beijingwalker

ELITE MEMBER

- Joined

- Nov 4, 2011

- Messages

- 65,191

- Reaction score

- -55

- Country

- Location

CQQQ: Weighing The Benefits Of Chinese Tech Ascendance Vs. Geopolitical Risk

Mar. 13, 2023 2:19 PM ETWilliam_Potter

Investment thesis: A recent Australian study identified China as the leader in 37 out of 44 technological fields that they studied. The Invesco China Technology ETF (NYSEARCA:CQQQ) is one potentially good candidate for providing investors exposure to what is seemingly a surge in Chinese technological and intellectual property dominance.

The CQQQ fund is down from over $100/share, to about $42/share currently, which adds to its appeal as an arguably enticing investment opportunity that trades at arguably depressed levels. It is the classical case of the battered investment opportunity that one can find plenty of reasons to expect it to thrive going forward, making it currently undervalued. Then again, given the geopolitical trends of the times we live in, it is important to factor in the risk assessment. Betting on Chinese technology may seem tempting, but for investors, especially those of us based in the Western World, it also carries an extra risk that we did not have to factor into our potential risk/reward calculations just a few years ago.

About the CQQQ fund.

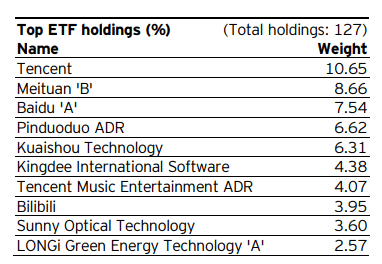

The makeup of this fund is not particularly diverse, with only 127 companies represented. Furthermore, the top holdings take up a relatively large portion of the total.

Invesco

What I see missing from this fund is a higher proportion of electronic hardware producers, as well as EV industry-related companies, that would provide investors with a broader, more diverse exposure to Chinese technological advances.

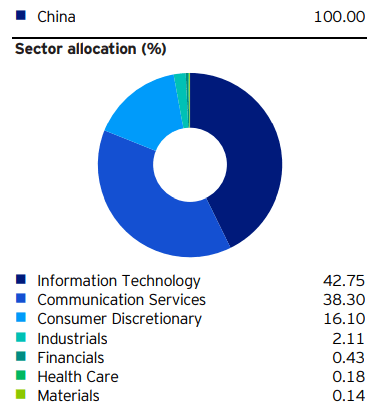

Invesco

Even though it does not contain the mix of Chinese stocks that I would find ideal, it does present investors with the opportunity to gain somewhat broad exposure to China's rising tech industry. The expense ratio of .7% can take a toll on one's position in this fund if it is held for a prolonged period.

The rise of China's tech sector is globally significant, therefore it is hard as an investor to just watch it pass by, without participating in it.

With the end of the zero COVID policies, China is back in economic expansion mode. The growing pressure that the US is exerting on China's tech sector by denying it critical inputs such as high-end semiconductors and the equipment needed to produce them, is in fact a stimulant to China's own tech sector. It is causing a drive to self-sufficiency that leads to a push to displace foreign inputs with domestic ones, which in turn stimulates innovation and expansion of the sector. The recent announcement in regards to Huawei potentially seeing some breakthroughs in UV lithography which is crucial to achieving the production of high-end silicon chips is just a recent example where Chinese innovation seems to be getting ahead of expectations, and it is arguably being stimulated by our efforts to try to contain its rise.Another factor that is helping China's tech sector is its growing interconnectivity with the rest of the world through its belt & road investment program, which indirectly leads to an opening for Chinese high-tech products and services in new markets, all around the world.

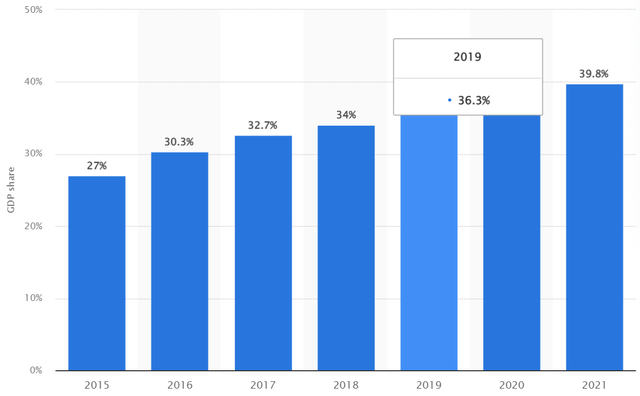

China's share of the digital economy in GDP (Statista)

As we can see, even within the context of the overall fast-expanding Chinese economy, the high-tech portion of it, which is heavily represented in the CQQQ ETF is growing in importance.

