Black_cats

ELITE MEMBER

- Joined

- Dec 31, 2010

- Messages

- 10,031

- Reaction score

- -5

Bangladesh eyes $35b slice of Saudi market

30 August, 2022, 11:10 pm

Last modified: 30 August, 2022, 11:18 pm

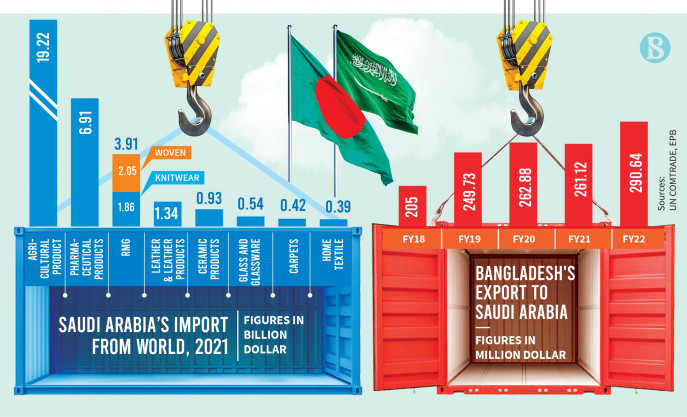

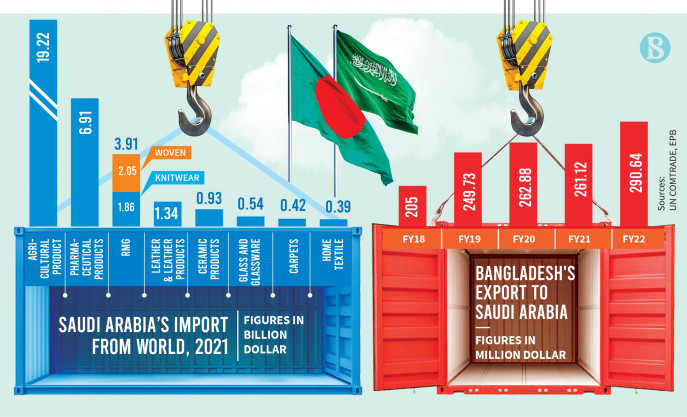

Infographic: TBS

Infographic: TBS

Bangladesh looks to gain a foothold in the Kingdom of Saudi Arabia (KSA) with seven potential products, including food and beverage, apparel, and jute and leather, products which are now sourced from the global market for $35 billion annually.

Ceramic, pharmaceutical, and plastics also have good demand in this market - where Dhaka currently has a stake of less than $300 million.

Keeping this goal in mind, Dhaka wants to showcase its capacity through the first ever "Trade and Investment Fair-2022" in Riyadh to be held during 6-8 October this year, according to a recent letter of the Export Promotion Bureau (EPB).

The expo will also focus on attracting some investment to Bangladesh.

The EPB's effort to plan to explore new export markets by organising a single-country expo is to reduce dependence on US and EU markets.

Similarly, the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) is looking for new markets; as part of its endeavour, it will organise expos in China, Japan and Korea next year to enhance the country's shares in those destinations and reach the $100 billion apparel shipment target by 2030.

According to the International Trade Centre (ITC) data, Saudi Arabia's imports stood at $152.34 billion in 2021. China is the KSA's largest export source, $31.07 billion, followed by the USA, UAE, India and Germany.

On the other hand, Bangladesh exported only $290 million in FY2022, of which apparel shipments amounted to about $144million, according to the EPB. Saudi Arabia is the country's 24th largest export partner out of 202 destinations, while the country is also the 26th largest destination for apparel shipments.

However, EPB data does not show the actual amount of exports to KSA, exporters say. The actual figures are higher, they assert.

They say a good amount of export is conducted informally through individual initiative as cargo or baggage, something that also carries a risk of non-payments for goods.

Talking to The Business Standard, BKMEA Executive president Mohammad Hatem said, "We are scheduled to join the KSA expo to explore the untapped market potential."

