beijingwalker

ELITE MEMBER

- Joined

- Nov 4, 2011

- Messages

- 65,191

- Reaction score

- -55

- Country

- Location

Factory slump and cost-of-living squeeze puts UK economy on course to shrink

By David MillikenAugust 23, 20237:46 PM GMT+8

A man works in the Farrat factory in Altrincham, Britain, May 12, 2023. REUTERS/Carl Recine/File Photo

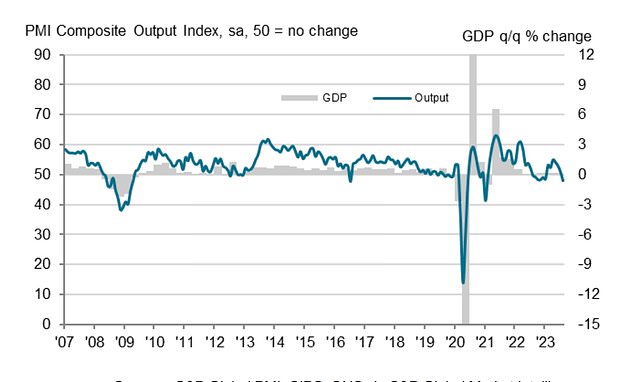

LONDON, Aug 23 (Reuters) - Britain's economy looks on course to shrink during the current quarter and risks falling into a recession, as a survey on Wednesday showed a slump in factory output and broader weakness in the face of higher interest rates.

The S&P Global/CIPS composite Purchasing Managers' Index (PMI) tumbled to 47.9 in August from 50.8 in July, according to a preliminary estimate which was below all forecasts in a Reuters poll of economists.

The reading was the lowest since January 2021, when Britain was in a COVID-19 lockdown, and the first fall below the 50 level which divides growth from contraction since January this year.

Britain's economy - struggling with high inflation as well as the after-effects of the coronavirus pandemic and Brexit - last shrank in the third quarter of 2022, when many businesses closed to mark Queen Elizabeth's funeral. Since then it has defied widespread forecasts of recession but has grown slowly.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said the PMI pointed to a 0.2% fall in overall economic output during the three months to the end of September.

"The fight against inflation is carrying a heavy cost in terms of heightened recession risks," he said.

The eurozone composite PMI also came in below all economists' forecasts at 47.0, down from 48.6 in July.

Sterling fell against the dollar and the euro and British government bond yields headed for their biggest daily fall in more than a month as investors scaled back expectations for further interest rate rises.

The Bank of England has raised rates 14 times since December 2021, taking them to a 15-year high of 5.25%. Financial markets still expect a further rate rise to 5.5% in September, but now expect rates to peak at 5.75% rather than 6%.

"The PMIs are unquestionably bad," said James Smith, an economist at ING. However, after a strong finish to the second quarter and other data showing a recovery in car production, he said he did not expect contraction in the third quarter.

Nonetheless, the figures did highlight the risk that the BoE was too focused on wage inflation, which often lags other economic developments, he said.

EASING PRICE PRESSURES?

British inflation has been slow to fall since it hit a 41-year high of 11.1% last year, and at 6.8% in July was the highest of any major economy.S&P's Williamson said he expected it to drop to 4% "in the months ahead". The BoE said earlier this month it only saw inflation falling below 4% from the second quarter of 2024.

The PMI survey recorded the slowest growth in output prices since February 2021.

Services prices, which the BoE has been watching closely, grew at the slowest pace since April 2021.

Manufacturers - who make up 10% of Britain's economy - reported the biggest fall in output prices since February 2016, echoing wider weakness in the sector.

The manufacturing PMI dropped from 45.3 to 42.5 in August, its lowest since May 2020, while the services sector fell from 51.5 to 48.7, matching January's two-year low.

"Companies are reporting reduced orders for goods and services as demand is increasingly hit by the cost-of-living crisis, higher interest rates, export losses and concerns about the economic outlook," Williamson said.

Customers reduced stocks of manufactured goods at the fastest rate since March 2009, during the depths of the global financial crisis.

Manufacturers said this fall appeared to be an attempt to reduce the need for working capital at a time of rising interest rates. They hoped this would be a one-off move as there was a limit to how much customers could reduce stock levels.

Services companies said households had stretched finances, which was only partly offset by strong tourism demand.

Overall business optimism for the year ahead dropped to an eight-month low but was broadly in line with its pre-pandemic average.

Factory slump and cost-of-living squeeze puts UK economy on course to shrink

Britain's economy looks on course to shrink during the current quarter and risks falling into a recession, as a survey on Wednesday showed a slump in factory output and broader weakness in the face of higher interest rates.