Hamartia Antidote

ELITE MEMBER

- Joined

- Nov 17, 2013

- Messages

- 35,188

- Reaction score

- 30

- Country

- Location

Here's every electric vehicle that currently qualifies for the US federal tax credit

As sales of electric vehicles continue to surge, many new and prospective customers have questions about qualifying for federal tax...

electrek.co

electrek.co

New Federal Tax Credits in the Inflation Reduction Act

- Federal tax credit for EVs will remain at $7,500

- Timeline to qualify is extended a decade from January 2023 to December 2032

- Tax credit cap for automakers after they hit 200,000 EVs sold is eliminated, making GM, Tesla, and Toyota once again eligible

- The language in the bill indicates that the tax credit could be implemented at the point of sale instead of on taxes at the end of the fiscal year

- That means you can get your credit up front at the dealer, but these terms may not kick in until 2024

- In order to get the full tax credit, the EV must be assembles in North America and…

- Two binary pieces separate the full $7,500 credit meaning the vehicle either qualifies for each piece of the credit or it doesn’t

- $3,750 of the new credit is based upon the vehicle having at least 40% of its battery critical minerals from the United States or countries with a free trade agreement with the United States. This is a list of countries with free trade agreements with the US.

- The other $3,750 of the new credit is based on at least 50% of the battery components of the vehicle coming from the United States or countries with a free trade agreement with the US

- Note – these battery requirements are not being enforced until April 18, m2023 onward. More below.

- The 40% minerals requirement increases to 50% in 2024, 60% in 2025, 70% in 2026 and 80% in 2027

- The 50% battery components requirement increases to 60% in 2024, 70% in 2026, 80% in 2027, 90% in 2028 and 100% in 2029

- Beginning in 2025, any vehicle with battery minerals or components from a foreign entity of concern are excluded from the tax credit

- Qualifying EVs must also have a battery size of at least 7 kWh and a gross vehicle weight rating less than 14,000 pounds

- New federal tax credit of $4,000 for used EVs priced below $25k

- Subject to other requirements like lower annual income (see below)

- Revised credit applies to battery electric vehicles with an MSRP below $55,000

- Also includes zero-emission vans, SUVs, and trucks with MSRPs up to $80,000

- New credit also expands to commercial fleet customers

- Includes separate qualifications and limits

- The federal EV tax credit will be available to individuals reporting adjusted gross incomes of $150,000 or less, $225,000 for heads of households, or $300,000 for joint filers

- The new credit will also continue to apply to Plug-in Hybrid EVs (PHEVs) as long as they meet the same requirements outlined above

