Black_cats

ELITE MEMBER

- Joined

- Dec 31, 2010

- Messages

- 10,031

- Reaction score

- -5

2 more banks allowed to trade in rupees, 6 more in pipeline

21 September, 2023, 09:05 am

Last modified: 21 September, 2023, 11:43 am

Photo: Collected

Highlights

The initiative was taken to alleviate the reliance on the US dollar, which has traditionally been the primary currency for Bangladesh's external trade.

The Bangladesh Bank (BB) has already granted permission to two more banks — Islami Bank and Standard Chartered Bank — to engage in trade with India using rupees, bringing the total to four banks participating in this arrangement.

On 11 July when the rupee trade with India was launched, Sonali Bank and Eastern Bank (EBL) assumed responsibility from the Bangladesh side for opening Letters of Credit (LC) in rupees, rather than in dollars, for the import and export of goods with India.

In addition, six more banks — Trust Bank, Social Islami Bank, AB Bank, NCC Bank, Prime Bank, and Premier Bank — have submitted applications to the central bank for authorisation to conduct trade in rupees, a senior central bank official told The Business Standard.

"The applications of these banks are currently under review," said Zakir Hossain Chowdhury, executive director of the Bangladesh Bank.

Mohammad Mamdudur Rashid, managing director and CEO of NCC Bank, said, "We applied to join the rupee trade a month ago. This form of bilateral trade, conducted outside of international currencies, is a novel endeavour for our banks. Nevertheless, we believe it presents opportunities for our institutions, which is why we are keen to be part of it."

Referring to the process of trade in rupees, bankers said, first the traders will export the goods and receive the price in rupees. It will be deposited in the Nostro account of the concerned bank in India. Later, the trader can pay the import cost from the earned rupees. By doing this, the loss that we had in case of conversion from dollar to rupee or taka, will not happen anymore.

This process of trade is likely to be expanded in the future, a policymaking officer of a private bank said, "Currently, 18 countries in the world trade in rupees. As our bilateral trade increases, we may also export to other countries and receive payments in rupees. These rupees will help meet the cost of imports from India."

So far, EBL has opened and settled Pran Toast worth INR1.1 million for Pran Group and Packing raw materials worth INR1.3 million for the same group.

Amit Kumar, country head of the State Bank of India in Bangladesh, told The Business Standard, "In July, we opened an LC for import of vehicles and export of crude soya oil with the Neetal-Niloy Group. A total of four LCs of INR 16.1 million in imports and INR 12.4 million in exports have been opened so far."

Apart from this, Standard Chartered Bank, Bangladesh has opened import and export LC for Walton Hi-Tech Industries PLC, a concern of the Walton Group.

Ahmed Shaheen, additional managing director of EBL, said, "Trade in rupees is a bit of a new experience for our banks. It has just begun. So initially, import and export will be in small amounts but the volume will gradually increase."

Pointing out that it is possible to meet the import cost of about $2 billion with rupees, he said, "Currently, we export goods worth about $2 billion to India annually. That is, out of the $14 billion cost of our imports, $2 billion dollars of payment can be made in rupee."

"If trade with India was in dollars, those who buy products from us in India would have to face trouble in fixing the prices of their products. But they do not have to do that conversion while trading in rupees. They will buy in rupee and sell in rupee, as a result, it will be easier to determine their prices," he said.

The experienced banker also said the pressure on the country's reserves will decrease if trade in the rupee picks up more steam.

www.tbsnews.net

www.tbsnews.net

BANKING

Tonmoy Modak21 September, 2023, 09:05 am

Last modified: 21 September, 2023, 11:43 am

In addition, six more banks — Trust Bank, Social Islami Bank, AB Bank, NCC Bank, Prime Bank, and Premier Bank — have submitted applications to the central bank for authorisation to conduct trade in rupees, a senior central bank official told The Business Standard.

Photo: Collected

Photo: Collected

Highlights

- The rupee trade with India was launched on 11 July

- At that time, Sonali Bank and Eastern Bank assumed responsibility for opening LCs in rupees

- Trust Bank, Social Islami Bank, AB Bank, NCC Bank, Prime Bank, and Premier Bank have also sought permission to conduct trade in rupees

- The applications of these banks are currently under review

The initiative was taken to alleviate the reliance on the US dollar, which has traditionally been the primary currency for Bangladesh's external trade.

