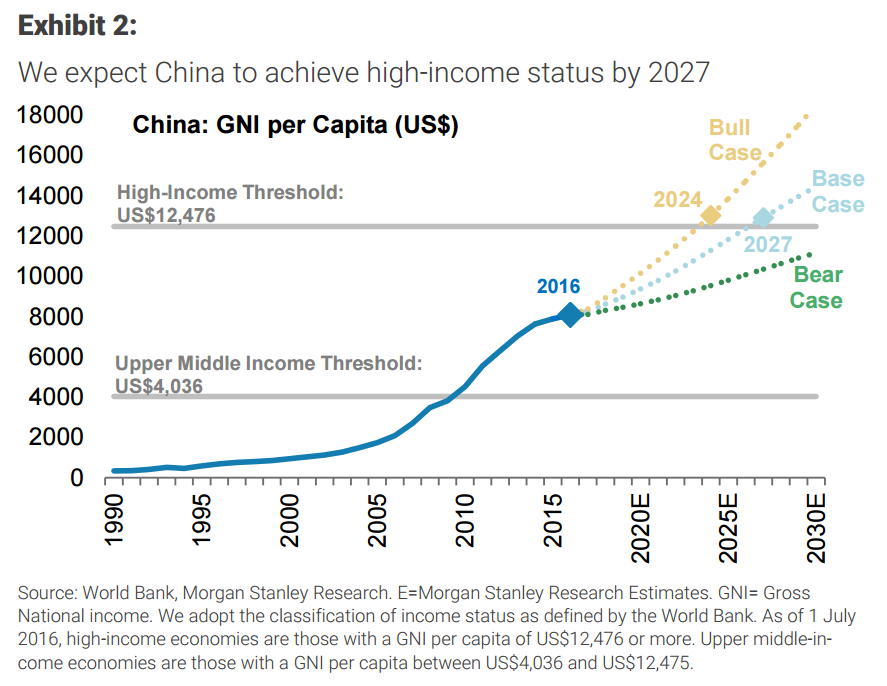

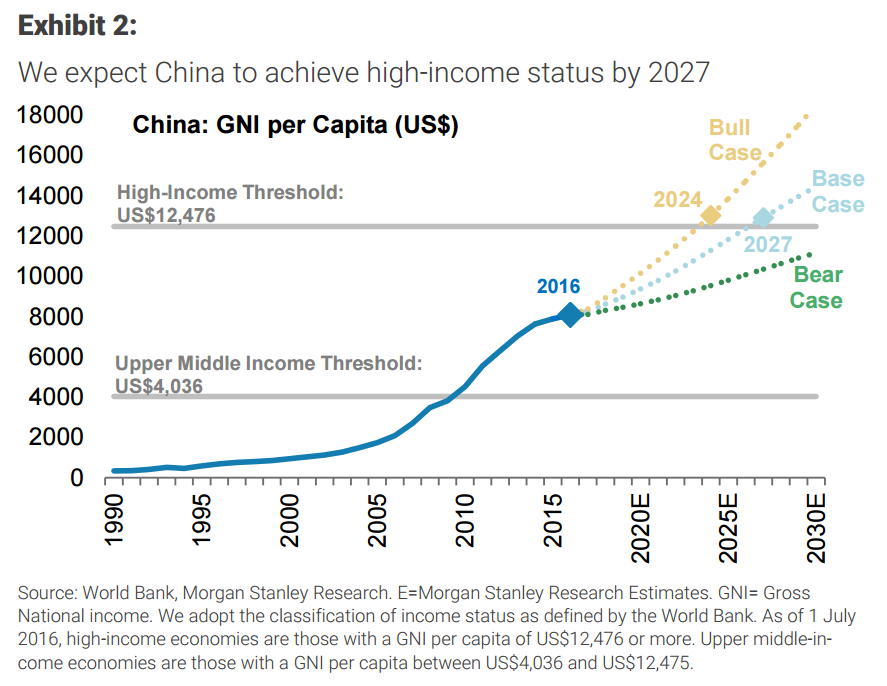

More importantly, we estimate that China will be able to attain a high income status by 2027 as we expect per capita incomes to reach US$12,900 by then, up from US$8,100 currently, thereby crossing the high-income threshold of US$12,500. China will therefore have broken out of the middle income trap and joined the rarefied ranks of a high income society, which has been achieved by only two large economies with a population of above 20m (Korea and Poland) over the past three decades. Indeed, the attainment of high income status will be the key defining moment in China’s economic development over the next decade.

