Enigma SIG

ELITE MEMBER

- Joined

- Feb 20, 2009

- Messages

- 8,593

- Reaction score

- -5

- Country

- Location

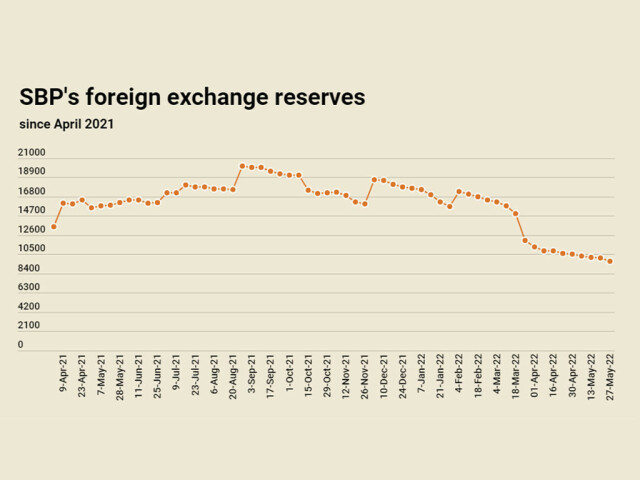

Foreign exchange reserves held by the State Bank of Pakistan (SBP) decreased by $366 million in the period between May 20 to May 27 to stand at $9.72 billion, said the central bank on Thursday, with the level staying at less than 1.5 months of import cover.

This is the lowest level since December 6, 2019. In the week ending May 20, the level had decreased by $75 million to $10.09 billion.

Meanwhile, liquid foreign reserves held by the country stood at $15.77 billion as of May 27, the SBP said in a note. Reserves held by commercial banks clocked in at $6.05 billion.

SBP's reserves fall another $75mn, now stand at $10.09bn

“During the week, SBP reserves decreased by $366 million to $9,722.9 million due to external debt repayment,” the central bank said.

Reserves held by the SBP have been on a declining trend, with Pakistan desperately seeking revival of the International Monetary Fund (IMF) programme, hoping it will pave way for lending from other sources as well.

Miftah says $2.3bn refinancing agreement reached with Chinese banks

During the day, Finance Minister Miftah Ismail had announced that the government reached a refinancing agreement worth $2.3 billion with Chinese banks, a move that would ease pressure on the external front and shore the country's dwindling foreign exchange reserves.

In a tweet, he said that “the terms and conditions for refinancing of RMB 15 billion deposit by Chinese banks (about US$ 2.3 billion) have been agreed".

"Inflow is expected shortly after some routine approvals from both sides. This will help shore up our foreign exchange reserves," the finance minister announced.

His tweet came after Moody's Investors Service (Moody's) downgraded Pakistan’s outlook to negative from stable. It affirmed Government of Pakistan's B3 local and foreign currency issuer and senior unsecured debt ratings.

Moody's downgrades Pakistan's outlook to negative from stable

“The decision to change the outlook to negative is driven by Pakistan's heightened external vulnerability risk and uncertainty around the sovereign's ability to secure additional external financing to meet its needs,” read the statement.

The ratings agency said Pakistan's external vulnerability risk has been amplified by rising inflation, which puts downward pressure on the current account, the currency and – already thin – foreign exchange reserves, especially in the context of heightened political and social risk.

Last week, the IMF mission concluded its talks with Pakistan authorities without a word on reviving the stalled Extended Fund Facility (EFF).

In its statement, the IMF mission said deviations from the policies agreed in the last review, partly reflecting the fuel and power subsidies announced by the authorities in February, require urgency of concrete policy actions, including in the context of removing fuel and energy subsidies and the FY2023 budget, to achieve programme objectives.

"The mission has held highly constructive discussions with the Pakistani authorities aimed at reaching an agreement on policies and reforms that would lead to the conclusion of the pending seventh review of the authorities’ reform program, which is supported by an IMF EFF arrangement," said the IMF in its statement at the conclusion of talks.

Alarm bells: SBP-held foreign currency reserves fall to $9.72bn

* Fall $366mn on a weekly basis due to external debt repayment * Total reserves held by country stand at $15.77 billion as of May 27

www.brecorder.com