Black_cats

ELITE MEMBER

- Joined

- Dec 31, 2010

- Messages

- 10,031

- Reaction score

- -5

$12b from exports did not come home last year

20 August, 2023, 11:55 pm

Last modified: 21 August, 2023, 12:16 am

Export receipts based on the central bank’s data declined to $43 billion in FY23 from $43.68 billion in FY22

Infographics: TBS

" style="box-sizing: inherit; outline: currentcolor; cursor: pointer;">

Infographics: TBS

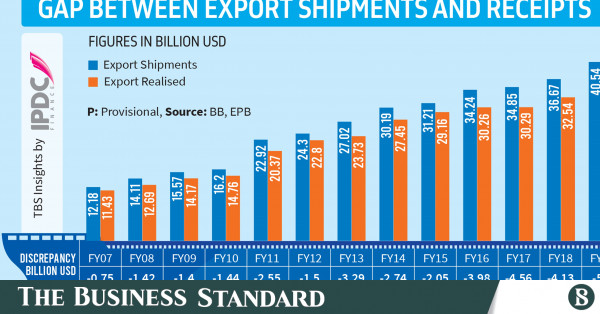

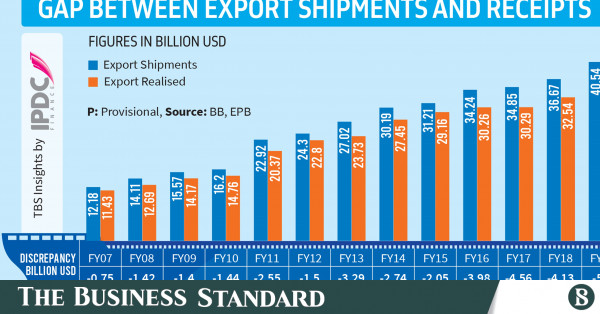

In fiscal 2022-23, export receipts totaled $43 billion, a figure 22% lower than the export shipment value of $55.6 billion, as reported by the Bangladesh Bank. The unrealised export value was twice the amount recorded in FY22 and six times higher than that of FY20.

While common factors such as time lag and export bill discounts can account for mismatches between shipment and realised values, a senior executive at the Bangladesh Bank noted that the recent trend of unrealised export proceeds is unusually high.

In light of this situation, the central bank initiated the collection of export documents to ascertain the reasons behind this surge in unrealised export proceeds, he said.

The senior executive also noted that the extent of overdue and time-lagged unrealised proceeds is still unknown to the Bangladesh Bank.

Bangladesh's global market share in clothing exports rises to 7.9%

Nonetheless, this substantial backlog of export proceeds held abroad contributes to the widening trade deficit, despite robust export growth and controlled import expenditure.

This disparity arises because the government relies on the Export Promotion Bureau (EPB) data, which is based on shipment value.

Conversely, the Bangladesh Bank formulates balance of payment statements and calculates reserves based on exports received through banking channels. This divergence has led to the inability to rebuild foreign exchange reserves, even in the face of considerable export growth and negative import growth.

In FY23, export growth, based on shipment value, was 6.28%, whereas import growth was a negative 15.76% according to the country's Balance of Payment statement. However, when considering the actual export value received, the growth in exports was slightly negative.

Export receipts in FY23 totaled $43 billion, a slight decline from $43.68 billion in the preceding year. The EPB's data relies on the customs' bill of export, while the Bangladesh Bank's data stems from the realisation of export procedures in banking systems.

The mismatch between export shipment and realised value has been notably pronounced over the last two years since FY22 after the Bangladesh Bank started to devalue the Taka amidst a rising dollar crisis.

In FY22, unrealised export proceeds reached $8.4 billion, with export receipts lagging 16% behind shipment value of $52 billion, as disclosed by Bangladesh Bank data in the publication titled "Export Receipts of Goods and Services".

The central bank data demonstrated that unrealised export proceeds ranged from 10% to 12% of the export shipment value between FY07 and FY21, with figures varying from $1 billion to $5 billion.

The impact of the substantial unrealised export proceeds over the past couple of years was reflected in negative trade credit in FY23, according to the Bangladesh Bank's Balance of Payment statement.

The country's trade credit, which is the difference between unrealised export proceeds and import payment obligations, plummeted from negative $438 million in FY22 to a historic low of negative $6.5 billion in FY23.

In response to queries regarding the escalating value of unrealised exports during the monetary policy announcement event for the current fiscal year in June, Bangladesh Bank Governor Abdur Rouf Talukder explained that some exporters were deliberately delaying the repatriation of export proceeds to capitalise on currency devaluation.

