.,.,.

PDM’s economic year in review

The collapsing economy is likely to bury the House of Sharif with it, at least for the foreseeable future.

Uzair M. Younus

April 9, 2023

When historians write about causes that led to the French Revolution, they frequently point out that King Louis XVI’s weakness, indecisiveness, and lack of political insight played a critical role in bringing about the downfall of the House of Bourbon in France.

While perusing over the events that led to the Reign of Terror in France, one reads about the indecisiveness of Louis XVI, the failure to implement economic reforms, a shortage of essential food products, especially wheat, an elite that refused to pay its fair share of taxes, and even a scandal referred to as the “Affair of the Diamond Necklace”, which discredited the royal family and dented its popularity beyond repair.

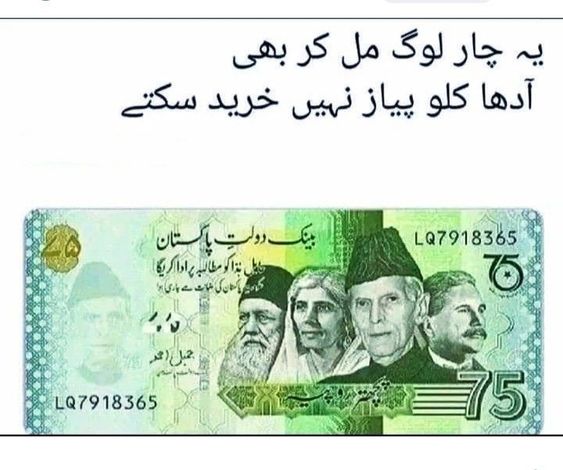

In so many ways, today’s Pakistan seems awfully similar to the Ancien Régime. As we mark the one-year anniversary of the return of “purana Pakistan”, as Foreign Minister Bilawal Bhutto-Zardari famously put it during his speech on the floor of Parliament, Pakistan is undergoing seismic and earth-shattering upheaval. And much like all upheavals, the worst affected are ordinary citizens who are experiencing emotional and economic trauma that will take generations to recover from.

So what exactly are the causes behind this economic crisis? And why is it that things have become so bleak in such a small period of time?

Indecisiveness and infighting

The obvious answer, as this author has reiterated in many analyses, is the unviability of Pakistan’s political economy, which has become captured by a parasitic kleptocracy that is now devouring its own kind for survival.

But this in and of itself does not explain the sharp decline in Pakistan’s economic prospects over the last 12 months. The crisis that began with a disastrous — and I would argue criminal — decision to lay an economic minefield through a petroleum subsidy by the PTI government was not unmanageable when Shehbaz Sharif donned his sherwani to become the 23rd Prime Minister of the Islamic Republic of Pakistan.

The International Monetary Fund (IMF) programme was indeed off-track at the time and yes, Pakistan had lost any and all credibility with the lender. But a new government, one that entered power with the stated desire to rescue the republic and the economy, was capable of turning things around at the time.

The delay in rolling back the petrol subsidies was an early signal that the prime minister and his cabinet were woefully unprepared to act decisively. It took Shehbaz Sharif over six weeks to do what he should have done on the first day of assuming power — end the subsidy and signal that his government meant business.

The dithering was not just limited to raising petroleum prices — months before they came to power, the PML-N’s “economic think tank” was engaging with experts to understand what it needed to do to rescue the economy. So it was not as if the likes of Miftah Ismail, Musadik Malik, and Ahsan Iqbal were not aware of what they should be doing.

But it turned out that the prime minister himself was on the fence, not only about what he needed to do to show intent and action, but also about whether he would remain in power. In a recent interview to Hamid Mir, Shehbaz himself acknowledged that he was ready to announce elections and the decision was not taken only because Imran Khan announced a long march towards Islamabad.

During this period, the prime minister also made it evident that it was not him, but his elder brother, Nawaz Sharif, who was calling the shots — Shehbaz went to London in early May with members of his cabinet to meet the elder brother.

There were other examples of the role that Nawaz and his daughter, Maryam Nawaz, played in determining the government’s policy — Maryam asked Miftah to look into pet food issues and a tax scheme to collect revenue from retailers was reversed after she objected to it — the pressure of course was coming from traders, a core voter bloc of the PML-N.

Despite this indecisiveness, the economy was still not beyond repair as the IMF programme was brought on track with a Staff Level Agreement being reached on July 13, 2022. This was another opportunity to push through meaningful reforms that would not only be good for the economy, but also rebuild Pakistan’s credibility among international creditors.

Dar returns, with a vengeance

But the man responsible for pushing through these actions was facing an insurgency led by a member of his own party. Enjoying a pleasant English summer, Ishaq Dar kept unleashing one strike after another against a member of his own party, leading Ismail to say that “he would be happy to relinquish his position” to pave the way for Dar’s return.

