UBS Global Real Estate Bubble Index 2023: Deflating bubbles

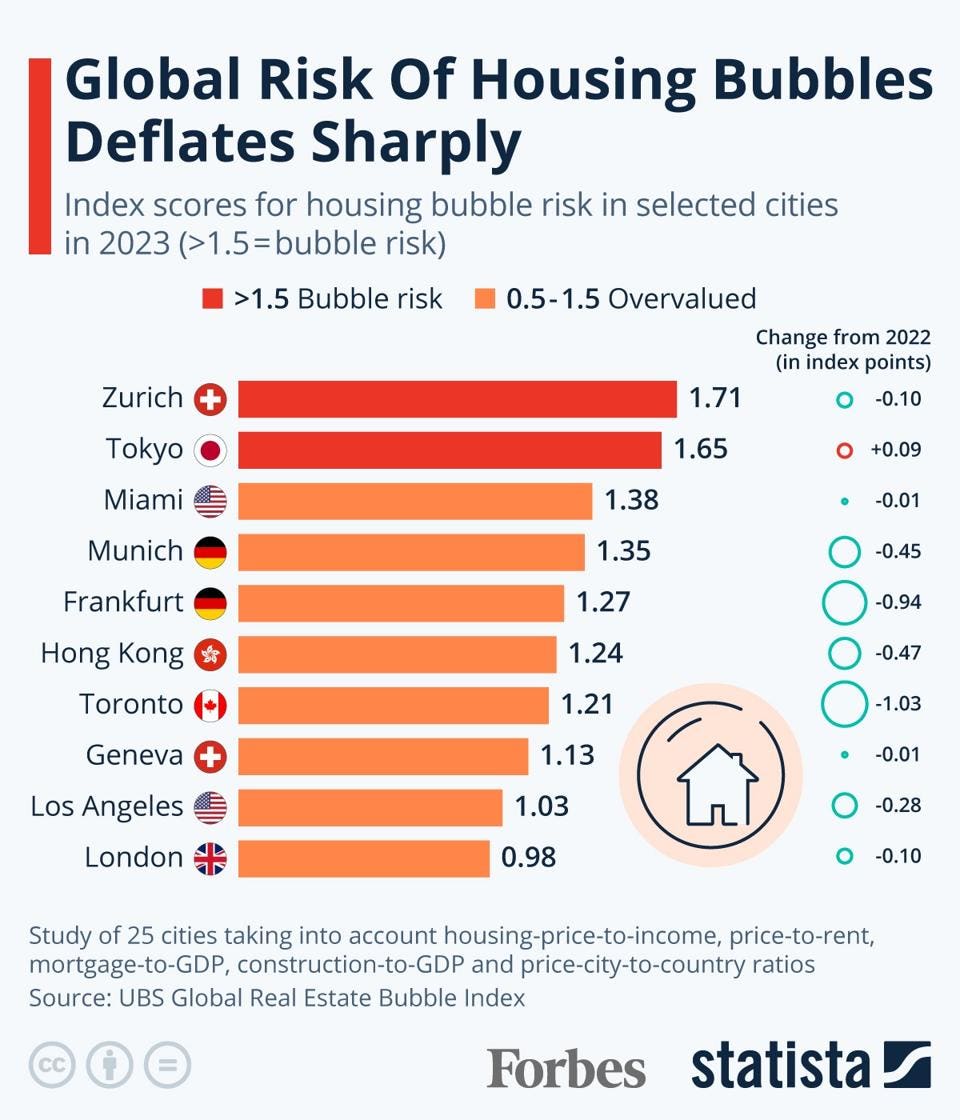

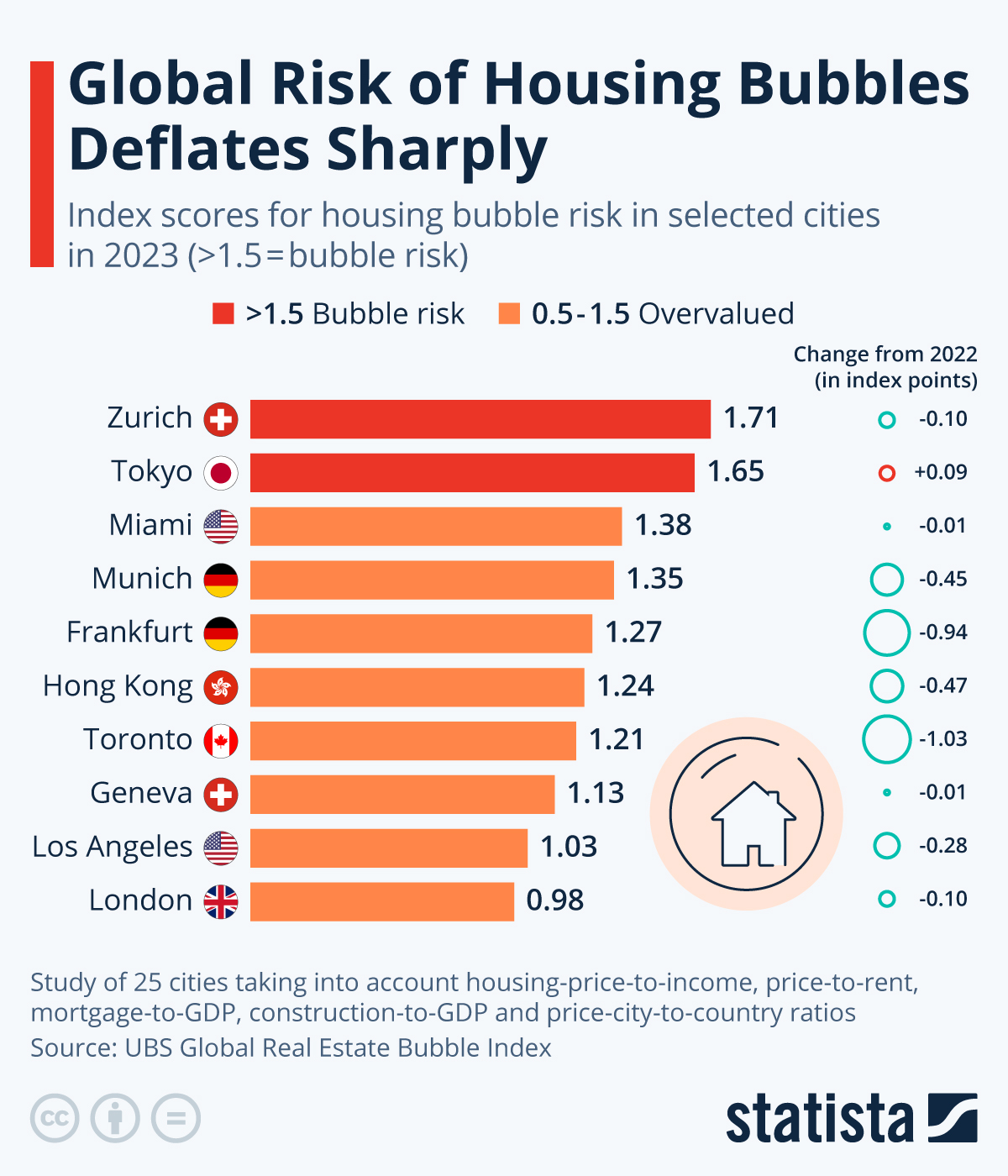

According to this year’s edition of the UBS Global Real Estate Bubble Index, imbalances in housing markets declined sharply. Only Zurich and Tokyo remain in the housing bubble risk category. For the study, UBS analyzed residential property prices in 25 major cities around the world.

From mid-2022 to mid-2023, real house prices in the cities fell by 5% on average. More downside in prices is likely.

Zurich, 20 September 2023 – The global surge in inflation and interest rates over the past two years has led to a sharp decline in imbalances in the housing markets of global financial centers on average, according to the

UBS Global Real Estate Bubble Index 2023. In this year’s edition

, only two cities – Zurich and Tokyo – remain in the bubble risk category, down from nine cities a year ago. Formerly in the bubble risk zone, Toronto, Frankfurt, Munich, Hong Kong, Vancouver, Amsterdam, and Tel Aviv, are now all in the overvalued territory. Unchanged from the previous year, housing markets in Miami, Geneva, Los Angeles, London, Stockholm, Paris, and Sydney also continue to be

overvalued.

Similarly, New York, Boston, San Francisco, and Madrid have experienced a drop in imbalances. These housing markets are now fairly valued, according to the index, as are Milan, São Paulo, and Warsaw. This also applies to Singapore and Dubai, even though their reputation as geopolitical safe havens has recently triggered a surge in demand for both renting and buying.

Price corrections across the board

House price growth has suffered due to rising financing costs as average mortgage rates have roughly tripled since 2021 in most markets. Annual nominal price growth in the 25 cities analyzed came to a standstill after a buoyant 10% rise a year ago. Claudio Saputelli, Head of Real Estate at UBS Global Wealth Management’s Chief Investment Office, adds: “In inflation-adjusted terms, prices are actually 5% lower now than in mid-2022. On average the cities lost most of the real price gains made during the pandemic and are now close to mid-2020 levels again.“

