cirr

ELITE MEMBER

- Joined

- Jun 28, 2012

- Messages

- 17,049

- Reaction score

- 18

- Country

- Location

Richard Macauley

July 29, 2015

Chinese companies’ overseas shopping sprees have been well documented in recent years, after Beijing encouraged its own inefficient, bloated state-owned enterprises to “go out,” and acquire knowledge and expertise by gobbling up foreign enterprises.

But Japanese companies, not Chinese, have quietly been doing more overseas deals in the past decade. The news last week that Japan’s Nikkei paid $1.3 billion for the Financial Times was just the latest example of this trend. Japanese companies are embracing foreign deals for growth, as a way to hedge against an aging population and a stagnant economy at home.

According to Dealogic data, between 2005 and 2015 year-to-date, companies in Japan and China spent $590.3 billion and $568 billion, respectively, either merging with or acquiring (i.e. M&A) international companies. These figures include Hong Kong companies in the China category — if they were stripped out, China’s overseas acquisitions would fall even farther short of Japan’s, thanks to huge deals like Hutchison Whampoa’s $15.4 billion deal for O2.

Looking at the same data cumulatively shows the pace of investment from both countries is well matched, but Japan has pulled slightly ahead every year since 2006.

Below are two maps pointing to the whereabouts of the 10 top countries for China and Japan’s M&A activity, and they show some distinct differences in the countries’ outbound investment attack. Japanese companies, for instance, spent $258.1 billion merging with or acquiring US companies in the period, 43.7% of all such expenditure over the 10-plus years:

Whereas the biggest target country for Chinese and Hong Kong companies was the UK. Britain received $82.9 billion in the period, or 14.6% of China’s total outbound investment:

It is worth mentioning that although no African countries appear in the top 10 destinations for merger and acquisition deals, there is plenty of extra cash flowing from China into the continent. Ethiopia has received $17 billion in Financing (note: not M&A) in recent years from China, and China’s involvement in infrastructure investment across Africa has been well-documented.

Given the different challenges both China and Japan face as nations, companies from both countries have somewhat different goals when they do overseas deals.

- China, for instance, is set on building a new global infrastructure that puts Chinese companies at the center of the world. The country also is concerned with securing enough natural resources to sustain its impressive economic growth and maintain manufacturing jobs.

- Japanese companies are positioning to cope with a rapidly aging society and smaller workforce, albeit one that is already rich enough to represent a strong consumer marketplace. (Aging population will be an issue for China down the road, though).

- Chinese companies, therefore, are more likely to target heavy industry when they go overseas deals:

- While Japanese companies have focused on the healthcare and consumer sectors:

**************************************************************

Lenovo buys IBM's server business in China's biggest IT acquisition

BEIJING Thu Jan 23, 2014 4:19am EST

Boxes containing Lenovo desktop computers are seen in an office in Kiev March 12, 2012.

Credit: Reuters/Gleb Garanich

BEIJING (Reuters) - Lenovo Group Ltd, the world's largest PC maker, agreed to buy IBM Corp's low-end server business in a long-awaited deal valued at about $2.3 billion, the biggest-ever tech acquisition by a Chinese company.

Lenovo will pay $2.07 billion in cash and the rest with stock of the Beijing-based PC maker, the company said in a statement to the Hong Kong exchange on Thursday.

The deal surpasses Baidu Inc's acquisition of 91 Wireless from NetDragon Websoft Inc for $1.85 billion last year, according to Thomson Reuters data, and underscores the growing clout of the country's technology firms as they look to expand overseas.

