Kambojaric

MODERATOR

- Joined

- Apr 6, 2010

- Messages

- 5,480

- Reaction score

- 16

- Country

- Location

Most fund managers get their research in the comfort of a conference room. For Ami Kemppainen, investment decisions can entail long-haul flights followed by river boat rides.

The investor, who manages $88 million at Terra Nova Capital Advisors’ Evli Emerging Frontier, recently traveled from Dubai to Vietnam, where a meeting with an energy company’s chief financial officer convinced him how a looming power-price increase would boost profit. Shares in PetroVietnam Nhon Trach 2 Power JSC, whose plant is carved out of the jungle two hours by boat from Ho Chi Minh City, have gained almost 40 percent since the June 2015 investment.

Most fund managers get their research in the comfort of a conference room. For Ami Kemppainen, investment decisions can entail long-haul flights followed by river boat rides.

The investor, who manages $88 million at Terra Nova Capital Advisors’ Evli Emerging Frontier, recently traveled from Dubai to Vietnam, where a meeting with an energy company’s chief financial officer convinced him how a looming power-price increase would boost profit. Shares in PetroVietnam Nhon Trach 2 Power JSC, whose plant is carved out of the jungle two hours by boat from Ho Chi Minh City, have gained almost 40 percent since the June 2015 investment.

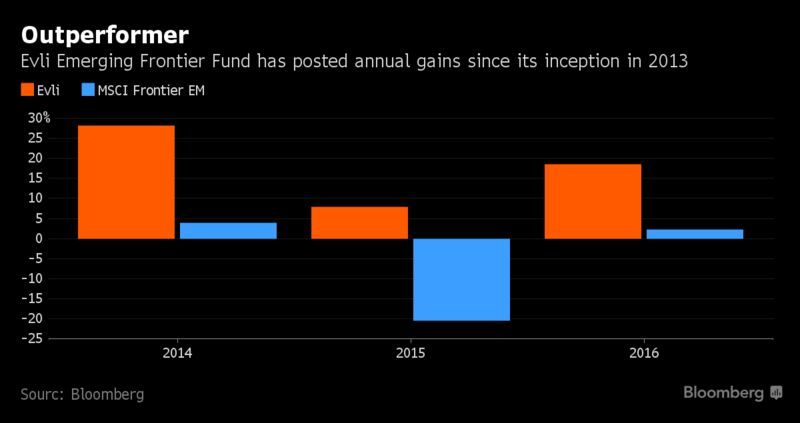

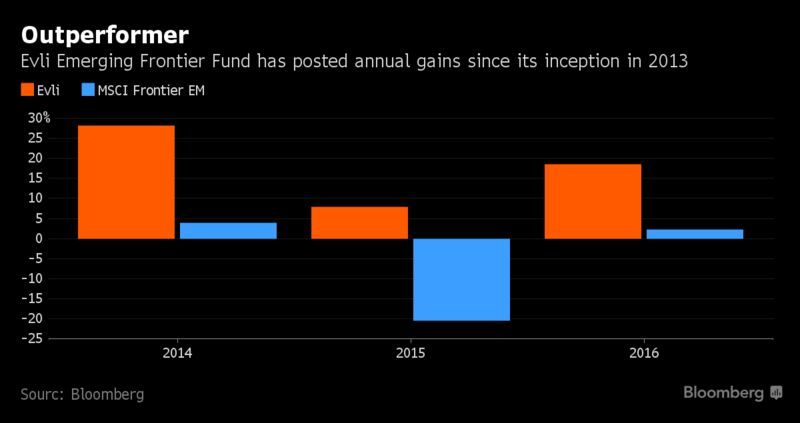

Among the biggest risks for the frontier investor is becoming entangled in an illiquid stock domiciled in a country where governance falls short of best practice. To date, Kemppainen has mostly avoided the pitfalls. His fund’s 19 percent return in 2016 was more than eight times that of the MSCI Frontier Emerging Market Index. Taken from inception in 2013, its performance is better than 99 percent of a peer group comprising 533 open-end funds focused on emerging-market stocks, according to data compiled by Bloomberg.

