August 26, 2013

The Political Economy of Pakistan's National Energy Policy

By Asif Faiz

As Pakistan's government was preparing to present the National Energy Policy 2013-18 to the Council of Common Interest (CCI), the Peshawar Electric Supply Company (PESCO) was placing advertisements in major newspapers in KP during the holy month of Ramadan, exhorting the faithful that stealing electricity is a sin. Seeking divine help may now be the only way to stop electricity theft—a major obstacle in stemming power load shedding that results in blackouts up to twenty hours a day in most parts of the country.

Ultimately, the power and energy crisis in Pakistan is a problem of political economy. Good policies as articulated by the new government will no doubt help, but resolving this crisis will require a national consensus on how to address the myriad vested interests that profit from the chaos and disorder in the power and energy sectors.

Take for example the circular debt (see box below); which appears to be a convenient scam for channeling massive public subsidies to a variety of political, commercial, and industrial interests for producing high cost power; using guaranteed supply of fuel oil to public electricity generation companies (GENCOs) and independent power producers (IPPs); for not producing any power at all (under various power rental schemes); and for underwriting outright theft and cheating at all levels, small and large—the 'kunda' artists, the meter readers, public sector institutions, commercial and industrial enterprises of all sizes, and owners of upscale air conditioned residences, to name a few. The circular debt may have also served as a clever device for the Ministry of Finance to mask the real size of the country's fiscal deficit since 2009. In the face of a failing power supply, it becomes expedient to restore underutilized generation capacity by shelling out billions of dollars of public monies to IPPs and a variety of energy suppliers (at last count some US $5 billion since the advent of the new government, and more in the offing) to pay off the circular debt. This payout will buy the new government time to deflect public wrath, but it may simply set the stage for a new round of circular debt.

Explaining the Circular Debt

Circular debt is the amount of cash shortfall within Pakistan's Central Power Purchasing Agency (CPPA) that it cannot pay to power supply companies. This shortfall is the result of:

•the difference between the actual cost of providing electricity in relation to revenues realized by the power distribution companies (DISCOs) from sales to customers plus subsidies; and

•insufficient payments by the DISCOs to CPPA out of realized revenue as they give priority to their own cash flow needs.

This revenue shortfall cascades through the entire energy supply chain, from electricity generators to fuel suppliers, refiners, and producers; resulting in a shortage of fuel supply to the public sector thermal generating companies (GENCOs), a reduction in power generated by Independent Power Producers (IPPs), and an increases in load shedding.

Circular debt at the end of Fiscal Year (FY) 2011 was estimated to be Rs537 billion (about US $5billion). By the end of FY 2012, it was predicted to have grown to Rs872 billion (about US $8.7 billion), representing approximately 4 percent of the national nominal Gross Domestic Product (GDP).

There are two main contributors to the circular debt:

•Non-collection of revenues (including theft and losses) from a range of public and private consumers (main contributor until 2009).

•Tariff and subsidy issues(main contributor since 2009), in particular the Tariff Differential Subsidy (TDS), the largest contributor accounting for nearly a third of the circular debt.

TDS is the difference between the uniform electricity tariff (generally the minimum rate for each category of customer requested by any of the nine DISCOs) applied countrywide and the individual electricity tariffs determined by NEPRA, based on the revenue requirement of each DISCO to meet all costs and to earn a suitable profit. Ultimately each DISCO must receive the revenue, as allowed by NEPRA, either from the customers or through a state subsidy. For political expediency, the government has elected the subsidy (TDS) route instead of charging the users. But the Ministry of Finance has not provided the required TDS in a timely manner, either compelling the DISCOs to borrow from commercial banks or to default on payables to CPPA. Moreover, a national tariff regime based on a weighted average of the tariffs determined by NEPRA for each DISCO would have significantly reduced the size of TDS.

Source: The Causes and Impacts of Power Sector Circular Debt in Pakistan, USAID and Planning Commission of Pakistan, March 2013

In the short run, the Government does not have much space to maneuver. The new energy policy comprises mostly actions with a medium to long term impact. In the near term, short of borrowing massively to pay for subsidies and losses, the Government has few options but to raise tariffs and undertake a massive crackdown on theft and corruption. Tariff increases may help in curbing fiscal imbalances in the short-run, but tariff increases that simply pass the cost of inefficient and unreliable production and blatant theft to the general consumer will invite a public backlash and in any case will not yield the anticipated revenues. Resourceful consumers and conniving operators will find ways to thwart such tariff increases. On the other hand, a massive drive to curb corruption and theft at all levels will garner widespread public support, especially if it is matched with gradual and calibrated improvements in service delivery. Reduced losses would allow power utilities to sell more power, hence the possibility of lower tariffs while generating the same level of revenues. Anti-corruption measures also need to include transparent public procurement of good and services by state-owned energy entities, including oil purchases and delivery.