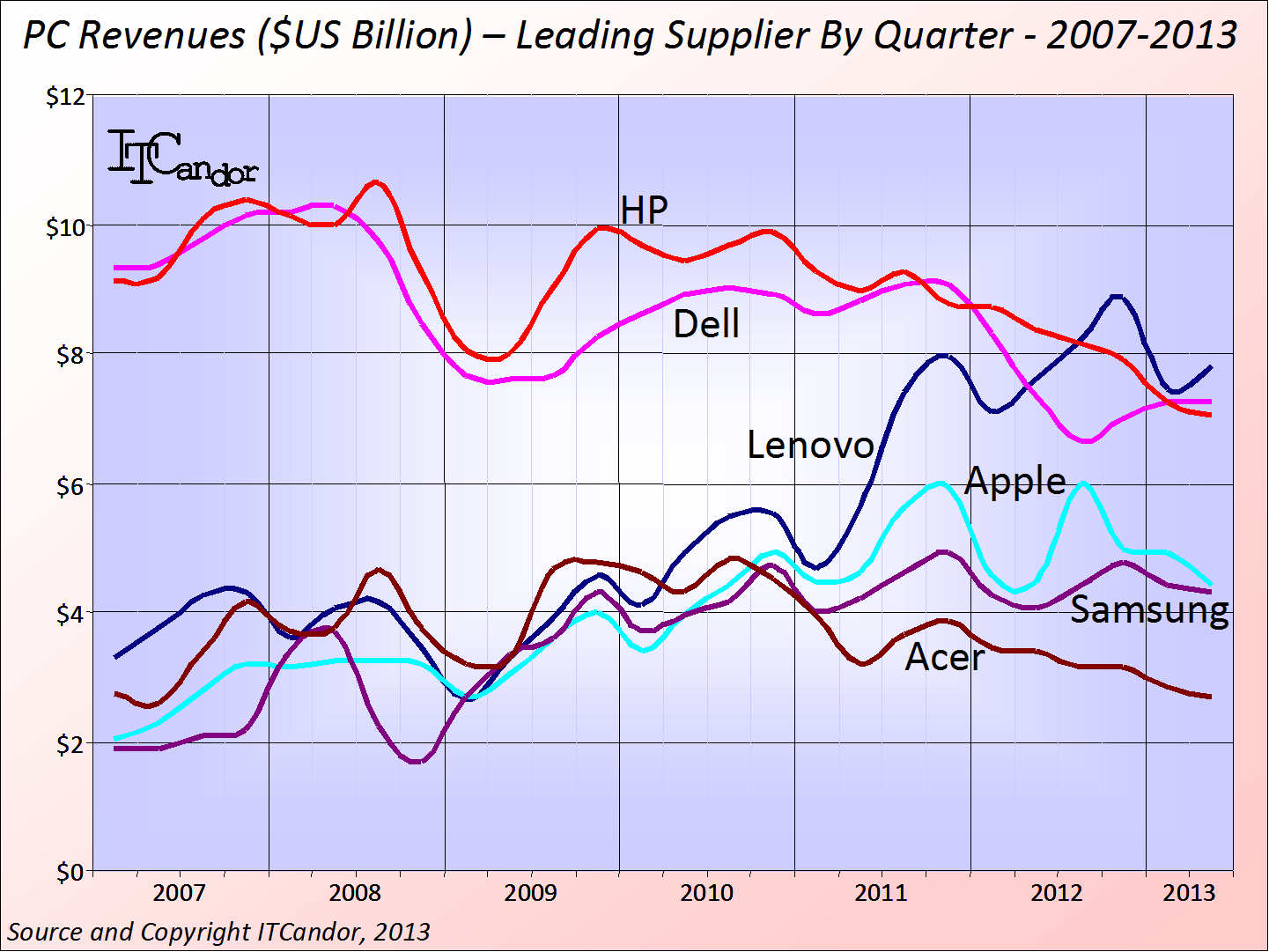

The acquisition will allow Lenovo to diversify revenue away from the shrinking PC business and remodel itself as a growing force in mobile devices and data storage servers. Analysts said Lenovo will likely find it easier than International Business Machines (IBM) to sell the x86 servers to Chinese companies as Beijing tries to localize its IT purchases in the wake of revelations about U.S. surveillance.

The sale allows IBM to dump its low-margin x86 business - which sells less powerful and slower servers than the company's higher-margin offerings - and focus on the firm's decade-long shift to more profitable software and services. The unit had reported seven straight quarters of declining revenue.

"What the business is worth to IBM is no longer relevant. The only thing that matters is what it's worth to Lenovo," said Alberto Moel, a Hong Kong-based analyst at Sanford C. Bernstein. "If Lenovo can improve the margins... that could offset any continued revenue shrinkage."

Lenovo's purchase of IBM's ThinkPad PC business in 2005 for $1.75 billion became the springboard for its leap to the top of global PC maker rankings. The market is betting Lenovo will enjoy similar success with its latest acquisition, which is partly reflected in a 9.44 percent rise in its shares this year.

Credit Suisse and Goldman Sachs advised Lenovo, PC maker said in its statement.

HIGHER VALUATIONS

Talks between IBM and Lenovo fell apart last year due to differences on pricing, with media reports at the time suggesting IBM wanted as much as $6 billion for the unit.

Analysts said the sale may have been accelerated by IBM's China woes and ongoing weakness in hardware sales, after the world's biggest technology services company reported a 23 percent drop in fourth-quarter revenue from China on Tuesday.

Revenue from its hardware business, including servers, fell for the ninth consecutive quarter as more companies switched to the cloud from traditional infrastructure.

IBM's server business was the world's second-largest, with a 22.9 percent share of the $12.3 billion market in the third quarter of 2013, according to technology research firm Gartner.

Hewlett-Packard Co is the biggest player, while Lenovo does not appear in the top five.

"The acquisition presents a unique opportunity for the company to gain immediate scale and credibility in this market," Lenovo said on Thursday.

The x86 unit has annual revenues of roughly $4 billion, analysts estimate.

(Reporting by Paul Carsten; Editing by Denny Thomas, Stephen Coates and Ryan Woo)

Lenovo buys IBM's server business in China's biggest IT acquisition| Reuters