SoulSpokesman

SENIOR MEMBER

- Joined

- Dec 1, 2016

- Messages

- 3,631

- Reaction score

- -15

- Country

- Location

Key takeaways

1.Sterling performance on CAD- while India racks up a deficit of USD 15 billion + p.m. Pak has practically broken even

2. Strong export growth in August inspite of disruptions

3. Overseas Pak reaffirm faith in their nation inspite of reservations over the "Imported" govt

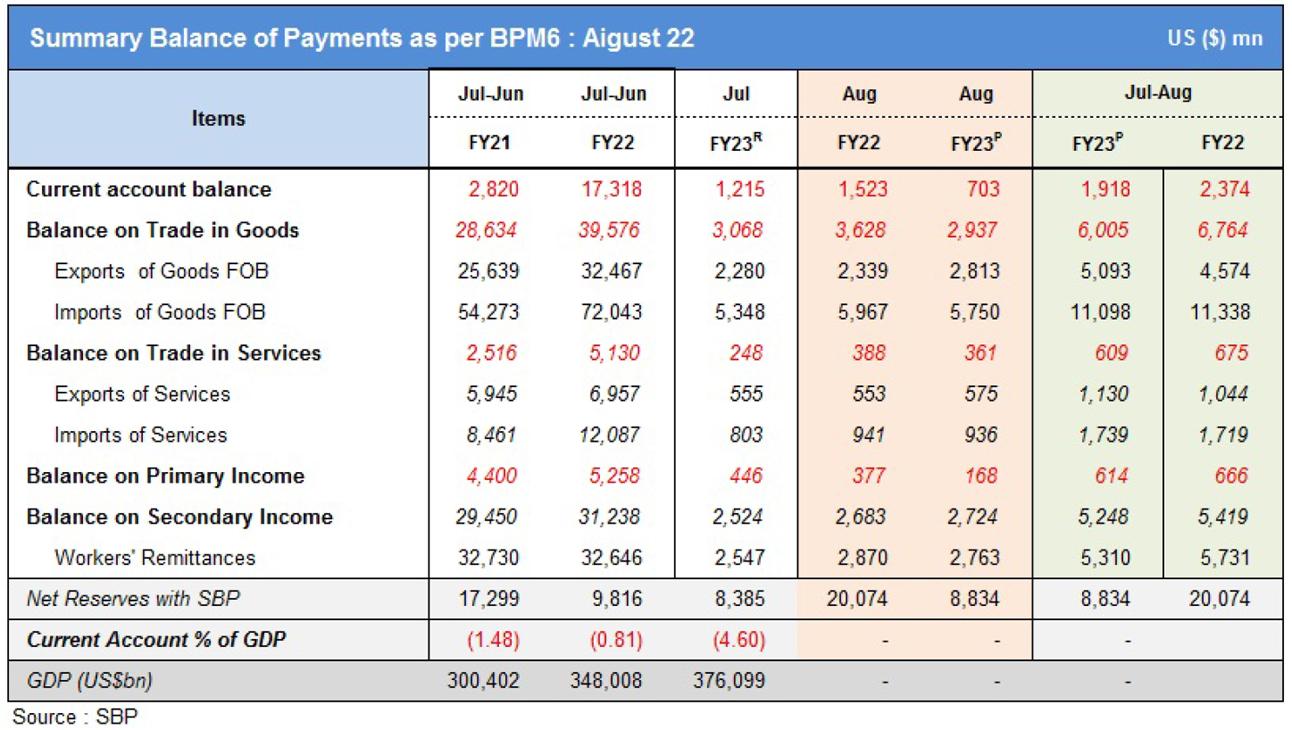

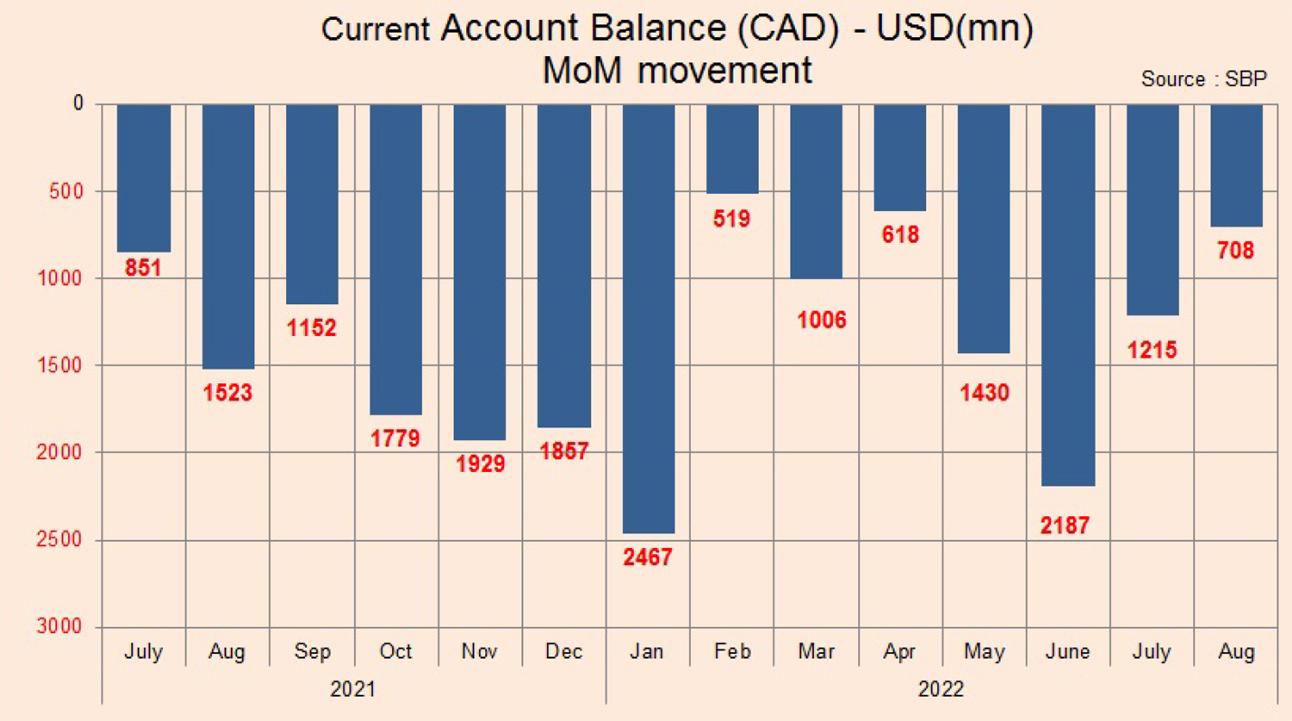

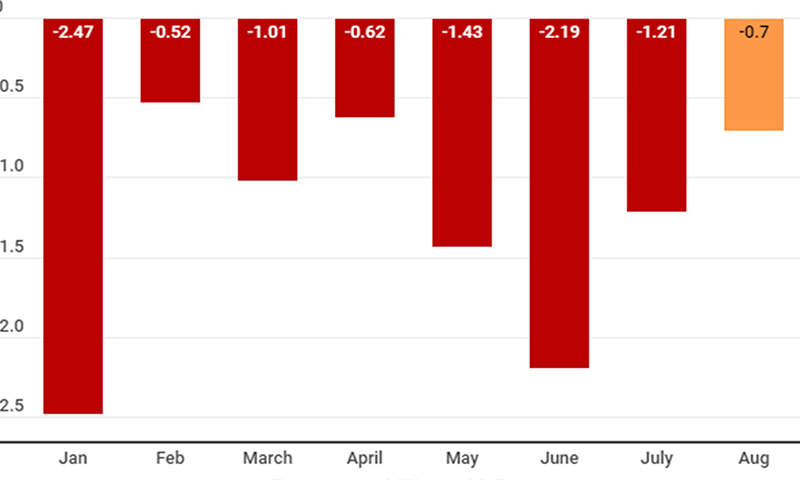

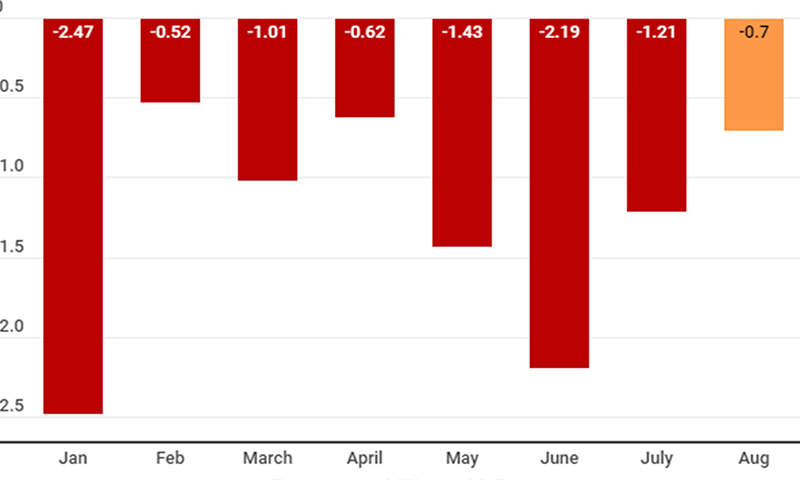

Pakistan’s current account deficit (CAD) fell to $0.7 billion in August, compared to $1.2bn in the previous month, the State Bank of Pakistan (SBP) said late on Wednesday night. This equates to a decline of 41.67 per cent month-on-month.