Currently, Bangladeshi apparel makers are exporting via some Bangladeshi vendors based in KSA and most of them cheat their exporters, he also said, adding that in most cases, the apparel makers have no recourse as they trade informally.

He hoped that this expo would open up a new window of opportunity to do business with Saudi retailers directly.

BGMEA vice-president Shahidullah Azim said 15 of their members are scheduled to join this expo. The expo potential will also tap the market in the region besides Saudi Arabia as it is also the centre of the Gulf countries.

Saudi Arabia has been sourcing most of their apparel items from China, India, Turkey and other countries. "Our participation is very nominal in this market despite being the second-largest apparel exporter globally," he noted.

A huge opportunity in this market is still untapped owing to a lack of government initiative. It will be a big market for other export items, such as home textile, agricultural products, leather goods, jute and ceramics, he continued.

The government initiative will help to grab at least $5 -$6 billion market share, he pointed out, adding that Arabian traditional dresses are also high in value products.

"We already have good export growth in Asian countries as our alternative markets," Shahidullah Azim said.

To find new buyers and boost earnings from those potential markets, they are also going to participate in an expo in Dubai in November this year.

Rashed Mosharaff, executive director marketing at Zaber and Zubair Fabrics Ltd (Home), said they are doing business in Saudi Arabia and other gulf countries through their own retailers.

Landmark Group, one of the largest retailers based in Dubai, is also doing well in these markets, he said, adding that Zaber and Zubair make home textiles for that retailer under their brands – Max, Homecenter, Babyshop, and Home Box.

Eleash Mridha, managing director at Pran Group, the largest agro-based products exporter, said, "We are having a good business in gulf countries, mostly in KSA, UAE, Qatar and Lebanon."

He also mentioned that gulf countries account for about 30% of their total exports, which also have double-digit growth each year.

Pran-RFL exported goods worth $532 million in FY22, while it also set a target to export products worth $1 billion by 2025.

$10bn RMG potential in Gulf countries yet untapped

Despite good diplomatic relations with Gulf countries, Bangladesh is missing out on the $10 billion unexplored apparel market owing to a lack of initiatives on parts of the government and the private sector.

The Gulf Cooperation Council is a political and economic union of Arab states, including the United Arab Emirates (UAE), Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

According to the International Trade Centre data, in 2020, the UAE sourced about $4.40 billion worth of apparel items from global markets. The numbers for other countries there were: Saudi Arabia $3.01 billion, Kuwait $1.13 billion, Qatar $660 million, Oman $608 million and Bahrain $274 million.

Bangladesh now exports only $367.49 million worth of goods to this region, according to EPB data.

But the country can supply about 5% of the annual demand of the UAE, around 4% of Saudi Arabia's and less than 1% of the rest, the bureau says.

Earlier BGMEA President Faruque Hassan said Bangladeshi apparel exporters have a big potential in the Gulf and Middle East markets that have remained untapped for a long time owing to a lack of initiatives.

"We are planning to explore those markets in association with the commerce ministry and the foreign affairs ministry," he added.

ECONOMY

Jasim Uddin & Salah Uddin Mahmud30 August, 2022, 11:10 pm

Last modified: 30 August, 2022, 11:18 pm

Infographic: TBS

Infographic: TBS

Bangladesh looks to gain a foothold in the Kingdom of Saudi Arabia (KSA) with seven potential products, including food and beverage, apparel, and jute and leather, products which are now sourced from the global market for $35 billion annually.

Ceramic, pharmaceutical, and plastics also have good demand in this market - where Dhaka currently has a stake of less than $300 million.

Keeping this goal in mind, Dhaka wants to showcase its capacity through the first ever "Trade and Investment Fair-2022" in Riyadh to be held during 6-8 October this year, according to a recent letter of the Export Promotion Bureau (EPB).

The expo will also focus on attracting some investment to Bangladesh.

The EPB's effort to plan to explore new export markets by organising a single-country expo is to reduce dependence on US and EU markets.

Similarly, the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) is looking for new markets; as part of its endeavour, it will organise expos in China, Japan and Korea next year to enhance the country's shares in those destinations and reach the $100 billion apparel shipment target by 2030.