He further mentioned that exporters were permitted to retain export proceeds in their Export Retention Quota (ERQ) account, and a six-month time lag existed between shipment and receipt.

Referring to the export trend for the first six months of the current year, he stated, "We have observed a $2 billion gap between export realisation and shipment value."

He, however, expressed optimism that the Bangladesh Bank's issuance of a circular to deter gains from devaluation would contribute to reducing the unrealised export value.

What exporters say

MA Rahim Feroz, vice president of DBL Group, a prominent exporter in the country, told TBS that his company does not have any overdue amounts.

He expressed astonishment at the reported $12 billion overdue and suggested, "I believe the figure should be closer to two or three billion dollars."

Feroz, also a director of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), further said, "When the amount of order is low, some buyers send the proceeds late claiming quality issues. Due to this, the overdue may increase. Now some exporters, especially small and medium ones, are facing it."

However, he dismissed the notion that these delays are indicative of money laundering activities.

With heavy reliance on RMG, Bangladesh revises down export target to $70b

Shahidullah Azim, a vice president of the BGMEA, echoed similar sentiments, attributing the export proceeds overdue to buyers' payment delays.

He cited the decreased demand for products due to the Russia-Ukraine war as a key factor behind buyers not meeting their financial obligations on time, leading to a rise in overdues.

Azim further clarified that the BGMEA lacks precise information concerning the extent of export funds being withheld.

Mahmud Hasan Khan Babu, managing director of Rising Group, a prominent exporter in the country, has refuted the accusation of intentionally delaying the processing of proceeds, purportedly based on the anticipation of the Bangladeshi currency's devaluation against the US dollar.

"Any exporters failing to promptly proceed with their transactions would be ineligible to access the low-interest loan facilities offered under the refinancing scheme by the Bangladesh Bank, including the Export Development Fund (EDF). If the loan is forced again, additional interest charges would be levied. Consequently, no exporters will intentionally delay or become overdue in their proceedings," he explained.

Babu emphasised that exporters who have no intention of repatriating their proceeds will never do so.

Rising export overdue

Customs data reveal that overdue export earnings amounted to $80 million in 2022, marking the highest figure within the past five years.

According to regulations, there is a stipulated obligation to repatriate this money within a maximum of 180 days following the submission of export documents to the importer's bank after goods have been shipped.

A historical trend demonstrates that export overdue tends to be more pronounced before election years.

For example, in 2017, just before the national election in 2018, the export overdue was a substantial $1.76 billion.

A similar pattern was observed in 2012 with an amount of $30.5 million, right before the national election in 2013.

This trend seems to have continued into 2022, as the national election approaches.

www.tbsnews.net

www.tbsnews.net

ECONOMY

Jebun Nesa Alo & Reyad Hossain20 August, 2023, 11:55 pm

Last modified: 21 August, 2023, 12:16 am

Export receipts based on the central bank’s data declined to $43 billion in FY23 from $43.68 billion in FY22

Infographics: TBS

" style="box-sizing: inherit; outline: currentcolor; cursor: pointer;">

Infographics: TBS

- In FY23, export growth, based on shipment value, was 6.28%, whereas import growth was a negative 15.76% according to the country's Balance of Payment statement

- However, when considering the actual export value received, the growth in exports was slightly negative

- Unrealised export value in FY23 was twice that of FY22, six times FY20

- Mismatch between shipment and realised value attributed to Taka devaluation

- Trade credit drops to historic low -$6.5b

- Exporters cite buyer payment delays, quality issues; deny money laundering involvement

In fiscal 2022-23, export receipts totaled $43 billion, a figure 22% lower than the export shipment value of $55.6 billion, as reported by the Bangladesh Bank. The unrealised export value was twice the amount recorded in FY22 and six times higher than that of FY20.

While common factors such as time lag and export bill discounts can account for mismatches between shipment and realised values, a senior executive at the Bangladesh Bank noted that the recent trend of unrealised export proceeds is unusually high.

In light of this situation, the central bank initiated the collection of export documents to ascertain the reasons behind this surge in unrealised export proceeds, he said.

The senior executive also noted that the extent of overdue and time-lagged unrealised proceeds is still unknown to the Bangladesh Bank.

Bangladesh's global market share in clothing exports rises to 7.9%

Nonetheless, this substantial backlog of export proceeds held abroad contributes to the widening trade deficit, despite robust export growth and controlled import expenditure.

This disparity arises because the government relies on the Export Promotion Bureau (EPB) data, which is based on shipment value.

