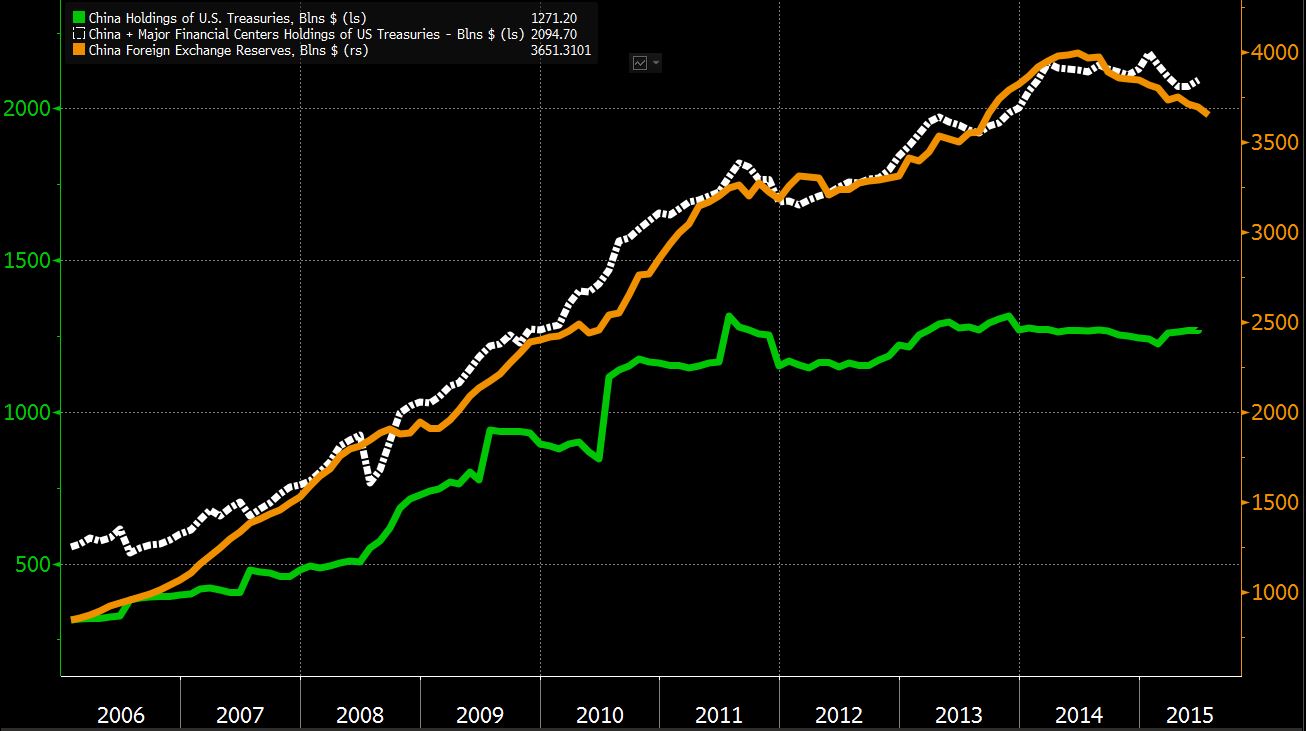

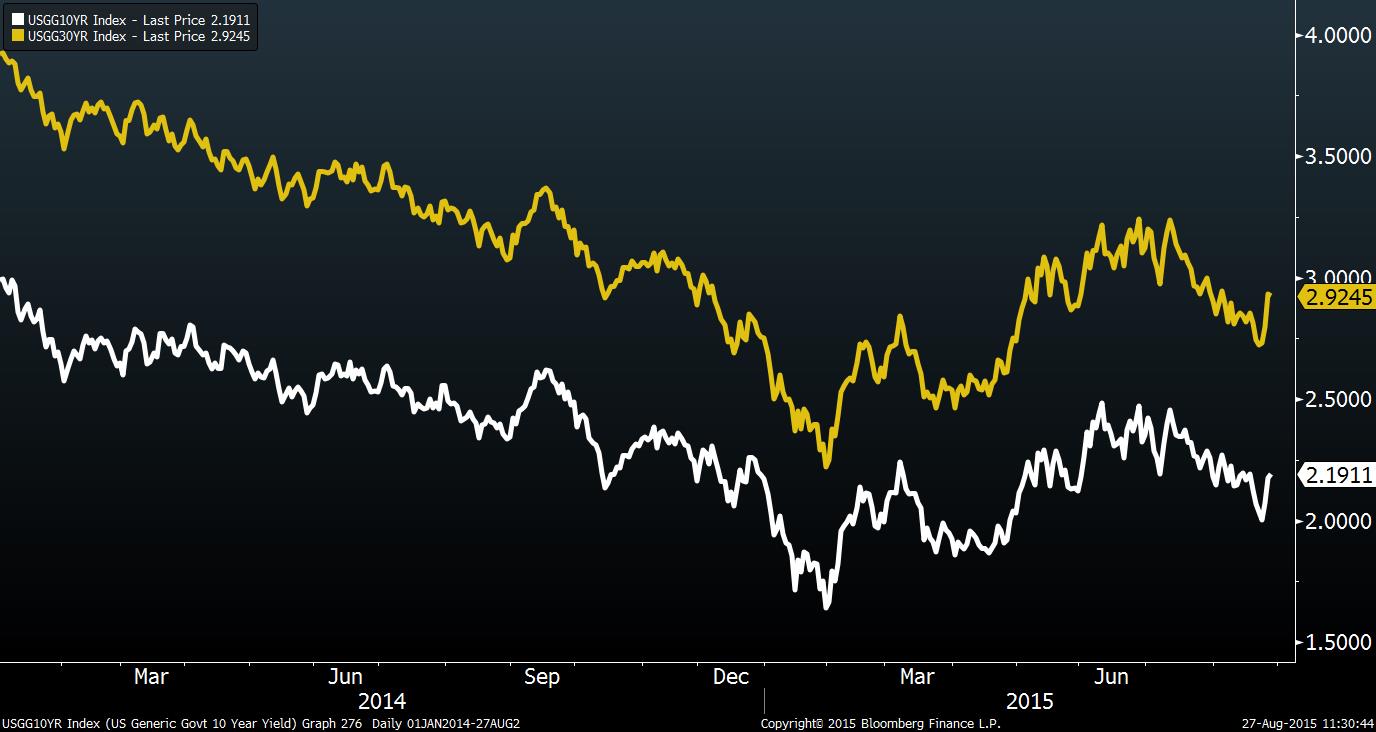

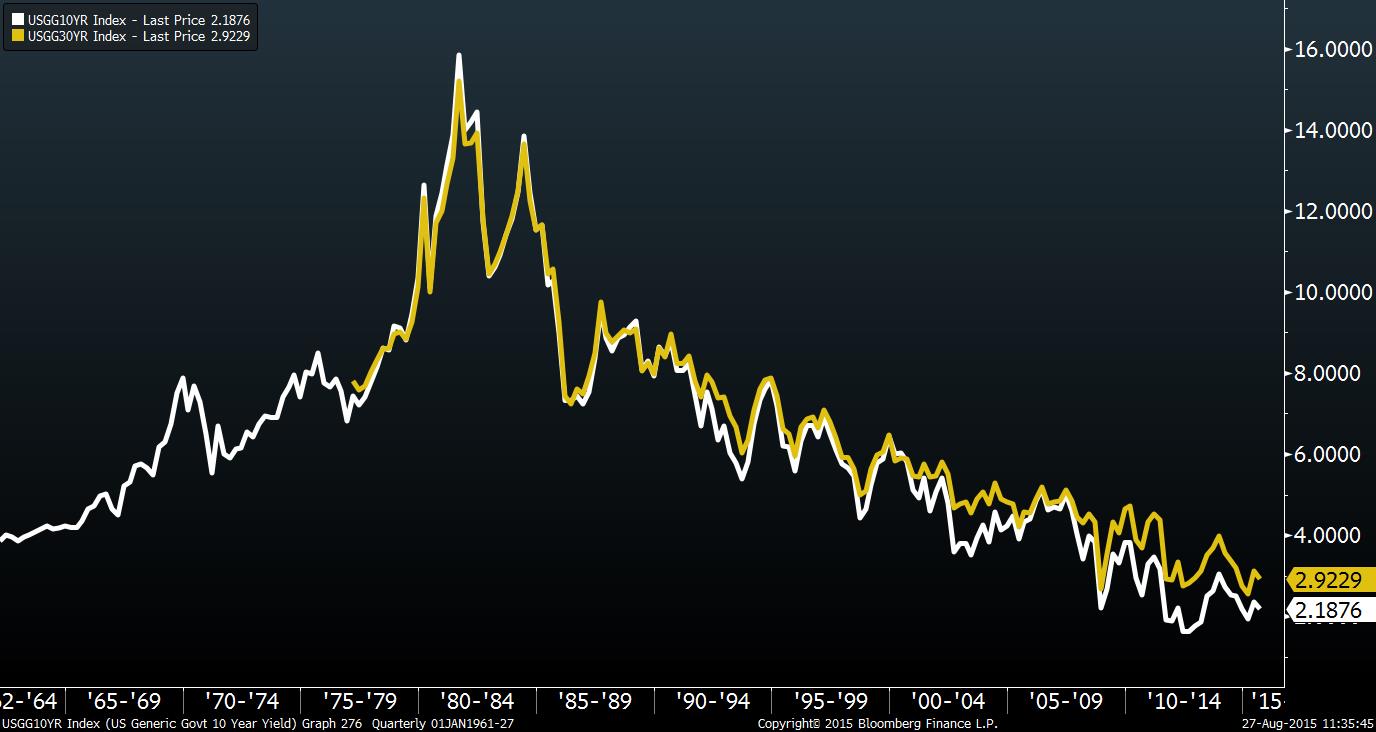

Another bold move from China. Of course someday this was expected, because you can't loan your entire savings to someone else if you wanna build an economy based on private consumption. Here's the graph for US 10 year yield treasuries.

Here's the news coverage.

-----

China has cut its holdings of U.S. Treasuries this month to raise dollars needed to support the yuan in the wake of a shock devaluation two weeks ago, according to people familiar with the matter.

Channels for such transactions include China selling directly, as well as through agents in Belgium and Switzerland, said one of the people, who declined to be identified as the information isn’t public. China has communicated with U.S. authorities about the sales, said another person. They didn’t reveal the size of the disposals.

