Bilal9

ELITE MEMBER

- Joined

- Feb 4, 2014

- Messages

- 26,569

- Reaction score

- 9

- Country

- Location

https://cpanewsbd.com/2021/01/01/ease-of-doing-business-bangladesh-on-a-great-leap/#

Prologue

No doubt, investment is the best cure for economic ailment, especially from the private sector. But that do not come easy. We must create a conducive environment in order to welcome investments. For it to start off without much ado, where it can build the infrastructure without hassles and the utility services come faster and at a low cost. In starting a business, you need to consider concerns such as bank loans, protection safeguarding the interests of small investors, the payment of taxes and the facilitation of border trades, as well. It is equally important to resolve any dispute and bankruptcy as soon as possible. A good business environment depends on how easily, economically and quickly these services can be delivered, and that require relentless reforms and adjustments. World Bank ranks countries in the ‘Ease of Doing Business’ question based on the progress made of these reforms. This ranking acts as an influencer in the decision making moments of the local and foreign investors.

The origin of a ranking

The concept of the ‘Ease of Doing Business’ comes from a research paper titled ‘The Regulation of Entry’ developed by the Bulgarian economist Simeon Djankov. The paper became widely known much before it came in light in 2002. Based on data obtained in 1999, Djankov and his co-researchers published facts and figures regarding the processes, timing and cost of starting a business in 85 countries. Later, in 2003, the World Bank published the data on their website, which ultimately led to the establishment of the Ease of Doing Business concept. In 2004, the World Bank published the ‘Ease of Doing Business’ report based on findings from 145 countries. However, the ranking first came up in 2005 when for the first time the report mentioned the 20 best and 20 worst countries regarding the ease of doing business. Since 2006, the ‘Ease of Doing Business’ ranking covers all countries across the world was primarily based on four key indicators.

Since then, different countries introduced different measures to make the investment environment easier. For example, in 2002, six steps had to be passed for starting a business in 13% of the countries. In 2014, more than half the countries achieved this while just one-fourth of the countries were able to complete all the processes within just a week. This advantage was available in less than 5% of the countries in 2002. With years, the number of indicators in the rankings has also increased. Efforts are also being made to improve reforms in all these indicators. As one of the fastest growing economies, Bangladesh is also a fierce contestant on that ranking table.

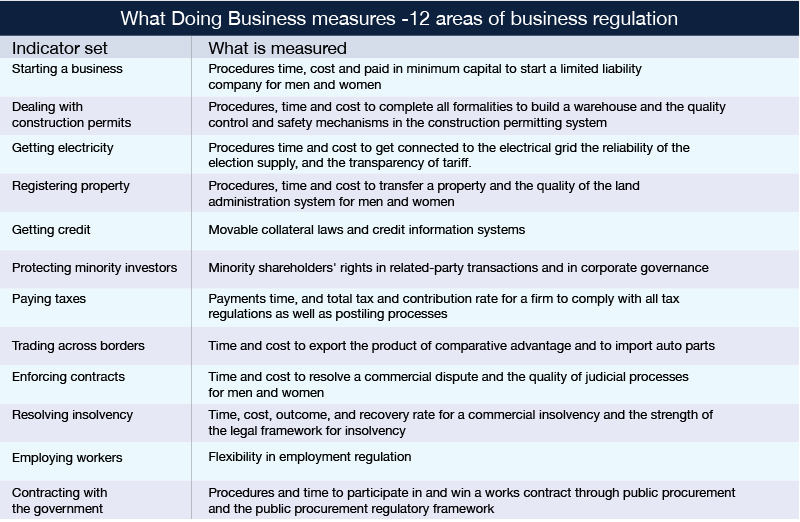

Note: The employing workers and contracting with the government indicator sets are not part of the ease of doing business ranking in Doing Business 2020.

