beijingwalker

ELITE MEMBER

- Joined

- Nov 4, 2011

- Messages

- 65,191

- Reaction score

- -55

- Country

- Location

Can anyone challenge China’s EV battery dominance?

Edward White and Christian Davies in Seoul, Ryan McMorrow in Ningde and Harry Dempsey in London

August. 27 2023

Designed to look like its lithium-ion cells, CATL’s headquarters towers over its surroundings in Ningde, eastern China.

The group’s low-cost batteries, which power one in three electric vehicles worldwide, have made the coastal city a must-visit destination for any auto executive thinking about affordable next-generation cars.

Its 18,000 research staff, along with an R&D budget that doubled last year to more than $2bn, show how hard it will be for rivals to catch up. Banners on CATL’s factory walls underline its determination to stay in front, urging staff to “break through, break through and break through again”.

The company and Shenzhen-based BYD have raced ahead of battery rivals in South Korea and Japan, leaving the US and Europe contemplating how to stoke an electric car industry without relying on China for the most important and costly piece of the puzzle.

But given China’s lead, particularly in the lower-cost battery type that has come to dominate the local market despite its restricted driving range, the question is whether anyone can develop cheaper or better technology to loosen China’s grip.

“The rest of the world’s ‘miss’ on batteries is that they prioritised battery chemistry tied to performance, not affordability,” said Bill Russo, founder of consultancy Automobility and Chrysler’s former China head. “What we’ve discovered in China is that electrification, and the democratisation of the EV, prioritises consumer affordability. By making it cheaper, China wins.”

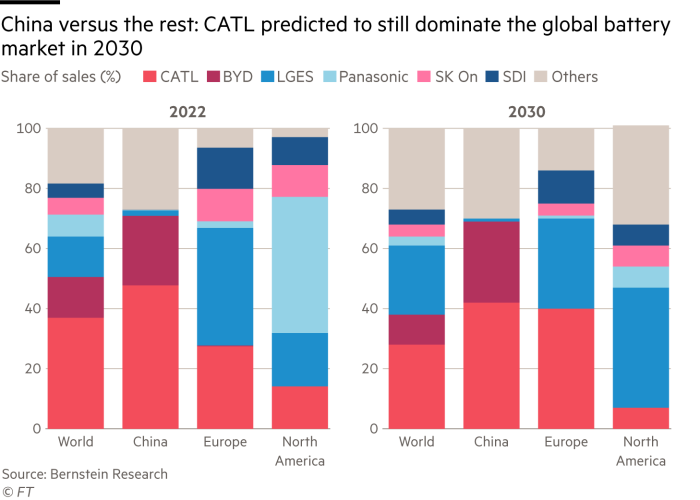

Founded just 12 years ago, CATL has stormed into an industry hitherto controlled by a clutch of American, European, Japanese and Korean carmakers. Under founder Robin Zeng, it has carved out about 37 per cent of the global electric vehicle battery market, supplying brands from Tesla and BMW to Volkswagen and Ford.

“New entrants can’t quickly catch up,” said a CATL spokesperson. “We are way ahead in innovation and we have demonstrated the ability to rapidly transfer R&D to mass production.”

In one recent example of the Chinese group’s prowess, US carmaker Ford has turned to licensing CATL’s technology and engineering knowhow to build a $3.5bn battery plant in Michigan.

BYD, or Build Your Dreams, is no less impressive. Backed by Warren Buffett, Wang Chuanfu’s company has cornered almost 15 per cent of the battery market, powering not only its own fast-growing EV brands but also rival carmakers in China.

As the dominant battery forces in the world’s largest EV market and with local supply chains, CATL and BYD have managed to lower the capital costs at their factories to less than $60mn per gigawatt hour of batteries produced, according to Bernstein analysts, against $88mn/GWh for LG and SK, the two biggest Korean groups, and $103mn/GWh for Japan’s Panasonic.

With the cost gap appearing insurmountable, foreign rivals are staking their futures on emerging technologies.

The most immediate challenge comes from South Korea’s LG Energy Solution, SK On and Samsung SDI, which all specialise in lithium-ion batteries using NMC cathodes composed of lithium, nickel, manganese and cobalt.

The technology, used in the majority of electric vehicles sold outside China, offers longer range and higher performance than the lithium iron phosphate (LFP) cathode chemistry in which CATL specialises. But it is more expensive, has a shorter lifespan and has a history of causing fire.

Tim Bush, a Seoul-based battery analyst for UBS, believes predictions that Chinese LFP technology is destined to dominate the global EV battery market fail to appreciate differences in driving behaviour between China and the west.

“The average Chinese EV consumer is making short trips within a large city with much greater charging infrastructure,” said Bush. “That is totally different to a consumer in North America who would think nothing of driving 500 miles in a single weekend.”

