Nilgiri

BANNED

- Joined

- Aug 4, 2015

- Messages

- 24,797

- Reaction score

- 81

- Country

- Location

https://economictimes.indiatimes.co...m_medium=HPTN&utm_campaign=AL1&utm_content=23

@rott @GeraltofRivia @TaiShang @Chinese-Dragon @Sam.

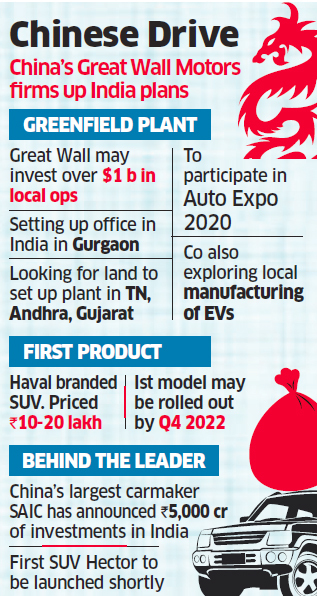

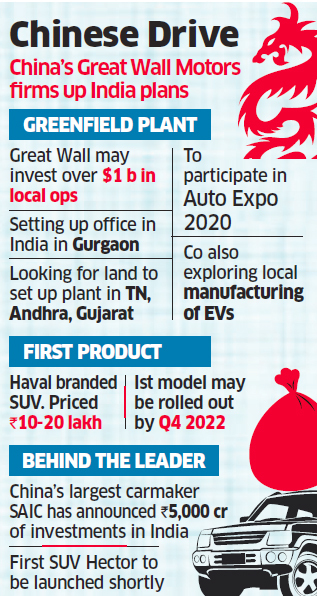

Chinese automobile companies step on the gas to invest in India

After SAIC’s Rs 5,000-crore commitment to India, Great Wall Motors set to pump in over $1 billion.

MUMBAI: China’s largest utility vehicle maker, Great Wall Motors, is set to invest over $1 billion in India, which is expected to become the third-largest market in the world in the next three-five years. This comes close on the heels of the largest Chinese carmaker SAIC committing Rs 5,000 crore to India.

Great Wall Motors has approved an India unit under Haval India to be headquartered at Gurgaon in the national capital region and the team is being put in place to define the blueprint, said people with knowledge of the matter. The company is also planning to participate in the upcoming Auto Expo in 2020.

Great Wall approved a $1.6-million investment in February to set up the local office, which may be named India Haval Auto, India Haval or India Haval Auto Sales. The final name is subject to approval by local authorities, said a news report.

The commitment from Chinese manufacturers comes at a time when their home country, the world’s largest car market, has shrunk for the first time in decades. Despite a slowing Indian market, they see Asia’s third-largest economy driving their global ambitions, experts said.

Several people in the know said a senior executive contingent from Great Wall’s headquarters is currently in India scouting for a manufacturing location. Andhra Pradesh, Tamil Nadu and Gujarat are potential sites for the plant, which is expected to roll out its first SUV by the fourth quarter of 2022.

Great Wall is likely to follow a similar game plan as MG Motor and may come out with a range of locally produced SUVs in India from Rs 10 lakh to Rs 20 lakh.

While the immediate priority is to look at conventional internal combustion engine vehicles, Great Wall is also exploring electric vehicles for the Indian market, with the company having in-house expertise in making batteries and EVs, said the people cited above.

Great Wall sold 1.1 million vehicles at home last year, registering a marginal decline of 1.6%. However, its overseas sales grew in double digits in 2018, albeit on a low base, to about 50,000 units.

“The immediate focus is to localise some of the Chinese products in the Indian market,” one of the people said, though the existing portfolio is exported to about 60 global markets. “However, over the medium term, there may be a dedicated emerging market architecture, which will be driven by India — approval on the same is awaited.”

The company hired former Maruti Suzuki executive Kaushik Ganguly last year to define its product road map in India. Besides that, it has hired Mainak Chanda to lead overseas procurement. Chanda worked briefly with another Chinese company Changan, in its bid to enter the Indian market, before Great Wall.

Chanda was with Mahindra’s sourcing team before moving to Changan. His presence in the global office could help bolster the India operation.

Great Wall didn’t respond to queries.

“One thing is for sure, dynamics of the Indian market are in for a big transformation with new regulations and new entrants like Kia, PSA, MG Motor and now Haval who will change the competitive landscape,” said Gaurav Vangaal, country lead for production forecasting at IHS Markit. “For Great Wall, it may make logical sense to explore acquisition of plants of other vehicle makers which are highly underutilised in the market to get a quick access.”

@rott @GeraltofRivia @TaiShang @Chinese-Dragon @Sam.

Chinese automobile companies step on the gas to invest in India

After SAIC’s Rs 5,000-crore commitment to India, Great Wall Motors set to pump in over $1 billion.

MUMBAI: China’s largest utility vehicle maker, Great Wall Motors, is set to invest over $1 billion in India, which is expected to become the third-largest market in the world in the next three-five years. This comes close on the heels of the largest Chinese carmaker SAIC committing Rs 5,000 crore to India.

Great Wall Motors has approved an India unit under Haval India to be headquartered at Gurgaon in the national capital region and the team is being put in place to define the blueprint, said people with knowledge of the matter. The company is also planning to participate in the upcoming Auto Expo in 2020.

Great Wall approved a $1.6-million investment in February to set up the local office, which may be named India Haval Auto, India Haval or India Haval Auto Sales. The final name is subject to approval by local authorities, said a news report.

The commitment from Chinese manufacturers comes at a time when their home country, the world’s largest car market, has shrunk for the first time in decades. Despite a slowing Indian market, they see Asia’s third-largest economy driving their global ambitions, experts said.

Several people in the know said a senior executive contingent from Great Wall’s headquarters is currently in India scouting for a manufacturing location. Andhra Pradesh, Tamil Nadu and Gujarat are potential sites for the plant, which is expected to roll out its first SUV by the fourth quarter of 2022.

Great Wall is likely to follow a similar game plan as MG Motor and may come out with a range of locally produced SUVs in India from Rs 10 lakh to Rs 20 lakh.

While the immediate priority is to look at conventional internal combustion engine vehicles, Great Wall is also exploring electric vehicles for the Indian market, with the company having in-house expertise in making batteries and EVs, said the people cited above.

Great Wall sold 1.1 million vehicles at home last year, registering a marginal decline of 1.6%. However, its overseas sales grew in double digits in 2018, albeit on a low base, to about 50,000 units.

“The immediate focus is to localise some of the Chinese products in the Indian market,” one of the people said, though the existing portfolio is exported to about 60 global markets. “However, over the medium term, there may be a dedicated emerging market architecture, which will be driven by India — approval on the same is awaited.”

The company hired former Maruti Suzuki executive Kaushik Ganguly last year to define its product road map in India. Besides that, it has hired Mainak Chanda to lead overseas procurement. Chanda worked briefly with another Chinese company Changan, in its bid to enter the Indian market, before Great Wall.

Chanda was with Mahindra’s sourcing team before moving to Changan. His presence in the global office could help bolster the India operation.

Great Wall didn’t respond to queries.

“One thing is for sure, dynamics of the Indian market are in for a big transformation with new regulations and new entrants like Kia, PSA, MG Motor and now Haval who will change the competitive landscape,” said Gaurav Vangaal, country lead for production forecasting at IHS Markit. “For Great Wall, it may make logical sense to explore acquisition of plants of other vehicle makers which are highly underutilised in the market to get a quick access.”