Indicators that matter

Initially, the World Bank covered just a few countries judging their efficiency on a smaller number of indicators. Subsequently, both the scope of the indicators and the number of countries have increased. At present, the World Bank publishes ranks on 10 indicators that include starting a business, dealing with construction permits, getting electricity, registering property, getting credits, protecting minority investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency.

Method of ranking

There were only five indicators when the first Doing Business report came in public in 2003. The study covered 133 countries at that time. At present, 190 countries are ranked on the basis of 10 indicators. In most of the countries, data from only the largest business cities are taken into account. In countries whose population exceeded 100 million by 2013, the World Bank procures data two busy cities. Bangladesh is one of those 11 countries and its scoring and ranking in Ease of Doing Business is based on the business environment that prevails in Dhaka and Chattogram. The scores goes from zero to 100. The higher a country’s score, the higher it ranks on the list.

Certain standard is followed for the scoring. First, the World Bank’s Doing Business team, along with experts, create a questionnaire and the answers are collected from local experts. This expert panel includes lawyers, business consultants, accountants and freight forwarders, as well as government officials and other professionals who work as consultants for various legal and regulatory needs. These experts exchange views with the Doing Business team. These include conferences, written answers and on-the-spot inspections by the Doing Business team. Prior to the Doing Business 2019 report, members of the World Bank’s team visited 28 countries to verify data and recruit the respondents.

Position of Bangladesh

Bangladesh implemented 15 reforms before the World Bank released its latest Ease of Doing Business report. In the latest report, the reform work was done on three indicators. The process of starting a business has been simplified by reducing the company registration fees and time. Besides, electricity connection in Dhaka has been made easier through digitisation and investment in human resources. Similarly, the amount of security money has also been reduced in getting new electricity connections. At the same time, with the expansion of the Credit Information Bureau, loan-related information is becoming more readily available than before which have been reflected in the Ease of Doing Business Report 2020. Bangladesh improved its ranking by eight steps in the latest World Bank report published in 2019 which is 168 out of 190 countries that was 176 in the previous year.

Currently, the Doing Business score of Bangladesh stands at 45 out of a total of 100. Considering the individual score, most success has been achieved in the ‘starting a business’ indicator where the country scored 82.4 while for the others, it is 61.1 for ‘dealing with construction permits’, 34.9 for ‘getting electricity’, 29 for ‘registering property’, 45 for ‘getting credit’, 60 for ‘protecting minority investors’ interests, 56.1 for ‘paying taxes’, 31.8 for ‘trading across borders’, 22.2 for ‘enforcing contracts’ and 28.1 for ‘resolving insolvency’.

Bangladesh on the list of the best winners

Bangladesh has already made it to the list of top 20 countries that made outstanding development in creating conducive business environment. The others on the list includes China, India, Pakistan, Azerbaijan, Bahrain, Djibouti, Jordan, Kenya, Kosovo, Kuwait, Kyrgyzstan, Myanmar, Nigeria, Qatar, Saudi Arabia, Tajikistan, Togo, Uzbekistan and Zimbabwe.

In addition, the Ease of Doing Business 2020 report also lists 42 countries that have improved on three or more indicators through reforms during 2018/19 tenure. Bangladesh has made it on that list too.

Emphasis on improving in indicators

In the first year of the rankings, several countries, including Algeria, Burkina Faso, Malawi and Mali, called on the World Bank to provide specific direction for reform. The World Bank eventually developed a specific method of evaluation. Later, some countries started public campaign about their reform programmes, for example, Georgia made an open announcement to increase its position from 100 to 20 within two years. Since 2016, governments of Yemen, Portugal, Mauritius, El Salvador and India have also been campaigning for their reforms. Heads of state and government of many countries also spoke about this. For example, Indonesian President Joko Widodo announced that he would upgrade his country’s position from 109th to 40th position in the Ease of Doing Business ranking. Kazakhstan’s Finance Minister Erbolat Dosaev had vowed to stay in the list of top 30 countries while Serbia wants to be on top, claimed by its President Aleksandar Vučić.

