RisingShiningSuperpower

BANNED

- Joined

- Jun 12, 2014

- Messages

- 1,446

- Reaction score

- -6

- Country

- Location

http://www.forbes.com/global2000/list/#tab:overall

Forbes Global 2000 list of the world's largest public companies was released today.

56 Indian companies made the list, the same as last year.

249 Chinese companies are listed.

China has four companies in the top 10. In fact, the top 3 companies are all Chinese.

There are no Indian companies in the top 120.

Worryingly, all listed Indian companies are heavily indebted, posing a grave risk to India's banking sector and national solvency. However, I'm confident that under Modi-ji's brilliant leadership, all difficulties can be overcome. India will quickly overtake China and America to become a superpower by 2020!

http://www.economist.com/news/leade...lic-sector-banks-only-way-fix-them-rump-stake

IN THE beauty contest among big emerging markets, India has a fair claim to the crown. Growth is above 7%, inflation below 5%. Interest rates are falling, if slowly; the rupee has been fairly resilient. Yet India’s economy looks rather less handsome in one regard: the finances of many of its companies and the public-sector banks that fund them are in rotten shape.

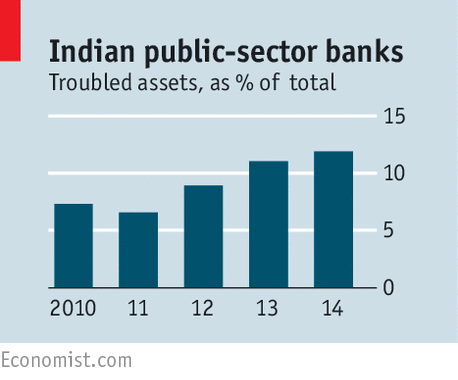

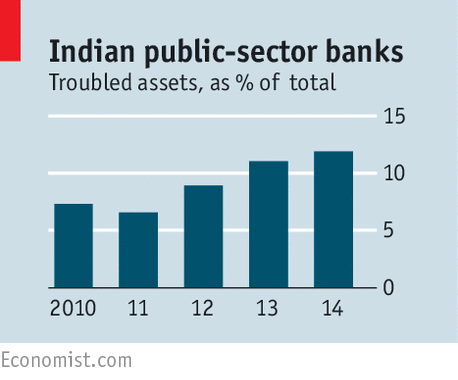

An analysis last year by the IMF showed that India’s corporate sector has a higher level of debt relative to equity than that of any other emerging market, bar Brazil. A third of the 3,700 listed companies sampled in a recent study by Credit Suisse paid more in interest than they earned. Not surprisingly, the incidence of Indian public-sector bank loans that are troubled has risen—to 12% at the last count—and that could grow further. Among private banks the share of troubled loans is 4%. Public-sector banks account for more than 70% of India’s loan stock. These banks already require around $40 billion of fresh capital by 2018 just to conform to internationally agreed rules on minimal capital standards. Add in the rising share of bad debts, and the worry is that banks will not be able to fuel the investment that India’s economy needs.

Banks are at least being made to come clean about their souring assets. The Reserve Bank of India (RBI) has clamped down on the practice of making new loans to the chronically indebted in the usually vain hope that the old ones might be repaid. From April 1st this year, banks have been told to treat loans that have had their terms softened as if they were non-performing and set aside 15% of their value as a precaution. If a bank reports a dud loan, the RBI will assemble the firm’s lenders to agree on remedial action. That will stop indebted firms from playing one bank off against the other. The government of Narendra Modi has also promised a new bankruptcy code that will help creditors take over troubled firms.

Loans freed from their bonds

More, however, must be done, particularly to change the banking culture that has given rise to the bad-debt problem. Many of the troubles that afflict public-sector banks, including political interference, a lack of talent in the boardroom and the herd mentality that encourages them to charge into the same bad bets, stem from majority state ownership (see article). Mr Modi has so far been timid about privatisations. But to create a financial system that can fund the growth India needs, he must get the state out of the business of running banks.

India has historically sold off small equity stakes in state-owned firms to fund its budget deficits. The government’s holdings in public-sector banks have fallen to levels of between 57% and 82%. Mr Modi has pledged to reduce them to 52% across the board, but no further. He wants the state to remain in control, but has promised to reduce government meddling, to lure chief executives from the private sector and to give them longer tenures. Those are welcome gestures, particularly a pledge to end phone calls from officials in Delhi putting in a good word for a favoured businessman in search of credit. But commitments of this sort cannot bind future governments. Not surprisingly, few top-notch bankers are interested; senior vacancies in India’s state-run banks are piling up.

