Arabian Legend

SENIOR MEMBER

- Joined

- Mar 7, 2012

- Messages

- 5,155

- Reaction score

- 9

- Country

- Location

^^ The mandala looks beautiful isn't?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Yes it is^^ The mandala looks beautiful isn't?

The King Abdullah Financial District (KAFD) is a new development under construction near King Fahad Road in the Asahafa area ofRiyadh, Saudi Arabia[1][2] being undertaken by the Rayadah Investment Corporation[3] on behalf of the Pension Authority of the Kingdom of Saudi Arabia, consisting of 34 towers in an area of 1.6 million square metres. It will provide more than 3 million square metres of space for various uses, 62,000 parking spaces and accommodation for 12,000 residents. In 2011 it was the largest project in the world seeking green building accreditation.[4] Bombardier won a $241m USD contract to build an automated monorail for the development.[5][6] The district is designed to keep it isolated from close contact with the strictly monitored Riyadh society.[7] The design guidelines do not separate the sexes in the district.[7] The KAFD master plan was designed and overseen by Danish Architects Henning Larsen Henning_Larsen_Architects

The project is estimated to cost 29 billion Saudi riyals ($7.8 billion).[8]

Saudi Gazette, Jeddah

Wednesday, 8 January 2014

The healthcare industry in the GCC is expected to continue its robust growth propelled by demographic and macroeconomic factors in the region, EY said Tuesday.

GCC healthcare spending is expected to increase by a CAGR of 11.4 percent from 2010-2015.

The main growth drivers of the industry include the region’s fast growing population, rising income levels, increased prevalence of lifestyle diseases, growing demand for quality healthcare and mandatory health insurance policies.

GCC governments are trying to make significant investments to support healthcare provision and help the industry to grow to international standards. Several GCC nations have announced plans to ramp up infrastructure to cater to rising demand, with major healthcare projects across the region being planned to accommodate the ever-growing demand. Even though GCC Governments continue to lead in healthcare expenditure, increased participation by private players has been seen in the GCC healthcare industry.

Andrea Longhi, MENA Advisory Healthcare Leader, EY, said: "The healthcare industry is driven by positive growth prospects and increased purchasing power. The growing demand for healthcare services coupled with regulatory changes and emphasis on quality healthcare makes the GCC an important destination for both domestic and international investors. Healthcare spending in the region has witnessed significant growth over the past few years and we expect the growth to continue in the future with the higher incidence of lifestyle diseases and an increasing amount of GCC Governments enforcing mandatory medical insurance."

With programs such as mandatory insurance there is an increasing reliance on the private healthcare sector and most well established facilities are focusing to expand rapidly to create capacity for their growing markets. One way of doing this is by way of an IPO and raising capital for expansion. The recent IPO of several healthcare facilities have set a precedent and more are to follow in the coming years. Not only this, numerous new facilities are planned in almost all GCC countries.

Imad U Bokhari, MENA Transaction Advisory Services Healthcare Leader EY, said: “Healthcare in general is now a major topic for private investors, as it weathered the recent financial crisis. The inclusion of this sector as part of the overall investment strategy for major institutions has become vital. We are at the dawn of a major expansion in the healthcare sector in the region, even if only few of the many planned facilities come to fruition. Some of these healthcare developments are so large that they can only be called “medical cities”. These promise to bring more successful medical treatments, world class healthcare education, significantly experienced human capital and some concepts that are entirely new to the region.”

Despite the fast growth of the industry as well as the increasing demand, there are challenges facing the GCC healthcare sector. Considerable shortage of local physicians and qualified allied healthcare staff in the region poses an obstacle to the industry’s growth as GCC countries are heavily depending on expatriates for healthcare workforce.

Healthcare expenditure in the region as a percentage of the gross domestic product (GDP) still remains low, despite the considerable healthcare spending which was witnessed over the past few years. Healthcare infrastructure in the GCC also continues to lag international standards which restrains the market from expanding, given GCC‘s strong demand and high income per capita.

