Shipyard Capacity, China’s Naval Buildup Worries U.S. Military Leaders

1/26/2023

By Meredith Roaten

While U.S. military leaders exchange fire over what the next-generation of naval fleets will look like, the shipbuilding industrial base is treading water.

Since 2016, the Navy has been working toward a 355-ship fleet goal as outlined in its long-term force structure plan.

But Navy ambitions have been complicated by the Marine Corps’ modernization strategy, prompting back-and-forth between service leadership and lawmakers regarding future fleet size and structure.

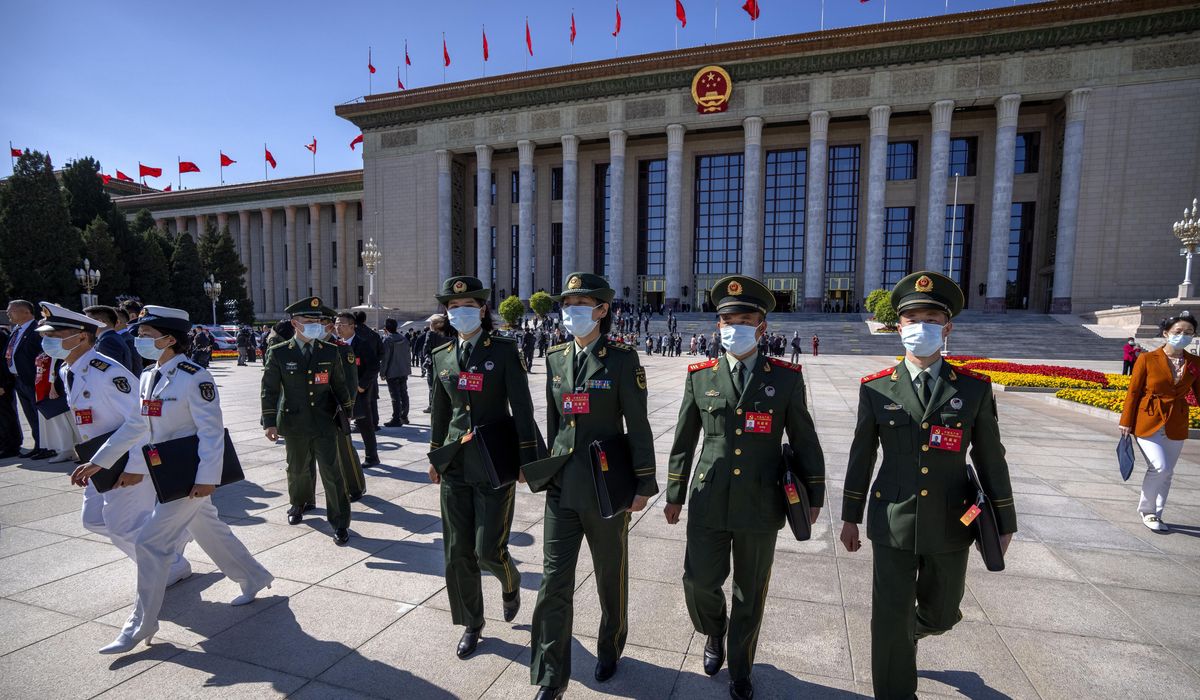

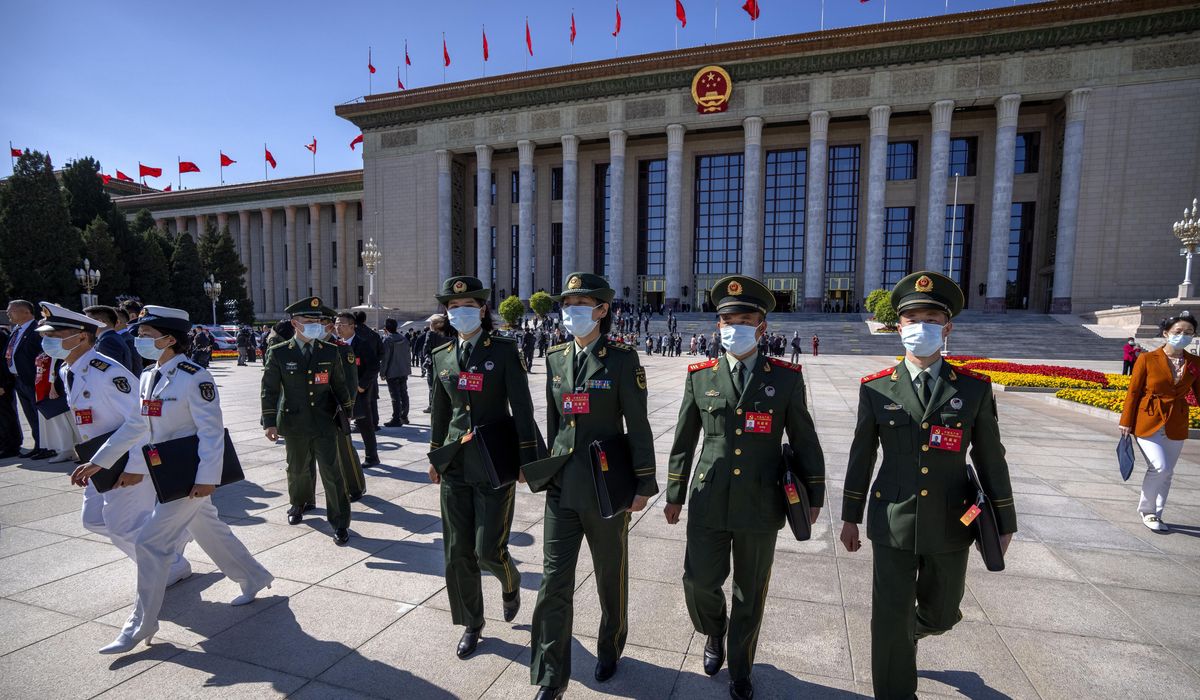

In addition, China’s more aggressive moves in the Indo-Pacific — especially considering Taiwan — is elevating the need for greater shipbuilding and maintenance capacity to meet demand, naval power experts said.