The Bangladesh Bank (BB) has already granted permission to two more banks — Islami Bank and Standard Chartered Bank — to engage in trade with India using rupees, bringing the total to four banks participating in this arrangement.

On 11 July when the rupee trade with India was launched, Sonali Bank and Eastern Bank (EBL) assumed responsibility from the Bangladesh side for opening Letters of Credit (LC) in rupees, rather than in dollars, for the import and export of goods with India.

In addition, six more banks — Trust Bank, Social Islami Bank, AB Bank, NCC Bank, Prime Bank, and Premier Bank — have submitted applications to the central bank for authorisation to conduct trade in rupees, a senior central bank official told The Business Standard.

"The applications of these banks are currently under review," said Zakir Hossain Chowdhury, executive director of the Bangladesh Bank.

Mohammad Mamdudur Rashid, managing director and CEO of NCC Bank, said, "We applied to join the rupee trade a month ago. This form of bilateral trade, conducted outside of international currencies, is a novel endeavour for our banks. Nevertheless, we believe it presents opportunities for our institutions, which is why we are keen to be part of it."

Referring to the process of trade in rupees, bankers said, first the traders will export the goods and receive the price in rupees. It will be deposited in the Nostro account of the concerned bank in India. Later, the trader can pay the import cost from the earned rupees. By doing this, the loss that we had in case of conversion from dollar to rupee or taka, will not happen anymore.

This process of trade is likely to be expanded in the future, a policymaking officer of a private bank said, "Currently, 18 countries in the world trade in rupees. As our bilateral trade increases, we may also export to other countries and receive payments in rupees. These rupees will help meet the cost of imports from India."

So far, EBL has opened and settled Pran Toast worth INR1.1 million for Pran Group and Packing raw materials worth INR1.3 million for the same group.

Amit Kumar, country head of the State Bank of India in Bangladesh, told The Business Standard, "In July, we opened an LC for import of vehicles and export of crude soya oil with the Neetal-Niloy Group. A total of four LCs of INR 16.1 million in imports and INR 12.4 million in exports have been opened so far."

Apart from this, Standard Chartered Bank, Bangladesh has opened import and export LC for Walton Hi-Tech Industries PLC, a concern of the Walton Group.

Ahmed Shaheen, additional managing director of EBL, said, "Trade in rupees is a bit of a new experience for our banks. It has just begun. So initially, import and export will be in small amounts but the volume will gradually increase."

Pointing out that it is possible to meet the import cost of about $2 billion with rupees, he said, "Currently, we export goods worth about $2 billion to India annually. That is, out of the $14 billion cost of our imports, $2 billion dollars of payment can be made in rupee."

"If trade with India was in dollars, those who buy products from us in India would have to face trouble in fixing the prices of their products. But they do not have to do that conversion while trading in rupees. They will buy in rupee and sell in rupee, as a result, it will be easier to determine their prices," he said.

The experienced banker also said the pressure on the country's reserves will decrease if trade in the rupee picks up more steam.

Completion of major infrastructure projects to boost investment in Bangladesh: ADB

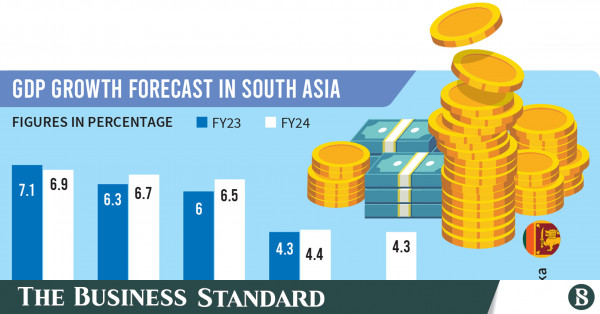

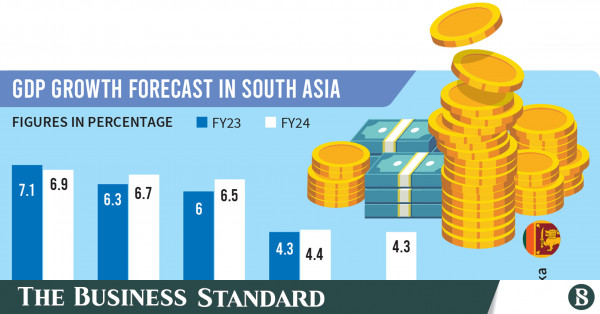

Bangladesh's GDP is expected to grow 6.5% in FY24, compared to 6.0% last year, forecasts the ADB