NG Missile Vessels

FULL MEMBER

- Joined

- Apr 9, 2023

- Messages

- 1,600

- Reaction score

- 0

- Country

- Location

President Joe Biden recently hosted Narendra Modi in a lavish state visit, the Indian prime minister’s first, with both nations seeking to realign their strategic interests at a time when China’s global influence continues to grow.

During the event, both leaders committed to strengthening defense and commercial ties, highlighting the importance of international law and maritime freedom amid rising tensions in the East and South China Sea.

The state visit also underlined the burgeoning technological partnership between the two nations, with many notable tech leaders in attendance, including Google’s Sundar Pichai and Microsoft’s Satya Nadella, both born in India.

The prime minister’s goal? To establish India as a global manufacturing and diplomatic powerhouse, an ambition fueled by strained relations with China.

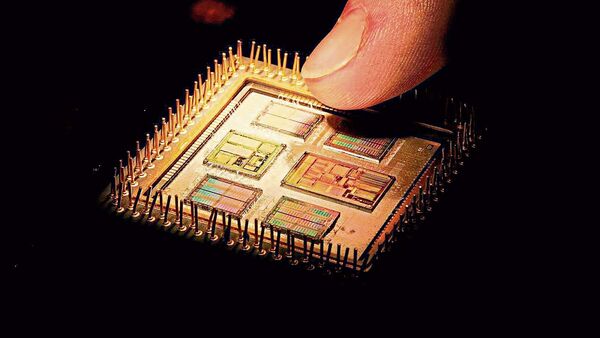

The visit led to several significant agreements, spanning sectors from semiconductors and critical minerals to technology, space and defense. Of these, a landmark deal will allow General Electric to produce jet engines in India, underscoring the country’s manufacturing prowess. Boise, Idaho-based chipmaker Micron Technology’s $2.75 billion investment for a semiconductor facility in India was also announced. Further, India agreed to join the U.S.-led Artemis Accords, marking a new era in collaborative space exploration.

The World’s Second-Largest Economy By 2075?

These ties aren’t just about politics. They’re rooted in a flourishing economy that’s turning heads globally. India’s GDP currently stands at around $3.75 trillion, but Deutsche Bank believes it could double to $7 trillion by 2030. Put another way, India’s GDP per capita is right around where China’s was in the 2007 period.

Deutsche attributes this growth to an expanding middle class, policy reforms, infrastructural development and a shift toward clean energy, among other factors. The nation has very favorable demographics, with the median age of its citizens below 30.

At the end of April, the United Nations reported that India had overtaken China as the most populous country on earth, and it’s now on track to add 97 million individuals to its working population over the next 10 years. This is believed to represent the largest workforce growth of any nation on earth for that period.

Yet challenges persist, such as inadequate employment opportunities.

Despite these issues, India continues to be a powerhouse of wealth creation. New millionaires are being minted at a staggering pace, and according to the Henley Private Wealth Migration Report 2023, the country’s net outflow of high-net-worth individuals (HNWIs) appears to be slowing year-over-year.

And the future? Goldman Sachs predicts that by 2075, India will be the world’s second-largest economy after China, overtaking the U.S. by a slim margin. The possibilities seem endless if the right policies can be aligned with the anticipated rapid population growth.

Global Giants Are Betting On India’s Growth Story

While uncertainties remain, signs of optimism abound. India’s Sensex, the benchmark index of the Bombay Stock Exchange, recently hit a record high when priced in the Indian rupee, buoyed by rapid economic growth and increased foreign investment.

Investors, too, are recognizing India’s potential. Despite recent dips in foreign direct investment (FDI) due to geopolitical tensions, India has managed to attract nearly $920 billion in total from April 2000 to March 2023, according to Dezan Shira & Associates.

Major global corporations like Amazon and Google are betting big on India. Amazon plans to invest an additional $15 billion by 2030, with Amazon Web Services (AWS) contributing $12.7 billion to cater to surging customer demand. Google aims to establish a fintech center in India’s Gujarat International Finance Tec-City (GIFT City) and extend its AI chatbot Bard to more Indian languages, making the internet more accessible to India’s diverse population.

Both the investments decisions were announced after the Indian-origin CEO of Google and its parent company and Jassy met Prime Minister Narendra Modi on Friday, in Washington, during the latter’s US tour. The investment announcement was made post the meeting.

Post the meeting, Pichai told reporters, “We shared with the Prime Minister that Google is investing $10 billion in India’s digitisation fund…. We are announcing the opening up of our global fintech operation centre in GIFT city, Gujarat.”

“The PM’s vision for Digital India was way ahead of its time. I now see a blueprint that other countries are looking to do,” he added

During his U.S. visit, Prime Minister Modi met with Elon Musk, signaling potential investments in India’s renewable energy and electric vehicle sectors. With its recent policy reforms opening its space sector to private players, India offers a promising arena for SpaceX’s Starlink satellite internet service.

India has “more promise than any large country in the world,” Musk said following the meeting, adding that he was confident that Tesla will be in India “as soon as humanely possible.”

A Rising Beacon Of Opportunity

India is rapidly transforming into a formidable global superpower and an increasingly attractive destination for investor capital. Amid rising geopolitical tensions and the impact of disruptive technologies, India’s story is a beacon of opportunity in a challenging landscape. Its steadily growing middle class, policy reforms and digital prowess are reshaping its economic trajectory, inviting an influx of foreign capital.

For investors, I believe the time to recognize India’s potential could be now.

Why India Could Be The Next Big Destination For Global Investors

India is rapidly transforming into a formidable global superpower and an increasingly attractive destination for investor capital.

www.google.com

www.google.com