In Frankfurt and Toronto – the two cities with the highest risk scores in last year’s edition – real prices tumbled by 15% in the last four quarters. A combination of high market valuations and relatively short mortgage terms also put prices under strong pressure in Stockholm and to a lesser degree in Sydney, London, and Vancouver. In contrast, in Madrid, New York, and São Paulo – cities with moderate risk valuations so far – real home prices have continued to rise at a moderate pace.

Inflation reduces bubble risk

The sharp drop in imbalances was not only driven by declining house prices but also by inflation-driven income and rental growth. As mortgage lending growth has

halved since mid-2022, household debt to income has been declining, especially in Europe. And – apart from the US – nominal rental growth has accelerated markedly and has been positive in all locations analyzed.

However, inflation-driven income growth, as well as price corrections, have not been enough to meaningfully improve affordability. On average, the amount of living space that is financially affordable for a skilled service worker is still 40% lower than before the pandemic began. More downside in prices – at least in real terms – is likely if interest rates remain at their current elevated levels.

Demand shows green shoots

In some cities, however, the seeds for the next property price boom have already been sowed. Hybrid working has not weakened demand for city-living in a sustained manner and the housing shortage will likely intensify as fewer building permits have been issued recently – most notably in European urban centers.

Matthias Holzhey, lead author of the study at UBS Global Wealth Management, concludes: “Housing demand continues to accumulate and prices may rebound as soon as financial conditions for households improve.”

According to this year’s edition of the UBS Global Real Estate Bubble Index, imbalances in housing markets declined sharply. Only Zurich and Tokyo remain in the housing bubble risk category. For the study, UBS analyzed residential property prices in 25 major cities around the world. From...

www.ubs.com