Shotgunner51

RETIRED INTL MOD

- Joined

- Jan 6, 2015

- Messages

- 7,165

- Reaction score

- 48

- Country

- Location

The Global South has not been the center of international spotlight for centuries, be it during the world war times like WWI/WWII, or during peace time when economic development is the main tone of global geopolitics. However these don't rule out the fact that the Global South is home to majority of people on earth, have huge natural resources and growth potential. Other than currently dominant China-West (OECD) trade relation and the grand vision of Eurasian integration, from the events of a series of efforts, apparently China has a clear picture of long-term vision and solid strategy on the Global South. These action plans are being witnessed:

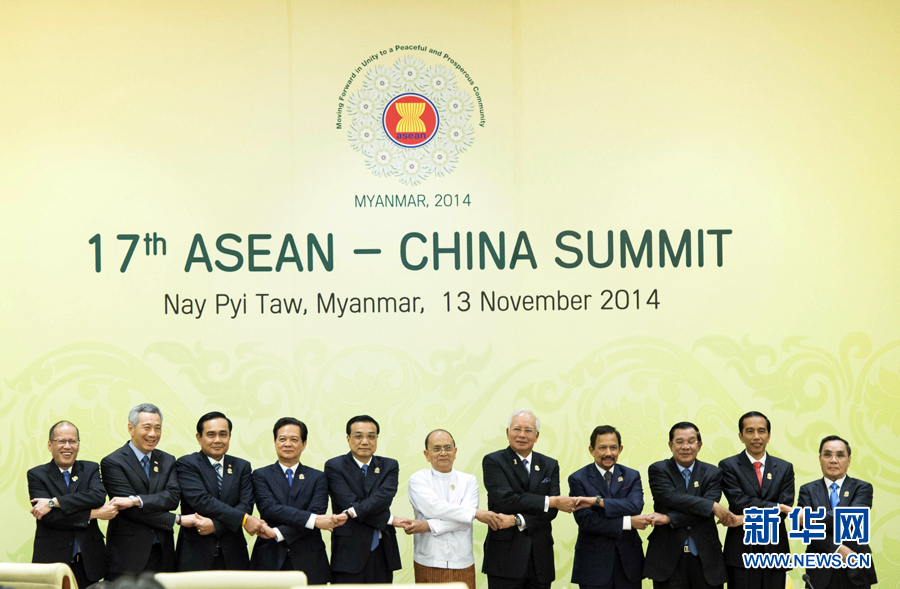

1) ASEAN

Other than the smaller and advanced economy of Singagore, all are nations with huge people/growth potentials in industry, domestic market. Solid actions are taken on 10+1 FTA (ACFTA), 10+3 (JP, SK included, HK likely to join) forum, grand Mekong River development plan, Kunming-Singapore Rail Link, and numerous other sub-regional level or bi-lateral co-operation/initiatives. Despite some minor disruption arises from two bi-lateral territorial disputes, the overall integration progress in deepening fast.

2) Africa

Africa, a land of 30 million sqm, 1.1 billion people and GDP of US$ 2.39 trillion (2013; If Africa is viewed as a country then it's world's 7th largest economy). Given its massive size, rich resources and fast growing GDP, is probably one of the most favorite destination for Chinese trade investment for decades.

Due to its size and diversity, other than venue like China-Africa Forum, a multitude of sub-regional or bi-lateral co-operations are implemented to cater for unique situations in different region (say North which is part of Arabaic World vs Sub-Saharan Africa) and countries (from relatively more advanced SA, Nigeria to less developed Congo, Angola etc.).

Other than economic ties, certain degree of security co-operation is also boosted to reinforce domestic economic development e.g. Sudan, and with states around Horn of Africa to protect maritime trade/commercial interests.

The Next Rising Country for Investment

3) South Asia

Despite relatively low economic base in the region, the growth potential is highly optimistic. Trade and investment co-operations with friendly states in the region has been progressing fast, and initiatives from Silk Road (or Maritime Silk Road) like ports (e.g. Gwadar, Chittagang, Colombo), Pak-China economic corridor, infrastructure/utility building (e.g. electricity) and industrial developments would help integrate the regional economy into the prospering Eurasian economic bloc.

4) Latin America & the Caribbean

Similarly, China is dramatically expanding ties with Latin America in all fields from trade, finance, investments, infrastructure, utility to defense. Another PDF thread for reference:

China's big chess move against the US: Latin America

5) Arabic World

The Arabic World spans from North Africa to West Asia, and it's highly diversified in geopolitics, economy status (so literally speaking not all of it is regarded as Global South) and even culture. Other than venue like China-Arab Forum, China is also deeply engaged in building/expanding economic tie with each individual country based on country-specific situations. In general, China is already one of the largest trading partner of the Arab world, it not the largest, and the such ties are expected to to further deepen.

