notorious_eagle

PDF THINK TANK: CONSULTANT

- Joined

- Dec 25, 2008

- Messages

- 4,666

- Reaction score

- 34

- Country

- Location

ISLAMABAD:

The energy sector’s circular debt surged sharply to Rs370 billion in the wake of the expiry of International Monetary Fund programme, after a parliamentary body probing wrongdoings in Rs480 billion debt payments of 2013 decided to expand the scope of its inquiry.

As of the end of January this year, the flow of circular debt amounted to roughly Rs370 billion –a net addition of Rs50 billion over the past seven months, sources in the ministries of water and power and finance told The Express Tribune.

For the first time in the country’s history, the total flow and stock of circular debt cumulatively grew to a whopping Rs705 billion, including the Rs335 billion parked by the government in the Power Holding Company Limited (PHCL).

The finance ministry slowed down payments of subsidies and other financial obligations following the expiry of the IMF programme, said the sources. The programme expired in September last year.

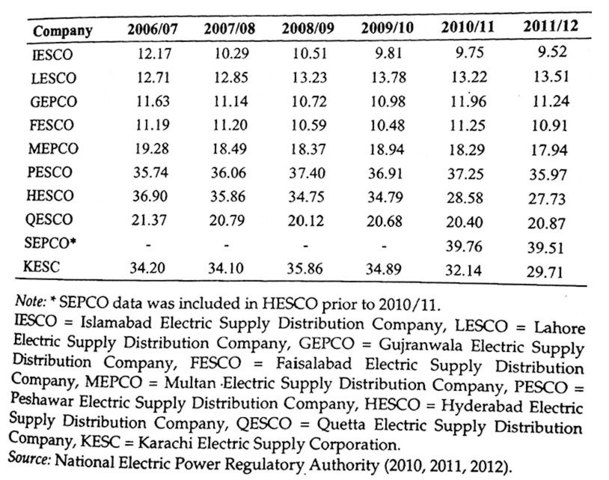

Another reason was persistently high transmission and distribution losses and relatively low electricity bill recoveries.

The government also breached its commitment that it gave to the IMF to retire the circular debt that it parked in PHCL by selling stakes in power distribution companies (DISCOs). After three profitable distribution companies, Mepco, Iesco and Fesco, reported losses, these DISCOs could no longer be listed on the Pakistan Stock Exchange (PSX).

Meanwhile, the Senate’s sub-committee on finance, investigating Rs480 billion circular debt payments by the PML-N government in 2013, decided to broaden the scope of its inquiry.

Headed by Senator Mohsin Aziz of the Pakistan Tehreek-e-Insaf, the panel decided to focus on a report compiled by the Auditor-General of Pakistan (AGP) on the clearance of circular debt.

The report showed that the PML-N government had failed to adequately verify all claims before retiring the circular debt and made ‘avoidable payments’ amounting to Rs165 billion to power producers.

Audit objections belied the incumbent government’s claim that its current tenure was not marred by any major scandal.

According to the AGP report, the PML-N government cleared the entire circular debt on June 28, 2013 without performing a mandatory pre-audit function.

According to the report, the finance ministry disregarded a pre-agreed release mechanism, bypassing the Accountant-General of Pakistan Revenue (AGPR) and directing the State Bank of Pakistan (SBP) to release the money.

On Wednesday, a finance ministry official insisted that the pre-audit mechanism was bypassed because of an emergency, saying that pre-audit was a “time consuming exercise”.

The sub-committee did not agree with this assertion.

An AGPR official informed the subcommittee that it took between one and three days to perform the pre-audit function.

Fresh disclosures made in a meeting of the sub-committee showed that Independent Power Producers (IPPs) did not fulfill all their commitments that they had made to the government despite receiving full payment. They failed to convert 1,500 megawatts of their generation capacity to coal: under a 2013 deal, they were bound to do so in two years.

The IPPs took the government to the International Court of Arbitration after the government withheld payments amounting to Rs22.9 billion on account of liquidated damages, said Joint Secretary at the Ministry of Water and Power Zargham Eshaq Khan.

These damages had been imposed on the IPPs for not generating electricity despite receiving fuel and demand from the government.

The AGP report also stated that the payment of Rs342 billion to the Pakistan Electric Power Company (Pepco) was irregular. Pepco subsequently made payments to the IPPs.

The sub-committee asked the AGP to attend its next meeting for defending the departmental report.

Furthermore, the government paid Rs31.7 billion in ‘late payment charges’, which auditors said was avoidable. The auditors also objected to non-cash adjustment of Rs25.1 billion, terming it “unjustifiable”.