Retired Adm. Phil Davidson, former commander of Indo-Pacific Command, predicted in 2021 that the following six years would see China’s threat to naval forces reach its height.

An October report entitled “A Modern Naval Act to Meet the Surging China Threat” from the conservative think tank the Heritage Foundation called for legislation to increase shipbuilding capacity and action within what policymakers have begun to call “the Davidson window.”

Brent Sadler, senior research fellow at the Heritage Foundation’s Center for National Defense, said in the report: “A war with China would be decided at sea, and an American victory will depend on having adequate naval forces.”

While the Navy has planned to keep the fleet greater than 300 ships, the service has averaged 10 ships below its own procurement plans since 2017 and has sustained fewer than 300 warships since 2003, Sadler noted. During the same time, China has increased its fleet capacity by about 150 ships, according to the report.

Sadler estimates that it would take two to three years to expand shipbuilding capacity due to the vendor selection process — which is why Congress should pass legislation in the next session if the Navy wants to be ready by 2027.

Marine Corps Commandant Gen. David Berger said that China is far behind in capability but is expanding rapidly in capacity.

“They're building an amphibious force so they can project power, and I don't see that trajectory stopping,” he said during a Defense Writers Group event in December. “So capability wise [they are] way behind us. Capacity wise, we should pay absolute attention to [it].”

Some lawmakers support increasing maritime capacity, especially those who represent constituents who stand to benefit from a boost to the local economy.

In July, House Armed Services Committee members Rep. Elaine Luria, D-Va., and Rep. Jared Golden, D-Maine, introduced a $37 billion National Defense Authorization Act amendment that would have appropriated more than $4 billion for ship procurement and maintenance. Virginia and Maine are home to two of the United States’ four public shipyards.

Luria warned a reduction in fleet size would decrease capability “in the timeframe when the threat from China is the greatest,” she said in a press release at the time. The amendment asked for funding to invest in public and private shipyards crucial to maintaining the fleet, build one additional Arleigh Burke-class destroyer this fiscal year and restore five littoral combat ships along with other research and development investments.

The authorization bill, including the amendment, was signed into law in December, charting a course for Congress to fund the additional destroyer. That brings the total to three ships in the next fiscal year.

Lawmakers also passed language in the legislation that could help the Marine Corps’ bid to increase amphibious ship production.

The legislation authorizes $32.6 billion in spending for Navy shipbuilding, including one amphibious ship. However, it clarifies that the Navy cannot enter into a contract without consulting with the Marine Corps first.

As for maintenance of existing ships, Adm. Daryl Caudle, the commander of U.S. Fleet Forces Command, said the lack of capacity “is placing a large and unsustainable strain on our [Optimized Fleet Response Plan], our operational availability and our forward presence options.”

The Navy currently has four public shipyards designated for maintenance and overhauls.

When asked if there’s an argument to be made for opening a fifth public shipyard, Caudle replied: “Of course, I mean … I need six.”

The Navy has stated that because of maintenance costs and delays, it could move to decommission several amphibious ships, including four amphibious dock landing ships, in the coming years counter to the Marine Corps’ modernization plan, known as Force Design 2030.

However, the Navy commissioned a study that has yet to be released that would provide analysis of how many amphibious ships would make up the final count. The service has a requirement for 31 ships, but Berger said the NDAA enables the service to move beyond that.

Regardless of the distribution of ships across the services, the Marine Corps and Navy are more aware of the precarious position that shipyards are in than ever before, Berger added.

“I think the Department of Defense leadership, civilian and uniformed, is a lot more aware of — even if we're not smart enough on — the industrial base than we were five years ago,” he said.

He noted shipbuilding mergers have cut down the number of shipyards significantly, reducing capacity and competition.

“Industrial capacity, diversity — this is a discussion like every week, and it never was before,” he said.

In November, Bollinger Shipyards acquired ST Engineering subsidiary VT Halter Marine, the shipyard that has a contract for the Coast Guard’s new Polar Security Cutter. It will be the first icebreaker built in the United States since the 1970s.

The program has pushed back its delivery date to the Coast Guard from 2025 to about 2026, Coast Guard Vice Adm. Peter Gautier, deputy commandant for operations, told the House Transportation and Infrastructure Subcommittee on Coast Guard and Maritime Transportation in December.

Berger noted labor is the “main limiting factor” for shipyard capacity, as workforce retention has taken a hit across industries because of the COVID-19 pandemic. But he also said the uncertainty of business in the shipbuilding industry has made it even more challenging to keep workers.

“We got to keep that active, warm producing all the time,” he said. If production goes cold, it makes it “harder and harder to bring that factory back, harder to bring those workers back.”

He added competition could help cut costs in the long run.

“I think if the CNO had his druthers, he would double the number of shipyards tomorrow because we need capacity and we need competition,” Berger said. “We need both to get the citizens a good price on their ships, right?”

Caudle said: “I need enough capacity in our shipyards to drive down the [maintenance] backlog to zero,” he said. “We just continue to stack ships up [and] not get them back into the fight. So … yes, we need to be thinking about what we do to increase that capability.”

ANALYSIS: Shipyard Capacity, China’s Naval Buildup Worries U.S. Military Leaders

www.nationaldefensemagazine.org

www.washingtontimes.com

www.washingtontimes.com