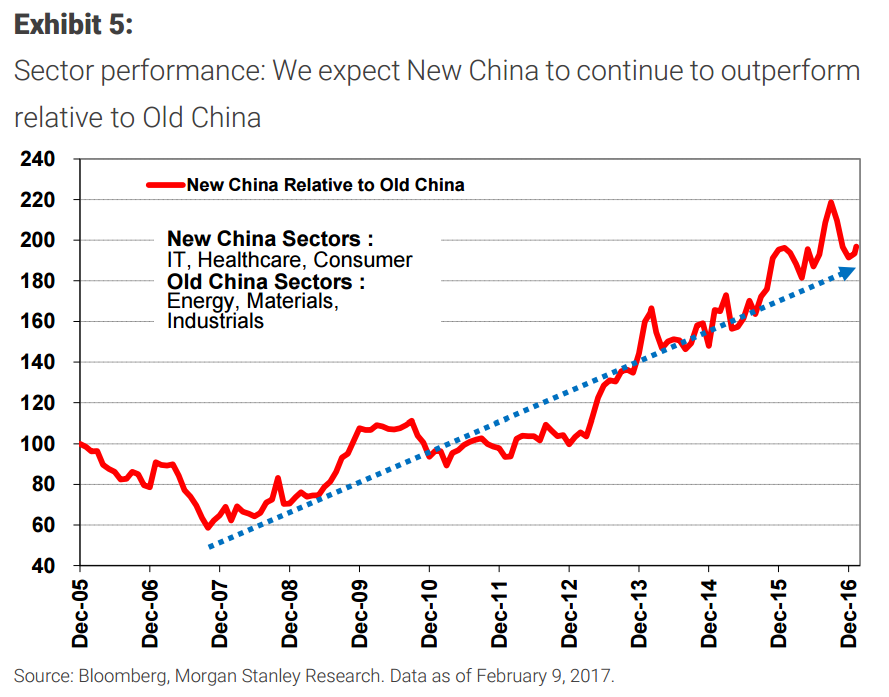

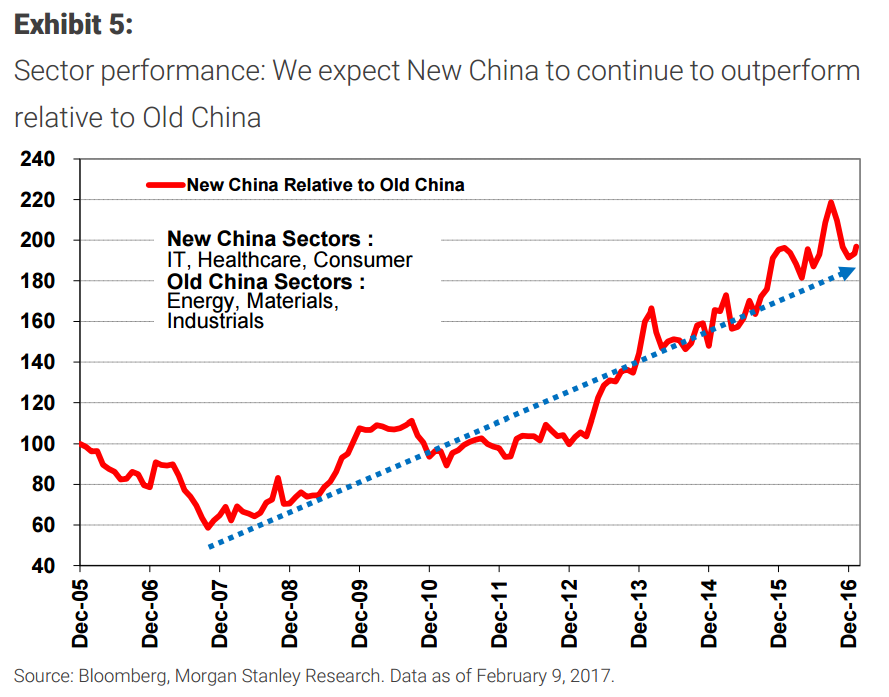

Alongside this rise in per capita incomes, there will also continue to be significant structural changes in the economy. To continue on its journey towards a high income society, China will need to move up the value chain in economic activities, shutting down capacities in old, redundant industries while fostering the development of new, high value-added economic activities in sectors such as high end manufacturing, healthcare, education and environmental services. Consumption and services will come to dominate the economic landscape .

China will complete its recent rapid emergence as a formidable competitor to traditional leaders in the high value-added manufacturing spaces in sectors such as telecom equipment, semiconductors, railways, power supply infrastructure and defense. The further development of indigenous automobile and aircraft manufacturing is a key area to watch. Meanwhile, a key structural weakness of poor SOE performance is likely to be addressed though the mechanism chosen by China of more top down reorientation and consolidation of SOEs into national champions rather than by improving efficiency via privatization.

To be sure, the journey towards high income will have its risks. The two key anchors that will determine whether our base case will pan out is how policy makers are managing the debt cycle and how the key transitions into higher value economic activities are proceeding. In our view, the most recent and arguably the most significant development on the policy front is that policy makers are now signaling a willingness to accept slower rates of growth, and place more focus on preventing financial risks and asset bubbles, indicating that they would not protect growth at all costs, often with the use of investment of a low return nature. This gives us greater confidence that policy makers will be able to slow the pace of rise in debt to GDP and will focus their efforts on setting a more stable environment which will allow China’s vibrant private sector and formidably resourced SOE to continue the move towards high value added economic activities.