“The region will need to invest in training their local talent to help build a larger pool of physicians to cater to the growing demand. As the GCC governments continue to invest in healthcare, we should see health expenditure as a percentage of GDP increase in the future. The new healthcare projects will help to attract people to the region as a medical tourism destination. Additionally, establishing research and clinical trial centers will have significant impact on retention of talent,” Imad noted.

This article was first published in the Saudi Gazette.

Last Update: Wednesday, 8 January 2014 KSA 14:36 - GMT 11:36

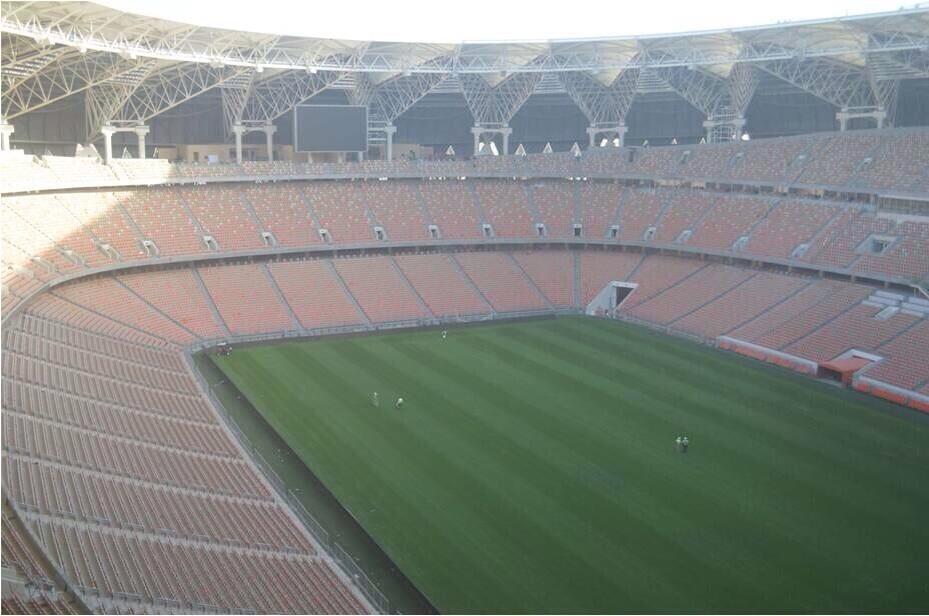

