senheiser

SENIOR MEMBER

- Joined

- Jun 26, 2012

- Messages

- 4,037

- Reaction score

- -1

- Country

- Location

Yandex.Translate

Russia and China will encounter further U.S. government bonds

German Economic News | Published: 20.03.14, 00:07 | 85 comments

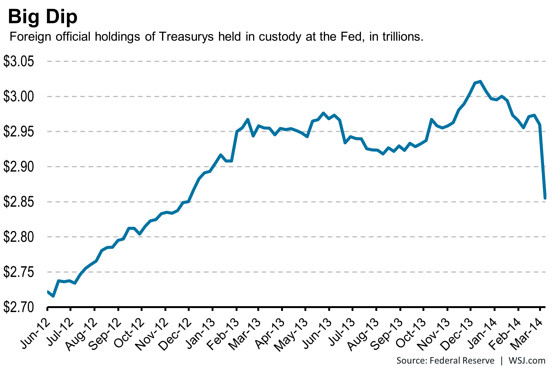

The US Treasury was now known, that Russia in January massive US government bonds sold. China also reduces further the purchase of the notes. It jumped Belgium and acquired in only two months bonds for 100 billion dollars.

Topics: Belgium, China, Japan, Lew, Russia, Schuldpapier, Government bond, U.S. bond, US Treasury,USA

The US Finance Minister, Jack Lew, are increasingly Worried about the low demand for U.S. bonds. (Foto: dpa)

Russia and China continue to sell in large-scale U.S. bonds. This is from the recently published Data from the U.S. Department of Treasury . Therefore sold in Russia in January U.S. Bonds in the value of seven billion dollars. The largest buyer of US debt, was once more the little Belgium.

The publication of the data undermined the authority of a gross error, because they published the first completely wrong Numbers. A few hours later, had the U.S. Treasury Department to admit, that the data were true, Zero Hedge reported. In fact, the Ministry had completely false data ago and had to be subsequently corrected.

For Japan, the authority had initially a standstill in the purchase of U.S. government bonds will be announced. In the corrected Version, bought Japan in January 2014 surprising about 19 billion of the notes.

Instead of the initially defined 14 billion dollars, bought China in January, in fact, only 3.5 billion dollars of U.S. bonds. And Russia has no U.S. bonds worth one billion dollars bought, as first published, but government bonds to the value of seven billion dollars sold.

Both China and Japan met in December massive U.S. bonds. Only China sold accordingly, bonds with a value of 48 Billion Dollars and so that as much as never before (more here).

Belgium is now with 310 billion dollars, the third largest holder of US debt. (Source: TIC, Zero Hedge)

Belgium had as a Savior to step in and bought alone in the December U.S. promissory note in the amount of 57 billion dollars. Also in January bought the small country of U.S. bonds for 53 billion dollars and is now with 310 billion dollars the third-largest holder of U.S. government debt. Only China and Japan hold even more bonds (the Fed excluded). For comparison: Belgium generated in the last year and a GDP of just over $ 500 billion.

According to rumors, the sale of U.S. government bonds in March only on the right to drive on. Unknown foreign investors, attracted bonds for about $ 100 billion, as Zero Hedge reported. This is the the largest sale of US bonds in the story. Whether Russia or China behind the action, we can only speculate. The US Treasury Department published the data only with a three-month delay. But it would not be surprised if the balance of Belgium also in the following month, will continue to grow.