6) Central-Eastern Europe

Though not literally belongs to Global South, similar to the Arab world, its current status and potential are equally attractive. Traditionally China has deep ties with the Eastern Europe region dated back to the Soviet era. Nowadays the main tone of co-operation become economic development. Trade, infrastructure (ports, rail-link, express-ways etc), investment, finance and industrial alliance are the key areas of co-operation. Similar to the ASEAN 10+1 concept, a 16+1 concept is also breeding in the region, with an objective to boost intra-regional economic integration as well as with boost tie with China.

Currently China's largest trading/investment/tech partners are still the West, namely US, West Europe (Germany is an interesting country to study separately) and East Asia (Japan is also worth studying separately). While China is increasingly betting on a Eurasian integration with Russia and other SCO states, a clear vision as well as well-balanced strategy on the Global South would also be equally important. Ultimately, the Global South is where most people live, where resources are found, and where future growth would be.

The above is a quick and simple summary of it, welcome to add more context, data and analysis on China's vision and strategy on the Global South.

1) ASEAN

Other than the smaller and advanced economy of Singagore, all are nations with huge people/growth potentials in industry, domestic market. Solid actions are taken on 10+1 FTA (ACFTA), 10+3 (JP, SK included, HK likely to join) forum, grand Mekong River development plan, Kunming-Singapore Rail Link, and numerous other sub-regional level or bi-lateral co-operation/initiatives. Despite some minor disruption arises from two bi-lateral territorial disputes, the overall integration progress in deepening fast.

2) Africa

Africa, a land of 30 million sqm, 1.1 billion people and GDP of US$ 2.39 trillion (2013; If Africa is viewed as a country then it's world's 7th largest economy). Given its massive size, rich resources and fast growing GDP, is probably one of the most favorite destination for Chinese trade investment for decades.

Due to its size and diversity, other than venue like China-Africa Forum, a multitude of sub-regional or bi-lateral co-operations are implemented to cater for unique situations in different region (say North which is part of Arabaic World vs Sub-Saharan Africa) and countries (from relatively more advanced SA, Nigeria to less developed Congo, Angola etc.).

Other than economic ties, certain degree of security co-operation is also boosted to reinforce domestic economic development e.g. Sudan, and with states around Horn of Africa to protect maritime trade/commercial interests.

The Next Rising Country for Investment

3) South Asia

Despite relatively low economic base in the region, the growth potential is highly optimistic. Trade and investment co-operations with friendly states in the region has been progressing fast, and initiatives from Silk Road (or Maritime Silk Road) like ports (e.g. Gwadar, Chittagang, Colombo), Pak-China economic corridor, infrastructure/utility building (e.g. electricity) and industrial developments would help integrate the regional economy into the prospering Eurasian economic bloc.

4) Latin America & the Caribbean

Similarly, China is dramatically expanding ties with Latin America in all fields from trade, finance, investments, infrastructure, utility to defense. Another PDF thread for reference:

China's big chess move against the US: Latin America

5) Arabic World

The Arabic World spans from North Africa to West Asia, and it's highly diversified in geopolitics, economy status (so literally speaking not all of it is regarded as Global South) and even culture. Other than venue like China-Arab Forum, China is also deeply engaged in building/expanding economic tie with each individual country based on country-specific situations. In general, China is already one of the largest trading partner of the Arab world, it not the largest, and the such ties are expected to to further deepen.

6) Central-Eastern Europe

Though not literally belongs to Global South, similar to the Arab world, its current status and potential are equally attractive. Traditionally China has deep ties with the Eastern Europe region dated back to the Soviet era. Nowadays the main tone of co-operation become economic development. Trade, infrastructure (ports, rail-link, express-ways etc), investment, finance and industrial alliance are the key areas of co-operation. Similar to the ASEAN 10+1 concept, a 16+1 concept is also breeding in the region, with an objective to boost intra-regional economic integration as well as with boost tie with China.

Currently China's largest trading/investment/tech partners are still the West, namely US, West Europe (Germany is an interesting country to study separately) and East Asia (Japan is also worth studying separately). While China is increasingly betting on a Eurasian integration with Russia and other SCO states, a clear vision as well as well-balanced strategy on the Global South would also be equally important. Ultimately, the Global South is where most people live, where resources are found, and where future growth would be.

The above is a quick and simple summary of it, welcome to add more context, data and analysis on China's vision and strategy on the Global South.

Last edited: