beijingwalker

ELITE MEMBER

- Joined

- Nov 4, 2011

- Messages

- 65,191

- Reaction score

- -55

- Country

- Location

ignorance has no boundaries

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

ignorance has no boundaries

Why are you still shamelessly in denial after being caught lying in front of everyone? so you still insist that China doesn't produce bananas?View attachment 910633

Australia must be one of the major Banana Production country then, judging by this photo.

Yes, indeed, ignorant know no bound

You are such a helpless liar...You can't read does not equate to I lied.

I wrote "Banana is NOT NATIVE to China" You can grow it in a green house or anywhere with climate control facilities

Even in your map, Guangxi and Yunnan are in the green, and Guangxi and Yunnan not part of China?I wrote "Banana is NOT NATIVE to China" You can grow it in a green house or anywhere with climate control facilities

By the way this is the map of what Banana is native at

View attachment 910635

lol... Even in your map, Guangxi and Yunnan are in the green, many other Chinese provinces are in orange, and Guangxi and Yunnan not part of China? or you just can't read your own map?Wow, exactly how stupid were you.

You cannot produce Banana (Naturally) they are native in sub-Tropical area. You can "FARM" in greenhouse it. Did you even know how to grow fruit?

Why would I talk about where banana is native in if I am not talking about how you grow them naturally??

What? I move goal posts? are you kidding me? first you said China doesn't produce bananas and later you said you mean China can't "naturally" grow bananas ... they are both wrong, and now you are accusing me of moving goal posts? are you for real?I can't argue when you keep moving your goal post.

Yuan is not free trade currency. Imagine one day Chinese government decides to allow Yuan to be traded freely. Yuan's share will rise sharply. The day will come when China makes breakthrough in semiconductor and more profitable goods like EV dominate world market.

lol, you are just incredible, why you never admit that you could make a mistake? this is what you wrote, let everyone translate it to see if anyone could understand it otherwiseLol, you first were called out by the mistake on tell me I lie, and then I reminded you what I wrote,

Denial is not a river in Egypt, you are just incredible...Sure, repeat your claim, that make it more believable.

lol, sure USD is backed by faith, is that why China uses USD as denomination of their Forex and use it to almsot all International Financial activities. And probably to around 140 countries in the world.

Dude, the only thing that show is you know nothing about Finance and Currency.

Lol Then ask your self why CCP hasnt allowed (and probably wont ever allow) the Yuan to trade freely. CCP likes to be in control of everything, for them to allow the Yuan to be freely traded means they will lose control over it and it will be left to market forces which is something CCP won't allow anytime soon. LolYuan is not free trade currency. Imagine one day Chinese government decides to allow Yuan to be traded freely. Yuan's share will rise sharply. The day will come when China makes breakthrough in semiconductor and more profitable goods like EV dominate world market.

Can China grow bananas, naturally?And Repeat is not a town in China, just because you keep saying the same thing does not make it true dude.

All it will make you is an off topic comment warning and maybe a ban.

Off topic? who brought bananas in this thread?All it will make you is an off topic comment warning and maybe a ban.

These yahoo don't know how deep US Dollar cut into world economy. The world financial system is build based on US Dollar.The US Fed's monetary policy has ramifications on global asset pricing, currency movements, global inflation, global economic growth, corporate/government funding globally, deposit interest rates and even the monthly mortgage people in faraway countries pay.

Do Chinese monetary policymakers even have 10% of that global influence? Who really cared when China cut interest rates the last time?

Meanwhile PDF Chinese who know nuts about the finance are saying the USD with >40% share of global transaction volume is backed only with faith and the RMB is more reliable lmao.

Man, I am just going to report your post from now on. Not really a point talking to you.Can China grow bananas, naturally?

Off topic? who brought bananas in this thread?

Reporting me? for debunking your lies? Can China grow bananas, naturally? yes or no?Man, I am just going to report your post from now on. Not really a point talking to you.

Lol Then ask your self why CCP hasnt allowed (and probably wont ever allow) the Yuan to trade freely. CCP likes to be in control of everything, for them to allow the Yuan to be freely traded means they will lose control over it and it will be left to market forces which is something CCP won't allow anytime soon. Lol

Value of your dollar doesnt matters with all this BS capital control. In the meantime, I know some troll will claim Yuan is worthless and China made low quality products which nobody wants. Yet these troll countries continue to have record trade deficiency with China and import record made in China products.

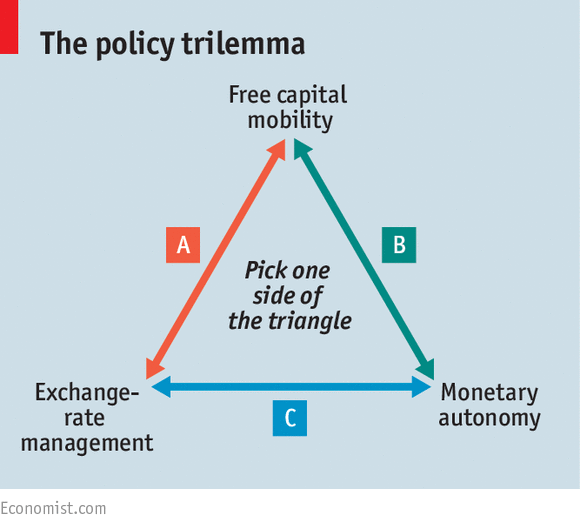

The impossible trinity says that between free capital mobility, exchange-rate management and an independent monetary policy, a country can only choose two out of these three.

Examples of A, B and C.

A – Singapore: Manages exchange rates (managed float) and allows free capital flow > gives up control over interest rates, leaving it to market forces.

B – US: Controls interest rates and allows free capital flow > gives up control over exchange rates, leaving it to market forces.

C – China: Controls both interest rates and exchange rates > restricts capital flow. The last time China toyed with the idea of free capital flow in 2015, $1tril of their foreign reserves got wiped out and it dropped from ~$4tril to ~$3tril. Capital controls were swiftly tightened.

View attachment 910696

Meanwhile PDF Chinese: We are going to liberalize the Yuan when we sell more EVs.