beijingwalker

ELITE MEMBER

- Joined

- Nov 4, 2011

- Messages

- 65,191

- Reaction score

- -55

- Country

- Location

Chinese investment in EU dwarfs flow the other way

Growing gap fuels debate on market imbalance as acquisitions soar in Germany

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our T&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights.

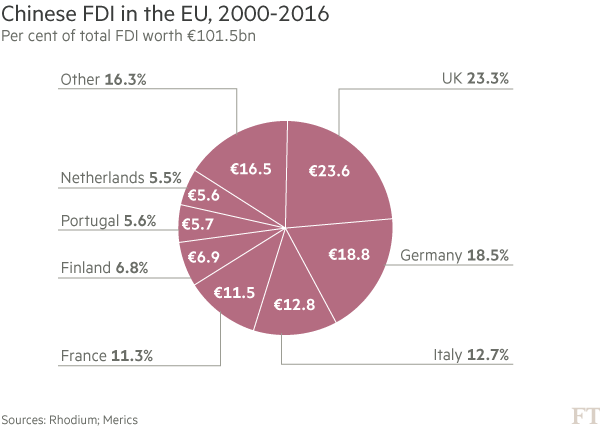

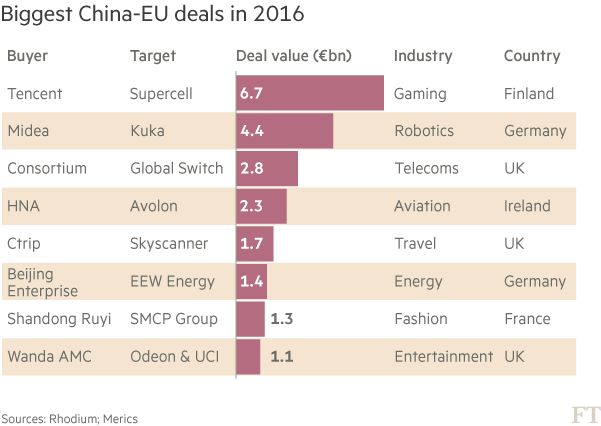

Chinese investors spent four times as much on acquisitions in the EU last year as European companies did in China, according to new figures that will inflame an already heated debate about growing imbalances between the world’s two largest markets.

A report by Rhodium Group, a research firm, and the Mercator Institute for China Studies, a think-tank in Berlin, estimates that Chinese direct investment in the EU surged 76 per cent to €35.1bn in 2016. EU acquisitions in China, by contrast, fell for the second consecutive year, to €7.7bn. “The growing gap in two-way investment flows is fuelling European perceptions of a fundamental lack of ‘reciprocity’ between the EU and China,” said Thilo Hanemann at Rhodium. “Chinese interest is growing rapidly in sectors that remain restricted to foreign investors in China, which has further amplified the political salience of unequal market access.” The imbalance was particularly sharp in Germany, where Chinese acquisitions soared to €11bn from €1.2bn in 2015. German acquisitions in China totalled €3.5bn, making 2016 the first year in which Chinese acquisitions in Germany exceeded German M&A activity in China.

Chinese acquisition flows into the US also exceeded those in the opposite direction for the first time last year, according to another recent report by the research firm. Rhodium and Merics estimate that total outbound direct investment by Chinese companies is likely to have exceeded $200bn in 2016, double the amount spent in 2015. Last year’s figures — and the Sino-EU investment imbalance — would have been larger but for a growing European backlash against Chinese investment in sensitive sectors and Beijing’s efforts to slow capital outflows over recent months. Many experts believe these developments will prevent a similar surge in Chinese outbound investment this year. “Chinese investment in Europe will drop but it won’t fall off a cliff,” said Cui Hongjian, a European expert at the China Institute of International Studies in Beijing. “Chinese companies think highly of the EU’s investment environment and Europe needs them to boost the economy.” Analysts believe the creation of a pan-European screening mechanism, similar to the Committee on Foreign Investment in the US (Cfius), is unlikely.

“There are different perceptions of what Chinese investment means for certain countries,” said Mikko Huotari at Merics. “For Germany it’s becoming more of an issue in terms of competition. For countries like Hungary it’s a very welcome source of financing and investment.” Last year German authorities decided to withdraw their initial approval of Fujian Grand Chip Investment’s bid for Aixtron, a semiconductor equipment manufacturer. US intelligence services had advised them that Aixtron’s equipment could make chips for China’s nuclear programme. The information was presented at briefings attended by senior German officials at the US embassy in Berlin.

Fujian Grand Chip subsequently abandoned its bid after President Barack Obama agreed with Cfius’ assessment that it posed an unspecified risk to US national security. “German authorities didn’t initially appreciate that the US was super-focused on Aixtron,” said a German banker familar with tech deals. “Some of the know-how could be used for purposes that people in the national security community were very worried about.” “The Americans did the Germans a favour on Aixtron,” added a European diplomat in Beijing. “I’m sure they are relieved.” Around the same time, Sigmar Gabriel, Germany’s economics minister, pushed for an expansion of the 2009 Foreign Trade Law to give Berlin much greater leeway to block foreign investments. The proposed law would allow ministers to protect companies in strategic sectors from Chinese approaches, especially when the acquirers are linked to the Chinese state and the deal is “driven by industrial policy”.

