Get Ya Wig Split

SENIOR MEMBER

- Joined

- Feb 22, 2017

- Messages

- 2,585

- Reaction score

- -2

- Country

- Location

Apple Stock: It Could Reach $5 Trillion By 2025

AAPL has failed to stay above the $3 trillion valuation mark, but it could reach well past it in a few years. In fact, I think that Apple stock might be worth $5 trillion by 2025.Apple stock (AAPL) - Get Free Report has failed to stay above the $3 trillion market cap by any longer than a day or two. But this is not to say that share value can not climb substantially above these levels in the next four years.

In fact, I believe that Apple could be worth $ 5 trillion by then. Here is how I see the journey unfolding through the end of 2025.

AAPL: $5 trillion around the corner

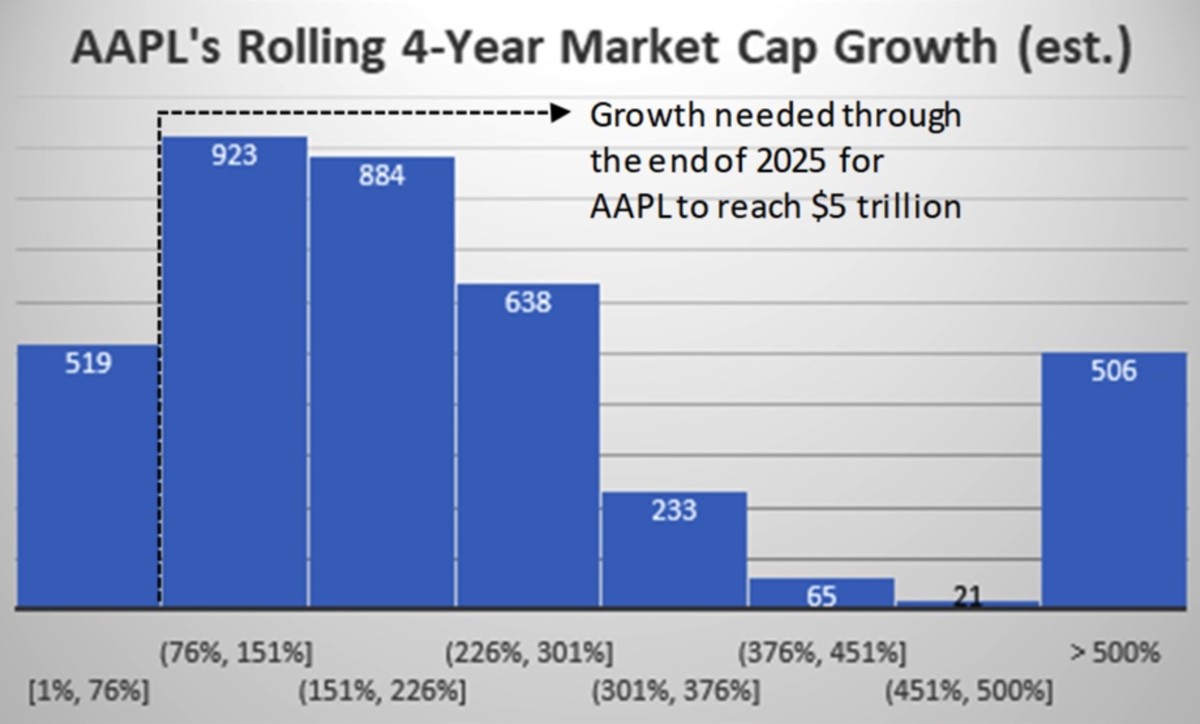

The number “5 trillion” may sound a bit too large to our limited human brains that are not used to dealing with such figures. Also, considering that Apple stock is worth around $2.8 trillion today, the near doubling of the market cap seems a bit aggressive over such a short period of time.But for AAPL to get to $5 trillion in value, its market cap would need to “only” rise by about 15% compounded annually through the end of 2025 (the math: $2.8 trillion times 1.15 to the power of 4 years), or about 75% cumulative. Does this rate of growth sound unrealistic?