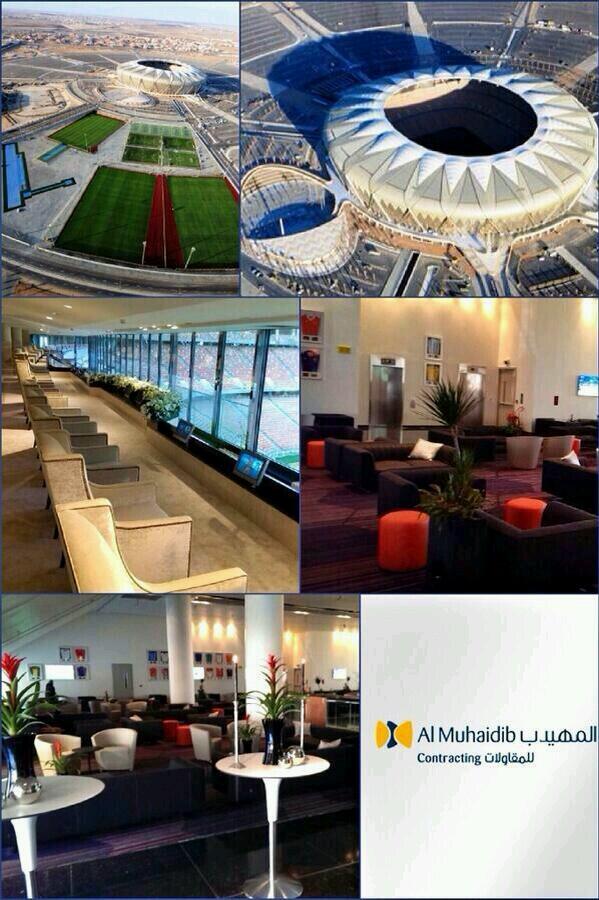

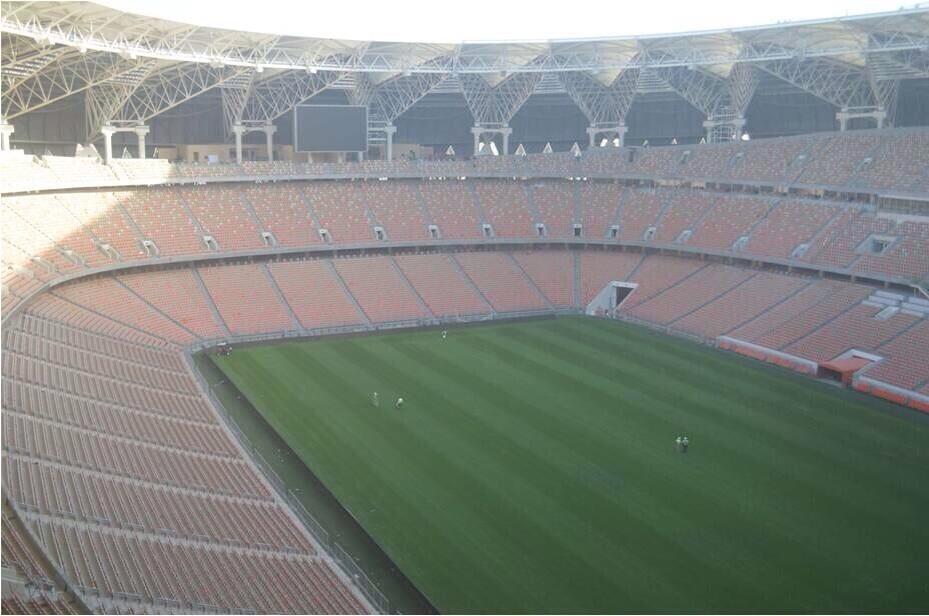

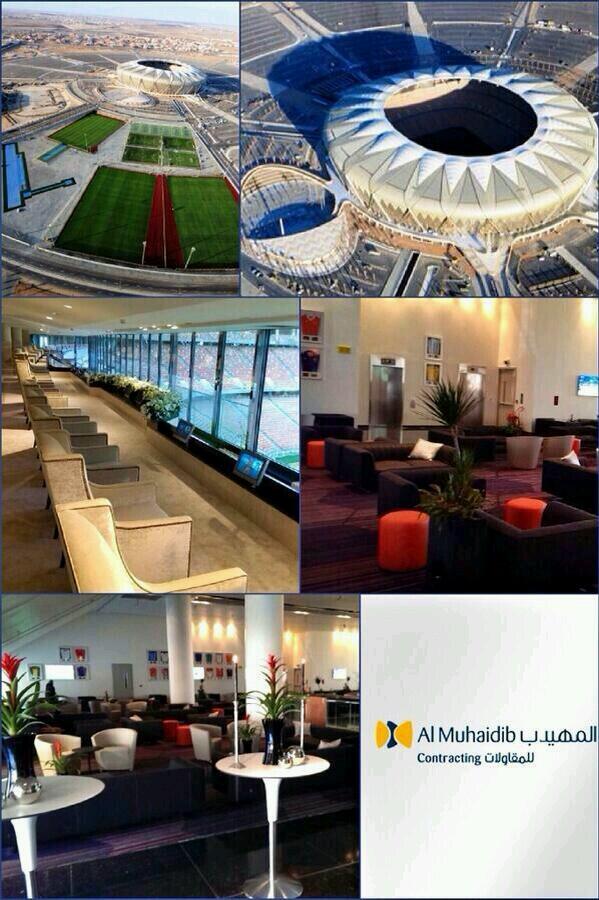

This must be a new Saudi building record. Usually it takes fucking forever to build these projects.The King Abdullah Sports City is in he middle of being built and the 60.000 capacity stadium is close to being fully finished:

KSA needs more chicks, more than a better economy

But thats just me

LOL.

Last page on this link, 7abibi.

Saudi Arabia in Pictures | Page 66

You have plenty of them in the US anyway and they are all mostly doing marvelous. They hide their Arabian beauty well. So no harassment please or I will come after you.