As these transitions materialise, China will continue to present significant investment opportunities for global investors. We are confident that MSCI China can continue its long run track record of outperformance of global emerging markets. Moreover, in this report, we have identified sectors and stocks which are specifically positively geared towards the themes that we have discussed. The list that we have presented here is by no means exhaustive or static. We will be sure to keep a watchful eye on the progress of the transition and its implications on the markets and stay engaged with you on this topic in the coming months.

This is simply a reiteration of the old reform story. It makes sense but, if so, why is China still privileging growth over reform today and risking burnout via bad loans instead? Conventional wisdom is that Xi Jinping is consolidating power ahead of a renewed reform push post-CCP nation conference late this year. That is the MB base case too but I confess that the current credit binge has me wondering. Anyways, here is what it will mean for Australia one way or another in one chart:

Either way, forward looking policy should be preparing for the post-mining boom period.

Related:

Morgan Stanley Sees a Bright Decade for China Stocks

https://www.bloomberg.com/news/arti...stanley-sees-a-bright-decade-for-china-stocks

Why Morgan Stanley has turned bullish on China

at 10:39 am on February 15, 2017|

China’s shift from low income to middle income status has been the largest and most rapid economic transition in world economic history. Yet, throughout this journey doubts have been raised about its sustainability. Rising imbalances prior to 2007, a rapid buildup of debt after 2008, the currency regime shift in 2015 and more recently the impact of rising protectionism have all been cited as factors that could constrain China’s economic development.

We take a positive view that China will continue to be able to navigate these challenges. Although investors have turned more skeptical and indeed hold a decade-low underweight position in China equities, we are confident that China will avoid a financial shock and complete its transition towards high-value added manufacturing and services and hence attain a high per capita income status.

In this report, we are taking a step back from our usual 12-18 month view and instead we focus on the longer term, laying down the macro outlook for China, addressing the key debates and identifying the key transitions and investment opportunities.

We lay out the view that China will be able to avoid a financial shock, as the self-funded nature of China’s growth, its specific macro setup and policy preferences will allow policy makers to manage liquidity conditions and prevent the debt cycle from becoming adverse. Under this scenario, a one-off devaluation of the currency is not our base case. That said, we think the currency will depreciate by a moderate but manageable pace over the forecast horizon.

More importantly, we estimate that China will be able to attain a high income status by 2027 as we expect per capita incomes to reach US$12,900 by then, up from US$8,100 currently, thereby crossing the high-income threshold of US$12,500. China will therefore have broken out of the middle income trap and joined the rarefied ranks of a high income society, which has been achieved by only two large economies with a population of above 20m (Korea and Poland) over the past three decades. Indeed, the attainment of high income status will be the key defining moment in China’s economic development over the next decade.

Alongside this rise in per capita incomes, there will also continue to be significant structural changes in the economy. To continue on its journey towards a high income society, China will need to move up the value chain in economic activities, shutting down capacities in old, redundant industries while fostering the development of new, high value-added economic activities in sectors such as high end manufacturing, healthcare, education and environmental services. Consumption and services will come to dominate the economic landscape .

China will complete its recent rapid emergence as a formidable competitor to traditional leaders in the high value-added manufacturing spaces in sectors such as telecom equipment, semiconductors, railways, power supply infrastructure and defense. The further development of indigenous automobile and aircraft manufacturing is a key area to watch. Meanwhile, a key structural weakness of poor SOE performance is likely to be addressed though the mechanism chosen by China of more top down reorientation and consolidation of SOEs into national champions rather than by improving efficiency via privatization.

To be sure, the journey towards high income will have its risks. The two key anchors that will determine whether our base case will pan out is how policy makers are managing the debt cycle and how the key transitions into higher value economic activities are proceeding. In our view, the most recent and arguably the most significant development on the policy front is that policy makers are now signaling a willingness to accept slower rates of growth, and place more focus on preventing financial risks and asset bubbles, indicating that they would not protect growth at all costs, often with the use of investment of a low return nature. This gives us greater confidence that policy makers will be able to slow the pace of rise in debt to GDP and will focus their efforts on setting a more stable environment which will allow China’s vibrant private sector and formidably resourced SOE to continue the move towards high value added economic activities.

As these transitions materialise, China will continue to present significant investment opportunities for global investors. We are confident that MSCI China can continue its long run track record of outperformance of global emerging markets. Moreover, in this report, we have identified sectors and stocks which are specifically positively geared towards the themes that we have discussed. The list that we have presented here is by no means exhaustive or static. We will be sure to keep a watchful eye on the progress of the transition and its implications on the markets and stay engaged with you on this topic in the coming months.

This is simply a reiteration of the old reform story. It makes sense but, if so, why is China still privileging growth over reform today and risking burnout via bad loans instead? Conventional wisdom is that Xi Jinping is consolidating power ahead of a renewed reform push post-CCP nation conference late this year. That is the MB base case too but I confess that the current credit binge has me wondering. Anyways, here is what it will mean for Australia one way or another in one chart:

Either way, forward looking policy should be preparing for the post-mining boom period.

Related:

Morgan Stanley Sees a Bright Decade for China Stocks

https://www.bloomberg.com/news/arti...stanley-sees-a-bright-decade-for-china-stocks