A continent masquerading as a country: Explore India in our interactive map

A continent masquerading as a country: Explore India in our interactive map

Mr Modi needs to be bolder by turning over banks to be run as private companies, with a minority government stake. End government control, and many of the management constraints that have contributed to the poor performance of these banks would disappear. For instance, the limits on public-sector pay scales would go, enabling banks to attract the best staff at board level and below. An intermediary body to manage the state’s shareholdings would rein in political interference—as long as it is independent. Private investors would then be happier to provide the extra capital the banks need to fund India’s next investment upswing.

Core capital

The alternative to privatising India’s state-owned banks is a continual top-up of capital buffers to make up for losses, using money that might better be spent on public goods, education or targeted welfare. And unless the banking sector is fixed, the economy cannot flourish. If Mr Modi is serious about reform, he will have to discredit the shibboleth that banks can only serve society’s ends if they are state-owned.

Forbes Global 2000 list of the world's largest public companies was released today.

56 Indian companies made the list, the same as last year.

249 Chinese companies are listed.

China has four companies in the top 10. In fact, the top 3 companies are all Chinese.

There are no Indian companies in the top 120.

Worryingly, all listed Indian companies are heavily indebted, posing a grave risk to India's banking sector and national solvency. However, I'm confident that under Modi-ji's brilliant leadership, all difficulties can be overcome. India will quickly overtake China and America to become a superpower by 2020!

http://www.economist.com/news/leade...lic-sector-banks-only-way-fix-them-rump-stake

IN THE beauty contest among big emerging markets, India has a fair claim to the crown. Growth is above 7%, inflation below 5%. Interest rates are falling, if slowly; the rupee has been fairly resilient. Yet India’s economy looks rather less handsome in one regard: the finances of many of its companies and the public-sector banks that fund them are in rotten shape.

An analysis last year by the IMF showed that India’s corporate sector has a higher level of debt relative to equity than that of any other emerging market, bar Brazil. A third of the 3,700 listed companies sampled in a recent study by Credit Suisse paid more in interest than they earned. Not surprisingly, the incidence of Indian public-sector bank loans that are troubled has risen—to 12% at the last count—and that could grow further. Among private banks the share of troubled loans is 4%. Public-sector banks account for more than 70% of India’s loan stock. These banks already require around $40 billion of fresh capital by 2018 just to conform to internationally agreed rules on minimal capital standards. Add in the rising share of bad debts, and the worry is that banks will not be able to fuel the investment that India’s economy needs.

Banks are at least being made to come clean about their souring assets. The Reserve Bank of India (RBI) has clamped down on the practice of making new loans to the chronically indebted in the usually vain hope that the old ones might be repaid. From April 1st this year, banks have been told to treat loans that have had their terms softened as if they were non-performing and set aside 15% of their value as a precaution. If a bank reports a dud loan, the RBI will assemble the firm’s lenders to agree on remedial action. That will stop indebted firms from playing one bank off against the other. The government of Narendra Modi has also promised a new bankruptcy code that will help creditors take over troubled firms.

Loans freed from their bonds

More, however, must be done, particularly to change the banking culture that has given rise to the bad-debt problem. Many of the troubles that afflict public-sector banks, including political interference, a lack of talent in the boardroom and the herd mentality that encourages them to charge into the same bad bets, stem from majority state ownership (see article). Mr Modi has so far been timid about privatisations. But to create a financial system that can fund the growth India needs, he must get the state out of the business of running banks.

India has historically sold off small equity stakes in state-owned firms to fund its budget deficits. The government’s holdings in public-sector banks have fallen to levels of between 57% and 82%. Mr Modi has pledged to reduce them to 52% across the board, but no further. He wants the state to remain in control, but has promised to reduce government meddling, to lure chief executives from the private sector and to give them longer tenures. Those are welcome gestures, particularly a pledge to end phone calls from officials in Delhi putting in a good word for a favoured businessman in search of credit. But commitments of this sort cannot bind future governments. Not surprisingly, few top-notch bankers are interested; senior vacancies in India’s state-run banks are piling up.

A continent masquerading as a country: Explore India in our interactive map

A continent masquerading as a country: Explore India in our interactive mapMr Modi needs to be bolder by turning over banks to be run as private companies, with a minority government stake. End government control, and many of the management constraints that have contributed to the poor performance of these banks would disappear. For instance, the limits on public-sector pay scales would go, enabling banks to attract the best staff at board level and below. An intermediary body to manage the state’s shareholdings would rein in political interference—as long as it is independent. Private investors would then be happier to provide the extra capital the banks need to fund India’s next investment upswing.

Core capital

The alternative to privatising India’s state-owned banks is a continual top-up of capital buffers to make up for losses, using money that might better be spent on public goods, education or targeted welfare. And unless the banking sector is fixed, the economy cannot flourish. If Mr Modi is serious about reform, he will have to discredit the shibboleth that banks can only serve society’s ends if they are state-owned.