艹艹艹

SENIOR MEMBER

- Joined

- Jul 7, 2016

- Messages

- 5,149

- Reaction score

- 0

- Country

- Location

A new front is opening up in the US-China conflict over chips

Bloomberg

Updated On Nov 21, 2023 at 02:03 PM IST

By Jane Lanhee Lee, Ian King, Mackenzie Hawkins and Jillian Deutsch

President Joe Biden has adopted a two-pronged approach to constrain China’s hightech progress, curbing Beijing’s access to leading-edge chips while bolsteringsemiconductor production in the US.

With advanced packaging rapidly becoming a new front in the global conflict overchips, some argue it’s long overdue.

The administration has until now focused on subsidies to bring back chipmaking tothe US, but “we can’t ignore packaging because you can’t do one without theother,” said Representative Jay Obernolte, a California Republican who is one of twovice-chairs of the Congressional Artificial Intelligence Caucus. “It wouldn’t matter ifwe did 100% of our chip manufacturing onshore if the packaging is still offshore,” headded.

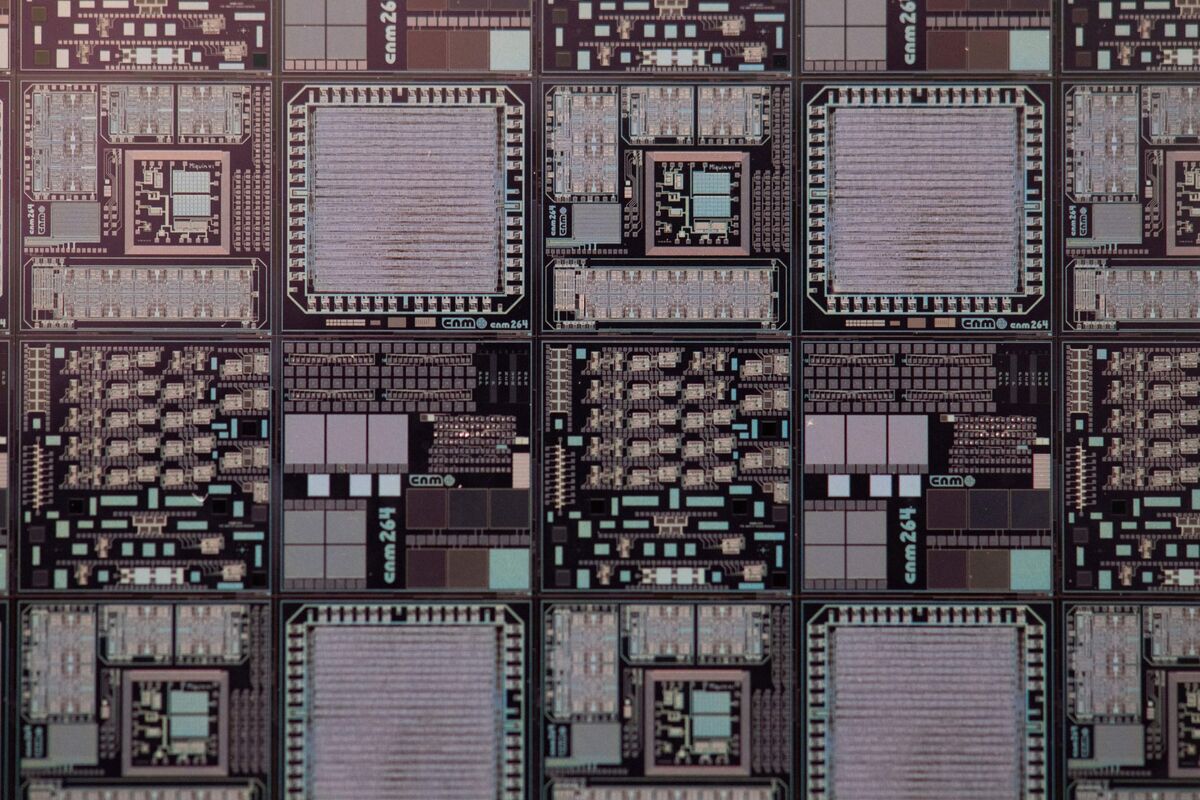

Assembly, testing and packaging – usually considered together as “back-end”manufacturing - was always the least glamorous end of the semiconductor industry,with less innovation and lower added value than the “front end” business of makingchips with features measured in the billionths of a meter. Yet the level ofsophistication is rising fast as new technologies enable chips to be combined, stackedand their performance enhanced in what industry executives are calling an inflectionpoint.

Advanced packaging can’t help China compete with leading-edge semiconductordevelopments from the U.S., but it allows Beijing to build faster, cheaper systems forcomputing by stitching together different chips closely together. In that case Chinacould save its latest chip technology, which is expensive and likely available in limitedvolume, for the most important part of the chip and use older, cheaper technologiesto make chips that carry out other functions like battery management and sensorcontrols, combining the whole in a powerful package.

It's a “pivotal solution,” said Bloomberg Intelligence technology analyst CharlesShum. “It doesn’t merely enhance chip-processing speed but crucially enablesseamless integration of varied chip types.” As a result, he said, it’s “set to reshapethe semiconductor-manufacturing landscape.”

Beijing has long made a strategic priority of semiconductor packaging technologies,including in President Xi Jinping’s Made in China program announced in 2015. Chinahas 38% of the world’s assembly, testing and packaging market, the most of anynation, according to the US-based Semiconductor Industry Association. While it lagsbehind Taiwan and the US in advanced technology, analysts agree that unlike in waferprocessing, it’s in a much better position to be able to catch up.

China already boasts the most back-end facilities by number, including the world’sthird-largest assembly and testing company, JCET Group, which trails only Taiwan’sASE Group and Amkor Technology of the US in revenue. What’s more, Chinesecompanies are building market share, including through JCET’s acquisition of anadvanced facility in Singapore and construction of an advanced packaging plant in itshometown of Jiangyin.

“For China, one way around technology transfer restrictions is advanced packaging,because so far it’s a safe space that everyone invests in,” said Mathieu Duchatel ofthe Institut Montaigne think tank, a Taiwan-based China expert who studies thegeopolitics of technology.

It’s a realization now touching Washington as it seeks to deny Beijing access to thekind of advanced computing technologies that could be put to military use – withquestionable success.

When Huawei Technologies Inc. quietly released its Mate 60 Pro smartphone inSeptember, China hawks in Washington raised questions as to why US export controlshad failed to prevent a development supposedly beyond Beijing’s capabilities.

In testimony to the House Sept. 19, Commerce Secretary Gina Raimondo defendedthe Biden administration’s focus on denying China access to leading-edge chips andthe equipment to make them. But she was primed on advanced packaging. The USneeds to ramp up its own advanced packaging capacities, she said, since “chips canonly get so small, which means all the special sauce is in the packaging.”

One reason for the sudden focus on that special sauce is its necessity to the kind ofhigh-power semiconductors needed for artificial intelligence applications. Indeed, ashortage of a particular type of packaging known as Chip on Wafer on Substrate, orCoWoS, is a key bottleneck in the production of Nvidia Corp’s AI chips.

Taiwan Semiconductor Manufacturing Co., the main chipmaker for Nvidia, thissummer committed $3 billion to a packaging plant to help alleviate the blockage. CEOC.C. Wei told investors on the company’s third-quarter earnings call that thecompany planned to double CoWoS capacity by the end of next year.

While TSMC has been working on the technology for 12 years, it was a nicheapplication that only took off this year, Jun He, Vice President of Advanced PackagingTechnology, told a conference in Taipei in October. “We’re building capacity likecrazy,” said Jun He, adding that “everybody, probably even in Starbucks,” is talkingabout CoWoS.

It’s not just TSMC. Micron Inc. is setting up a $2.75 billion back-end facility in India,while Intel agreed to build a $4.6 billion assembly and test plant in Poland and isputting some $7 billion into advanced packaging in Malaysia. South Korea’s SK Hynixsaid last year that it plans to invest $15 billion in a packaging facility in the US.

Intel has “some very unique technology now in the packaging area,” Chief ExecutiveOfficer Pat Gelsinger said in an interview. “Everybody who’s doing AI chip worktoday is looking to say, wow, this is the way that I can advance my AI chipcapabilities.”

