ziaulislam

ELITE MEMBER

- Joined

- Apr 22, 2010

- Messages

- 23,620

- Reaction score

- 9

- Country

- Location

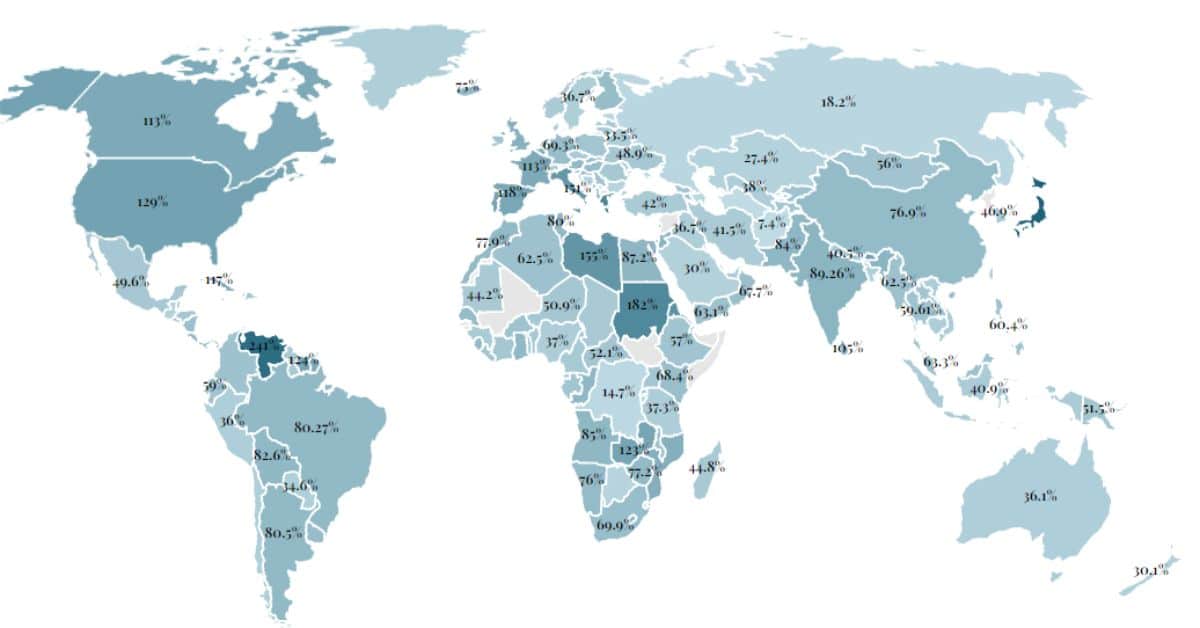

He already posted figures look at them.US household debt is 15.24 Trillion USD. So the total US debt to GDP ratio is 200%.

China's LGFV's * are not included by Bloomberg if you add 7 trillion USD worth of LGFV's China's total debt to GBP ratio is well over 300%.

so no USA figures are not "much higher"

*LGFV's are loans made by banks to local governments

USA total debt is higher then China total debt.

The 279 includes that.That figure includes loans taken by private businesses if you include those numbers for China's then China's ratio will be well over 1000% points.

Without that China debt is much lower less then 70%