The National Energy Policy (NEP) articulated by the new government is a visionary document which for the first time pulls together the various strands of energy policy into a comprehensive blueprint for power and energy development, based on sound technical, financial, and regulatory principles. NEP covers all the bases but policy implementation requires an action plan that has time-bound actions and targets. Otherwise the government's claim that it will overcome power shortages within three to five years would remain a wishful endeavor. Moreover, NEP focuses mainly on supply side measures to increase generating capacity. This is understandable —demand side measures carry a heavy political cost, as these would alienate so many powerful constituencies, within and outside the government.

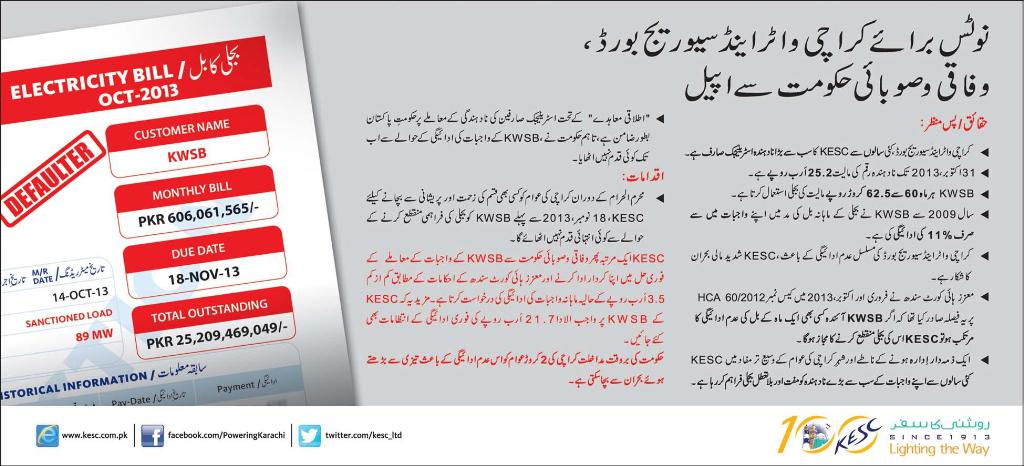

NEP foresees a lead role for the private sector in improving the power and energy futures. In the critical power distribution area, privatization of the Karachi Electric Supply Company (KESC) variety will help but this is only a partial solution. Most electricity distribution companies (DISCOs) are loss making public entities, heavily indebted and unionized, and dens of graft and corruption. The worst performing are PESCO, Tribal Areas Electric Supply Company (TESCO), and the distribution companies serving Hyderabad, Sukkur and Quetta (HESCO, SEPCO and QESCO, respectively), accounting for 73 percent of the Rs197 billion ( about US $2 billion) receivables from private consumers at the end of FY 2012. Who will invest in these?

Try obtaining an electricity connection for new house construction and it becomes clear how systemic and organized the corruption is. Without a bribe, there is a waiting time ranging from a few months to a couple of years. The time is shortened to a few days by paying a bribe--the payment is a fixed amount that is paid directly to a DISCO employee or through an agent, generally the contractor building the house. For a monthly payment of Rs1000 (US $10) ,a consumer can pay a DISCO technician to slow down electricity meters, to bypass meters with concealed lengths of wire, or apply a variety of gimmicks to under record or not record at all the electricity that is being consumed.

In the Federally Administered Tribal Areas (FATA) free electricity is considered a birth right, (apparently promised by various governments to retain the loyalty of tribal elders or to permit development works to take place such as the construction of Pakistan's first hydroelectric dam at Warsak in former NWFP in the 1950s), and in Pakistan-administered Kashmir (AJK), rural communities are provided electricity at a nominal unmetered monthly charge. Rural AJK households use electric stoves for space heating, boiling water, and cooking, with the electric stoves running round the clock in winter months.Subsidies to FATA and AJK are significant contributors to the circular debt. There is little accountability for energy use across the country while poorly targeted and undifferentiated subsidies multiply.

According to NEP, Pakistan has a broken power distribution system; this is where the major losses, both technical and commercial, occur. With a 50 percent reduction in losses, coupled with conservation measures such as energy efficient bulbs and electric appliances (especially air conditioners), the need for new generating capacity could be reduced by at least 20-30 percent. Modern solid state electricity meters with smart cards (not dissimilar to the SIM cards used in cell phones) can eliminate the need for conventional electro-mechanical meters and meter readers. In South Africa, Sudan and Northern Ireland prepaid meters are recharged by entering a unique, encoded twenty digit number using a keypad. This makes the tokens, essentially a slip of paper, very cheap to produce. Smartcards also allow two way data exchange between meter and the utility. Tinker with the device and power shuts off automatically and the power utility knows instantly where the tinkering is taking place. The NEP recommends the use of prepaid meters for consumers who default on paying their bills. But why cannot this robust smart metering technology is used in Pakistan to do away with the menace of the meter reader? The answer perhaps lies in the vested interests that manufacture and supply conventional meters.