All-electric vehicles

| Make and Model | MSRP Limit | Full Tax Credit |

| CADILLAC (GM) | ||

| Lyriq (2022-2023) | $80,000 | $,7500 |

| CHEVROLET (GM) | ||

| Bolt EUV (2022-2023) | $55,000 | $7,500 |

| Bolt EV (2022-2023) | $55,000 | $7,500 |

| Silverado EV (2024) | $80,000 | $7,500 |

| FORD | ||

| F-150 Lightning (2022-2023) | $80,000 | $7,500 |

| Mustang Mach-E (2022-2023) | $80,000 | $7,500 |

| E-Transit (2022-2023) | $80,000 | $7,500 |

| GENESIS | ||

| GV70 Electrified (2024) | $80,000 | $7,500 |

| NISSAN | ||

| LEAF SV, S Plus, SL Plus (2021-2022) | $55,000 | $7,500 |

| LEAF S / SV Plus (2021-2023) | $55,000 | $7,500 |

| RIVIAN | ||

| R1T (2022-2023) | $80,000 | $7,500 |

| R1S (2022-2023) | $80,000 | $7,500 |

| TESLA | ||

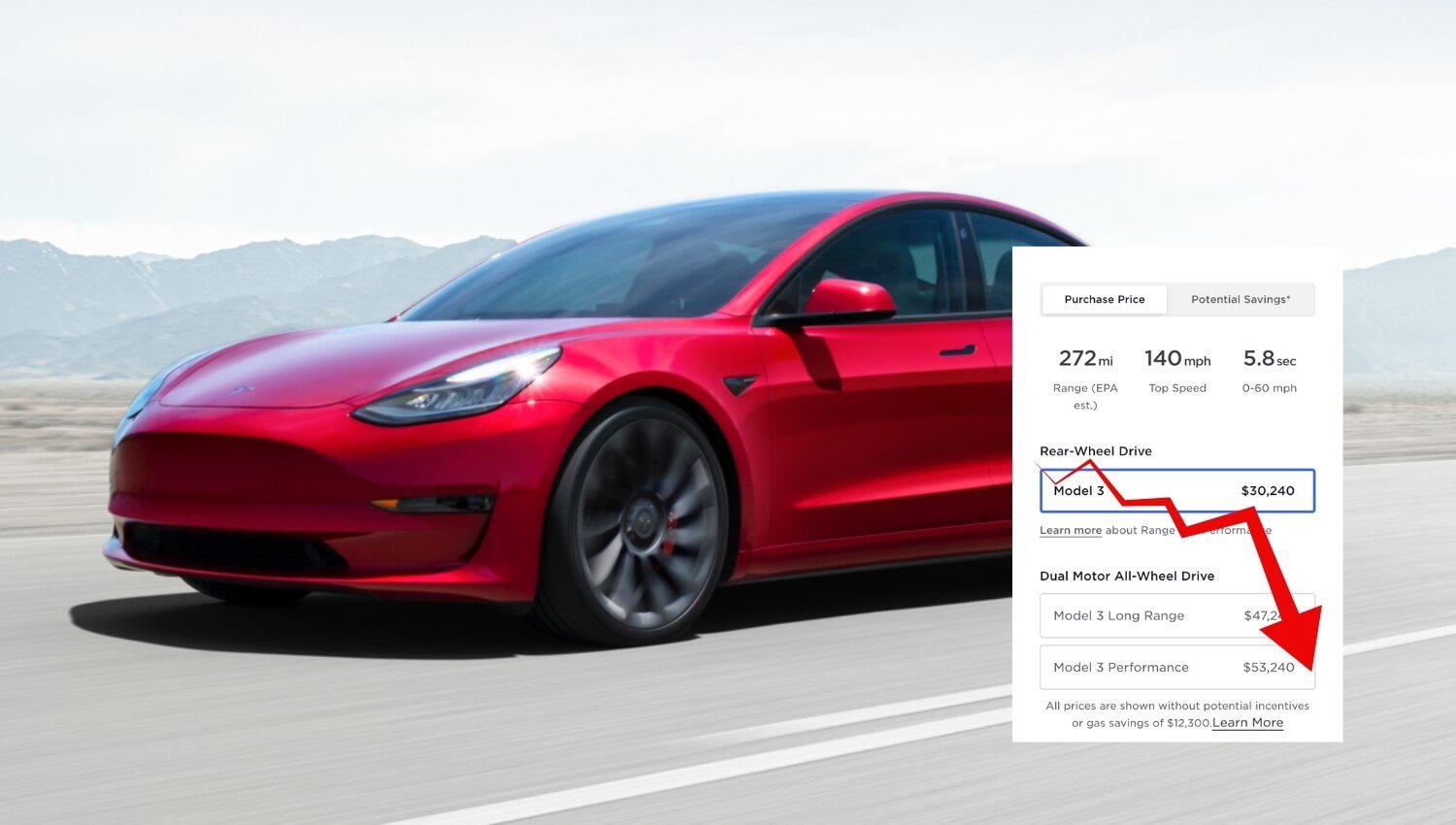

| Model 3 RWD/Long Range/Performance (2022-2023) | $55,000 | $7,500 |

| Model Y AWD/Long Range/Performance (2022- 2023) | $80,000 | $7,500 |

| VOLKSWAGEN | ||

| ID.4 / ID.4 S (2023) | $80,000 | $7,500 |

| ID.4 Pro/Pro S (2023) | $80,000 | $7,500 |

| ID.4 AWD Pro/AWD Pro S (2023) | $80,000 | $7,500 |

Last edited: