Semiconductors: Can India become a global chip powerhouse?

Share

IMAGE SOURCE,GETTY IMAGES

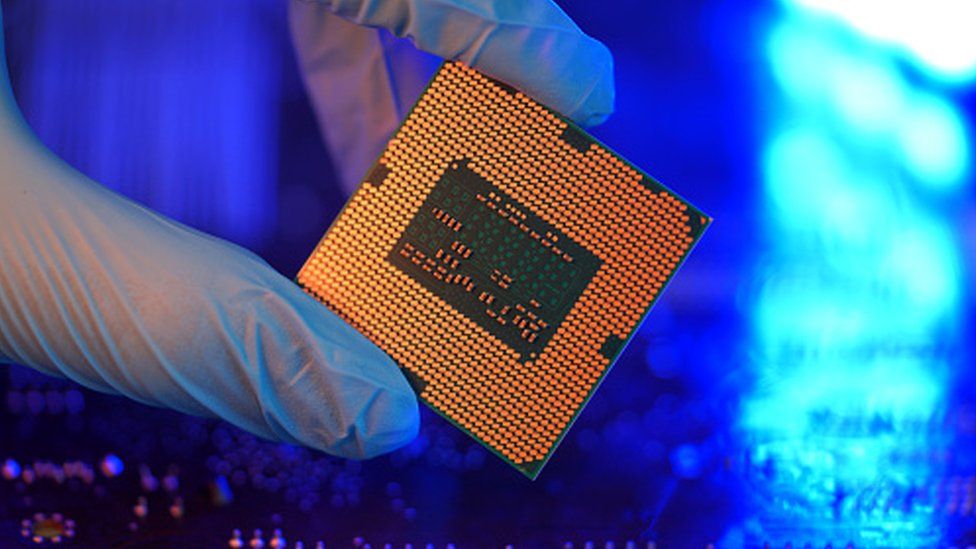

Image caption,

Semiconductors power every aspect of modern, digital life

By Nikhil Inamdar

BBC Business Correspondent, Mumbai

It has been a year-and-a-half since India announced incentives to power up a homegrown semiconductor manufacturing industry and launched a national mission, but progress has been slapdash.

Days after US major Micron announced it would invest nearly $3bn (£2.3bn) in an assembly and test facility in the western state of Gujarat, Taiwanese tech giant Foxconn

withdrew from its $19.5bn joint venture with India's Vedanta to build a chip-making plant in the country.

Plans of at least two other companies appear to have been stalled, local media say.

But as Mr Modi's government waits for high-value investments from chipmakers to match a $10bn incentives outlay, it has been inking a bunch of technology partnerships to get the industry on a firmer footing.

Following an agreement with the US on Critical and Emerging Technology (iCET) to enhance bilateral collaboration on semiconductor supply chains, India signed a similar memorandum of understanding with Japan last week.

Separately, at least three Indian states have announced individual policies aiming to secure investments in this sphere.

While generous subsidies and a strong policy push have created a springboard for the sector to take off, time is of the essence and transfer of technology will be key to India's emergence as a manufacturing hub, says Konark Bhandari, a fellow at Carnegie India.

"Whether companies commit to bringing these technologies will hinge upon an agglomeration of multiple factors, such as business climate, domestic market, export potential, infrastructure and talent," he says.

As things stand, only parts of this puzzle appear to have fallen into place.

India advantage

Semiconductors power every aspect of modern, digital life - from tiny smartphones to mega data centres that control the internet.

Advanced semiconductor technologies also play a key role in the auto industry's transition to climate-friendly electric vehicles and the development of AI applications.

India makes up 5% of the global demand for chips. That's likely to double by 2026, according to Deloitte, driven by greater adoption of smartphones, consumer appliances and new trends like self-driving cars.

IMAGE SOURCE,GETTY IMAGES

Image caption,

Prime Minister Modi's government has announced several incentives to encourage semiconductor manufacturing

The domestic market is evidently thriving. But across key phases of the chip production value chain - product development, design, fabrication, ATP (assembly, test and packaging) and support - India has a strong presence only in the design function and will have to start from scratch when it comes to manufacturing.

"India houses 20% of the global talent in chip design. There are 50,000 Indians doing this work," Kathir Thandavaryan, a partner at Deloitte, told the BBC.

Most semiconductor manufacturers - including Intel, AMD and Qualcomm - also have their largest research and development centres in India, leveraging local engineering talent.

Getting trained personnel, however, could become a major headwind for companies, according to Deloitte, with an estimated quarter million people required to work across the value chain when investments start flowing in.

Greater industry-academia collaborations in this area will, therefore, be crucial.

To its credit, the government has been working towards enabling this by training 85,000 engineers, for instance, through its 'Chips to Startup' scheme.

A number of other factors too - such as an improvement in global rankings on logistics, infrastructure and efficiency, and a more stable electricity grid, a critical prerequisite for semiconductor manufacturing - have fortified India's preparedness to be part of this global race, experts say.

Geopolitics also seems to be in India's favour, with increased focus in the US to seek alternative locations to China to outsource parts of its own semiconductor supply chain.

India, as an increasingly close ally, can become a viable "friend shoring" destination for US companies seeking to outsource support functions, according to Mr Thandavaryan.

But its protectionist trade policy, particularly its absence in multilateral trade pacts like RCEP (Regional Comprehensive Economic Partnership), could prove costly.

"If semiconductor companies based out of China were to diversify, they would be unlikely to face major changes to the tariff scheme applicable to their components if they were moved to Vietnam. This is because there is likely to be more uniformity among countries that are part of the same regional trade arrangement," says Mr Bhandari.

Stumbling blocks

New Delhi's single biggest challenge to positioning itself as a global option for chip makers, however, is one that's all too familiar to manufacturers across industries - a notoriously difficult 'doing business' environment.

The country, known for its software prowess, doesn't really have hardware capabilities. The manufacturing sector's share of GDP has remained stagnant for years because of the lack of a facilitating ecosystem.

India will need to undertake "fundamental and enduring reforms" to change this and make its semiconductors mission a success, say experts.

"That entails addressing investment barriers such as customs/tariffs, taxation, and infrastructure," Stephen Ezell, vice president for global innovation policy at the US-based Information Technology and Innovation Foundation, told the BBC.

"India's not going to be able to compete in the long-run with competitors such as China, the European Union, or the US if incentives are its first-order strategy to attract semiconductor ATP or fabs."

That's primarily because India's semiconductors incentives policy is just one among several in the world. The subsidies simultaneously being offered by blocs like the EU or the US are far larger.

IMAGE SOURCE,GETTY IMAGES

Image caption,

In June, federal minister Ashwini Vaishnaw spoke about the technology Micron will bring to India

Most companies will also not relocate their operations at the drop of a hat for subsidies "because they have an existing ecosystem of suppliers, partners, consumers, a logistics network - all of which make it difficult to offshore operations to other jurisdictions", says Mr Bhandari.

India's subsidies could also be better directed, say experts.

Right now, it offers them across all ends of the chip-making value chain. Instead, the country could play to its strengths.

For example, it can invest in training schools for engineers or double down on its competitiveness in semiconductor ATP and design support rather than on the actual fabrication of chips, which is hugely capital-intensive and has long gestation periods.

The government mustn't get locked in a "shiny-object syndrome" of focusing on fabrication, warns Mr Ezell.

However, being competitive in it would mark a "major technological leap for the country" and the government is right to try and seek more investment in this category, he adds.

Not having some domestic fabrication facilities would also have "serious implications for India's import costs", says Mr Bhandari, as domestic electronics production crosses the significant $100bn mark.

High-stakes gamble

Much is clearly at stake with India's semiconductor gamble. It has had several false starts in the past. But after years of delays, a dedicated policy that broadly gets it right is just the first step in the right direction.

This is a "fresh opportunity to correct the earlier misses," says Mr Bhandari. "The geopolitical stars have aligned to aid this opportunity. In a fractious world with fragmented supply chains, India finds itself at a crossroads - it can either undertake a serious attempt at nurturing hardware manufacturing or let yet another opportunity slip."

BBC News India is now on YouTube. Click here to subscribe and watch our documentaries, explainers and features.

bbc