Destranator

SENIOR MEMBER

- Joined

- Jul 20, 2018

- Messages

- 3,794

- Reaction score

- -3

- Country

- Location

@waz @LeGenD Recommend making this a sticky for posting all Bangladesh Balance of Payments Updates to avoid the need for creating unnecessary new threads every 5 seconds.

Thanks.

Bangladesh forex reserves top $42 billion in pandemic

Bangladesh’s foreign currency reserves have reached another milestone despite the coronavirus pandemic.

Ad

The forex reserves at the Bagnladesh Bank stood at $42.03 billion after the end of Tuesday’s business hours.

Kazi Saidur Rahman, a deputy governor of the central bank, said the achievement was possible mainly due to the remittances sent by Bangladeshis working abroad.

Growth in exports and foreign loans also contributed to the rise of the reserves, he added.

Zaid Bakht, a researcher at Bangladesh Institute of Development Studies, said that a drop in import also helped the forex reserves to grow.

“Such record-breaking reserves will give courage to the government to tackle the pandemic,” he said.

The reserves have increased by nearly $10 billion in a year. On Dec 15 last year, the reserves were $32.11 billion.

They crossed the $41 billion mark for the first time on Oct 29 but dropped again after the clearance of $1.15 billion import bills of September and October to the Asian Clearing Union on Nov 5.

With the current reserves, it is possible to clear import costs of over 10 months.

Thanks.

Bangladesh forex reserves top $42 billion in pandemic

Bangladesh’s foreign currency reserves have reached another milestone despite the coronavirus pandemic.

bdnews24.com

Bangladesh forex reserves top $42 billion in pandemic

Bangladesh’s foreign currency reserves have reached another milestone despite the coronavirus pandemic.

Ad

The forex reserves at the Bagnladesh Bank stood at $42.03 billion after the end of Tuesday’s business hours.

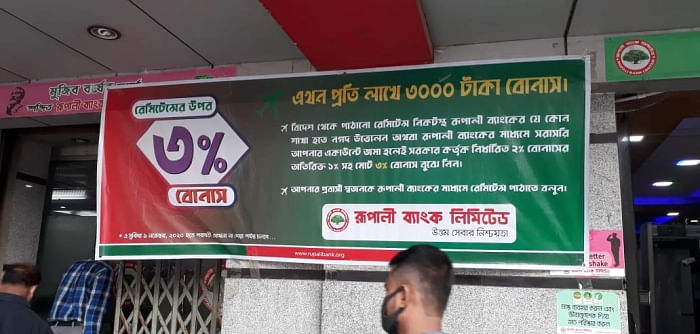

Kazi Saidur Rahman, a deputy governor of the central bank, said the achievement was possible mainly due to the remittances sent by Bangladeshis working abroad.

Growth in exports and foreign loans also contributed to the rise of the reserves, he added.

Zaid Bakht, a researcher at Bangladesh Institute of Development Studies, said that a drop in import also helped the forex reserves to grow.

“Such record-breaking reserves will give courage to the government to tackle the pandemic,” he said.

The reserves have increased by nearly $10 billion in a year. On Dec 15 last year, the reserves were $32.11 billion.

They crossed the $41 billion mark for the first time on Oct 29 but dropped again after the clearance of $1.15 billion import bills of September and October to the Asian Clearing Union on Nov 5.

With the current reserves, it is possible to clear import costs of over 10 months.