Furqan Sarwar

FULL MEMBER

- Joined

- Aug 20, 2016

- Messages

- 326

- Reaction score

- 0

- Country

- Location

Rocket explosion is blow to SpaceX, Facebook and others

After a thunderous explosion rocked SpaceX's main launch pad in Florida, destroying a rocket and a satellite Facebook was going to use to beam Internet to parts of Africa, companies are counting the cost.

No one was injured in the massive blast that left a Falcon 9 rocket engulfed in flames in Cape Canaveral on Thursday. But while the human cost was zero, financially the accident could leave its mark on several involved companies' bottom lines.

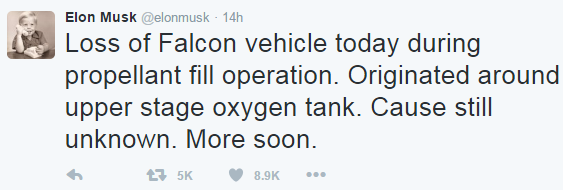

The explosion was a major setback for the private launch company SpaceX that billionaire entrepreneur Elon Musk set up in 2002 to make space exploration more affordable.

SpaceX had already been working at full tilt to get through a backlog of launch orders that arose after another mishap last year in June. At the time, a rocket support strut snapped and evidently allowed helium to escape.

It still isn't clear just how badly the latest explosion damaged the company's launch pad, which it had been leasing from the US Air Force. NASA, one of SpaceX's biggest customers, also said it wasn't sure what - if anything - the blast would mean for future missions.

'A significant impact'

SpaceX hasn't debuted on the stock market yet, but shares in Musk's other companies, Tesla Motors and SolarCity, were respectively down 4 and 5.5 percent on Thursday, though it wasn't clear if that was attributable to the Falcon 9 blowing up.

Another company, Space Communication from Israel, also saw its stock price fall 8.9 percent. That's the company that owned the satellite the SpaceX rocket was scheduled to hoist into orbit this Saturday. Its CEO said in a statement to the Tel Aviv Stock Exchange that the loss of the payload would have "a significant impact" on Space Communication.

The satellite was going to be used to boost data connectivity to large swathes of sub-Saharan Africa by Facebook and Eutelsat, who were planning on leasing bandwidth as part of Mark Zuckerberg's Internet.org initiative.

"I'm deeply disappointed to hear that SpaceX's launch failure destroyed our satellite that would have provided connectivity to so many entrepreneurs and everyone else across the continent," Zuckerberg wrote on Facebook while on a trip to Africa.

Eutelsat estimated the potential impact of the botched launch exercise at around 50 million euros ($56 million).

Launchpad Blast Deals Setback, Opportunities for Israeli Industry

TEL AVIV – Thursday’s loss of the Israeli-built Amos-6 communications satellite in a launch pad explosion at Cape Canaveral marked a strategic setback, but also opportunities, for the Israeli space industry, whose follow-on orders were threatened by the planned sale of Spacecom, the Tel Aviv-based satellite operator, to a Beijing conglomerate.

Spacecom’s Amos-6, an estimated $200 million satellite built by state-owned Israel Aerospace Industries (IAI), was deemed a total loss after the Space-X Falcon 9 launcher to which it was attached blew up during a static engine test. In its report to the Tel Aviv Stock Exchange, Spacecom said the “anomaly” would have “substantial influence” on the company.

Just last week in an Aug. 24 notice to its principal shareholders, Spacecom said it had agreed to sell the company for Xinwei Technology Group for $285 million in cash. The firm noted that the sale was contingent upon the successful launch of the Amos-6, planned from Cape Canaveral, planned for this Saturday, Sept. 3.

Now, with that planned deal clouded by uncertainty, Israeli industry executives and experts here say IAI may have greater chances of snagging an Amos-6 replacement order as well as follow-on contracts that may have gone to non-Israeli firms once the sale was complete.

Industry executives here said Spacecom has been in communication with US firms Boeing and Loral for price and availability data for its follow-on Amos-7 and possibly Amos-8 satellites.

And in an interview earlier this summer, Yossi Weiss, chief executive officer and president of IAI, acknowledged that IAI will have to fight hard to keep Spacecom from going abroad to meet its follow-on communications satellite (Comsat) needs, just as the firm had to fight to clinch the Amos-6 deal more than three years ago.

“It’s a crisis and opportunity at the same time,” said Tal Inbar, head of space programs at Israel’s Fisher Institute for Air and Space Strategic Studies. “It all depends on the strength and financial resources of Spacecom.”

Inbar confirmed that if the deal with the Beijing conglomerate had gone ahead, chances were slim that the Amos-7 order would be awarded to IAI. Now, he said, it could be a different story.

“If, after Spacecom gets the insurance money, they embark on an emergency buildup for a new satellite and if – and it’s a big if – the next satellite will be ordered from IAI, this could assure continued business for the state of Israel’s Comsat sector,” he said.

He added, “The big question is what will be Spacecom’s future plans. If they want to replace Amos-6 very quickly, they may opt to buy an existing satellite that is already in space.”

Neither Spacecom nor IAI would comment specifically on how, if at all, Thursday’s upset would impact on the planned sale or potential follow-on orders for Israel’s satellite production firm.

In a Sept. 1 announcement, IAI noted that Amos-6 was the largest and most advanced Comsat ever built in Israel.