For the first two months of the current fiscal year, the current account deficit narrowed by $0.5bn to $1.9bn compared to the corresponding period in FY22, the central bank tweeted. This was primarily due to exports increasing by $0.5bn and imports declining by $0.2bn, it added.

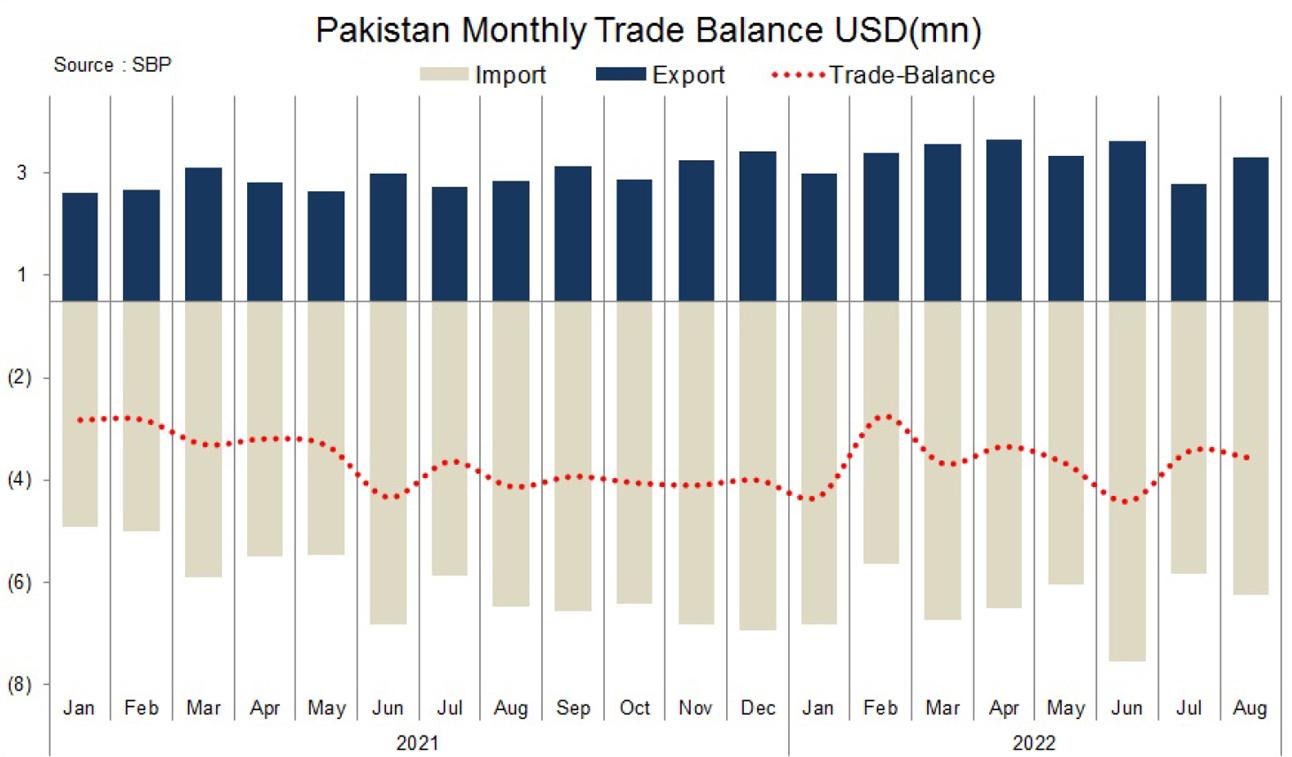

SBP data showed the balance of trade in goods and services also declined by 0.54pc month-on-month to $3.98bn.

During August, imports of goods stood at $5.75bn, compared to $5.35bn in the preceding month. On the other hand, exports increased significantly to $2.81bn, jumping 23.38pc from $2.28bn in July.

Workers’ remittances clocked in at $2.72bn compared to $2.52bn in the previous month.