This clearly shows the significance of the World Bank’s Ease of Doing Business ranking and Bangladesh puts great emphasis on the issue. The honourable Prime Minister Sheikh Hasina has instructed all to introduce necessary reforms in the business environment to place the country within two digit ranking. The reason is quite clear, the better the position in the ranking, the more it is possible to attract domestic and foreign investment.

BIDA- the focal point

Improving of business environment in the country is not a one-man-show. It is involved with several ministries, departments and agencies of the government. All these organisations are working to improve the ranking since its beginning, however, for long they lacked coordination. A focal point was needed to sort out all the works. The initiative was taken in 2016 through the merger of the Board of Investment and the Privatisation Commission to form the Bangladesh Investment Development Authority (BIDA). Since BIDA got the responsibility, it decides what reforms need to be brought in which ministry or department to improve the business environment. It started the work by determining the work plan accordingly. Although the work actually began in 2016, it gained momentum since 2018.

The two committees that are working specifically to achieve the double digit target 2022 are, one, the National Steering Committee chaired by Finance Minister AHM Mustafa Kamal MP and two, the National Committee for Monitoring Implementation of Ease of Doing Business Reforms (NCMID). The committee, chaired by the Cabinet Secretary, provides guidance to government officials on the implementation of the reform plans adopted to improve the business environment and regularly monitors it. Besides, Mr Salman F Rahman MP, Private Industry and Investment Adviser to the Prime Minister, is providing regular guidance to achieve the reform targets.

One Stop Service

One Stop Service (OSS) is one of the vital measures taken to make business easier. The One Stop Service Act was passed in 2018 to enable investors to get all kinds of services under one roof. In the interest of improving the living standards of the people of Bangladesh, the law provides for the timely implementation of domestic and foreign investment plans so that investors get any services, facilities, incentives, licenses, permits or clearances required for any of their proposed projects or initiatives. These include trade license, land registration, naming, environmental clearance, construction approval, electricity-gas-water connection, telephone-internet connection, explosive license and boiler certificate. In other words, there is no more need to visit different offices for initial approval and other formalities of any project.

In October 2020, the Bangladesh Economic Zones Authority (BEZA) the One Stop Service (OSS) Centre to provide the investors with all necessary services from a single window.

The law includes Bangladesh Investment Development Authority, Bangladesh Economic Zone Authority, Bangladesh Export Processing Zone Authority and Bangladesh Hi-Tech Park Authority as the ‘Central One Stop Service Authority’. BIDA started OSS on 24 February 2019 and on 10 May 2020, it published its rules and regulations for the OSS.

Initially, 150 services of 35 agencies were targeted to be provided from this single platform. Till 2019, only 18 services were provided online that added 23 more services since 2020 which has increased to 42 by now. It hopes to increase the number of services to 150 by January 2021.

In the primary stage, only government services were provided through BIDA’s OSS platform, but now non-governmental organisations are also becoming more and more interested in it. BIDA has already signed a Memorandum of Understanding (MoU) with the Dhaka Chamber of Commerce and Industry while the Metropolitan Chamber of Commerce and Industry, Dhaka and the Chattogram Chamber of Commerce and Industry have also expressed their aspiration to join the platform.

Reforms and indicators

Bangladesh has undertaken major reforms in all the indicators of business facilitation which has also been reflected on various indicators. Some of these reforms are reflected in the World Bank’s recent Doing Business report, as well, although that is not a complete reflection. This may be due to the limitation of World Bank’s method of data collection. The matter has already been discussed with the representatives of the World Bank’s International Finance Corporation (IFC).

Besides, many reforms have been completed in seven indicators in the fiscal year 2019-20 which have also been submitted to the World Bank, which will be reflected in the next World Bank report. The World Bank also admits that the business environment has become much stress-free for entrepreneurs in Bangladesh.

- Approval to starting a business

The process of getting approval to start a business has been greatly reduced. Charges have been reduced for company name approval, certification, etc. Where in the past, it used to cost BDT 2,400 to register and it has now been reduced to BDT 1,200 only.