Conversely, the Bangladesh Bank formulates balance of payment statements and calculates reserves based on exports received through banking channels. This divergence has led to the inability to rebuild foreign exchange reserves, even in the face of considerable export growth and negative import growth.

In FY23, export growth, based on shipment value, was 6.28%, whereas import growth was a negative 15.76% according to the country's Balance of Payment statement. However, when considering the actual export value received, the growth in exports was slightly negative.

Export receipts in FY23 totaled $43 billion, a slight decline from $43.68 billion in the preceding year. The EPB's data relies on the customs' bill of export, while the Bangladesh Bank's data stems from the realisation of export procedures in banking systems.

The mismatch between export shipment and realised value has been notably pronounced over the last two years since FY22 after the Bangladesh Bank started to devalue the Taka amidst a rising dollar crisis.

In FY22, unrealised export proceeds reached $8.4 billion, with export receipts lagging 16% behind shipment value of $52 billion, as disclosed by Bangladesh Bank data in the publication titled "Export Receipts of Goods and Services".

The central bank data demonstrated that unrealised export proceeds ranged from 10% to 12% of the export shipment value between FY07 and FY21, with figures varying from $1 billion to $5 billion.

The impact of the substantial unrealised export proceeds over the past couple of years was reflected in negative trade credit in FY23, according to the Bangladesh Bank's Balance of Payment statement.

The country's trade credit, which is the difference between unrealised export proceeds and import payment obligations, plummeted from negative $438 million in FY22 to a historic low of negative $6.5 billion in FY23.

In response to queries regarding the escalating value of unrealised exports during the monetary policy announcement event for the current fiscal year in June, Bangladesh Bank Governor Abdur Rouf Talukder explained that some exporters were deliberately delaying the repatriation of export proceeds to capitalise on currency devaluation.

He further mentioned that exporters were permitted to retain export proceeds in their Export Retention Quota (ERQ) account, and a six-month time lag existed between shipment and receipt.

Referring to the export trend for the first six months of the current year, he stated, "We have observed a $2 billion gap between export realisation and shipment value."

He, however, expressed optimism that the Bangladesh Bank's issuance of a circular to deter gains from devaluation would contribute to reducing the unrealised export value.

What exporters say

MA Rahim Feroz, vice president of DBL Group, a prominent exporter in the country, told TBS that his company does not have any overdue amounts.

He expressed astonishment at the reported $12 billion overdue and suggested, "I believe the figure should be closer to two or three billion dollars."

Feroz, also a director of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), further said, "When the amount of order is low, some buyers send the proceeds late claiming quality issues. Due to this, the overdue may increase. Now some exporters, especially small and medium ones, are facing it."

However, he dismissed the notion that these delays are indicative of money laundering activities.

With heavy reliance on RMG, Bangladesh revises down export target to $70b

Shahidullah Azim, a vice president of the BGMEA, echoed similar sentiments, attributing the export proceeds overdue to buyers' payment delays.

He cited the decreased demand for products due to the Russia-Ukraine war as a key factor behind buyers not meeting their financial obligations on time, leading to a rise in overdues.

Azim further clarified that the BGMEA lacks precise information concerning the extent of export funds being withheld.

Mahmud Hasan Khan Babu, managing director of Rising Group, a prominent exporter in the country, has refuted the accusation of intentionally delaying the processing of proceeds, purportedly based on the anticipation of the Bangladeshi currency's devaluation against the US dollar.

"Any exporters failing to promptly proceed with their transactions would be ineligible to access the low-interest loan facilities offered under the refinancing scheme by the Bangladesh Bank, including the Export Development Fund (EDF). If the loan is forced again, additional interest charges would be levied. Consequently, no exporters will intentionally delay or become overdue in their proceedings," he explained.

Babu emphasised that exporters who have no intention of repatriating their proceeds will never do so.

Rising export overdue

Customs data reveal that overdue export earnings amounted to $80 million in 2022, marking the highest figure within the past five years.

According to regulations, there is a stipulated obligation to repatriate this money within a maximum of 180 days following the submission of export documents to the importer's bank after goods have been shipped.

A historical trend demonstrates that export overdue tends to be more pronounced before election years.

For example, in 2017, just before the national election in 2018, the export overdue was a substantial $1.76 billion.

A similar pattern was observed in 2012 with an amount of $30.5 million, right before the national election in 2013.

This trend seems to have continued into 2022, as the national election approaches.

$12b from exports did not come home last year

Export receipts based on the central bank’s data declined to $43 billion in FY23 from $43.68 billion in FY22