Bangladesh joining BRICS. What now?

Infographic: TBS

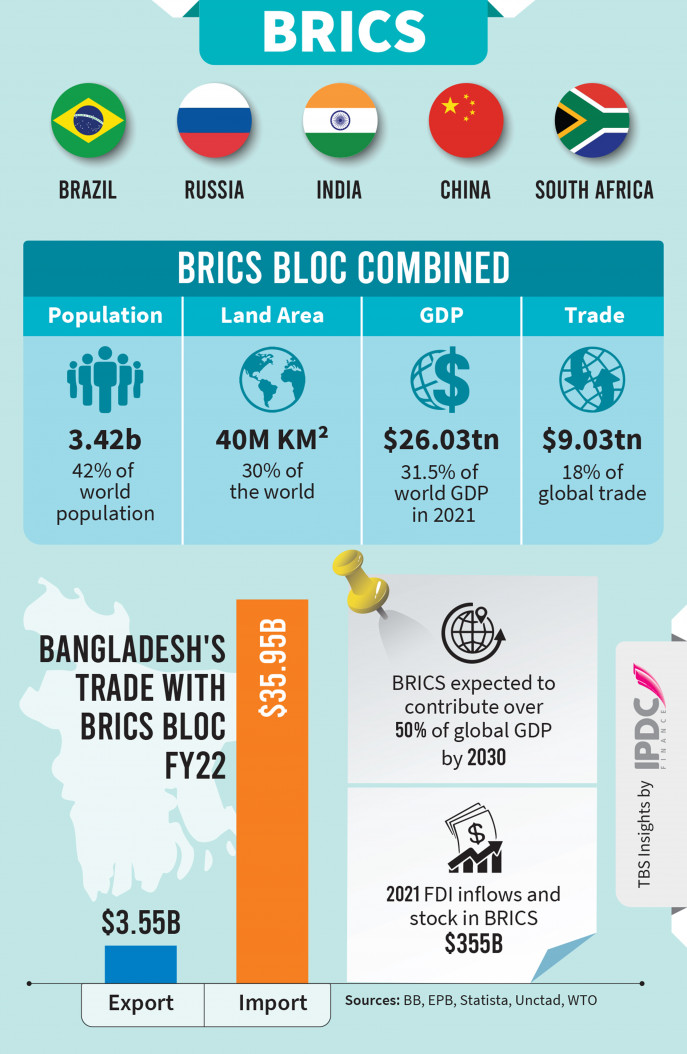

As the BRICS looks to expand and Bangladesh hopes to join it in August, analysts have started weighing the gains from being part of the bloc that aims to create a new global order to counter the dominance of US and its currency dollar.

Foreign Minister AK Abdul Momen on Wednesday said in Geneva that Bangladesh is likely to become a member of the BRICS in August this year.

After a meeting between Prime Minister Sheikh Hasina and South African President Matamela Cyril Ramaphosa, Momen said the BRICS Bank had invited Bangladesh as a guest, adding that in the future it would invite Bangladesh to join in.

Bangladesh's decision to join BRICS, which groups Brazil, Russia, India, China and South Africa, with a share of global GDP surpassing that of rich nations' club G7, is seen as a move to diversify foreign relations and currency.

While immediate benefits may not be apparent, analysts believe that joining BRICS will yield medium- to long-term advantages as the bloc actively expands to reduce the dominance of the US and the US dollar.

Foreign Minister AK Abdul Momen announced that Bangladesh, along with Saudi Arabia, the United Arab Emirates, and Indonesia, has been invited to join BRICS. These countries are expected to join the group in August during a summit in South Africa.

Professor Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), views this as a positive step, considering BRICS' status as the largest club of developing economies and its increasing economic and political influence.

"Joining BRICS will deepen Bangladesh's relations with these countries. It will also help Bangladesh diversify its foreign relations," he said. Of the BRICS countries, China and India are the top two trade partners of Bangladesh, accounting for almost 40% of its imports.

Professor Mustafizur recently attended an event in Shanghai as a panelist on the sidelines of the annual meeting of the New Development Bank (NDB), a bank formed by BRICS. He said that the NDB is considering the introduction of an alternative currency in October, which could benefit Bangladesh by diversifying its currency and foreign exchange reserves beyond the US dollar.

Bangladesh has already become a member of the NDB in 2021, and joining BRICS would increase its voice and access to funds from the bank, according to Professor Mustafizur.

Dr MA Razzaque, research director of Policy Research Institute of Bangladesh, also welcomed Bangladesh's decision to join BRICS.

"But we have to keep in mind that it is not a trade bloc and there will be no immediate economic benefit from joining this group," he said.

Razzaque, who is a trained economist specialising in applied trade and development issues, said there will be indirect benefits from joining the dynamic group. He said Bangladesh can be more proactive in global issues and bat for setting agenda, such as technology transfer and promoting bilateral trade, in the BRICS meeting.

Immediate benefits may come as foreign investments as investors would think that Bangladesh is a member of this biggest bloc of developing economies, he said. Also, there is a chance that bilateral trade between the member countries would increase, he noted.