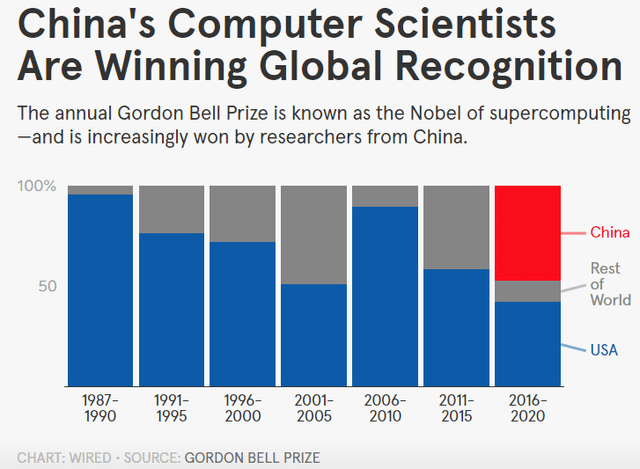

Aside from historical trends, it should be mentioned that China currently has almost ten times more engineering undergrads hitting the job market than the US does every year. It is reasonable to assume therefore that innovation within the Chinese tech sector is likely to be robust for the foreseeable future. In fact, a recent study suggests that China is leading currently in 37 out of 44 identified fields in terms of innovation. By another metric that is arguably more relevant to the CQQQ fund, Chinese Computer Scientists seem to be increasingly establishing co-dominance in the world, along with the United States.

Wired

While there are still plenty of detractors who firmly believe that Chinese innovation capacity is still mostly confined to stealing & copying technology from others, it seems to me that such concepts are increasingly outdated. I think there is innovation happening as we speak and more will come down the pipeline, which should help to boost the market value of the Chinese tech sector, thus it is a very positive fundamental factor for the CQQQ fund.

The geopolitical risk to investors positioned in Chinese assets.

If there is one important, often painful lesson that investors were able to come away with last year, it is the fact that at this geopolitical juncture, aside from a few, mostly developed world markets and investments, most foreign investment opportunities now carry very elevated geopolitical risk. We entered a new era of geopolitical great power competition and the breakout of the Ukraine war suggests that it can be very messy. For investors, it is important to come away with the lesson that there is a clear willingness on the side of Western governments to punish investors that may have exposure to foreign investment assets, especially from major geopolitical competitors, if the jockeying gets out of control and escalates.In regard to this particular investment opportunity, the trigger could be anything including China deciding to start supplying Russia with military aid, in the event that China deems it necessary to prevent the NATO alliance from achieving certain objectives in the proxy war in Ukraine. It is far from clear at this point whether such a Chinese intervention will ever be necessary. Russia does have its own military industrial base, which it can expand, and some indications are that it has expanded in the past year in order to meet its needs.

The prospects of a Chinese invasion of Taiwan depend mostly on how the semiconductor squeeze on the Chinese economy shapes up, in my view. If we succeed in undermining China's own tech sector to enough of an extent that China feels compelled to make its move in order to disrupt the global semiconductor industry, then there will probably be an invasion. In that case, we will see investors in all China ETFs face the same situation that we saw with the RSX Russia ETF.

On the other hand, if China will be able to break the technological chokehold that we are trying to put it into, by denying it access to some key technological inputs, the outcome may still be the same. Chinese companies are currently seeing work on breaking Western dominance of semiconductor production technology on three different routes, which as I stated in my first article of the year, may turn out to be the biggest investment story of 2023. A Chinese semiconductor production technological breakthrough could potentially trigger a desperate economic confrontation, meant to derail China's economic expansion in the world, with technological containment having failed. Such a conflict would most likely hit Western investors with exposure to Chinese investments first and foremost, although it will not stop there, as retaliatory measures could potentially hit the entire global financial market, and indeed derail the global economy.

Investment implications:

Balancing the overall attractive prospects of participating in the continued rise of China's tech sector, versus the increasingly less hypothetical and more real geopolitical risks involved, the risk/reward picture on the CQQQ ETF seems to be less than ideal. It is true that in the event of a full-blown economic war between the US, its allies on one hand, and China on the other, would escalate into an economic confrontation that would leave few investments on this planet unaffected. The difference may be that investors may have some time to beat the rush for the exit doors in the case of most investment positions, in response to early signs that the geopolitical situation is deteriorating. This may not be the case with investors who choose to have investments like CQQQ in their portfolio, given that such investments are likely to be the first to be impacted. It may be worth taking the risk in order to participate in what seems like a Chinese sector that has good growth prospects, which is increasingly a rare opportunity within the current global and especially Developed World growth prospects. The unfortunate reality is that within the current global geopolitical environment, the risk of being blindsided by events that may have nothing to do with fundamentals is increasingly high.

CQQQ: Weighing The Benefits Of Chinese Tech Ascendance Vs. Geopolitical Risk

China has arguably positioned itself as the main competitor to the US tech sector in recent years. CQQQ ETF is one way to gain broad investor exposure.