艹艹艹

SENIOR MEMBER

- Joined

- Jul 7, 2016

- Messages

- 5,149

- Reaction score

- 0

- Country

- Location

Turkey: Markets Down After Moody’s Downgrades Credit Grade To Junk Status

Flag of Turkey

Flag of Turkey

BYPANARMENIANSEPTEMBER 27, 2016

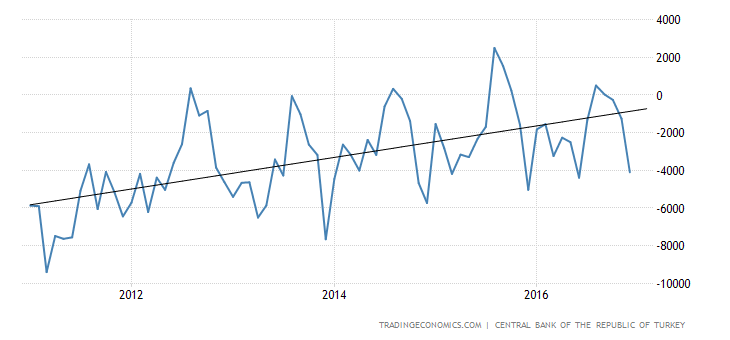

Turkish financial markets took a battering Monday, September 26 after ratings agency Moody’s downgraded the country’s credit grade to junk status to account for a series of shocks to the economy that included a string of bombings and an attempted coup, the Associated Press reports.

The Istanbul 100 stock index was down 4.4% at 76,237 points and the national currency, the lira, also took a hit. The dollar was up 0.5% at 2.9822 lira.

The sell-off is largely due to Moody’s statement late Friday that it was cutting Turkey’s government debt rating to Ba1 from Baa3. The downgrade means Moody’s joins Standard & Poor’s in rating Turkey below investment grade. That’s important because it will likely cost the government more to borrow on capital markets and prompt some investment funds to sell Turkish assets.

Turkey’s economy has suffered this year in the face of a string of extremist attacks and uncertainty following the failed coup on July 15 against President Recep Tayyip Erdogan that saw more than 270 people killed.

Tourism, a key component of the economy as well as a substantial foreign-currency earner, has taken a hit — not least because Russian tourists have stayed away in the wake of a diplomatic spat over Turkey’s downing of a Russian warplane last year.

Moody’s said the “upsurge in security-related incidents” and the sanctions imposed by Russia last year following the downing of the jet, have had “an adverse impact” on tourism, which accounts for around 4.4 percent of Turkey’s annual GDP but 15 percent of its foreign capital receipts. In the first half of this year, Moody’s said, tourist arrivals and revenues were down 27.9 percent and 28.2 percent compared with the same period last year.

The agency said that the country “continues to operate in a fragile financial and geopolitical environment and that its external vulnerability has risen, both over the past two years and more recently as a result of unpredictable political developments and volatile investor perception.”

It added that this has “credit implications for Turkey given its dependence on foreign capital.”

BYPANARMENIANSEPTEMBER 27, 2016

Turkish financial markets took a battering Monday, September 26 after ratings agency Moody’s downgraded the country’s credit grade to junk status to account for a series of shocks to the economy that included a string of bombings and an attempted coup, the Associated Press reports.

The Istanbul 100 stock index was down 4.4% at 76,237 points and the national currency, the lira, also took a hit. The dollar was up 0.5% at 2.9822 lira.

The sell-off is largely due to Moody’s statement late Friday that it was cutting Turkey’s government debt rating to Ba1 from Baa3. The downgrade means Moody’s joins Standard & Poor’s in rating Turkey below investment grade. That’s important because it will likely cost the government more to borrow on capital markets and prompt some investment funds to sell Turkish assets.

Turkey’s economy has suffered this year in the face of a string of extremist attacks and uncertainty following the failed coup on July 15 against President Recep Tayyip Erdogan that saw more than 270 people killed.

Tourism, a key component of the economy as well as a substantial foreign-currency earner, has taken a hit — not least because Russian tourists have stayed away in the wake of a diplomatic spat over Turkey’s downing of a Russian warplane last year.

Moody’s said the “upsurge in security-related incidents” and the sanctions imposed by Russia last year following the downing of the jet, have had “an adverse impact” on tourism, which accounts for around 4.4 percent of Turkey’s annual GDP but 15 percent of its foreign capital receipts. In the first half of this year, Moody’s said, tourist arrivals and revenues were down 27.9 percent and 28.2 percent compared with the same period last year.

The agency said that the country “continues to operate in a fragile financial and geopolitical environment and that its external vulnerability has risen, both over the past two years and more recently as a result of unpredictable political developments and volatile investor perception.”

It added that this has “credit implications for Turkey given its dependence on foreign capital.”