A circular has been issued by the Local Government Department to issue trade licenses in favour of any company registered with the Registrar of Joint Stock Companies in Dhaka North and South City Corporation and Chattogram City Corporation area within two days of submission of application. This has been made possible by the elimination of the inspection process that preceded the issue of trade licenses in earlier days.- Dealing with construction permits

The approval process for construction of warehouses has been reduced from 18 steps to 8 steps. CS map from Land Settlement Office in Dhaka, soil test report, project clearance from local authority such as Dhaka City Corporation Ward Counsellor, project clearance from Environment Department, fire safety clearance, load clearance from DESCO and Power Development Board for load approval up to 250 kW, water and Sanitation clearance and inspection of Rajdhani Unnayan Kartipakkha (RAJUK) will not be required any longer.

Similarly, seven processes have been cancelled for Chattogram. These are, CS map and certificate of ownership from Land Survey Department, project approval from Ward Counsellor, soil test report, fire safety clearance, clearance from Bangladesh Power Development Board (BPDB), water and sanitation clearance and inspection by Chattogram Development Authority (CDA).

The time of the three processes that have to be done from RAJUK has also been reduced. Where it used to take 45 days to get a land use clearance from RAJUK, now it has been reduced to a maximum of seven working days. Project clearance and building construction approval will now be available in a maximum of seven working days instead of 105 days. Applications for building construction and clearance permits can now be submitted within five working days instead of the previous 21 days.

The two CDA processes for building construction have also been shortened through reforms. Land use clearance from CDA will now be available in a maximum of seven working days instead of the previous 50 days. Permission to construct the building will be available in a maximum of seven working days instead of the previous 105 days. - Getting electricity

The suffering for getting electricity connection has also been reduced. It used to take 125 days to get electricity connection in earlier days while now it takes just 28 days.

In case of Dhaka, the cost of hiring contractors for procurement, testing and installing equipment for sub-station has been reduced from BDT 1,800,000 lac to BDT 1,238,500. In case of Chattogram, the expenditure has been brought down from BDT 1,400,000 to BDT 1,238,500. Earlier, it used to cost BDT 381,678 for submitting application and getting evaluation of BPDB for electricity connection in Chattogram while now it has been brought down to BDT 258,000 only.

In case of electricity for industrial need, pilot-based connection is given in two phases and within seven days. This means, investors are getting electricity connection faster than before. - Registering property

Registration of property has also been made easier. Time and cost have been reduced. Stamp duty on property registration has been reduced from 3% of the total value of the property to 1.5%. Separate Balam books have been introduced in the case of transfer of property from company to company. As a result, the original copy of the document is now available within seven working days. The time for mutation of property from company to company has also been reduced to seven working days.

The issuance of non-encumbrance certificate has been reduced to two working days. The registration fee has been reduced from 2% to 1% of the value of the land. Effective and efficient grievance redress system has been introduced. Statistics on land disputes and property transfers are being released. An electronic database has been compiled on land boundaries, designs and other information. - Getting credit

Two reforms have been brought in the ‘getting loan’ indicator in the fiscal year 2019-20. The debtor’s two-year data is now available at the Debt Information Bureau. At the same time, the coverage of information on credit has also been increased. At present, 7.12% of the adult population is covered. These are important reforms made to improve the Ease of Doing Business ranking. - Protecting of minority investors’ interests

To protect interests of the investors, the shareholder rights index, disclosure index, corporate transparency index, ownership and control index and director liability index have been reformed.

(A) Extent of shareholder rights index: No listed company can enter into an agreement to sell more than 50% of the company’s tangible assets without the approval of its shareholders.

(B) Extent of disclosure index: If the said company enters into such an agreement, the nature and quantity of the agreement must be communicated to the Bangladesh Securities and Exchange Commission (BSEC) and the stock exchange within 30 minutes of the execution of the agreement. At the same time, the description of the assets in question and the declaration of any conflict of interest have to be published in two widely circulated Bengali and English dailies.