The People’s Bank of China has been offloading dollars and buying yuan to support the exchange rate, a policy that’s contributed to a $315 billion drop in its foreign-exchange reserves over the last 12 months. The $3.65 trillion stockpile will fall by some $40 billion a month in the remainder of 2015 because of the intervention, according to the median estimate in a Bloombergsurvey.

China selling Treasuries is “not a surprise, but possibly something which people haven’t fully priced in,” said Owen Callan, a Dublin-based fixed-income strategist at Cantor Fitzgerald LP. “It would change the outlook on Treasuries quite a bit if you started to price in a fairly large liquidation of their reserves over the next six months or so as they manage the yuan to whatever level they have in mind.”

Gross’s Tweet

The PBOC and the U.S. Embassy in Beijing didn’t immediately respond to requests for comment. Bill Gross, who manages the $1.47 billion Janus Global Unconstrained Bond Fund, tweeted Wednesday “China selling long Treasuries ????”.

Two-year Treasuries erased an earlier advance, with their yield little changed at 0.67 percent as of 11 a.m. in London. It fell as much as two basis points. The 10-year yield declined three basis points to 2.15 percent, near to its average for the past month.

Chinese sales of U.S. government debt may have kept yields from falling this month as a selloff in global stocks prompted investors to favor the safest assets.

“By selling Treasuries to defend the renminbi, they’re preventing Treasury yields from going lower despite the fact that we’ve seen a sharp drop in the stock market,” David Woo, head of global rates and currencies research at Bank of America Corp., said on Bloomberg Television on Wednesday. “China has a direct impact on global markets through U.S. rates.”

China Holdings

The latest available Treasury data and estimates by strategists suggest that China controls $1.48 trillion of U.S. government debt, according to data compiled by Bloomberg. That includes about $200 billion held through Belgium, which Nomura Holdings Inc. says is home to Chinese custodial accounts.

