onebyone

SENIOR MEMBER

- Joined

- Jul 2, 2014

- Messages

- 7,550

- Reaction score

- -6

- Country

- Location

By

JENNYW. HSU

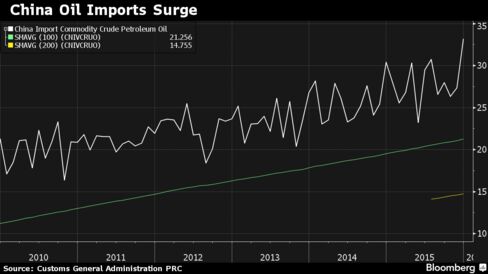

HONG KONG-- China's crude imports surged in December, underscoring the country's strong appetite for crude as it continues to fill its strategic petroleum reserves and as local refiners take advantage of cheap oil.

China imported 33.19 million tons of oil in December, 9.3% higher than a year before, the General Administration of Customs said Wednesday. That was a rise from the month before when it imported 27.3 million tons.

"This reinforces my view that China will continue to be a strong consumer of crude despite the market fear. Crude demand will stay on an uptrend as the economy is still expected to grow by at least 6%," said Barnabas Gan, a commodity analyst at OCBC.

As part of its ongoing energy reforms, Beijing has been allowing more small and privately-owned refiners, known as "teapots", to import crude directly from foreign sources. China imported 335.50 million barrels of crude in 2015, up 8.8% from 2014.

Platts China Oil Analytics projects China's crude demand growth will slow to over 6% on-year this year, driven by a deceleration in the Chinese economy.

Recent volatility in the Chinese stock market has spooked some oil traders who expect China's crude demand to falter. Global prices have fallen nearly 20% since the start of the year.

"Yes, the Chinese economy is in low gear. That is a fact, but it is definitely not over the cliff," said Kang Wu, the managing director of Beijing for FGE Consultancy, who expects China's crude demand to slow but remain healthy in 2016.

Reflecting China's increase in fuel exports in recent months, China's imports of refined oil products dropped 11% on year to 2.84 million tons in December, according to official data. In 2015, China's total imports of refined oil products fell 0.3% to 29.90 million tons.

With consumption weak at home, Chinese refiners have been exporting more. China exported 250,000 tons of crude in December, up 4.2% from a year earlier. In 2015, China exported 2.87 million tons of crude, a rise of 377% from the year before.

China also exported 4.32 million tons of oil products in December, a 53% on-year surge. In 2015, China exported 36.15 million tons of oil products, up 22% on-year.

Write to Jenny W. Hsu at jenny.hsu@wsj.com

China's oil imports jump 9.3% in December - MarketWatch

Published: Jan 13, 2016 2:45 a.m. ET

By

JENNYW. HSU

HONG KONG-- China's crude imports surged in December, underscoring the country's strong appetite for crude as it continues to fill its strategic petroleum reserves and as local refiners take advantage of cheap oil.

China imported 33.19 million tons of oil in December, 9.3% higher than a year before, the General Administration of Customs said Wednesday. That was a rise from the month before when it imported 27.3 million tons.

"This reinforces my view that China will continue to be a strong consumer of crude despite the market fear. Crude demand will stay on an uptrend as the economy is still expected to grow by at least 6%," said Barnabas Gan, a commodity analyst at OCBC.

As part of its ongoing energy reforms, Beijing has been allowing more small and privately-owned refiners, known as "teapots", to import crude directly from foreign sources. China imported 335.50 million barrels of crude in 2015, up 8.8% from 2014.

Platts China Oil Analytics projects China's crude demand growth will slow to over 6% on-year this year, driven by a deceleration in the Chinese economy.

Recent volatility in the Chinese stock market has spooked some oil traders who expect China's crude demand to falter. Global prices have fallen nearly 20% since the start of the year.

"Yes, the Chinese economy is in low gear. That is a fact, but it is definitely not over the cliff," said Kang Wu, the managing director of Beijing for FGE Consultancy, who expects China's crude demand to slow but remain healthy in 2016.

Reflecting China's increase in fuel exports in recent months, China's imports of refined oil products dropped 11% on year to 2.84 million tons in December, according to official data. In 2015, China's total imports of refined oil products fell 0.3% to 29.90 million tons.

With consumption weak at home, Chinese refiners have been exporting more. China exported 250,000 tons of crude in December, up 4.2% from a year earlier. In 2015, China exported 2.87 million tons of crude, a rise of 377% from the year before.