Glass half empty

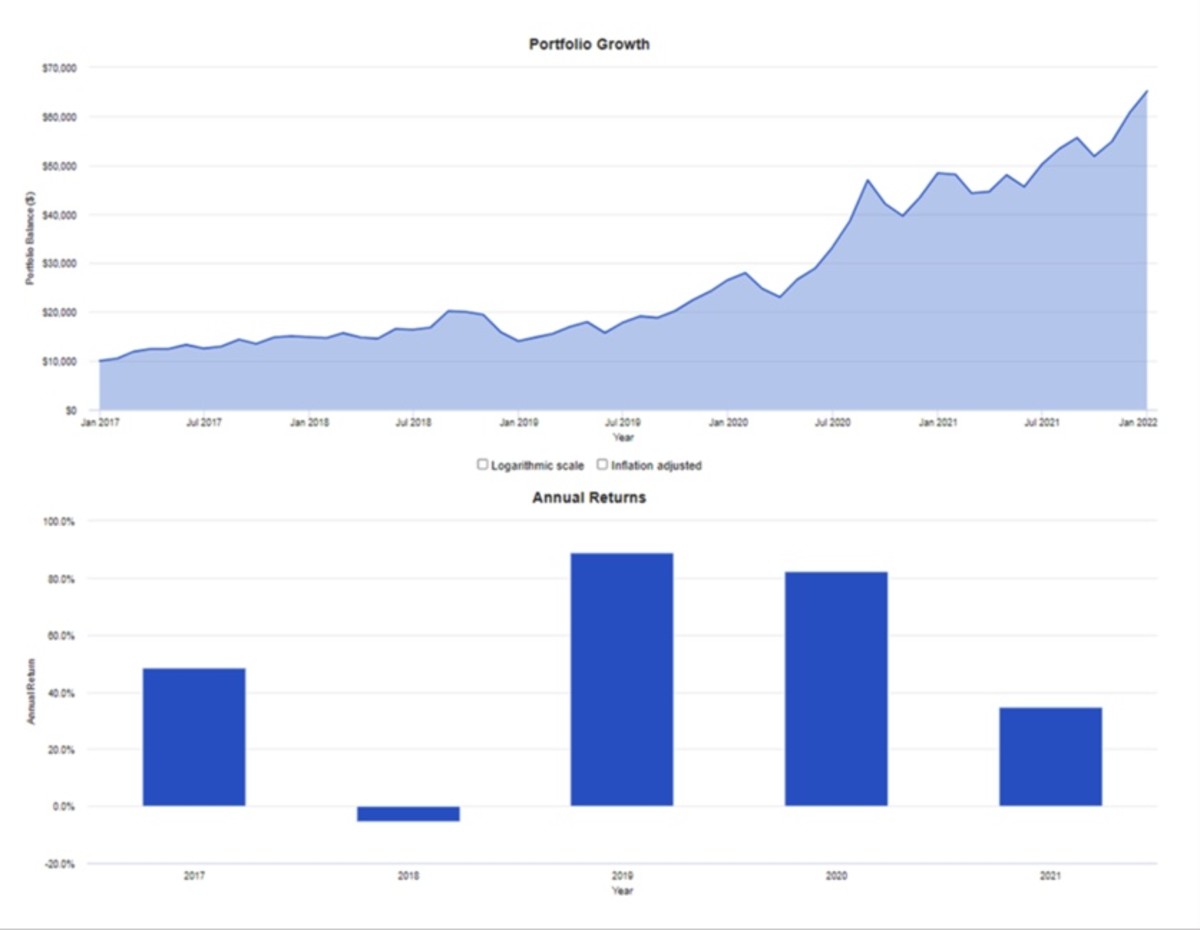

The more pessimistic investor might say “no way!” Apple stock has already climbed 550% over the past five years alone, with annual peaks of 89% in 2019 and 82% in 2020 (see below). It did so, in part, due to lower interest rates and the tailwinds of the pandemic-era, stay-at-home consumer trends. Both will have been left in the rearview mirror by the end of 2022.

Glass half full

But the more optimistic investor may see a different path forward. From a historical perspective, Apple stock has produced annual returns that are substantially better than the S&P 500’s over a long period: 33% vs. the broad market’s 11% since the start of the iPhone era.Because I am looking four years into the future through the end of 2025, it helps to analyze AAPL’s rolling four-year performance. Since 2007, when the iPhone was introduced, AAPL’s market cap climbed an average of 315% over any given four-year stretch (median 135%). This would be more than enough to send Apple stock well past $5 trillion by 2025.

What could make it happen

Of course, past results are not a guarantee of future performance. Apple’s market cap managed to grow aggressively over the last several years because it had plenty of room to do so. Today, Apple is already the most valuable company in the world.So, for $5 trillion to happen, the Cupertino company would need growth catalysts. Luckily for its shareholders, Apple has plenty of potential candidates.

The first is increased adoption of existing technology: smartphones, tablets, wearables and associated services, like streaming subscriptions and in-app purchases. While the US and Europe are more mature markets in which Apple is already a dominant force, developing markets offer much better growth prospects — see below.

The other growth route is through new technologies. This is the most likely path to $5 trillion by 2025, in my view.

Mixed reality devices will probably be a key building block of the metaverse. Morgan Stanley’s research team thinks that the yet-to-be-released Apple Glass will be the game changer that ultimately sparks the new internet 3.0 revolution.

Then, a bit later, the Cupertino giant is likely to launch the Apple Car — its official entry into the autonomous and electric vehicle space. Wedbush’s Dan Ives has chimed in on the opportunity, and he even quantified it during our conversation last year:

The combination of historical precedence in share price movements and growth opportunities in “old” and new technologies lead me to believe that Apple stock could, in fact, be worth $5 trillion in just a few years.“When I look at the Apple Car, it’s not a matter of if, it’s a matter of when. I believe they are continuing to build a vision, the infrastructure, they are looking for partnerships on the battery side. […] They are not going to miss out on the $5 trillion green tidal wave.”