The PBOC has sold at least $106 billion of reserve assets in the last two weeks, including Treasuries, according to an estimate from Societe Generale SA. The figure was based on the bank’s calculation of how much liquidity will be added to China’s financial system through Tuesday’s reduction of interest rates and lenders’ reserve-requirement ratios. The assumption is that the central bank aims to replenish the funds it drained when it bought yuan to stabilize the currency.

The yuan rose 0.08 percent to 6.4053 per dollar on Thursday in Shanghai, trimming this month’s decline to 3.1 percent. Daily fluctuations have averaged less than 0.1 percent in the past two weeks as the PBOC intervened to bring stability following the Aug. 11 devaluation. The nation’s Treasury holdings will stop falling once the intervention stops and the currency is freely floating, said Steve Wang, chief China economist at Reorient Financial Markets Ltd. in Hong Kong.

“Strategically, it probably has been China’s intention to find the right time to lighten up its excessive accumulation of U.S. Treasuries,” he said.

China Sells U.S. Treasuries to Support Yuan - Bloomberg Business

Here's the news coverage.

-----

China has cut its holdings of U.S. Treasuries this month to raise dollars needed to support the yuan in the wake of a shock devaluation two weeks ago, according to people familiar with the matter.

Channels for such transactions include China selling directly, as well as through agents in Belgium and Switzerland, said one of the people, who declined to be identified as the information isn’t public. China has communicated with U.S. authorities about the sales, said another person. They didn’t reveal the size of the disposals.

The People’s Bank of China has been offloading dollars and buying yuan to support the exchange rate, a policy that’s contributed to a $315 billion drop in its foreign-exchange reserves over the last 12 months. The $3.65 trillion stockpile will fall by some $40 billion a month in the remainder of 2015 because of the intervention, according to the median estimate in a Bloombergsurvey.

China selling Treasuries is “not a surprise, but possibly something which people haven’t fully priced in,” said Owen Callan, a Dublin-based fixed-income strategist at Cantor Fitzgerald LP. “It would change the outlook on Treasuries quite a bit if you started to price in a fairly large liquidation of their reserves over the next six months or so as they manage the yuan to whatever level they have in mind.”

Gross’s Tweet

The PBOC and the U.S. Embassy in Beijing didn’t immediately respond to requests for comment. Bill Gross, who manages the $1.47 billion Janus Global Unconstrained Bond Fund, tweeted Wednesday “China selling long Treasuries ????”.

Two-year Treasuries erased an earlier advance, with their yield little changed at 0.67 percent as of 11 a.m. in London. It fell as much as two basis points. The 10-year yield declined three basis points to 2.15 percent, near to its average for the past month.

Chinese sales of U.S. government debt may have kept yields from falling this month as a selloff in global stocks prompted investors to favor the safest assets.

“By selling Treasuries to defend the renminbi, they’re preventing Treasury yields from going lower despite the fact that we’ve seen a sharp drop in the stock market,” David Woo, head of global rates and currencies research at Bank of America Corp., said on Bloomberg Television on Wednesday. “China has a direct impact on global markets through U.S. rates.”

China Holdings

The latest available Treasury data and estimates by strategists suggest that China controls $1.48 trillion of U.S. government debt, according to data compiled by Bloomberg. That includes about $200 billion held through Belgium, which Nomura Holdings Inc. says is home to Chinese custodial accounts.

The PBOC has sold at least $106 billion of reserve assets in the last two weeks, including Treasuries, according to an estimate from Societe Generale SA. The figure was based on the bank’s calculation of how much liquidity will be added to China’s financial system through Tuesday’s reduction of interest rates and lenders’ reserve-requirement ratios. The assumption is that the central bank aims to replenish the funds it drained when it bought yuan to stabilize the currency.

The yuan rose 0.08 percent to 6.4053 per dollar on Thursday in Shanghai, trimming this month’s decline to 3.1 percent. Daily fluctuations have averaged less than 0.1 percent in the past two weeks as the PBOC intervened to bring stability following the Aug. 11 devaluation. The nation’s Treasury holdings will stop falling once the intervention stops and the currency is freely floating, said Steve Wang, chief China economist at Reorient Financial Markets Ltd. in Hong Kong.

“Strategically, it probably has been China’s intention to find the right time to lighten up its excessive accumulation of U.S. Treasuries,” he said.

China Sells U.S. Treasuries to Support Yuan - Bloomberg Business