Protest_again

BANNED

- Joined

- May 19, 2019

- Messages

- 4,650

- Reaction score

- -60

- Country

- Location

Abey dumbo, we already answered the question you are just too thick headed (like most lungis are) to understand it.Dumbo!!!!!! Again, seriously!!!! Grow up, boy!!!

Ok lets come to point,

You, said a lot but did not answer the question, question is where will Indian reserve stand at after the payments? And current imports which is about 50 plus billion per month, how many months of payments can it cover?

I am asking question here not commenting

I made no such comment that India going bankrupt paying this debt, only commented on the reserve situation impacted and how much will it stand at. I am not a troll like you, my questions are objective and request for meaningful discussion. And also I do not make imaginary calculation and make a comment hense asked where will it stand at?

You a troll will always feel someone trolling you back. Maybe your past experience with me where you got bashed made you feel that way, but understand those times I was answ

Ering to your kinds trolling not asking question.

Question was how much forex reserve will be left? You pay 250 billion or 500 billion is your issue, made no comment on debt to gdp or said these debt is taking india to bankrupcy.

First understand the question.

Wasted my time and yours answering what I did not ask for.

Listen again

Question is what will be the position of your foreign reserve and how many months of import bill can it cover then?

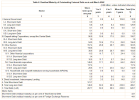

Manufacturing trade deficit has increased a bit but our service exports surplus cover the better part of it. India exports over $250 billion in services. Lol.

Overall Merchandise and Services Exports jump 24% in May, 2022;

INDIA’S FOREIGN TRADE: May 2022 India’s overall exports (Merchandise and Services combined) in Ma

pib.gov.in

Whatever trade deficit left after service surpluses is covered by our FDI ($80 billion) and remittances ($85 billion).

Most of this is not mentioned in Banglo/lungi jargon because you have no signifcant service exports nor the FDI.

Now stop making fool of yourself and get lost.