Dar’s return in September 2022 was yet another piece of evidence that the prime minister wasn’t really the one calling the shots, and it was an open secret that Dar was coming to Islamabad to represent the head honcho of the PML-N, Nawaz Sharif. While he did succeed in shouting down the dollar in the first few days of his return — in October, he claimed that the dollar would soon fall below Rs 200 — Dar was less Batman and more like Joker returning to Gotham.

On his watch, common sense economics was abandoned for gimmickry. The result was that the IMF programme went off track once more, Pakistan’s benefactors hit the pause button, and the slide accelerated. Dar’s visit to Washington for the annual meetings of the World Bank and IMF were not fruitful, despite his many pronouncements that significant progress had been made.

During these trips, Pakistan’s leaders were also seeking increased assistance in the aftermath of the catastrophic floods that had affected over 30 million people, and while the world did step up to provide some immediate support — pledging $9 billion in assistance — the IMF was unwilling to go easy on the country.

An important member of the cabinet told me at this time that Pakistan had lost all credibility with the IMF and that Dar had angered the IMF by doing exactly what the government had promised the lender it would not do.

In the months that followed, the government continued to harm both its credibility among international lenders and its popularity at home. Prime Minister Shehbaz Sharif seemed lost at sea, delegating the management of the economy to a man who seemed to have little understanding of the economy and was more interested in political gimmickry.

Dar’s belief that somehow the price of a commodity — the US dollar — was reflective of economic vibrancy and success added fuel to the fire. The infamous Dar Peg led to a yawning gap in the formal and informal exchange rate of the rupee, leading to declining formal flows of much-needed foreign currency into the economy.

Remittances shifted to the informal market, exports declined, and recognising that Dar was taking a bet he could not win, market participants began buying dollars to safeguard their wealth.

Rather than let the currency depreciate, import curbs were placed to save scarce foreign currency — these measures began prior to Dar’s return but took on a life of their own towards the end of 2022. As a result, supply-chains began to grind to a halt, leading to shortages of necessities such as medicines, price hikes of food commodities including chicken and flour, and shutdown of business operations across the country.

The Dar Peg did finally break and the dollar rose in value — but this was too little, too late. By the time the rupee found its true market value, those with means had already dollarised. They had lost faith in Shehbaz, Dar, and the economic capacity of the PDM government. Every other conversation was about where the dollar was headed and whether one should buy gold, silver, or some other dollar-denominated assets.

For ordinary citizens, things could not get worse: inflation was rising by the day and on a trip to Karachi in February 2023, this author experienced what could basically be described as unanchored inflation expectations.

Where do we go from here?

Much like the House of Bourbon in the run up to the French Revolution, the House of Sharif is facing a disaster. It may well be for this very reason that they are trying to delay elections in Punjab, even if it means violating the Constitution.

But given the way in which the Sharif-led government has governed over the last year, odds are that they will be unable to rescue both the economy and their own political prospects.

Inflation today stands at over 35 per cent — the highest ever recorded — and is showing no signs of slowing down. Interest rates are at 21pc — negative in terms of real rates. The central bank has been cajoled once more into functioning as an extension of the finance ministry. And Pakistan’s most talented citizens are running for the exits, promising to never look back.

Over the coming days, some funding from Saudi Arabia may materialise, which combined with the recent support from China may help reach a Staff Level Agreement (SLA) with the IMF; this may happen despite the government’s best efforts to derail the programme through announcements like the petrol subsidy plan unveiled a few weeks ago.

These much-needed inflows of foreign currency will ease the crisis in the immediate term, but the situation will only marginally improve, and only for the next three to four months. This gets the PDM to elections (if they are held at all), where the hope might be that a populist and expansionary budget would help them build a narrative that they have averted default and saved the country from disaster.

But this simply would not be true because the ongoing economic crisis in Pakistan — a crisis that has become a multi-headed hydra on the PDM’s watch — is going to last for quite a long period of time.

At the end of the day, the collapsing economy is likely to bury the House of Sharif with it, at least for the foreseeable future. But this rubble will also continue to bury millions of ordinary citizens — some four million have fallen below the poverty line already — and their successive generations. Rescuing these citizens and rebuilding their lives will take years, if not decades, of prudent economic policies paired with a complete overhaul of the country’s political economy.

Unfortunately for Pakistan, there is not a single leader, political party, or institution in the country that fully understands the nature of the crisis today and what it would take to build a more equitable, sustainable economy that works for the many, not just the few.

The collapsing economy is likely to bury the House of Sharif with it, at least for the foreseeable future.

www.dawn.com