The IPPs were further favoured when the government made another “unjustified payment” amounting to Rs18.5 billion on account of General Sales Tax. Inland Revenue member Rehmatullah Wazir informed the sub-committee that the government had not consulted the FBR before making the GST-related payment.

This showed that the government made all payments to the IPPs without verification from departments concerned, said Senator Kamil Ali Agha, a member of the subcommittee.

The AGP report also cited an objection over excess payments to IPPs by applying maximum currency exchange rate.

The water and power ministry said that this objection was valid and the government had started recovering the amount.

Published in The Express Tribune, February 9th, 2017.

Good governance of PML-N. Corruption has reached unprecedented levels. If there is no halt to corruption, we might as we be heading for an economic collapse.

The energy sector’s circular debt surged sharply to Rs370 billion in the wake of the expiry of International Monetary Fund programme, after a parliamentary body probing wrongdoings in Rs480 billion debt payments of 2013 decided to expand the scope of its inquiry.

As of the end of January this year, the flow of circular debt amounted to roughly Rs370 billion –a net addition of Rs50 billion over the past seven months, sources in the ministries of water and power and finance told The Express Tribune.

For the first time in the country’s history, the total flow and stock of circular debt cumulatively grew to a whopping Rs705 billion, including the Rs335 billion parked by the government in the Power Holding Company Limited (PHCL).

The finance ministry slowed down payments of subsidies and other financial obligations following the expiry of the IMF programme, said the sources. The programme expired in September last year.

Another reason was persistently high transmission and distribution losses and relatively low electricity bill recoveries.

The government also breached its commitment that it gave to the IMF to retire the circular debt that it parked in PHCL by selling stakes in power distribution companies (DISCOs). After three profitable distribution companies, Mepco, Iesco and Fesco, reported losses, these DISCOs could no longer be listed on the Pakistan Stock Exchange (PSX).

Meanwhile, the Senate’s sub-committee on finance, investigating Rs480 billion circular debt payments by the PML-N government in 2013, decided to broaden the scope of its inquiry.

Headed by Senator Mohsin Aziz of the Pakistan Tehreek-e-Insaf, the panel decided to focus on a report compiled by the Auditor-General of Pakistan (AGP) on the clearance of circular debt.

The report showed that the PML-N government had failed to adequately verify all claims before retiring the circular debt and made ‘avoidable payments’ amounting to Rs165 billion to power producers.

Audit objections belied the incumbent government’s claim that its current tenure was not marred by any major scandal.

According to the AGP report, the PML-N government cleared the entire circular debt on June 28, 2013 without performing a mandatory pre-audit function.

According to the report, the finance ministry disregarded a pre-agreed release mechanism, bypassing the Accountant-General of Pakistan Revenue (AGPR) and directing the State Bank of Pakistan (SBP) to release the money.

On Wednesday, a finance ministry official insisted that the pre-audit mechanism was bypassed because of an emergency, saying that pre-audit was a “time consuming exercise”.

The sub-committee did not agree with this assertion.

An AGPR official informed the subcommittee that it took between one and three days to perform the pre-audit function.

Fresh disclosures made in a meeting of the sub-committee showed that Independent Power Producers (IPPs) did not fulfill all their commitments that they had made to the government despite receiving full payment. They failed to convert 1,500 megawatts of their generation capacity to coal: under a 2013 deal, they were bound to do so in two years.

The IPPs took the government to the International Court of Arbitration after the government withheld payments amounting to Rs22.9 billion on account of liquidated damages, said Joint Secretary at the Ministry of Water and Power Zargham Eshaq Khan.

These damages had been imposed on the IPPs for not generating electricity despite receiving fuel and demand from the government.

The AGP report also stated that the payment of Rs342 billion to the Pakistan Electric Power Company (Pepco) was irregular. Pepco subsequently made payments to the IPPs.

The sub-committee asked the AGP to attend its next meeting for defending the departmental report.

Furthermore, the government paid Rs31.7 billion in ‘late payment charges’, which auditors said was avoidable. The auditors also objected to non-cash adjustment of Rs25.1 billion, terming it “unjustifiable”.

The IPPs were further favoured when the government made another “unjustified payment” amounting to Rs18.5 billion on account of General Sales Tax. Inland Revenue member Rehmatullah Wazir informed the sub-committee that the government had not consulted the FBR before making the GST-related payment.

This showed that the government made all payments to the IPPs without verification from departments concerned, said Senator Kamil Ali Agha, a member of the subcommittee.

The AGP report also cited an objection over excess payments to IPPs by applying maximum currency exchange rate.

The water and power ministry said that this objection was valid and the government had started recovering the amount.

Published in The Express Tribune, February 9th, 2017.

Good governance of PML-N. Corruption has reached unprecedented levels. If there is no halt to corruption, we might as we be heading for an economic collapse.