List of Chinese Investments in Pakistan....

CPEC to transform Pakistan landscape

China steps up investment in new trade route

Pakistan is one of the first countries along One Belt, One Road that is receiving massive investments from China. Through its initiatives, the world’s second largest economy aims to showcase how bilateral cooperation can lead to economic transformation

By Daniel Yu

Date 14 Dec 2016

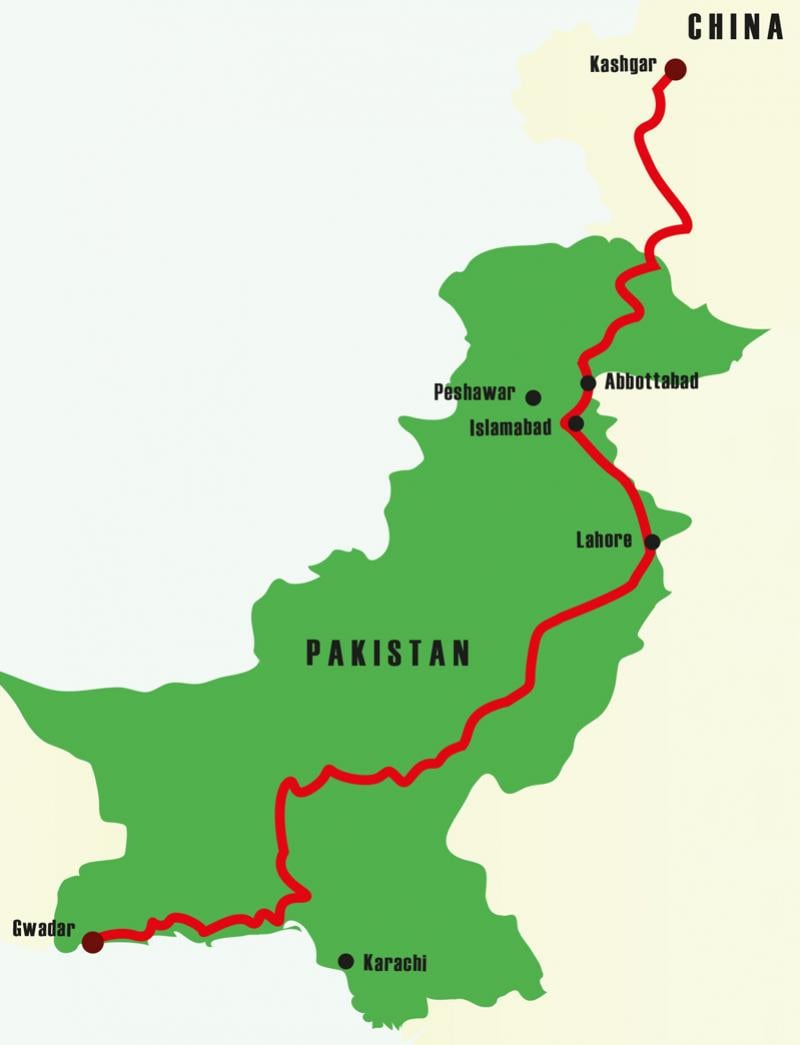

As the world was fixating over the high-pitch battle for the election of the next US president in the first week of November, a convoy of container trucks from Kashgar, China’s westernmost city in the Xinjiang Uygur Autonomous Region was making their way through the 1,300-kilometre Karakoram Highway. By the 12th of November, it had arrived at Gwadar Port on the Arabian Sea in the first-ever trial run of an overland route for Chinese goods destined for the Middle East and Europe.

For China, it marks an important milestone in its efforts to find an alternate route for its exports and especially in helping to develop its westernmost region, which has lagged behind the rapid growth seen in its eastern frontier. It is the first steps as China pursues its bold ambition to revive the historic Silk Road as part of its One Belt, One Road (OBOR) initiative.

For Pakistan, it is proof that since the China Pakistan Corridor (CPEC) was first announced, the country may be on the cusp of a change that could reverse the decades of under-development that has been one of the factors propagating the history of sectarian violence in the region.

That the Chinese initiatives are fraught with risks for its infrastructure projects in Pakistan and elsewhere along the OBOR initiative including in Central Asia is without question. But Dominique de Villepin, the former French prime minister recently told

The Asset that it was important to start as it creates incentives for other countries. “Projects in Pakistan have started quite well and building infrastructure means more relationships between countries.”

Shaukat Aziz, the former prime minister of Pakistan, describes the country’s partnership with China and which forms part of the OBOR initiative of Chinese President Xi Jinping as a game changer. China has committed US$46 billion worth of projects – about 17% of the country’s nominal GDP – which Aziz has described as unprecedented in the country’s history.

That commitment, in the guise of CPEC, was signed formally 20 months ago in April 2015 during the state visit of Xi to Pakistan. Already, more than US$14 billion of the funds promised have been invested. “Funds continue to come in every week, every month,” shares one informed source. “They are going to fund power plants, roads, ports and other infrastructure. Some are coming in as debt; others as equity.”

By 2018, Pakistan will be able to enjoy a surplus in power for the first time.

China has had a cordial relationship with Pakistan historically. But until recently, it has never translated to actual economic activity. Part of the problem is the security situation in the country. One of China’s objectives is to build an extensive road and rail network from China’s western Xinjiang province through Pakistan’s heartland and into the Port of Gwadar, a deep-water port with a draft of 47 feet located on the southwestern coast of Balochistan by the critical Straits of Hormuz in the Arabian Sea.

When the Pakistan army finally managed to take control of the security situation three years ago, the domestic economy started to turn a corner. With a population of 220 million people that needs to eat, live, etc, the pick-up started to accelerate, one analyst notes.

Then discussion with China resumed, which involves restarting work and expanding the port and the ancillary links. With the signing of the CPEC agreement, it essentially turbo-charged the engines, explains one banker. “If China was not there, you would still have seen some growth [as a result of the improved security situation] but the Chinese investments really transformed it.” Pakistan’s problem is the lack of long-term capital, which was critical to support its power sector. China supplied the much-needed, long-term strategic financing.

Pakistan is one of the first countries along OBOR that China is doing a variety of investments. “From China’s perspective, it wants to show Pakistan as a model case of how as a result of its initiatives, it was able to transform the place,” adds one observer. “Previously the relationship was based primarily on trade with Pakistan importing from China. With CPEC, it has become an economic partnership.”

China’s stepped-up investment in Pakistan has had other spillover effects. For example, the Pakistan Stock Exchange is one of the region’s best-performing up 17.1% to mid-October 2016 according to the MSCI Share Price Index behind Indonesia (23.1%) and ahead of the Philippines (1.7%) and Malaysia (1.5%). Portfolio investors from Europe and the US are notable especially as Pakistan secured an MSCI upgrade to emerging from frontier market status in June 2016.

Strategic investors are also showing interest to enter the country with a population of 195 million. In July 2016, the Dutch cooperative, FrieslandCampina (best known for the Dutch Lady brand of dairy products), teamed up with the International Finance Corp and FMO, the Netherlands development bank, to acquire a 51% interest in Engro Foods for US$448 million from Engro Corp, one of Pakistan’s largest conglomerates. It is one of the largest private sector foreign direct investment in Pakistan in recent years.

Chinese investors have started to make their move into Pakistan. Shanghai Electric has completed its deal to buy a controlling 66.4% stake in Pakistan power generation and distribution company K-Electric for US$1.77 billion.

Dubai based Abraaj Group said it had signed a definitive agreement, after the transaction was originally announced at the end of August. It is the biggest M&A deal in Pakistan in the past decade. K-Electric serves 2.2 million customers in and around Karachi.

Shanghai Electric Power, which is a subsidiary of State Power Investment Corporation of China, says that the deal makes the beginning of a long term cooperation arrangement with Abraaj. SEP is listed on the Shanghai Stock Exchange.

K-Electric used to be known as Karachi Electric Supply Co, and is the only vertically integrated power utility in Pakistan. Abraaj made its investment in 2009. Since then K- Electric has added 1,000 megawatts (MW) of generating capacity, as well as improving the efficiency of its transmission and distribution network.

K-Electric produces electricity from its own generation units, with an installed capacity of 2,341MW. It also has power purchase agreements for 1,021MW from various Independent Power Producers (IPPs) and from the Karachi Nuclear Power Plant.

Elsewhere, PowerChina Resources is currently building two 330MW units located in the THAR coal mining area. PowerChina is also building two 660MW units at the Port Qasim coal fired power plant, around 40-kilometre from Karachi. The first unit is expected to come into service by the end of 2017. This will be the biggest coal fired plant in Pakistan, with a project cost of US$2 billion.

China is also heavily involved in hydro and oil & gas projects in Pakistan, as it addresses power shortage problems that are holding back economic growth.

China-backed supranational, the Asian Infrastructure Investment Bank (AIIB) has partnered with the Manila-based Asian Development Bank (ADB) in June with each providing a US$100 million loan for a highway project in Pakistan. It marks the first co-financing between the two agencies.

The Department for International Development (DFID) of the UK has also committed a US$34 million grant for the project. As the lead financier, the ADB will administer both the AIIB loan and the DFID grant.

“This is a historic milestone for ADB and AIIB as we jointly aim to meet the pressing infrastructure needs in Asia and the Pacific region,” said ADB president Takehiko Nakao in a statement. “The project has strategic value to Pakistan as it supports north-south connectivity, new trade, and business opportunities, which will boost jobs and cut poverty.” The project is also an integral part of the Central Asia Regional Economic Cooperation (CAREC) corridors.

ADB and AIIB have been preparing projects for co-financing since last year. A memorandum of understanding for collaboration was signed by Nakao and AIIB president Liqun Jin at the time of ADB’s annual meeting in Frankfurt, Germany in early May.

This project will fund the remaining 64-km long four-lane section of the M-4 National Motorway connecting Shorkot and Khanewal in Punjab province. The project constitutes a key part of a 1,800 km CAREC transport corridor linking the port city of Karachi in the south, to major primary production and population centres, including Lahore, Faisalabad, Islamabad and Peshawar, and on to Torkham on the northern border with Afghanistan.

“Some suggests China’s commitment via CPEC to Pakistan is for it to be able to build an alternate to the South China Sea,” shares one banker. “Whatever the reason, China is taking its initiatives in Pakistan seriously.”

to

to