That has some analysts predicting a bonanza for companies in the sphere. Accordingto McKinsey, high-performance chips for data centers, AI accelerators, and consumerelectronics will create the greatest demand for advanced packaging technologies.

The number of chips shipped that use advanced packaging is forecast to increasetenfold in the next 18 months – but that could soar to 100 times if it becomesstandard in smartphones, Jeffries analysts Mark Lipacis and Vedvati Shrotre wrote in aSept. 14 report that classed the technology as part of a “tectonic shift” in theindustry

The reason, alluded to by Raimondo, is that chipmaking is running up against thelimits of physics.

Chips have been getting better over the last fifty years in large part through advancesin production technology. The components now contain up to tens of billions of thetiny transistors that give them the ability to store or process information. But now thatpath of advancement, called Moore’s Law after Intel’s founder, is coming up againstfundamental barriers that are making improvements more difficult and vastlyexpensive to achieve.

Moore’s Law – more of an observation – states that the number of transistors on achip doubles about every two years. As that pace of progress slows, and companies“are not able to deliver twice the transistors, at half the cost, at twice the clockspeed, and at lower power levels every two years, the industry has begun to rely moreon advanced packaging techniques to pick up the slack,” Lipacis and Shrotre wrote.

Instead of cramming ever more tiny components on to one piece of silicon, manydesigners and companies are touting the benefits of a modular approach, of buildingproducts out of several “chiplets” tightly packed together in the same package.

That explains why Dutch specialist BE Semiconductor Industries NV, which makes thetools used for chip packages, has doubled its value to some $9.8 billion in the past 12months, outpacing the Philadelphia Semiconductor Index two-fold despite a slump inthe chip industry in the second half of this year.

That’s still dwarfed by the kind of sums involved in front-end manufacturing – fellowDutch firm ASML NV, which has a near monopoly on the machines needed to produceleading-edge semiconductors, has a market cap approaching $250 billion. Intel’scutting-edge chip fabrication plant in the eastern German city of Magdeburg has aprice tag of $30 billion, or more than four times its Malaysia commitment.

Yet between Magdeburg, a new site in Ireland, and its Polish plant with capacity foradvanced packaging, “Poland could actually be the most important,” Gelsinger said.

Chinese companies are piling into the space, too. They include SemiconductorManufacturing International Corp. – China’s largest chipmaker, which made the 7nanometer chip powering the Mate 60 Pro – along with IP leader VeriSilicon andHuawei, according to Berlin-based researchers Jan-Peter Kleinhans and John Lee.

These companies “see potential in utilizing advanced packaging processes to achieveperformance gains without relying on foreign cutting-edge front-end processes,”Kleinhans and Lee, of the Stiftung Neue Verantwortung think tank and East WestFutures consultancy respectively, wrote in a December report.

The US Commerce Department justifies its decision to focus on front-endmanufacturing on the grounds that sanctioning assembly, test and packaging (APT)services would disrupt supply chains without reducing national security risks. China’sAPT services “now play a critical and indispensable role in the global supply chain,”and “cannot easily be substituted,” Commerce’s National Institute of Standardsand Technology said in September.

The irony is that luring the likes of TSMC and Samsung Electronics Co. to constructcutting-edge chip plants in Arizona and Texas doesn’t ensure self-reliance, since thecurrent lack of capacity means the advanced wafers those plants produce will need tobe shipped to Asia to be packaged – most likely in Taiwan.

For Jack Hergenrother, vice president of IBM Global Enterprise Systems Development,advanced packaging is relatively “overlooked” in funding terms. He wants doublethe allocation to help spur a rise in US packaging capacity to 10-15% of the globaltotal, and ideally to take 25% in a decade, to ensure a secure supply chain. “Having ahub in North America for advanced packaging is super important,” he said.

Bloomberg

Updated On Nov 21, 2023 at 02:03 PM IST

By Jane Lanhee Lee, Ian King, Mackenzie Hawkins and Jillian Deutsch

President Joe Biden has adopted a two-pronged approach to constrain China’s hightech progress, curbing Beijing’s access to leading-edge chips while bolsteringsemiconductor production in the US.

With advanced packaging rapidly becoming a new front in the global conflict overchips, some argue it’s long overdue.