It is interesting that energy security garners little mention in the NEP. Pakistan is becoming precariously reliant on foreign sources of energy (oil from Middle East, gas from Gulf states and Iran, nuclear energy from China, electricity from India, and coal from further afield). This, when Pakistan, according to US EIA ranks among the top 10 countries in the world with technically recoverable shale oil deposits, equal to those of Canada-- an estimated 9.1 billion barrels of oil compared to current annual production of about 23 million barrels of conventional crude; along with a probable (unproven) 105 trillion cubic feet of shale gas compared to current annual domestic production of about 1 trillion cubic feet of natural gas and 24 trillion cubic feet of proven gas deposits. Moreover, the country has vast reserves of coal. Why is it that the energy sector policy of the country does not focus on policies and incentives to develop domestic energy resources? Shale oil is the new frontier that will once again make US the largest producer of oil in the world. Why cannot Pakistan begin investigating its shale oil resources while expanding the prospecting and exploration for gas on a war footing?

Likewise, why is it that the government does not forcefully implement the Water and Power Development Authority's (WAPDA) master plan for hydropower development (also well-articulated in NEP), similar to what India has done in relation to its hydropower potential, and remains mired in a fruitless chase of donors to fund Daimer Bhasha Dam? Here again, the NEP offers attractive alternatives like the proposed Indus cascade dams scheme, which includes a string of hydropower investments including the Tarbela Tunnels (work has started on Tunnel #4 and needs to be extended to #5), Dasu (which some donors are willing to fund without much hesitation as it does not involve significant resettlement), Pattan and Thakotbesides Bhasha, along with numerous smaller dams on Jhelum and the Western tributaries of Indus. The potential is huge; ultimately, an installed hydropower capacity of 22,000 MW within the Indus Cascade and a strong possibility of realizing some 10,000 MW of new generating capacity within the next 10-15 years, shifting the power mix in favor of renewable and cheap hydropower, the way it was before the misguided leap to thermal generation started in the 1990s .

And there is need to fundamentally rethink the structure of the powersector. Privatization of DISCOs is a good starting point. But along with privatization or subsidized concessions for non-profitable DISCOs, the time has come to make power distribution a provincial/city government responsibility. Why should the federal government subsidize waste and corruption that takes place at provincial/local levels?The federal role should be confined to generation and

transmission as is the case in India, China and most federal countries.

The power sector reforms pushed by the IFIs (World Bank and ADB, in particular) remain incomplete. It seems that the Government was never serious about these reforms. Instead of unbundling the sector and creating a level playing period through fair regulation and incentivizing the private sector, what resulted was a weak regulator and a centralized bureaucracy centered on Pakistan Electric Power Company (PEPCO) and several public sector entities. The cost of waste, inefficiency and corruption was simply converted into the circular debt and later ever rising tariffs, while system performance and reliability took a nose dive. So what was wrong then with WAPD, as a vertically integrated utility that it had to be replaced by an unaccountable, monstrous bureaucracy? The country did not have the horrendous power mess it has today when WAPDA was in charge of the sector.

The NEP fortunately has given considerable thought to the institutional arrangements in the power sector. A future institutional set-up might include provincially regulated distribution companies that operate at provincial/local levels, a much strengthened and independent federal regulator, an autonomous public transmission company, and a large range of power producers both public and private at national, provincial and local levels, that can produce and sell power competitively to DISCOS and large independent consumers, such as industrial and agricultural units, housing estates, electricity cooperatives for farmers and rural consumers, etc. There is, however, a need to review all IPP contracts to ensure an equitable distribution of risk between the public and private sectors and to renegotiate or adjust poorly designed Government guarantees. Desperate conditions often require desperate remedies and no contract is so sacrosanct that it cannot be renegotiated.

The real irony is that Pakistan has made great strides in making electric power accessible to its population, by some estimates; about 80 percent has access to electricity, arguably among the highest access levels in South Asia. But there is no electric power to serve the connected! Load shedding is at a scale and magnitude only seen in economically collapsed states. But the steady expansion of power connections in rural areas and new housing colonies shows that incentives work in Pakistan (in this instance the lure of political patronage and graft) but seldom are they focused on productive and legitimate endeavors. Public interest unfortunately remains subservient to political expediency and private gain.

Asif Faiz is an infrastructure specialist. He was sector manager of World Bank's infrastructure programs in Latin America from 1992-2000 and operations adviser in the World Bank's Islamabad Office from 2010-2012.