Víðarr

FULL MEMBER

- Joined

- Feb 25, 2015

- Messages

- 260

- Reaction score

- 12

- Country

- Location

Here's More Proof the U.S. Economy Is Beating the Rest of the World

At first glance, the corporate profits data released today by the Commerce Department don't look good. Profits fell by 0.8 percent in 2014 from the prior year, the first decline since the middle of the recession.

Below the surface, however, the weakness was concentrated in earnings from abroad. It's the latest embodiment of the surge in the dollar as the U.S. recovery strengthens.

Profits originating outside the U.S. dropped by $36.1 billion in the fourth quarter, the biggest decrease since 2008 and the second-biggest since 2002. This would be money earned by big multinational companies, such as Coca-Cola Co. or Wal-Mart Stores Inc., as well as any business that sells goods and services abroad.

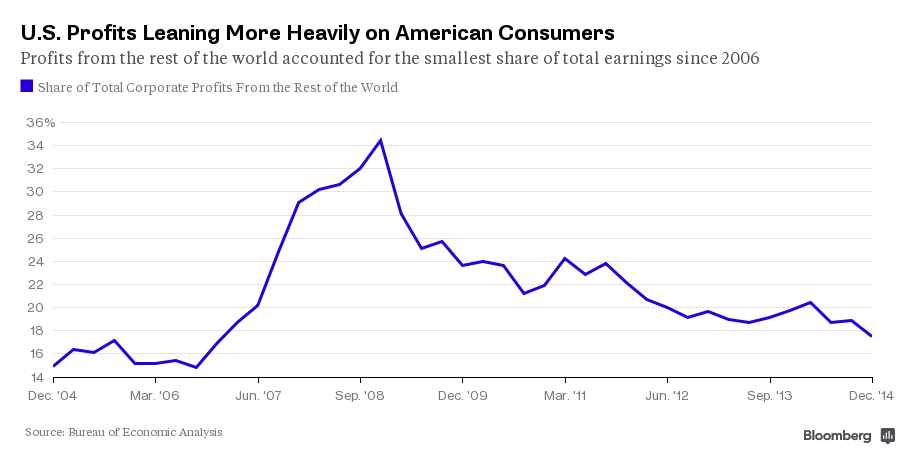

Profits from the rest of the world accounted for the smallest share of total corporate earnings since 2006 and have been on the downswing for years.

Meanwhile profits from domestic industries rose by $5.7 billion in the last three months of 2014, the Commerce Department's report showed. While that's not stellar, it was weighed down by a drop in earnings of financial companies. Non-financial industries reported a rise in profits of $18.1 billion.

A weak global picture is part of the problem, as places like Europe, Japan and China all work to reinvigorate their economies, said Gus Faucher, senior economist at PNC Financial Services Group in Pittsburgh. That's been compounded more recently by the stronger dollar, which reduces the value of profits earned abroad, he said.

"Corporate profits from overseas have been falling over the past few years, while at the same time they've continued to rise domestically,'' Faucher said. "It's because of better economic conditions in the United States than we've had overseas."

In the near term, "profits are going to remain under pressure," he said. "We've seen the dollar strengthen further in the first quarter so that's going to be a drag, and growth is still soft" in places like Europe.

From Here's More Proof the U.S. Economy Is Beating the Rest of the World - Bloomberg Business

At first glance, the corporate profits data released today by the Commerce Department don't look good. Profits fell by 0.8 percent in 2014 from the prior year, the first decline since the middle of the recession.

Below the surface, however, the weakness was concentrated in earnings from abroad. It's the latest embodiment of the surge in the dollar as the U.S. recovery strengthens.

Profits originating outside the U.S. dropped by $36.1 billion in the fourth quarter, the biggest decrease since 2008 and the second-biggest since 2002. This would be money earned by big multinational companies, such as Coca-Cola Co. or Wal-Mart Stores Inc., as well as any business that sells goods and services abroad.

Profits from the rest of the world accounted for the smallest share of total corporate earnings since 2006 and have been on the downswing for years.

Meanwhile profits from domestic industries rose by $5.7 billion in the last three months of 2014, the Commerce Department's report showed. While that's not stellar, it was weighed down by a drop in earnings of financial companies. Non-financial industries reported a rise in profits of $18.1 billion.

A weak global picture is part of the problem, as places like Europe, Japan and China all work to reinvigorate their economies, said Gus Faucher, senior economist at PNC Financial Services Group in Pittsburgh. That's been compounded more recently by the stronger dollar, which reduces the value of profits earned abroad, he said.

"Corporate profits from overseas have been falling over the past few years, while at the same time they've continued to rise domestically,'' Faucher said. "It's because of better economic conditions in the United States than we've had overseas."

In the near term, "profits are going to remain under pressure," he said. "We've seen the dollar strengthen further in the first quarter so that's going to be a drag, and growth is still soft" in places like Europe.

From Here's More Proof the U.S. Economy Is Beating the Rest of the World - Bloomberg Business

the Chinese on PDF keep saying the dollar is dead

the Chinese on PDF keep saying the dollar is dead