“We’re saddened by the loss of the satellite and stand ready to serve Spacecom. The sector of communications satellites is strategic for IAI and for the state of Israel and we hope that the state will continue to act for the good of preserving the knowledge that will allow continued production of communications satellites in Israel.”

After a thunderous explosion rocked SpaceX's main launch pad in Florida, destroying a rocket and a satellite Facebook was going to use to beam Internet to parts of Africa, companies are counting the cost.

No one was injured in the massive blast that left a Falcon 9 rocket engulfed in flames in Cape Canaveral on Thursday. But while the human cost was zero, financially the accident could leave its mark on several involved companies' bottom lines.

The explosion was a major setback for the private launch company SpaceX that billionaire entrepreneur Elon Musk set up in 2002 to make space exploration more affordable.

SpaceX had already been working at full tilt to get through a backlog of launch orders that arose after another mishap last year in June. At the time, a rocket support strut snapped and evidently allowed helium to escape.

It still isn't clear just how badly the latest explosion damaged the company's launch pad, which it had been leasing from the US Air Force. NASA, one of SpaceX's biggest customers, also said it wasn't sure what - if anything - the blast would mean for future missions.

'A significant impact'

SpaceX hasn't debuted on the stock market yet, but shares in Musk's other companies, Tesla Motors and SolarCity, were respectively down 4 and 5.5 percent on Thursday, though it wasn't clear if that was attributable to the Falcon 9 blowing up.

Another company, Space Communication from Israel, also saw its stock price fall 8.9 percent. That's the company that owned the satellite the SpaceX rocket was scheduled to hoist into orbit this Saturday. Its CEO said in a statement to the Tel Aviv Stock Exchange that the loss of the payload would have "a significant impact" on Space Communication.

The satellite was going to be used to boost data connectivity to large swathes of sub-Saharan Africa by Facebook and Eutelsat, who were planning on leasing bandwidth as part of Mark Zuckerberg's Internet.org initiative.

"I'm deeply disappointed to hear that SpaceX's launch failure destroyed our satellite that would have provided connectivity to so many entrepreneurs and everyone else across the continent," Zuckerberg wrote on Facebook while on a trip to Africa.

Eutelsat estimated the potential impact of the botched launch exercise at around 50 million euros ($56 million).

Launchpad Blast Deals Setback, Opportunities for Israeli Industry

TEL AVIV – Thursday’s loss of the Israeli-built Amos-6 communications satellite in a launch pad explosion at Cape Canaveral marked a strategic setback, but also opportunities, for the Israeli space industry, whose follow-on orders were threatened by the planned sale of Spacecom, the Tel Aviv-based satellite operator, to a Beijing conglomerate.

Spacecom’s Amos-6, an estimated $200 million satellite built by state-owned Israel Aerospace Industries (IAI), was deemed a total loss after the Space-X Falcon 9 launcher to which it was attached blew up during a static engine test. In its report to the Tel Aviv Stock Exchange, Spacecom said the “anomaly” would have “substantial influence” on the company.

Just last week in an Aug. 24 notice to its principal shareholders, Spacecom said it had agreed to sell the company for Xinwei Technology Group for $285 million in cash. The firm noted that the sale was contingent upon the successful launch of the Amos-6, planned from Cape Canaveral, planned for this Saturday, Sept. 3.

Now, with that planned deal clouded by uncertainty, Israeli industry executives and experts here say IAI may have greater chances of snagging an Amos-6 replacement order as well as follow-on contracts that may have gone to non-Israeli firms once the sale was complete.

Industry executives here said Spacecom has been in communication with US firms Boeing and Loral for price and availability data for its follow-on Amos-7 and possibly Amos-8 satellites.

And in an interview earlier this summer, Yossi Weiss, chief executive officer and president of IAI, acknowledged that IAI will have to fight hard to keep Spacecom from going abroad to meet its follow-on communications satellite (Comsat) needs, just as the firm had to fight to clinch the Amos-6 deal more than three years ago.

“It’s a crisis and opportunity at the same time,” said Tal Inbar, head of space programs at Israel’s Fisher Institute for Air and Space Strategic Studies. “It all depends on the strength and financial resources of Spacecom.”

Inbar confirmed that if the deal with the Beijing conglomerate had gone ahead, chances were slim that the Amos-7 order would be awarded to IAI. Now, he said, it could be a different story.

“If, after Spacecom gets the insurance money, they embark on an emergency buildup for a new satellite and if – and it’s a big if – the next satellite will be ordered from IAI, this could assure continued business for the state of Israel’s Comsat sector,” he said.

He added, “The big question is what will be Spacecom’s future plans. If they want to replace Amos-6 very quickly, they may opt to buy an existing satellite that is already in space.”

Neither Spacecom nor IAI would comment specifically on how, if at all, Thursday’s upset would impact on the planned sale or potential follow-on orders for Israel’s satellite production firm.

In a Sept. 1 announcement, IAI noted that Amos-6 was the largest and most advanced Comsat ever built in Israel.

“We’re saddened by the loss of the satellite and stand ready to serve Spacecom. The sector of communications satellites is strategic for IAI and for the state of Israel and we hope that the state will continue to act for the good of preserving the knowledge that will allow continued production of communications satellites in Israel.”