But analysts predict that expanding the law’s scope will be a challenge. “With the 2009 ordinance, Germany went as far as it could go without breaching EU law,” said Cora Jungbluth, project manager at the Bertelsmann Stiftung, a German think-tank, and an expert on Chinese investment in Germany. If Berlin wants to toughen restrictions, Ms Jungbluth believes it would have to do so on an EU rather than national level, “and so far there doesn’t seem to be much interest in that in the EU”. She added that the call for tougher restrictions may have simply been a bargaining chip in the EU's negotiations with China on a new bilateral investment treaty. The key German aim in these talks is reciprocity — improving German companies’ access to the Chinese market and freeing them from the obligation in certain sectors to form joint ventures with local partners. “The talk about limiting Chinese investment in Germany is just populist rhetoric,” another banker said. “It won’t be like the US where Cfius actually blocks deals. Germany has too much to lose from a crackdown on Chinese investment because there is so much German involvement in the Chinese economy.”

https://www.ft.com/content/79e3a2b2-d6f7-11e6-944b-e7eb37a6aa8e

Growing gap fuels debate on market imbalance as acquisitions soar in Germany

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our T&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights.

Chinese investors spent four times as much on acquisitions in the EU last year as European companies did in China, according to new figures that will inflame an already heated debate about growing imbalances between the world’s two largest markets.

A report by Rhodium Group, a research firm, and the Mercator Institute for China Studies, a think-tank in Berlin, estimates that Chinese direct investment in the EU surged 76 per cent to €35.1bn in 2016. EU acquisitions in China, by contrast, fell for the second consecutive year, to €7.7bn. “The growing gap in two-way investment flows is fuelling European perceptions of a fundamental lack of ‘reciprocity’ between the EU and China,” said Thilo Hanemann at Rhodium. “Chinese interest is growing rapidly in sectors that remain restricted to foreign investors in China, which has further amplified the political salience of unequal market access.” The imbalance was particularly sharp in Germany, where Chinese acquisitions soared to €11bn from €1.2bn in 2015. German acquisitions in China totalled €3.5bn, making 2016 the first year in which Chinese acquisitions in Germany exceeded German M&A activity in China.

Chinese acquisition flows into the US also exceeded those in the opposite direction for the first time last year, according to another recent report by the research firm. Rhodium and Merics estimate that total outbound direct investment by Chinese companies is likely to have exceeded $200bn in 2016, double the amount spent in 2015. Last year’s figures — and the Sino-EU investment imbalance — would have been larger but for a growing European backlash against Chinese investment in sensitive sectors and Beijing’s efforts to slow capital outflows over recent months. Many experts believe these developments will prevent a similar surge in Chinese outbound investment this year. “Chinese investment in Europe will drop but it won’t fall off a cliff,” said Cui Hongjian, a European expert at the China Institute of International Studies in Beijing. “Chinese companies think highly of the EU’s investment environment and Europe needs them to boost the economy.” Analysts believe the creation of a pan-European screening mechanism, similar to the Committee on Foreign Investment in the US (Cfius), is unlikely.

“There are different perceptions of what Chinese investment means for certain countries,” said Mikko Huotari at Merics. “For Germany it’s becoming more of an issue in terms of competition. For countries like Hungary it’s a very welcome source of financing and investment.” Last year German authorities decided to withdraw their initial approval of Fujian Grand Chip Investment’s bid for Aixtron, a semiconductor equipment manufacturer. US intelligence services had advised them that Aixtron’s equipment could make chips for China’s nuclear programme. The information was presented at briefings attended by senior German officials at the US embassy in Berlin.

Fujian Grand Chip subsequently abandoned its bid after President Barack Obama agreed with Cfius’ assessment that it posed an unspecified risk to US national security. “German authorities didn’t initially appreciate that the US was super-focused on Aixtron,” said a German banker familar with tech deals. “Some of the know-how could be used for purposes that people in the national security community were very worried about.” “The Americans did the Germans a favour on Aixtron,” added a European diplomat in Beijing. “I’m sure they are relieved.” Around the same time, Sigmar Gabriel, Germany’s economics minister, pushed for an expansion of the 2009 Foreign Trade Law to give Berlin much greater leeway to block foreign investments. The proposed law would allow ministers to protect companies in strategic sectors from Chinese approaches, especially when the acquirers are linked to the Chinese state and the deal is “driven by industrial policy”.

But analysts predict that expanding the law’s scope will be a challenge. “With the 2009 ordinance, Germany went as far as it could go without breaching EU law,” said Cora Jungbluth, project manager at the Bertelsmann Stiftung, a German think-tank, and an expert on Chinese investment in Germany. If Berlin wants to toughen restrictions, Ms Jungbluth believes it would have to do so on an EU rather than national level, “and so far there doesn’t seem to be much interest in that in the EU”. She added that the call for tougher restrictions may have simply been a bargaining chip in the EU's negotiations with China on a new bilateral investment treaty. The key German aim in these talks is reciprocity — improving German companies’ access to the Chinese market and freeing them from the obligation in certain sectors to form joint ventures with local partners. “The talk about limiting Chinese investment in Germany is just populist rhetoric,” another banker said. “It won’t be like the US where Cfius actually blocks deals. Germany has too much to lose from a crackdown on Chinese investment because there is so much German involvement in the Chinese economy.”

https://www.ft.com/content/79e3a2b2-d6f7-11e6-944b-e7eb37a6aa8e