According to the International Trade Centre (ITC) data, Saudi Arabia's imports stood at $152.34 billion in 2021. China is the KSA's largest export source, $31.07 billion, followed by the USA, UAE, India and Germany.

On the other hand, Bangladesh exported only $290 million in FY2022, of which apparel shipments amounted to about $144million, according to the EPB. Saudi Arabia is the country's 24th largest export partner out of 202 destinations, while the country is also the 26th largest destination for apparel shipments.

However, EPB data does not show the actual amount of exports to KSA, exporters say. The actual figures are higher, they assert.

They say a good amount of export is conducted informally through individual initiative as cargo or baggage, something that also carries a risk of non-payments for goods.

Talking to The Business Standard, BKMEA Executive president Mohammad Hatem said, "We are scheduled to join the KSA expo to explore the untapped market potential."

Currently, Bangladeshi apparel makers are exporting via some Bangladeshi vendors based in KSA and most of them cheat their exporters, he also said, adding that in most cases, the apparel makers have no recourse as they trade informally.

He hoped that this expo would open up a new window of opportunity to do business with Saudi retailers directly.

BGMEA vice-president Shahidullah Azim said 15 of their members are scheduled to join this expo. The expo potential will also tap the market in the region besides Saudi Arabia as it is also the centre of the Gulf countries.

Saudi Arabia has been sourcing most of their apparel items from China, India, Turkey and other countries. "Our participation is very nominal in this market despite being the second-largest apparel exporter globally," he noted.

A huge opportunity in this market is still untapped owing to a lack of government initiative. It will be a big market for other export items, such as home textile, agricultural products, leather goods, jute and ceramics, he continued.

The government initiative will help to grab at least $5 -$6 billion market share, he pointed out, adding that Arabian traditional dresses are also high in value products.

"We already have good export growth in Asian countries as our alternative markets," Shahidullah Azim said.

To find new buyers and boost earnings from those potential markets, they are also going to participate in an expo in Dubai in November this year.

Rashed Mosharaff, executive director marketing at Zaber and Zubair Fabrics Ltd (Home), said they are doing business in Saudi Arabia and other gulf countries through their own retailers.

Landmark Group, one of the largest retailers based in Dubai, is also doing well in these markets, he said, adding that Zaber and Zubair make home textiles for that retailer under their brands – Max, Homecenter, Babyshop, and Home Box.

Eleash Mridha, managing director at Pran Group, the largest agro-based products exporter, said, "We are having a good business in gulf countries, mostly in KSA, UAE, Qatar and Lebanon."

He also mentioned that gulf countries account for about 30% of their total exports, which also have double-digit growth each year.

Pran-RFL exported goods worth $532 million in FY22, while it also set a target to export products worth $1 billion by 2025.

$10bn RMG potential in Gulf countries yet untapped

Despite good diplomatic relations with Gulf countries, Bangladesh is missing out on the $10 billion unexplored apparel market owing to a lack of initiatives on parts of the government and the private sector.

The Gulf Cooperation Council is a political and economic union of Arab states, including the United Arab Emirates (UAE), Saudi Arabia, Qatar, Oman, Kuwait and Bahrain.

According to the International Trade Centre data, in 2020, the UAE sourced about $4.40 billion worth of apparel items from global markets. The numbers for other countries there were: Saudi Arabia $3.01 billion, Kuwait $1.13 billion, Qatar $660 million, Oman $608 million and Bahrain $274 million.

Bangladesh now exports only $367.49 million worth of goods to this region, according to EPB data.

But the country can supply about 5% of the annual demand of the UAE, around 4% of Saudi Arabia's and less than 1% of the rest, the bureau says.

Earlier BGMEA President Faruque Hassan said Bangladeshi apparel exporters have a big potential in the Gulf and Middle East markets that have remained untapped for a long time owing to a lack of initiatives.

"We are planning to explore those markets in association with the commerce ministry and the foreign affairs ministry," he added.