(C) Extent of ownership and control index: The provisions of the Corporate Governance Code and other orders and notifications issued under Section 2CC of the Securities and Exchange Ordinance 1969 must be complied. Otherwise, disciplinary action can be taken against any company listed on the stock exchange, such as, delisting or suspension of transactions from the stock exchange.

(D) Extent of corporate transparency index: In case of appointment or reappointment of a director to the board of directors of a listed company, his / her main work and involvement in other companies should be disclosed in the resume of the concerned director.

(E) Extent of director liability index: Under Section 233 of the Company Act, 1994, shareholders may take legal action against the directors for any wrongdoing.

Besides, by amending the company law, the time for convening a general meeting has been increased from 14 days to 21 days. In addition, by amending the company law, the shareholders with 5% shares have been given the opportunity to submit agenda in the general meeting. - Trading across borders

There is a general notion that trade facilitation depends on trading across borders and that the responsibility lies with the port. Although the ‘trading across borders’ is one of the 10 indicators, the activities under this indicator are not the sole responsibility of the port. Bangladesh Customs House is also involved.

An outline is created to define what kind of reform is required for any sub-indicator of this indicator to achieve the two digit ranking. As the port is partially responsible for these reforms, so is the customs. The Chattogram Port Authority has already achieved their reform targets. However, due to the limitation in World Bank’s data collection method, it was not reflected in the previous report.

The trading across borders indicator is based on the amount of time and expense it takes to complete documentation at the said port on import-export. A meeting chaired by the Principal Secretary to the Prime Minister’s Office on 27 January 2019 set a new target for the Chattogram Port Authority to reduce time and cost for export (Border compliance) and Documentary compliance. The target was to reduce the export time (Border compliance) from 168 hours to 36 hours as well as reduce the cost of exports (Border compliance) from USD 408 to USD 200. Similarly, the cost for documentation of export (Documentary compliance) was asked to be reduced from USD 225 to USD 100 on average.

The Chattogram Port Authority and the BIDA have been working on the issue for a year. Later, on 27 February 2020, a World Bank team visited Chattogram port. The team monitored the containers there, recorded the export time (Border Compliance) and gets an average time of 22 hours. Besides, the World Bank team consulted with stakeholders at the Chattogram Custom House. They record the cost of export (Border compliance) stays between USD 200 and USD 210. Similarly, the documented cost of export (Documentary compliance) varied between USD 80 and USD 100.

However, there is a confusion about the HS (Harmonised System) codes of import and export products (Garments and auto parts), especially the HS codes of auto-parts. BIDA and customs authority want a solution to get rid of this confusion.

A meeting with all stakeholders was held on 29 October 2020 presided over by the Chairman of Chattogram Port Authority on the latest developments. Representatives of BGMEA, BKMEA, Shipping Agents, Freight Forwarders, BICDA, Truck and Covered Van Owners Association, C&F Agents Association and Chattogram Chamber and Commerce and Industries took part in the meeting. Export time and cost were finalised after detailed discussion. At the same time, it was said that it was not clear which product of Bangladesh will be considered in the case of export due to the problem of HS code. However, ready-made garments of Bangladesh are being considered as the main export item in this case.

(A) Spent time for export

In case of export, time is spent in several steps. According to the latest calculations, it takes 2 hours for the product to be packaged in the factory for transportation. If the factory is located in Dhaka, it takes another 10 hours to reach the off-dock of Chattogram port. However, if the factory is located in Chattogram, then it takes 3 hours to reach the off-dock of Chattogram port. It takes 24 hours for a product to enter into a container from off-dock. Then, it takes 2 to 4 hours to take the container from the off-dock to the port gate. And it takes 22 hours to take the product on-board a ship from the port gate. In other words, the time required for bringing goods from Dhaka factory to its shipping at Chittagong port is 64 to 68 hours and for factories in Chattogram 57 to 61 hours.