The administration has until now focused on subsidies to bring back chipmaking tothe US, but “we can’t ignore packaging because you can’t do one without theother,” said Representative Jay Obernolte, a California Republican who is one of twovice-chairs of the Congressional Artificial Intelligence Caucus. “It wouldn’t matter ifwe did 100% of our chip manufacturing onshore if the packaging is still offshore,” headded.

Assembly, testing and packaging – usually considered together as “back-end”manufacturing - was always the least glamorous end of the semiconductor industry,with less innovation and lower added value than the “front end” business of makingchips with features measured in the billionths of a meter. Yet the level ofsophistication is rising fast as new technologies enable chips to be combined, stackedand their performance enhanced in what industry executives are calling an inflectionpoint.

Advanced packaging can’t help China compete with leading-edge semiconductordevelopments from the U.S., but it allows Beijing to build faster, cheaper systems forcomputing by stitching together different chips closely together. In that case Chinacould save its latest chip technology, which is expensive and likely available in limitedvolume, for the most important part of the chip and use older, cheaper technologiesto make chips that carry out other functions like battery management and sensorcontrols, combining the whole in a powerful package.

It's a “pivotal solution,” said Bloomberg Intelligence technology analyst CharlesShum. “It doesn’t merely enhance chip-processing speed but crucially enablesseamless integration of varied chip types.” As a result, he said, it’s “set to reshapethe semiconductor-manufacturing landscape.”

Beijing has long made a strategic priority of semiconductor packaging technologies,including in President Xi Jinping’s Made in China program announced in 2015. Chinahas 38% of the world’s assembly, testing and packaging market, the most of anynation, according to the US-based Semiconductor Industry Association. While it lagsbehind Taiwan and the US in advanced technology, analysts agree that unlike in waferprocessing, it’s in a much better position to be able to catch up.

China already boasts the most back-end facilities by number, including the world’sthird-largest assembly and testing company, JCET Group, which trails only Taiwan’sASE Group and Amkor Technology of the US in revenue. What’s more, Chinesecompanies are building market share, including through JCET’s acquisition of anadvanced facility in Singapore and construction of an advanced packaging plant in itshometown of Jiangyin.

“For China, one way around technology transfer restrictions is advanced packaging,because so far it’s a safe space that everyone invests in,” said Mathieu Duchatel ofthe Institut Montaigne think tank, a Taiwan-based China expert who studies thegeopolitics of technology.

It’s a realization now touching Washington as it seeks to deny Beijing access to thekind of advanced computing technologies that could be put to military use – withquestionable success.

When Huawei Technologies Inc. quietly released its Mate 60 Pro smartphone inSeptember, China hawks in Washington raised questions as to why US export controlshad failed to prevent a development supposedly beyond Beijing’s capabilities.

In testimony to the House Sept. 19, Commerce Secretary Gina Raimondo defendedthe Biden administration’s focus on denying China access to leading-edge chips andthe equipment to make them. But she was primed on advanced packaging. The USneeds to ramp up its own advanced packaging capacities, she said, since “chips canonly get so small, which means all the special sauce is in the packaging.”

One reason for the sudden focus on that special sauce is its necessity to the kind ofhigh-power semiconductors needed for artificial intelligence applications. Indeed, ashortage of a particular type of packaging known as Chip on Wafer on Substrate, orCoWoS, is a key bottleneck in the production of Nvidia Corp’s AI chips.

Taiwan Semiconductor Manufacturing Co., the main chipmaker for Nvidia, thissummer committed $3 billion to a packaging plant to help alleviate the blockage. CEOC.C. Wei told investors on the company’s third-quarter earnings call that thecompany planned to double CoWoS capacity by the end of next year.

While TSMC has been working on the technology for 12 years, it was a nicheapplication that only took off this year, Jun He, Vice President of Advanced PackagingTechnology, told a conference in Taipei in October. “We’re building capacity likecrazy,” said Jun He, adding that “everybody, probably even in Starbucks,” is talkingabout CoWoS.

