Nan Yang

SENIOR MEMBER

- Joined

- May 1, 2010

- Messages

- 5,252

- Reaction score

- 1

- Country

- Location

Qualcomm To Lose Up To 60 Million Chipset Orders in 2024 Thanks To Huawei’s Kirin 9000S, Potential Profit Loss In The Billions

Omar Sohail • Sep 6, 2023 01:23 PM EDT

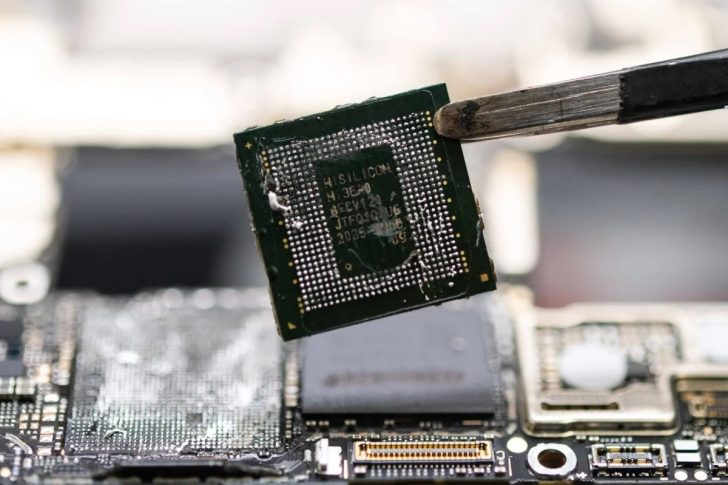

A teardown was performed on the newly launched Huawei Mate 60 Pro 5G, revealing the new Kirin 9000S chipset / Image Credits - Bloomberg

The U.S. sanctions may have forced Huawei into a corner as far as its smartphone business is concerned, but the Chinese firm has remained relentless and managed to circumvent those trade limitations with the Kirin 9000S, its first custom SoC that materialized after a brief hiatus and is found in the newly released Mate 60 Pro 5G.

While it is not the most capable chipset when doing performance and efficiency comparisons, its inception signifies Huawei’s intentions of not relying on the likes of Qualcomm in the future, who is said to potentially lose out on billions due to this new silicon, according to one analyst.

Huawei purchased between 40-42 million chipsets from Qualcomm in 2023, the Kirin 9000S will result in massive financial losses for the SoC maker

Despite the trade sanctions placed on Huawei, it was still one of Qualcomm’s biggest customers, purchasing between 23-25 million units in 2022 and 40-42 million units in 2023. With the Chinese firm said to completely adopt Kirin chipsets in 2024, at least according to analyst Ming-Chi Kuo, it means Qualcomm is set to ship around 50-60 million units less next year, putting a significant dent in its revenue stream for the entire 2024.Let us get into our estimations, and assuming that each one of those shipments is a Snapdragon 8 Gen 3, and the cost per SoC is $180, Qualcomm may lose $10.8 billion in revenue next year. It is unclear if Huawei intends to offer the Kirin 9000S to more Chinese brands next year, but if it does, it will likely be at a lower cost than Qualcomm’s own offerings.

To combat those dwindling chipset sales, Kuo reports that Qualcomm will likely start a price war as early as Q4 2023 to maintain a strong market share in the region, but that will come at the expense of its annual profits. Another danger lurking around the corner is Samsung’s upcoming Exynos 2400, which is said to be found in a few markets where the Galaxy S24 lineup will be sold.

If things were not bad enough, Kuo also notes that Apple is said to introduce its 5G modem in 2025, so Qualcomm may witness a decline in baseband chip sales two years from now. In any case, the San Diego company will have to make certain decisions in a few months or risk suffering continuous losses every quarter in the near future.

News Source: Ming-Chi Kuo