Pakistan, where security concerns overlay economic risks, is another market where Kemppainen saw the benefit of in-person discussions, meeting in Lahore with the chief executive and finance head of a family run Pakistani cement maker. A PowerPoint presentation accompanied by tea revealed Maple Leaf Cement Factory Ltd.’s plans to reduce reliance on intermediaries, a rare approach in the industry. “It was basically impossible to know all that if we didn’t get close to them.” Maple Leaf has gained more than fourfold since it was added to the fund in May 2014.

Not all the calls have turned out as well: In 2015, the fund lost half its investment in an Argentinian telecoms company with stock traded in London. The shares slumped after the South American country let its currency float freely, prompting a 35 percent plunge in the peso. Foreign exchange exposure became a major risk factor in vetting targets, Kemppainen said.

Kemppanien excludes BRIC nations from the filters he builds to find stocks, targeting a universe of developing markets that account for about 20 percent of the world’s population, but attract no more than 5 percent of global investments. There are no blue chips in the portfolio, which favors consumption-based companies.

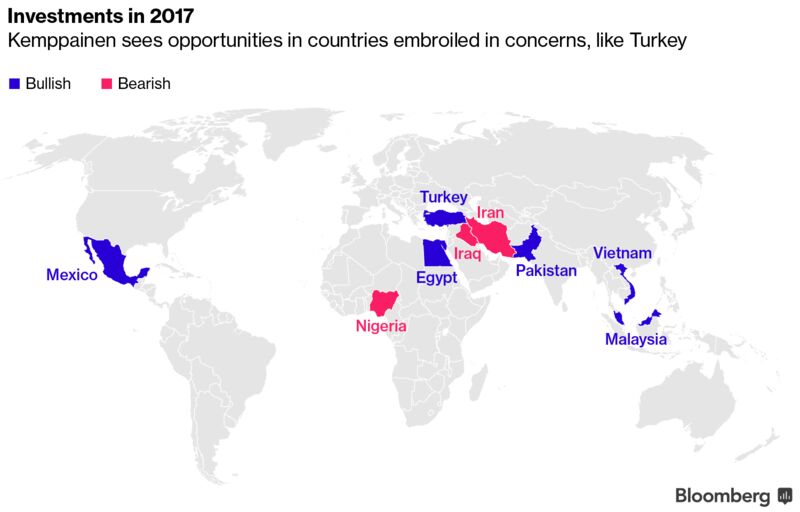

Here are his favorite markets for this year, and a clue to his travel plans:

*Vietnam and Pakistan: “Both have large, young, populations combined with fast growth. General valuations are still OK.”

*Malaysia, where the fund has invested in Latitude Tree Holdings Bhd, and Turkey, where holdings include Orge Enerji Elektrik Taahhut AS: “The macro scenario has generally punished the valuations of all listed companies, even those who could benefit from a weaker currency, such as exporters.”

*Egypt, where the fund holds ElSewedy Electric Co.: “Has the potential to rise and grow after November’s massive devaluation.”

*Mexico: “Was likely over-punished for Trump’s election. Several interesting companies have emerged.”

https://www.bloomberg.com/news/arti...-in-lahore-helps-frontier-investor-beat-peers

He is still avoiding:

*Nigera: “Massive devaluation coming; the country and most companies are in trouble until then, and for a good while afterwards.”

*Iran: A visit last year showed that it’s an “Example of a market that will be interesting once access is improved and risks subside.”

*Iraq: “Haven’t gone there yet. We’d need a well functioning market before I’d even consider it, and I believe security would have to improve dramatically before liquidity returned.”

The investor, who manages $88 million at Terra Nova Capital Advisors’ Evli Emerging Frontier, recently traveled from Dubai to Vietnam, where a meeting with an energy company’s chief financial officer convinced him how a looming power-price increase would boost profit. Shares in PetroVietnam Nhon Trach 2 Power JSC, whose plant is carved out of the jungle two hours by boat from Ho Chi Minh City, have gained almost 40 percent since the June 2015 investment.

Most fund managers get their research in the comfort of a conference room. For Ami Kemppainen, investment decisions can entail long-haul flights followed by river boat rides.

The investor, who manages $88 million at Terra Nova Capital Advisors’ Evli Emerging Frontier, recently traveled from Dubai to Vietnam, where a meeting with an energy company’s chief financial officer convinced him how a looming power-price increase would boost profit. Shares in PetroVietnam Nhon Trach 2 Power JSC, whose plant is carved out of the jungle two hours by boat from Ho Chi Minh City, have gained almost 40 percent since the June 2015 investment.