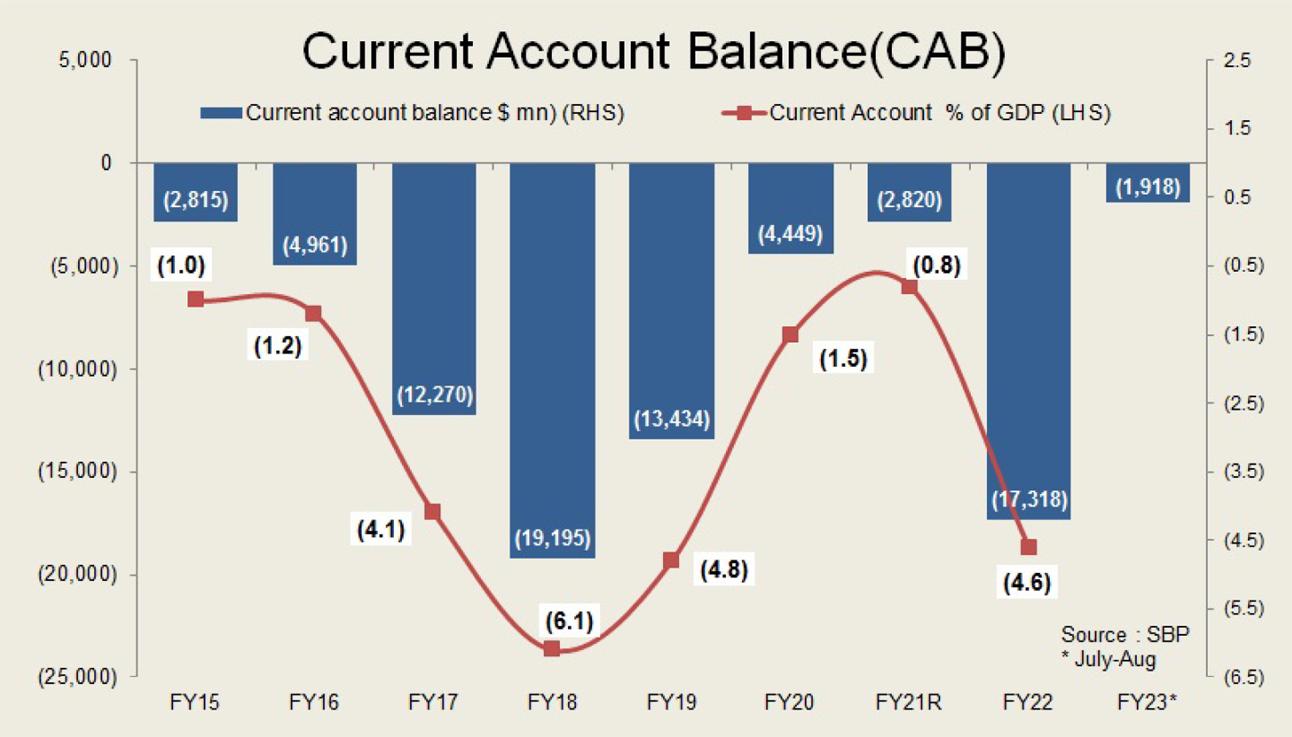

Pakistan posted a massive current account deficit of $17.3bn in the previous fiscal year, or a monthly average of $1.44bn.

The central bank expects CAD to lower to $10bn this year, according to a Mettis Global report.

Regards

1.Sterling performance on CAD- while India racks up a deficit of USD 15 billion + p.m. Pak has practically broken even

2. Strong export growth in August inspite of disruptions

3. Overseas Pak reaffirm faith in their nation inspite of reservations over the "Imported" govt

Current account deficit narrows to $0.7bn

For the first two months of the current fiscal year, the CAD fell by $0.5bn over the year-ago period.

www.dawn.com

Pakistan’s current account deficit (CAD) fell to $0.7 billion in August, compared to $1.2bn in the previous month, the State Bank of Pakistan (SBP) said late on Wednesday night. This equates to a decline of 41.67 per cent month-on-month.

For the first two months of the current fiscal year, the current account deficit narrowed by $0.5bn to $1.9bn compared to the corresponding period in FY22, the central bank tweeted. This was primarily due to exports increasing by $0.5bn and imports declining by $0.2bn, it added.

SBP data showed the balance of trade in goods and services also declined by 0.54pc month-on-month to $3.98bn.

During August, imports of goods stood at $5.75bn, compared to $5.35bn in the preceding month. On the other hand, exports increased significantly to $2.81bn, jumping 23.38pc from $2.28bn in July.

Workers’ remittances clocked in at $2.72bn compared to $2.52bn in the previous month.

Pakistan posted a massive current account deficit of $17.3bn in the previous fiscal year, or a monthly average of $1.44bn.

The central bank expects CAD to lower to $10bn this year, according to a Mettis Global report.

Regards

I wonder why could that be

I wonder why could that be