Hamartia Antidote

ELITE MEMBER

- Joined

- Nov 17, 2013

- Messages

- 35,188

- Reaction score

- 30

- Country

- Location

Chinese tech firms scramble to secure Nvidia’s AI chips before US ban cuts off supply

Chinese firms are scrambling to secure Nvidia’s GPUs after Washington tightened export restrictions, which dealt a fresh blow to China’s artificial intelligence ambitions.

- Xiamen Hongxin Electron-Tech Co said it was ‘stepping up communication with multiple Nvidia distributors’ to meet client demand

- China’s leading server maker Inspur, a key distributor of Nvidia products in the country, said it has been ‘actively stocking up’ amid tight supply

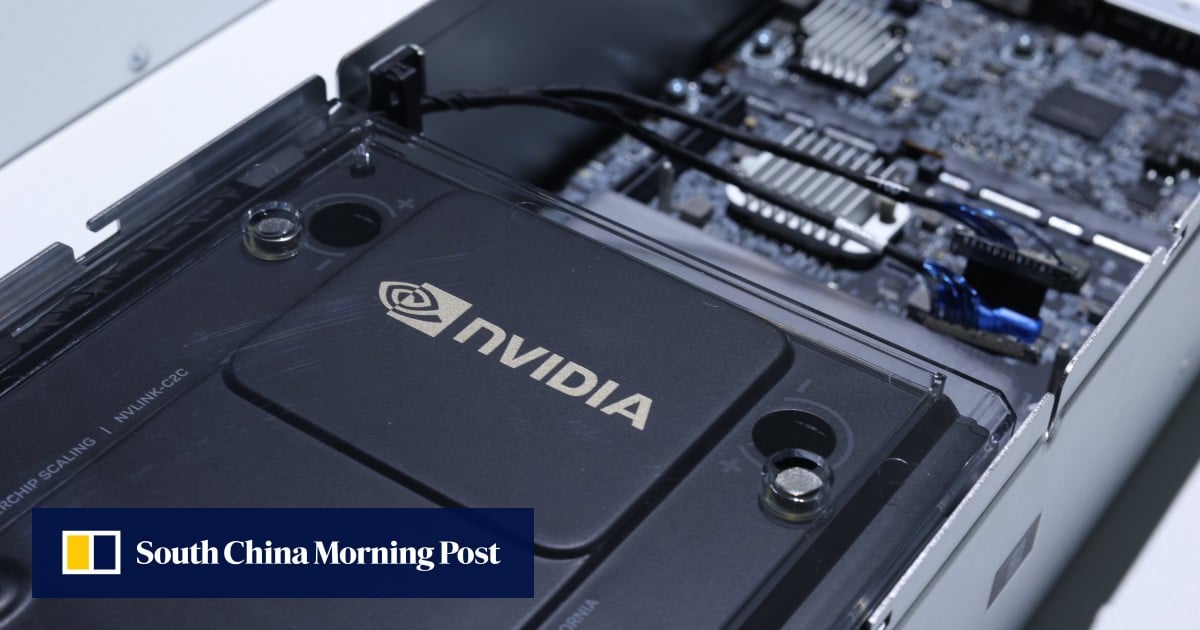

The logo of Nvidia is seen inside a GH200 server during the Hon Hai Technology Day in Taipei, Taiwan, October 18, 2023. Photo: EPA-EFE

Chinese companies are scrambling to secure Nvidia’s chips after the US further restricted the supply of key graphics processing units (GPUs), dealing a fresh blow to China’s artificial intelligence (AI) ambitions.

Xiamen Hongxin Electron-Tech Co, a publicly-listed maker of flexible printed circuit boards in Shenzhen, is “stepping up communication with multiple Nvidia distributors in the limited window period as the US government is still escalating its restrictions against computing power chips”, the company told investors on its official Q&A platform on Wednesday.

In the statement, Hongxin declined to elaborate on the progress of the communications with distributors, while admitting that it did not work directly with Nvidia.

The electronics firm, which also supplies semiconductors for AI servers through a partnership signed with Shanghai-based chip start-up Enflame Technology in April, said it would need to increase the use of domestic AI chips to meet client demand for computing power if Nvidia products are banned completely.

“The stricter the restrictions on Nvidia, the greater the space left for domestic AI chips and servers,” the company said on the investor platform.

Hongxin will lease servers and computing power for a 1 billion yuan (US$136.7 million) AI data centre project in Tianshui, the second-largest city in northwestern Gansu province, according to a company announcement earlier this month. Hongxin has ordered over 9,000 chips from Enflame for this project, the firm said on Wednesday.

China’s leading server maker Inspur, a key distributor of Nvidia products in the country, said it has been “actively stocking up” as supplies have been tight this year, but declined to elaborate on inventory levels, according to a report by Securities Times last week.

The US Commerce Department updated its technology export controls last week, restricting Nvidia from exporting its A800 and H800 chips, which had been designed to comply with Washington’s earlier export rules, undercutting China’s AI drive by denying it access to semiconductors used to train AI algorithms.

While the commerce department’s notice gave a 30-day period for the restrictions to kick in, Nvidia said in a filing to the US Securities and Exchange Commission on Tuesday that the rules were effective immediately. However, the company downplayed the impact of the tighter restrictions, citing strong demand worldwide.

The logo of Nvidia seen at its corporate headquarters in Santa Clara, California, in May 2022. Photo: Handout via Reuters

After Nvidia was banned from selling its state-of-the-art A100 and H100 chips to China under regulations Washington introduced a year ago, the firm tailor-made the A800 and H800 as alternatives for Chinese clients.

Washington’s latest move dealt a blow to Chinese tech giants that have rushed to launch their own ChatGPT-like products in China, where the OpenAI service is not available.

Tencent Holdings, ByteDance, Baidu and Alibaba Group Holding, owner of the South China Morning Post, have collectively placed orders worth US$1 billion for about 100,000 A800 processors to be delivered this year, and a further US$4 billion worth of GPUs to be delivered in 2024, the Financial Times reported in August, citing anonymous sources.