He added that if nickel prices start to come down as projected when large Indonesian projects come online over the next decade, the gap in cost between NMC and LFP batteries would narrow substantially.

Japan’s Panasonic hopes it can compete by targeting high-end batteries and concentrating investments in the US, where it is planning to build at least two plants to quadruple its battery capacity by 2030.

The company is betting the higher energy density of its nickel-rich batteries, which proponents say also offer advantages in charging time, safety and recyclability, will give it an advantage over CATL’s LFP cells.

Having built a reputation for reliable production through its partnership with Tesla, Panasonic is in talks to supply Japanese carmakers Mazda and Subaru. People close to the negotiations said the companies had also weighed risks posed by US-China tensions in debating where to procure batteries.

“Considering their technology is at the same level and the political factors involved, it’s unlikely for Panasonic to lose and CATL to win in North America,” said Koji Abe, professor and batteries expert at Yamaguchi University.

Among other nascent technologies with disruptive potential is the solid-state battery, which holds the prospect of huge improvements in capacity and charging time while eliminating use of volatile, flammable liquid electrolytes.

Toyota last month announced a solid-state breakthrough it said would halve the size, cost and weight of its EV batteries.

Glen Merfeld, chief technology officer at Albemarle, the world’s largest lithium company, said the performance gains in solid-state cells “will open up other application spaces that we probably can’t even predict from where we sit today”, suggesting next-generation batteries could power long-distance trucking, aviation or even shipping.

Several types of solid-state electrolyte are under development, all facing technical issues including the challenge of avoiding the formation of dendrites — metal filaments that can cause short circuits.

Asim Hussain, chief marketing officer at Volkswagen-backed US solid-state developer QuantumScape, said the technology would be vital if the US is to take a battery lead over China rather than merely catching up.

But critics note that solid-state producers are yet to show transparent data on their research.

“Solid-state has generated a lot of excitement in the battery industry but its promise has not yet been delivered into batteries produced at scale,” said Kevin Shang, battery analyst at consultancy Wood Mackenzie.

Dirk Uwe Sauer, energy storage professor at Germany’s RWTH Aachen University, also cautioned on solid-state’s immediate prospects, saying, “the Chinese have recognised earlier that this run towards higher energy density is not the way to go”.

Sodium-ion batteries are also set to play a big role in alleviating demand for lithium-ion products, particularly in the rapidly growing energy storage sector.

The cells, made from materials that are low-cost and abundant, are 15-20 per cent cheaper than their dominant NMC and LFP lithium-ion counterparts — and the cost could ultimately fall much further.

Whether they gain traction in cars is less certain because of their low energy density, although about 17 Chinese carmakers are considering their use, according to research by commodity trader Trafigura.

“What’s going to be interesting is what the effect of sodium-ion batteries is going to be on LFP. Sodium is such a reasonable drop-in technology,” said Clare Grey, battery professor at Cambridge university and chief scientist at battery materials start-up Nyobolt.

The technology is less of a threat to Chinese dominance, given CATL is already a leader in the technology and has stolen a march in securing a supply chain, analysts say. The group is expected to mass-produce the first generation of sodium-ion batteries for Chinese carmakers this year.

Solid-state and sodium-ion batteries are likely to take market share from different directions: sodium-ion for battery storage and entry-level cars, and solid-state for expensive, high-performance vehicles.

Shirley Meng, battery professor at the University of Chicago, concludes that while the two next-generation technologies have a big role to play, it will not necessarily be at the expense of lithium-ion cells.

“With geopolitics, supply chain issues and manufacturing that isn’t green, the [forecast] 10-times growth in battery demand is difficult for lithium-ion, so that’s why sodium-ion and solid-state come in,” she said.

The question of whether anyone can beat the Chinese battery industry may also be decided by factors beyond technology, performance or price.

President Joe Biden’s Inflation Reduction Act is likely to play a defining role in shaping the industry’s winners and losers, at least on US soil.

Biden has promised hundreds of billions of dollars in taxpayer-funded subsidies to cut US economic dependence on China and boost local manufacturing. Chinese groups have been blocked from generous consumer tax credits and hit with additional tariffs.

Yanmei Xie, a China analyst at Beijing consultancy Gavekal Research, also points out that a big barrier for many western countries in the fledgling battery industry has been environmental.

“Nobody has had the stomach for having these polluting and extremely energy-intensive factories on their home soil,” she said.

A more pertinent question may be which jurisdictions have the toughest trade policies to keep the Chinese groups at bay. While it is possible that Europe follows the US in its efforts to curb Chinese dominance, such moves are unlikely elsewhere.

“The reality is, without any sort of trade barrier, it is hard to see anyone competing seriously with CATL,” said Xie.

Can anyone challenge China’s EV battery dominance?

Technology breakthroughs and trade barriers will be needed to take on CATL and BYD