"Joining BRICS will open up issues for discussion and help Bangladesh leverage in getting benefits," said Razzaque.

On the floating of the single currency by BRICS, he said it would be very difficult at the moment as the member countries are not in a position to follow a unified monetary policy like that of the European Union.

However, M Humayun Kabir, former Bangladesh's ambassador to the USA, termed BRICS as a "loose kind of economic bloc" where there are economic competitors.

He said there is nothing wrong with the engagement in the multilateral forums as the global situation and geo-politics are changing fast.

"But it is also important to conduct the cost-benefit analysis of joining BRICS and not joining BRICS as there are issues like de-dollarization and launching of common currency among the members of the group," said Kabir, a career diplomat who retired in 2010.

"As there is de-dollarization and alternative currency issues in the BRICS, there is geo-politics and the USA may not be happy," he said.

BRICS is on expansion

BRICS, which stands for Brazil, Russia, India, China, and South Africa, is actively considering its first enlargement in over a decade. The aim is to further solidify itself as a representative of the "Global South" and provide an alternative model to the developed economies of the Group of Seven (G7) nations.

According to Anil Sooklal, South Africa's ambassador to BRICS, at least 20 countries have applied for BRICS membership. The proposed expansion, initially suggested by China during its chairmanship in 2022, would increase representation from countries in Africa, Latin America, the Middle East, and Asia. Some of the interested nations include Saudi Arabia, Egypt, Nigeria, Mexico, Iran, Indonesia, Turkey, and others.

Countries such as Bangladesh, Saudi Arabia, the United Arab Emirates, and Indonesia are making progress toward joining the bloc.

Sooklal views this as positive news, as it reflects the confidence of the Global South in the leadership of BRICS.

The relevance of BRICS has increased, particularly for countries in the Global South, in light of Russia's invasion of Ukraine. These nations seek to resist the West's "autocracy vs democracy" narrative, as noted by Ryan Berg, director of the Americas Program at the Center for Strategic and International Studies (CSIS), in a report published in the Japan Times in May of this year.

On 1 June 2023, the BRICS Ministers of Foreign Affairs and International Relations met in Cape Town, South Africa, and issued a joint statement. They recognized the impact on the world economy caused by unilateral approaches in violation of international law.

Additionally, they highlighted that the situation is further complicated by unilateral economic coercive measures, such as sanctions, boycotts, embargoes, and blockades.

The joint statement emphasized the importance of promoting the use of local currencies in international trade and financial transactions among BRICS members and their trading partners.

Enlargement of BRICS to boost its economies

The BRICS bloc, consisting of Brazil, Russia, India, China, and South Africa, is actively expanding and working towards establishing a new economic framework to challenge the dominance of the US dollar.

In terms of their share in the global GDP, BRICS has already surpassed G7 economies. It is projected that by 2030, BRICS will contribute over 50% of the global GDP, and the proposed enlargement of the bloc will likely accelerate this trend.

Even without expansion, the BRICS countries currently have a population of 3.42 billion, accounting for 42% of the world's population. In 2021, the group contributed 31.5% of the global GDP, amounting to $26.03 trillion. BRICS nations also accounted for 18% of global trade.

Experts believe that if countries such as Saudi Arabia, Indonesia, and Bangladesh join the bloc, the contribution of BRICS to the global GDP and trade will increase significantly.

BRICS targets to move away from US dollar

The New Development Bank (NDB), established by BRICS in 2015, took in Bangladesh, the UAE, and Uruguay as new members in September 2021, bringing the total membership to eight. Additionally, three more countries, Argentina, Saudi Arabia, and Zimbabwe, have been approved as new members.

The NDB's new chief, Dilma Rousseff, former leftist President of Brazil, recently announced that the bank is gradually moving away from the US dollar. She pledged that at least 30% of loans would be provided in the local currencies of member countries. The aim of diversifying currencies is to reduce the bloc's reliance on the dollar and help developing nations avoid the negative impact of exchange rate fluctuations, as experienced by Bangladesh over the past year.

The US dollar serves as the global reserve currency, and therefore, US domestic monetary policy has implications for the world economy. Since March 2022, the US Federal Reserve, the country's central bank, has aggressively increased interest rates. This has exerted downward pressure on the currencies of many Global South nations, resulting in higher costs for importing foreign goods and servicing dollar-denominated debts, while also encouraging capital flight.

Rousseff emphasized the need to establish a diversified global currency system during the NDB annual meeting earlier this month.

Unlike the World Bank, no country holds veto power in the NDB. The Bank's president is elected from one of the founding members on a rotational basis, and each of the other founding members must have at least one vice-president.

আরেকটি কথা। আপনি অভ্র সফটওয়্যার ডাউনলোড করে ফোরামে বাংলা লিখতে পারেন

আরেকটি কথা। আপনি অভ্র সফটওয়্যার ডাউনলোড করে ফোরামে বাংলা লিখতে পারেন