China also exported 4.32 million tons of oil products in December, a 53% on-year surge. In 2015, China exported 36.15 million tons of oil products, up 22% on-year.

Write to Jenny W. Hsu at jenny.hsu@wsj.com

JENNYW. HSU

HONG KONG-- China's crude imports surged in December, underscoring the country's strong appetite for crude as it continues to fill its strategic petroleum reserves and as local refiners take advantage of cheap oil.

China imported 33.19 million tons of oil in December, 9.3% higher than a year before, the General Administration of Customs said Wednesday. That was a rise from the month before when it imported 27.3 million tons.

"This reinforces my view that China will continue to be a strong consumer of crude despite the market fear. Crude demand will stay on an uptrend as the economy is still expected to grow by at least 6%," said Barnabas Gan, a commodity analyst at OCBC.

As part of its ongoing energy reforms, Beijing has been allowing more small and privately-owned refiners, known as "teapots", to import crude directly from foreign sources. China imported 335.50 million barrels of crude in 2015, up 8.8% from 2014.

Platts China Oil Analytics projects China's crude demand growth will slow to over 6% on-year this year, driven by a deceleration in the Chinese economy.

Recent volatility in the Chinese stock market has spooked some oil traders who expect China's crude demand to falter. Global prices have fallen nearly 20% since the start of the year.

"Yes, the Chinese economy is in low gear. That is a fact, but it is definitely not over the cliff," said Kang Wu, the managing director of Beijing for FGE Consultancy, who expects China's crude demand to slow but remain healthy in 2016.

Reflecting China's increase in fuel exports in recent months, China's imports of refined oil products dropped 11% on year to 2.84 million tons in December, according to official data. In 2015, China's total imports of refined oil products fell 0.3% to 29.90 million tons.

With consumption weak at home, Chinese refiners have been exporting more. China exported 250,000 tons of crude in December, up 4.2% from a year earlier. In 2015, China exported 2.87 million tons of crude, a rise of 377% from the year before.

China also exported 4.32 million tons of oil products in December, a 53% on-year surge. In 2015, China exported 36.15 million tons of oil products, up 22% on-year.

Write to Jenny W. Hsu at jenny.hsu@wsj.com

China's oil imports jump 9.3% in December - MarketWatch

Published: Jan 13, 2016 2:45 a.m. ET

By

JENNYW. HSU

HONG KONG-- China's crude imports surged in December, underscoring the country's strong appetite for crude as it continues to fill its strategic petroleum reserves and as local refiners take advantage of cheap oil.

China imported 33.19 million tons of oil in December, 9.3% higher than a year before, the General Administration of Customs said Wednesday. That was a rise from the month before when it imported 27.3 million tons.

"This reinforces my view that China will continue to be a strong consumer of crude despite the market fear. Crude demand will stay on an uptrend as the economy is still expected to grow by at least 6%," said Barnabas Gan, a commodity analyst at OCBC.

As part of its ongoing energy reforms, Beijing has been allowing more small and privately-owned refiners, known as "teapots", to import crude directly from foreign sources. China imported 335.50 million barrels of crude in 2015, up 8.8% from 2014.

Platts China Oil Analytics projects China's crude demand growth will slow to over 6% on-year this year, driven by a deceleration in the Chinese economy.

Recent volatility in the Chinese stock market has spooked some oil traders who expect China's crude demand to falter. Global prices have fallen nearly 20% since the start of the year.

"Yes, the Chinese economy is in low gear. That is a fact, but it is definitely not over the cliff," said Kang Wu, the managing director of Beijing for FGE Consultancy, who expects China's crude demand to slow but remain healthy in 2016.

Reflecting China's increase in fuel exports in recent months, China's imports of refined oil products dropped 11% on year to 2.84 million tons in December, according to official data. In 2015, China's total imports of refined oil products fell 0.3% to 29.90 million tons.

With consumption weak at home, Chinese refiners have been exporting more. China exported 250,000 tons of crude in December, up 4.2% from a year earlier. In 2015, China exported 2.87 million tons of crude, a rise of 377% from the year before.

China also exported 4.32 million tons of oil products in December, a 53% on-year surge. In 2015, China exported 36.15 million tons of oil products, up 22% on-year.

Write to Jenny W. Hsu at jenny.hsu@wsj.com