It’s not just TSMC. Micron Inc. is setting up a $2.75 billion back-end facility in India,while Intel agreed to build a $4.6 billion assembly and test plant in Poland and isputting some $7 billion into advanced packaging in Malaysia. South Korea’s SK Hynixsaid last year that it plans to invest $15 billion in a packaging facility in the US.

Intel has “some very unique technology now in the packaging area,” Chief ExecutiveOfficer Pat Gelsinger said in an interview. “Everybody who’s doing AI chip worktoday is looking to say, wow, this is the way that I can advance my AI chipcapabilities.”

That has some analysts predicting a bonanza for companies in the sphere. Accordingto McKinsey, high-performance chips for data centers, AI accelerators, and consumerelectronics will create the greatest demand for advanced packaging technologies.

The number of chips shipped that use advanced packaging is forecast to increasetenfold in the next 18 months – but that could soar to 100 times if it becomesstandard in smartphones, Jeffries analysts Mark Lipacis and Vedvati Shrotre wrote in aSept. 14 report that classed the technology as part of a “tectonic shift” in theindustry

The reason, alluded to by Raimondo, is that chipmaking is running up against thelimits of physics.

Chips have been getting better over the last fifty years in large part through advancesin production technology. The components now contain up to tens of billions of thetiny transistors that give them the ability to store or process information. But now thatpath of advancement, called Moore’s Law after Intel’s founder, is coming up againstfundamental barriers that are making improvements more difficult and vastlyexpensive to achieve.

Moore’s Law – more of an observation – states that the number of transistors on achip doubles about every two years. As that pace of progress slows, and companies“are not able to deliver twice the transistors, at half the cost, at twice the clockspeed, and at lower power levels every two years, the industry has begun to rely moreon advanced packaging techniques to pick up the slack,” Lipacis and Shrotre wrote.

Instead of cramming ever more tiny components on to one piece of silicon, manydesigners and companies are touting the benefits of a modular approach, of buildingproducts out of several “chiplets” tightly packed together in the same package.

That explains why Dutch specialist BE Semiconductor Industries NV, which makes thetools used for chip packages, has doubled its value to some $9.8 billion in the past 12months, outpacing the Philadelphia Semiconductor Index two-fold despite a slump inthe chip industry in the second half of this year.

That’s still dwarfed by the kind of sums involved in front-end manufacturing – fellowDutch firm ASML NV, which has a near monopoly on the machines needed to produceleading-edge semiconductors, has a market cap approaching $250 billion. Intel’scutting-edge chip fabrication plant in the eastern German city of Magdeburg has aprice tag of $30 billion, or more than four times its Malaysia commitment.

Yet between Magdeburg, a new site in Ireland, and its Polish plant with capacity foradvanced packaging, “Poland could actually be the most important,” Gelsinger said.

Chinese companies are piling into the space, too. They include SemiconductorManufacturing International Corp. – China’s largest chipmaker, which made the 7nanometer chip powering the Mate 60 Pro – along with IP leader VeriSilicon andHuawei, according to Berlin-based researchers Jan-Peter Kleinhans and John Lee.

These companies “see potential in utilizing advanced packaging processes to achieveperformance gains without relying on foreign cutting-edge front-end processes,”Kleinhans and Lee, of the Stiftung Neue Verantwortung think tank and East WestFutures consultancy respectively, wrote in a December report.

The US Commerce Department justifies its decision to focus on front-endmanufacturing on the grounds that sanctioning assembly, test and packaging (APT)services would disrupt supply chains without reducing national security risks. China’sAPT services “now play a critical and indispensable role in the global supply chain,”and “cannot easily be substituted,” Commerce’s National Institute of Standardsand Technology said in September.

The irony is that luring the likes of TSMC and Samsung Electronics Co. to constructcutting-edge chip plants in Arizona and Texas doesn’t ensure self-reliance, since thecurrent lack of capacity means the advanced wafers those plants produce will need tobe shipped to Asia to be packaged – most likely in Taiwan.

For Jack Hergenrother, vice president of IBM Global Enterprise Systems Development,advanced packaging is relatively “overlooked” in funding terms. He wants doublethe allocation to help spur a rise in US packaging capacity to 10-15% of the globaltotal, and ideally to take 25% in a decade, to ensure a secure supply chain. “Having ahub in North America for advanced packaging is super important,” he said.