Among the biggest risks for the frontier investor is becoming entangled in an illiquid stock domiciled in a country where governance falls short of best practice. To date, Kemppainen has mostly avoided the pitfalls. His fund’s 19 percent return in 2016 was more than eight times that of the MSCI Frontier Emerging Market Index. Taken from inception in 2013, its performance is better than 99 percent of a peer group comprising 533 open-end funds focused on emerging-market stocks, according to data compiled by Bloomberg.

Pakistan, where security concerns overlay economic risks, is another market where Kemppainen saw the benefit of in-person discussions, meeting in Lahore with the chief executive and finance head of a family run Pakistani cement maker. A PowerPoint presentation accompanied by tea revealed Maple Leaf Cement Factory Ltd.’s plans to reduce reliance on intermediaries, a rare approach in the industry. “It was basically impossible to know all that if we didn’t get close to them.” Maple Leaf has gained more than fourfold since it was added to the fund in May 2014.

Not all the calls have turned out as well: In 2015, the fund lost half its investment in an Argentinian telecoms company with stock traded in London. The shares slumped after the South American country let its currency float freely, prompting a 35 percent plunge in the peso. Foreign exchange exposure became a major risk factor in vetting targets, Kemppainen said.

Kemppanien excludes BRIC nations from the filters he builds to find stocks, targeting a universe of developing markets that account for about 20 percent of the world’s population, but attract no more than 5 percent of global investments. There are no blue chips in the portfolio, which favors consumption-based companies.

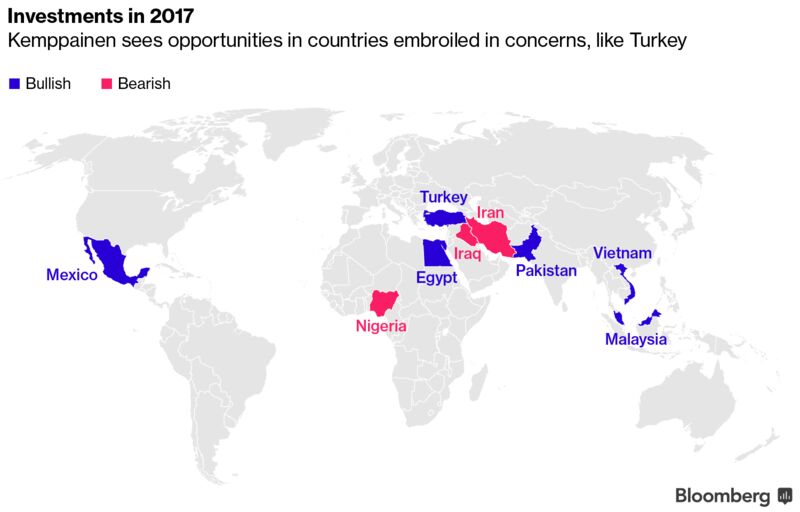

Here are his favorite markets for this year, and a clue to his travel plans:

*Vietnam and Pakistan: “Both have large, young, populations combined with fast growth. General valuations are still OK.”

*Malaysia, where the fund has invested in Latitude Tree Holdings Bhd, and Turkey, where holdings include Orge Enerji Elektrik Taahhut AS: “The macro scenario has generally punished the valuations of all listed companies, even those who could benefit from a weaker currency, such as exporters.”

*Egypt, where the fund holds ElSewedy Electric Co.: “Has the potential to rise and grow after November’s massive devaluation.”

*Mexico: “Was likely over-punished for Trump’s election. Several interesting companies have emerged.”

https://www.bloomberg.com/news/arti...-in-lahore-helps-frontier-investor-beat-peers

He is still avoiding:

*Nigera: “Massive devaluation coming; the country and most companies are in trouble until then, and for a good while afterwards.”

*Iran: A visit last year showed that it’s an “Example of a market that will be interesting once access is improved and risks subside.”

*Iraq: “Haven’t gone there yet. We’d need a well functioning market before I’d even consider it, and I believe security would have to improve dramatically before liquidity returned.”