The important point to note here is that the whole process is not the sole concern of the Chattogram Port Authority as the factory authority to the transport owners, workers and several other parties are also involved with it. The port falls under the jurisdiction of only a portion, especially from the gate to the shipping. The Chattogram Port Authority is taking less time than its target in there.

(B) Export expenditure

Costs for export of goods (Border compliance) are basically spent in five steps. One of these is unloading goods from trucks and storing them in off-dock warehouses that costs at an average BDT 1,500 or USD 17.65 per 15 metric ton of product at BDT 3 per 500 cartons. And for landing, the cost per 15 metric tons is BDT 3,105 or USD 36.9 at the rate of BDT 207 per metric ton. It costs BDT 4,500 or USD 53.6 to containerise the goods from off-dock. Then, from the port gate to on-board a ship it costs USD 65. The total cost is USD 173.35, which is much less than the target of USD 200. However, the Chattogram Port Authority gets USD 65 out of them and it is fixed. Considering this calculation, the export cost (Border compliance) for the port is much less than the World Bank account. Because in the Doing Business 2020 report, the export cost (Border compliance) showed USD 406 as export expenditure.

(C) Document processing fees

Fees are charged in a total of six steps for processing documents. These are Bill of Export, Off-Dock Permission, Email or Photocopy, Bangladesh Bank, Utilisation Declaration (UD) and others. In all, in case of exports, BDT 5,000 or USD 59 is collected in bulk for processing documents. However, in the latest report, the World Bank has estimated the cost in this sector at USD 225. Nonetheless, there is an unresolved issue here and that is whether the C&F commission will be included in this expenditure or not.

Reforms in the remaining three indicators

‘Paying taxes’, ‘enforcing contracts’ and ‘resolving insolvency’ were not reformed last year. However, the reform of these indicators started this year.

The National Board of Revenue has already reduced the corporate tax rate from 35% to 32.5%. Online income tax return and tax correction system will be introduced next year and steps have been taken to include e-payment via the online tax payment system.

A joint district judge or a senior assistant judge is being considered for the settlement of commercial disputes in the implementation of the contracts. The goal is to make it more powerful in the future by bringing it under digitisation through dedicated courts of which, one will be in Dhaka and the other in Chattogram. However, in the long run, the law ministry plans to set up a separate court to settle commercial disputes, because, according to the IFC, it takes an average of more than 1,400 days to complete a case. But if it takes more than 1,300 days, no point will be given in this indicator. So, the goal is to bring it down to 600 days.

Keeping in line with the Companies Act, the Bankruptcy Act, 1997 is being amended to include provisions for effective restructuring, enhancing the rights of creditors in bankruptcy proceedings and improving the administrative system of debtors’ property. The Financial Institutions Division of the Ministry of Finance is responsible for it. IFC and BIDA are providing technical assistance in there.

Apart from this, a new law called Secured Transaction Act has been enacted to protect the interests of the investors to be supervised by the Financial Institutions Department and Bangladesh Bank. The law is being enacted so that small entrepreneurs can take loans with movable property collateral.

End words

The Doing Business ranking process also has some limitations, which require consideration when interpreting data. First, the data of the top business city is collected in most countries and it, most of the time, does not truly represent other parts of the country. Second, data collection usually takes into account Limited Liability Company of a certain size, which does not represent other businesses. Above all, scoring in the indicators is mainly based on a lot of assumptions. Respondents also answer time-related questions on various indicators at their own discretion.

Despite these limitations, indicators of Ease of Doing Business are now universally accepted for determining the business environment in a country. Doing Business Index helps investors to decide in investing in a country. In order to attract investors in Bangladesh, the government is working on a large scale to improve the business environment through various reforms. The reform plan and its implementation so far clearly show that Bangladesh is on the way to take a big leap in the ranking of Doing Business.

Brother @Paul2 this maybe helpful for you.